Inna Dodor/iStock via Getty Images

Food and beverage are incredibly common these days, ranging from very small ones with niche markets, to global providers with vast portfolios. One trend that has really taken off is the emphasis on plant and fruit-based items. One company that does this well by offering a full line of products such as beverages that are based on oat, almond, coconut, soy, and more, as well as that focuses on dry and oil roasted in shell sunflower, sunflower kernels, and other products, is SunOpta (NASDAQ:NASDAQ:STKL) (TSX:TSX:SOY:CA). Even though shares of the company are not exactly cheap, the firm has held up well in this volatile market. Continued sales growth and improvements in the bottom line have created a tremendous amount of optimism amongst shareholders. In the long run, I suspect that the company will do well for its investors. But given how shares are priced right now, I do still believe that a ‘hold’ rating is perfectly appropriate, reflecting my view that it’s likely to generate returns that more or less match the broader market for the foreseeable future.

Excellent performance

In very early July of this year, I wrote my first article about SunOpta. In that article I talked about how the prior few years had been rather difficult for the business, but I also highlighted the fact that management was working to improve the company’s financial position moving forward. I found myself cautiously optimistic about the company’s future. But at the same time, I also stated, rightfully so, that banking on management’s forecast was a speculative idea, since nobody can know what the future holds. It would have been one thing if shares of the business were trading on the cheap. But considering how lofty the stock was, I ended up rating it a ‘hold’. Since then, the business has clearly outperformed my own expectations. While the S&P 500 is down by 5.5%, shares of SunOpta are up by 9.1%.

Author – SEC EDGAR Data

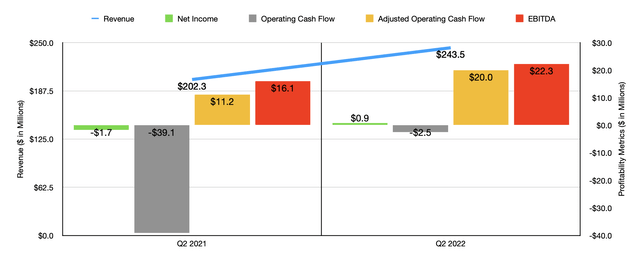

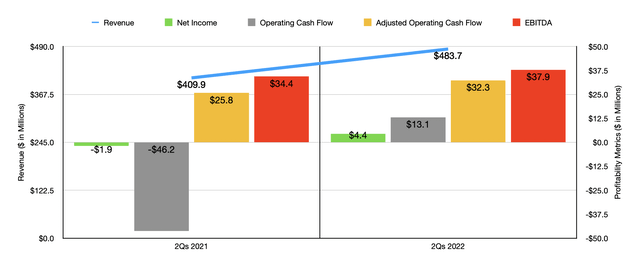

Based on this difference in returns, you might think that strong performance by the enterprise has been instrumental in building investor optimism. And that would be accurate. During the second quarter of the 2022 fiscal year, the only quarter for which we have data now that we did not have when I last wrote about the firm, sales came in at $243.5 million. That’s 20.4% higher than the $202.3 million generated the same quarter one year earlier. The largest improvement for the company came from the Plant-Based Foods and Beverages segment, with revenue jumping 31% year over year from $111.4 million to $145.9 million. This strength, management said, was driven by a 13.7% overall increase in pricing and a favorable volume/mix impact of 17.3%. This is the best kind of increase, with management still posting strong volume expansion at a time when pricing has been hiked to offset inflationary pressures.

Author – SEC EDGAR Data

On the bottom line, the picture has also been positive. Net income in the latest quarter came in at $0.9 million. That’s better than the $1.7 million loss generated the same quarter last year. Operating cash flow went from negative $39.1 million to negative $2.5 million. And if we adjust for changes in working capital, it would have gone from a positive $11.2 million to a positive $20 million. We also saw improvement when it came to EBITDA, with the metric climbing from $16.1 million to $22.3 million. Naturally, the results posted for the second quarter were also instrumental in pushing up results for the first half of the 2022 fiscal year as a whole relative to the same time last year.

SunOpta

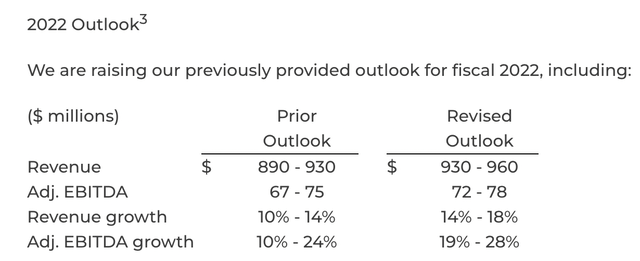

When it comes to the future, management has offered some guidance. They currently anticipate revenue of between $930 million and $960 million. This is favorable compared to the prior expected range of between $890 million and $930 million. At the midpoint, it would translate to a year-over-year increase of 16.3% compared to the $812.6 million the company generated in the 2021 fiscal year. When it comes to profitability, management is now forecasting EBITDA of between $72 million and $78 million. The prior expected range was between $67 million and $75 million. At the midpoint, the $75.5 million forecasted beats out the $60.7 million the company generated in 2021. No guidance was given when it came to other profitability metrics. But if we assume that adjusted operating cash flow will rise at the same rate that EBITDA should, then we should anticipate a reading for it of $52.3 million.

Author – SEC EDGAR Data

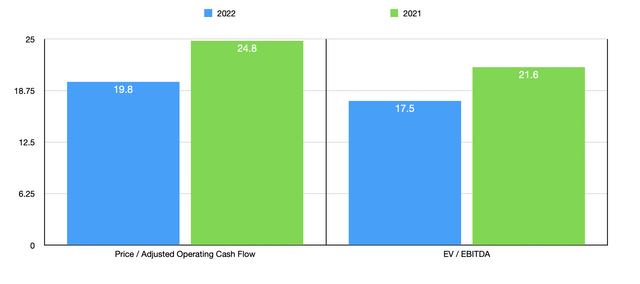

Based on these numbers, we can see that the company is trading at a forward price to adjusted operating cash flow multiple of 19.8 and at a forward EV to EBITDA multiple of 17.5. By comparison, using data from the 2021 fiscal year instead of forecasted results for 2022, we would have ended up with multiples of 24.8 and 21.6, respectively. Also as part of my analysis, I compared the company to five similar businesses. On a price to operating cash flow basis, four of the five companies had positive results, with a range of between 2.5 and 55.2. In this case, three of the four companies were cheaper than SunOpta. Meanwhile, using the EV to EBITDA approach, the range for the five firms was between 2.8 and 303.2. In this case, two of the five were cheaper than our prospect.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| SunOpta | 24.8 | 21.6 |

| Adecoagro S.A. (AGRO) | 2.5 | 2.8 |

| Calavo Growers (CVGW) | 55.2 | 41.6 |

| Mission Produce (AVO) | 23.7 | 13.2 |

| Tattooed Chef (TTCF) | N/A | 303.2 |

| Vital Farms (VITL) | 47.1 | 160.2 |

Takeaway

Based on all the data provided, SunOpta seems to me to be getting its act together. Financial performance is improving nicely and it’s probable that the company will continue to deliver value for its investors for the foreseeable future. Having said that, I don’t think that it makes sense for a lot of investors to own shares in it at this time. While the company doesn’t look overvalued, its bottom line results could be better and shares could be cheaper. All things considered, I would still rate it a ‘hold’, despite its recent strong performance.

Be the first to comment