Chip Somodevilla

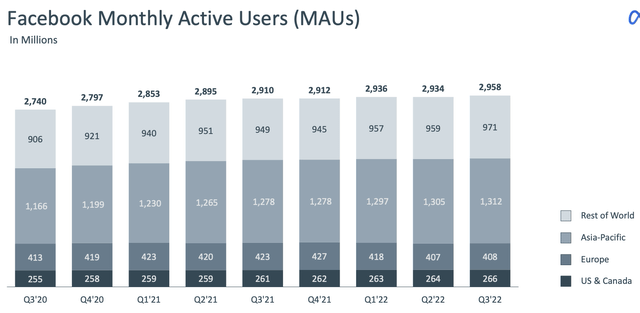

Meta Platforms (NASDAQ:META) formerly known as Facebook has recently announced results for a tough third quarter of 2022. The company beat revenue estimates but earnings missed expectations due to a huge increase in expenses related to Metaverse investments and hiring. Meta’s stock price has been butchered and is down by ~20% in pre-market trading; this compounds on top of the 65% decline in price the stock has had since September 2021. Its stock price is currently trading at a similar price to back in 2015, despite revenue increasing by 10X over the period from $17.9 billion to $117.9 billion. Therefore I believe that despite the fearful commentary, Meta may not be as in as bad of a position as mainstream news would like you to believe. The company is investing for the future and the stock is deeply undervalued intrinsically (even without the Metaverse). Thus in this post, I’m going to break down the third quarter results in granular detail, reveal the platform trends, Metaverse investments and of course, a valuation, let’s dive in.

Third Quarter Breakdown

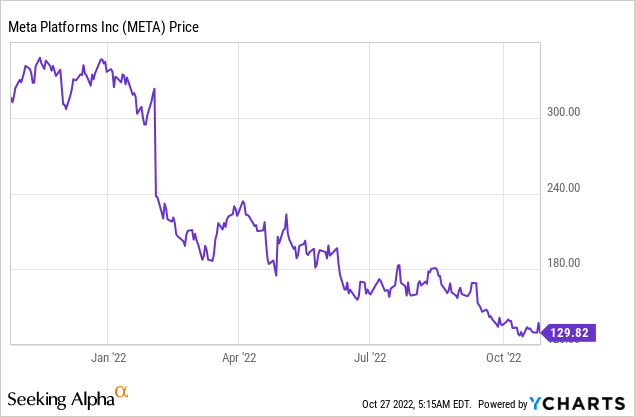

Meta generated mixed financial results for the third quarter of 2022. Revenue was $27.71 billion which declined by 4% year over year. This may seem like a disaster at first glance, but revenue still beat analyst consensus estimates by $313.8 million. Its international revenue was also impacted by a strong U.S dollar. Therefore on a constant currency basis, revenue would be up 2% year over year or an extra $1.79 billion. In addition, we should keep in mind that Meta experienced huge growth over the lockdown period as revenue jumped by over 35% between Q3 2020 and Q3 2021, therefore the comparison is unfavorable.

Meta Revenue by Geography (Q3 Earnings)

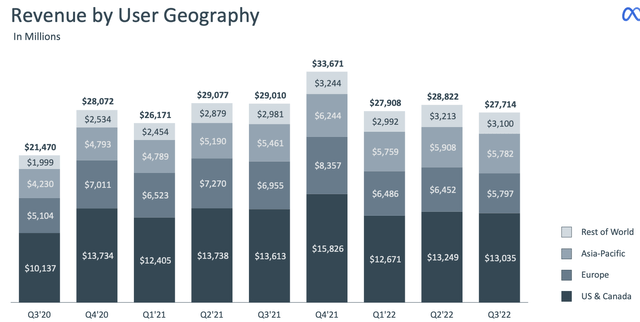

Meta Platforms makes the majority of its revenue from advertising to its users. Therefore user attention and engagement are vital metrics to analyze. In this case its “Family of Apps” which includes Instagram, Facebook and WhatsApp had 3.71 billion monthly active people in Q3,22 which increased by 4% year over year. This was slower than the ~11% growth rate achieved between Q3,20 and Q3,21 which represented the lockdown period of growth. Instagram had “more than” 2 billion monthly active users and WhatsApp had over 2 billion daily active users in Q3,22 which are both record figures. As of the end of 2021 (latest figures public), competitor TikTok had approximately 1.2 monthly active users, thus Instagram looks to be firmly out in front. In addition, I forecast Instagram users to be more “sticky” as it’s a very personal platform where people upload regular personal photos of friends, partners, and family. TikTok is categorized by more users than pure creators and is less personal and more entertaining by nature.

Family Monthly Active People (Q3,22)

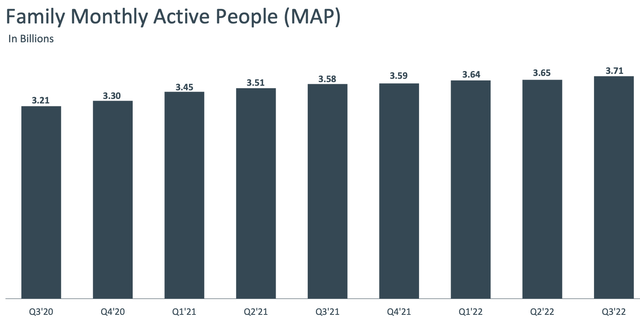

Meta’s flagship platform Facebook had monthly active users [MAUs] of 2.96 billion, which increased by 2% year over year. This was not huge growth, but at least users weren’t declining as we saw between Q1,22 and Q2,22.

Facebook Monthly Active Users (Q3,22)

Social Media Trends & Investments

Zuckerberg admitted in the third quarter earnings call that “some apps may be saturated in some countries or some demographics”. But he did highlight solid engagement growth in formats such as Reels, which is Facebook’s equivalent of TikTok’s.

In an October 2022 Interview, Zuckerberg admitted that he had “missed” the shift in how people discover content. Previously Facebook and Instagram were focused heavily on showing content from friends that you followed. However, now Zuckerberg believes that it is “less important who produces the content that your finding, you just want the best content”.

Therefore to help leverage this trend, Meta is investing in improving its “AI discovery engine” which will helps recommend more content across the Meta network as opposed to just from accounts that you follow. Video Reels are a big part of this and have over 140 billion plays each day, which is up 50% from 6 months ago. Zuckerberg believes Meta is “gaining” on competitors such as TikTok. The main unique selling points of the Facebook and Instagram platforms look to be the mix of content types which includes Photos, text, short-form and long-form videos etc. Whereas TikTok is a pure video “Reels” platform. Meta also has over 1 billion Reels shared each day through DMs, whereas TikTok doesn’t have this direct messaging feature. Facebook and Meta adverts are also great for Localization Marketing, as they offer more granular control of city-based targeting. For example, when I tested TikTok adverts I noticed that they had major city targeting but not smaller cities. Whereas on Facebook ads you can literally drop a pin on the map and target specific locations.

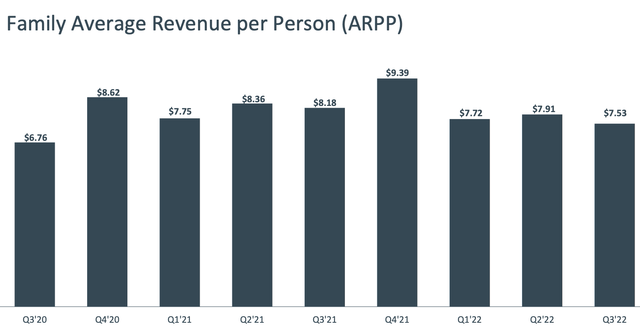

The Monetization of Reels has been a key issue Meta has struggled with, as has Google (GOOG) (GOOGL) with its “YouTube Shorts”. As Reels grow in popularity they are currently displacing revenue from higher revenue-generating in-app real estate. Meta believes its best to let the Reels platform grow despite taking a $500 million quarterly revenue headwind, which is substantial. You can see this negative trend via the Family Average Revenue Per Person (ARPP) metric graph below. ARPP was $7.53 in the third quarter of 2022, which was down ~8% year over year due to the aforementioned Reel monetization issues.

The good news is Meta believes that within 12 to 18 months, it should have improved its monetization rate. Instagram Reels alone crossed a $1 billion annual revenue run rate last quarter and thus the opportunity is immense. Overall ad impressions across its Family of Apps have increased by 17% year over year which is positive.

Family Average Revenue Per Person (Meta Q3,22)

Meta is also investing in “messaging” as historically its popular chat platform WhatsApp has not been utilized fully from a monetization standpoint. Meta has begun to implement “click to message” ads which enables customers to message businesses directly from Facebook adverts via Messenger or WhatsApp. This is one of the company’s fastest-growing ads products and now as a staggering $9 billion annual run rate. Meta is also leveraging its paid messaging features through partnerships with platforms such as Salesforce (CRM) which enables customers to directly connect through the messaging service. Meta also launched JioMart on WhatsApp in India which offers an end-to-end shopping experience.

Metaverse Investments

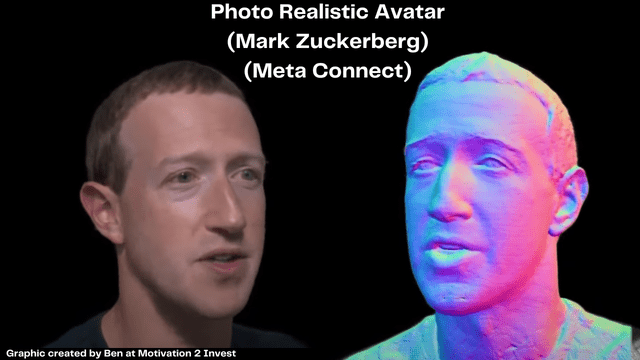

Mark Zuckerberg has a bold vision to build out the “Metaverse”, a new computing platform that aims to connect people with Virtual Reality and Augmented Reality technology. Meta announced a series of prototype technologies at its Connect event, these included a state-of-the-art AR controller and an incredible photo-realistic Avatar. In the image below, I have created from event screenshots you can see that both images on the left and right are of an avatar, not the real Zuckerberg.

Metaverse Photo Realistic Avatar Mark Zuckerberg (created by author Ben at Motivation 2 Invest (Connect))

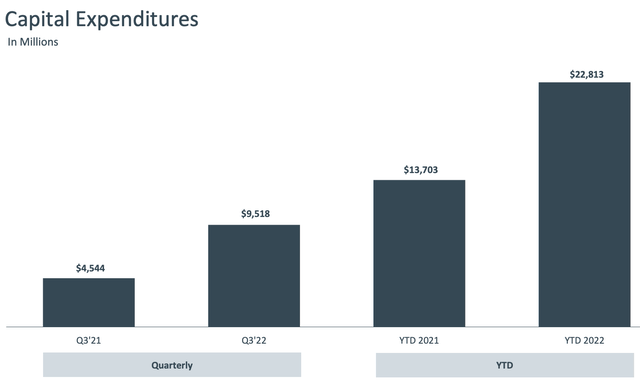

Despite the excitement surrounding the Metaverse, the technology is still in its early stages. Hedge Fund investor Brad called on Meta to invest “no more than $5 billion” into the Metaverse annually which is much lower than the $10 billion+ per year which Meta is currently investing. The estimated payback for these investments is over 10 years and thus in the meantime, the core business could decline. Capex Expenditures year to date are $22.8 billion, with $9.5 billion of these expenses coming in the third quarter of 2022. This major boost has been driven by investments in building out AI infrastructure. Capex is forecasted to continue to remain high in 2023, as the new Quest Virtual Reality headset launches and the effects of new employee hires (up 28% year over year) are felt. Meta’s management does expect these expenses to come down as a percentage of revenue in the long term.

Meta has bold plans to turn its Quest Pro Virtual Reality headset into a workplace productivity tool. The company has scored partnerships with rival Microsoft (MSFT) to enable teams on Quest. In addition, it has announced integrations with Adobe and Autodesk the design software packages. As a former design engineer, I do see the benefit of using a quest for designers and engineers to work together on a common model, for example in the aviation, automotive or buildings industry. The technology has been pitched to engineering firms for many years and I personally developed an Augmented Reality system back in 2015 for a manufacturing company. For mainstream meetings/business, I see Microsoft as a more natural partner as they are building out their own Metaverse platform.

Overall Profitability Review

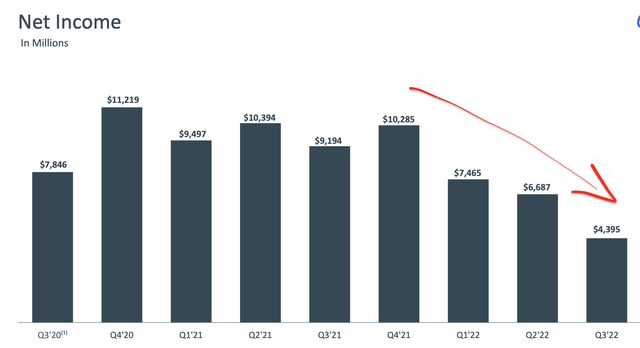

The company generated $22.05 billion in overall costs and expenses in Q3,22 which has increased by an eye-watering 19% year over year. This did include a $413 million impairment loss related to operating leases as the business streamlines its office space to cater for a hybrid workforce. Net Income was $4.4 billion in Q3,22 and is clearly on a downward trend. This has been driven by a combination of aforementioned factors which includes, heavy investments, Reel monetization issues and the macroeconomic environment which has caused advertisers to curb ad spending.

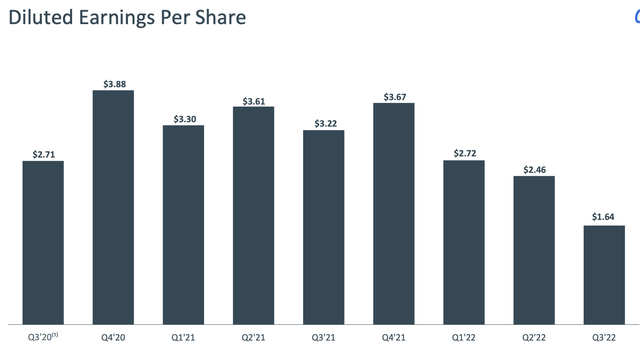

Earnings Per share showed a similar trend as it declined to just $1.64 which missed analyst expectations by $0.22, due to the aforementioned issues.

Robust Balance Sheet

The good news is Meta has a solid balance sheet with ~$41.78 billion in cash, cash equivalents and short-term investments. In addition to $9.92 billion in long-term debt. Meta bought back a staggering $6.55 billion in stock and has a further $17.78 billion available for share buy backs.

Advanced Valuation

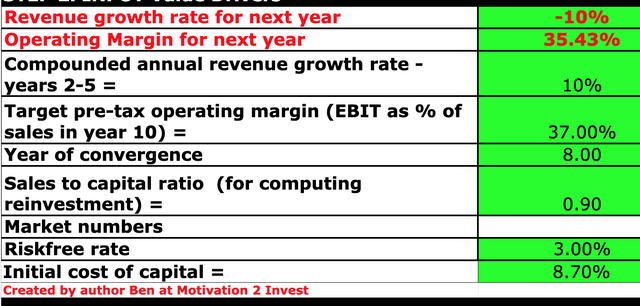

In order to value Meta, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted a minus 10% growth rate for next year based on guidance by management, driven by an expected 7% FX headwind and lower spending by advertisers due to macroeconomic issues. In addition, I have forecasted 10% growth per year in years 2 to 5. I expect this to be driven by a return on Meta’s investments in Reel Monetization and a rebound in the cyclical advertising market. This takes into account steady growth in Oculus but not huge metaverse growth, as that would be expected to be realized in years 8 to 10, and is uncertain.

Meta stock valuation 1 (created by author Ben at Motivation 2 Invest)

To increase the accuracy of the valuation, I have capitalized the company’s R&D expenses. This has boosted operating income and thus its operating margin to 35.43% which is extremely healthy given the average margin for the software industry is 23%. I have also forecasted a slight improvement in its operating margin over the next 8 years, given the Reel monetization improvements.

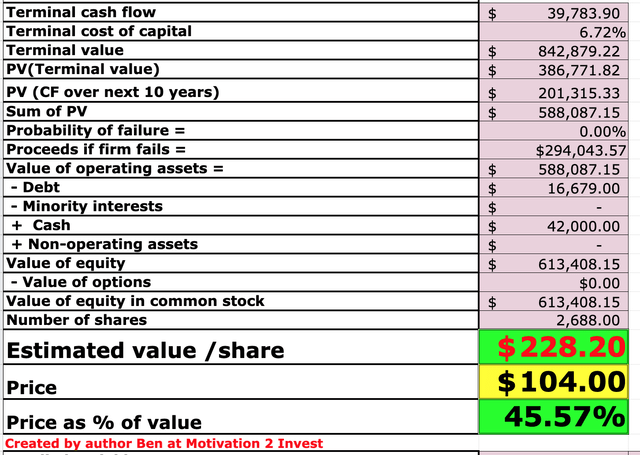

Meta stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $228.2 per share, the stock is trading at $104 per share at the time of writing and thus is ~54% undervalued. This means that despite the negative headlines there is a substantial upside for Meta stock.

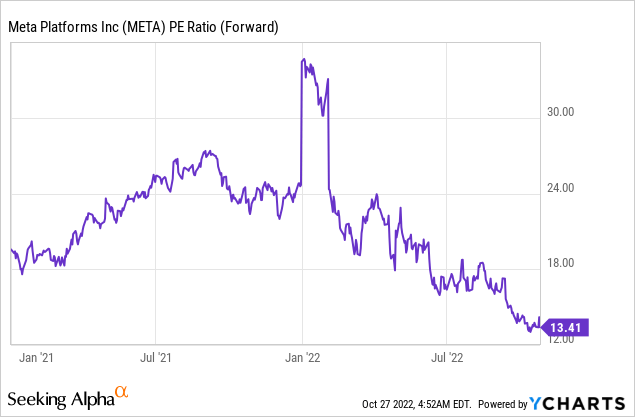

As an extra datapoint, Meta trades at a Price to Earnings ratio = 13.31 which is 46% cheaper than its 5-year average.

Risks

Recession/Lower Ad Spend/Competition

The high inflation and rising interest rate environment have caused many analysts to forecast a recession. This tepid environment has spooked advertisers who have pulled back ad spending which directly impacts Meta’s financials. The good news is advertising spend is cyclical and despite competition from the likes of TikTok, Meta still has one of the most advanced advertising platforms with the most attention from monthly active users.

Metaverse Payback

The “Metaverse” is still an unproven concept both from a technology standpoint and consumer adoption. For example, even if Meta can create a state-of-the-art 3D virtual world with a “feeling of presence”, there is nothing to say that mainstream consumers will want to use this platform regularly. Thus this means investors expecting to see payback on the $10 billion-plus in investment may be disappointed. However, Zuckerberg does have a track record of success and a great founder’s vision (with financial backing) can change the world. Thus we could also be at a historic time, when we will look back on this situation 10 years into the future and say, “I can’t believe we doubted the Zuck”. Every new technology has a pattern of being criticized by the mainstream. For example, the first mobile phones in the 1980s/1990s were deemed as dorky and unnecessary, until they reached a “tipping point” of mass adoption. I will leave you will this quote from Mark Zuckerberg, which could go down in history:

“There is still a long road ahead to build the next computing platform, but we are clearly doing leading work here.

This is a massive undertaking. And it’s often going to take a few versions of each product before they become mainstream, but I think that our work here is going to be of historic importance and create the foundation for an entirely new way that we will interact with each other and blend technology into our lives as well as the foundation for the long-term of our business.”

Final Thoughts

Meta Platforms is experiencing a series of headwinds which coupled with slowing growth rates and high investments have caused huge stock price declines. However, the majority of these issues from FX headwinds to advertiser spending reductions looks to be cyclical. Meta is investing for the future and the Metaverse adds a substantial amount of “optionality” into the stock. The core business is undervalued intrinsically and relative to historical multiples, thus long-term investors may be rewarded, but only those with a strong stomach.

Be the first to comment