8vFanI/iStock via Getty Images

Akoustis Technologies, Inc. (NASDAQ:NASDAQ:AKTS) is an innovative producer of RF filters operating at the cutting edge of technology with their XBAW filter technology. The company has 67 issued patents and 117 patents pending.

The company continues to rake in design wins on multiple fronts like 5G mobile, 5G infrastructure, WiFi6, 6E and 7 and some other markets, and it is also entering the timing and frequency market with their XBAW resonators, which management sees as a significant opportunity.

The company spent $28M in CapEx in FY22 (which ended in June) building out its production facility in upstate New York to a capacity of 500M RF filters a year and completing a redundancy project and the capacity to produce WFL (wafer level packaging) in-house.

Management has welcomed the CHIPS act and expects to be an ideal candidate, fitting with government plans to make New York the Global Innovation and Semiconductor Hub.

They are planning to apply for funding under the act in order to add multiple new 8-inch wafer manufacturing lines and build an advanced packaging center as the company is taking advanced WFL in-house as this confers important cost advantages.

The company is already benefiting from two DARPA R&D contracts, a current one for enhancing their XBAW PDK and a new one for extending the operating range of XBAW RF filters up to 18GHz.

Growth

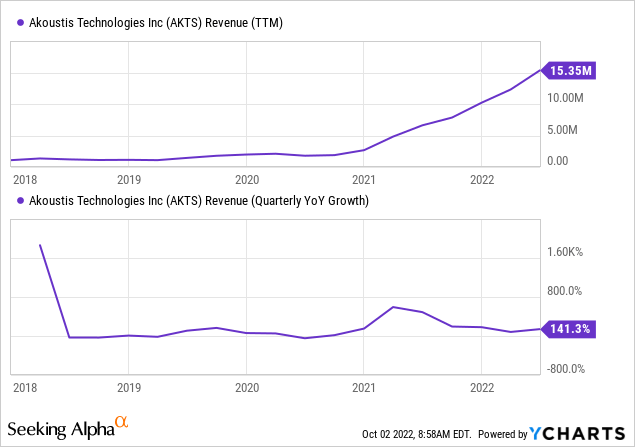

There is a significant ramp in production and revenues, albeit from a small basis, but it’s still pretty impressive as there were plenty of headwinds. These came in the form of chip shortages slowing down customers, and then rolling blackouts and Covid lockdowns in China, stretching lead times to a year (especially in WiFi6&6E).

Management does expect the supply chain problems to resolve in the coming 6-12 months.

Growth vectors

The main growth vectors are:

- New customers and design wins

- New products

On new customers and design wins, there were 5 new customers in Q4, like Aruba Networks now totaling 9 WiFi customers and 15+ design wins in WiFi and 20+ overall with a further two design wins (WiFi6E) in the current quarter (Q1/23) already in the bag.

Five new customers entered production in Q4, and there are now 13 customers ramping production (9 of which are in WiFi, their main segment) with additions expected in the coming quarters, with two additions coming in Q1/23 (the current quarter).

Then the company has multiple funded XBAW filters in design for 5G with four customers, three of which are Tier 1 companies. The first of three Tier 1 customers will enter production in late 2022 or early 2023 and a second Tier 1 customer will start to ramp in mid-2023 (calendar).

In their network infrastructure segment they have four completed 5G network wins, one of which for CBRS and the others for 5G small cell base stations with four additional design wins.

On new products, the company has produced improvements in 6E and 7 filters (Q4CC):

[W]e completed significant and frankly very exciting performance improvements to our 5.5 gigahertz and 6.5 gigahertz Wi-Fi 6E and Wi-Fi 7 filter solution. These enhanced filters use our new chip scale packages, and are currently shipping to multiple customers for testing. The advantages of these new filters include a massive improvement in out of band rejection, far superior to anything we have seen from our competitors. We have received significant interest from customers for these new filter products and expect to see design wins and production ramps using these new filter products in the near-term.

The company fully qualified 4 Wi-Fi 6E and Wi-Fi 7 XBAW filter products during the quarter and expects these to enter production in the current (Q1/23) quarter.

There is also progress with their WiFi 7 diplexers which they are developing for one of the largest PC chipset makers, with the first design shipped to a Fortune 100 internet company for using these in the AR/VR market and receiving positive feedback.

Management noted additional interest from other OEMs, and these products are scheduled for production in calendar 2024.

The company also developed the first samples of two new 5G mobile XBAW filters for a Tier-1 RF module maker. The company is bringing the WLP production in-house in their NY facility and expects production later this year.

Finances

Some data points:

- Revenues +140% (+13% q/q) to $5.2M

- OpEx loss $17.7M (non-GAAP $14.9M)

- CapEx $5.9M versus $9M in Q3/22 and $28M in FY22

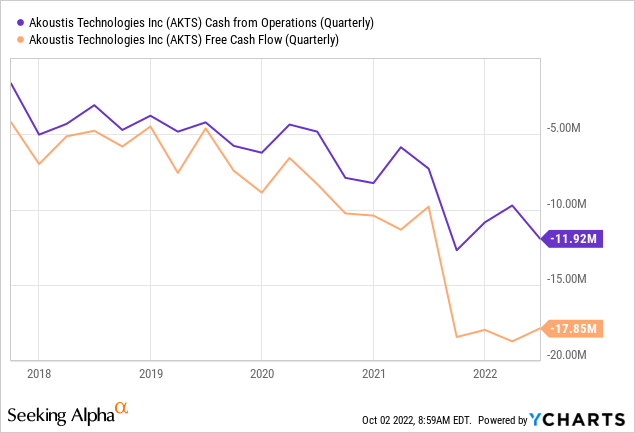

- OpEx Cash -$11.9M versus -$9.7M Q3/22 but declining in H2

- $80.5M in cash vs $55.9M Q3/22 due to $43.6M in convertible notes and $2M raise at $3.88

- Outlook for Q1/23 revenues +5%+ q/q and +200% y/y

- The company expects to be operating cash flow breakeven in the next 15-18 months on $15M-$18M of revenue a quarter, which would be December 2023 at the latest.

200% revenue growth sounds impressive, and it is of course, but investors should also keep a keen eye on the cash flow, which is increasingly negative:

$73M in free cash outflow for the last 12 months is very substantial, given that they just did a $43M financing in June and had $80M left at the end of Q4. With this rate of cash outflow, that’s not going to tie them over to cash flow breakeven. However:

- With the ramping of revenue, cash outflow will decline

- CapEx was $28M in FY22 but will decline 25%+ in FY23 and could very well receive CHIPS grants to lower its CapEx bill further.

But still, we expect them to have to come back to the financial markets somewhere next (calendar) year.

Valuation

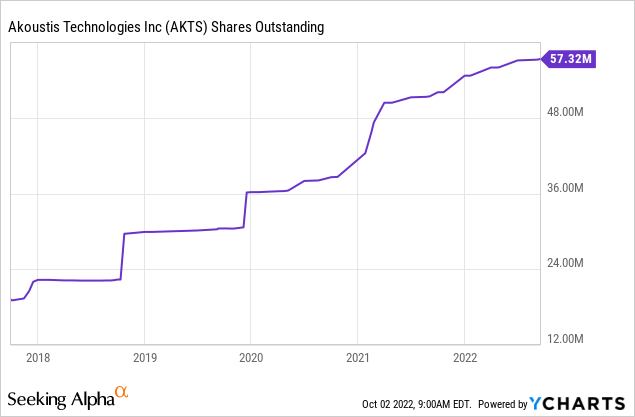

There were 57.2M shares outstanding, given the early stage of sales, the dilution is no surprise.

The company issued $44M in 6% convertible notes due in 2027 in June 2022 with a conversion price of $4.71, so this is another 9.34M shares and another 5.1M shares from various incentive plans.

So fully diluted there are 71.7M shares outstanding, at $3.5 that’s a market cap of $250M and an EV of $170M.

Revenue is expected to reach $28.5M in FY23 (June 2023) and $58.4M in FY24 (June 2024) for an FY24 EV/S of 2.9x although the company is still expected to produce a loss of 69 cents per share in FY24.

Since we don’t have a grip on their gross margin (which is actually still negative) it’s difficult to get an idea of their eventual unit economics. The company is shifting their WLP production in-house and is moving to an 8-inch manufacturing platform, both of which reduce cost, but the main effect will have to come from scaling up, which is what they are doing anyway.

Conclusion

There can be little doubt that the company is at the cutting edge of RF filter technology and production is scaling rapidly through raking up customers and design wins.

Most of its segments are still expanding, so it has the secular tailwind of increasing total addressable markets, as well as entering new segments like the timing and frequency market with its resonators.

That is, eventually, Akoustis is likely to be worth a lot more than its present market cap, but there is still the likelihood that shareholders have to be diluted along the way, given the rate of cash bleed.

Be the first to comment