cagkansayin

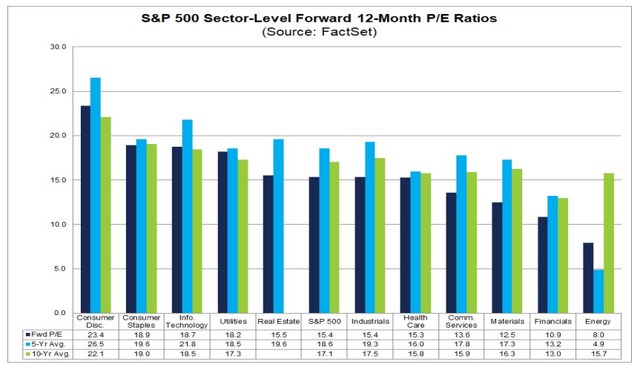

The S&P 500’s forward price-to-earnings ratio has fallen to just 15.4, according to John Butters, earnings analyst at FactSet. The steady and safe Consumer Staples sector is now the second-highest priced area using the forward operating P/E metric. It has been a place of relative calm for most of 2022.

One large-cap beverage company no doubt has seen solid demand for its adult drinks during this stressful year. Constellation Brands reports earnings Thursday morning. Let’s dig into the value proposition, options, and charts to see what the play is.

Staples Second Highest Sector Forward P/E

FactSet

According to Bank of America Global Research, Constellation Brands (NYSE:NYSE:STZ) is a leading global producer and marketer of alcoholic beverages. Its wide-ranging portfolio spans wine, spirits, and imported beer. STZ is one of the world’s largest wine companies overall and is the largest global premium wine company. Key brands include Robert Mondavi, Clos du Bois, Blackstone, Arbor Mist, Black Velvet, and SVEDKA vodka. It also owns 100 percent of the rights to brew, market, and sell Modelo’s Mexican beers in the U.S.

The New York-based $44.4 billion market cap beverage company within the Consumer Staples sector trades at a high 37.4 trailing 12-month GAAP PE ratio and pays a small 1.4% dividend yield, according to The Wall Street Journal.

With a 1.5% global market share and a 13% presence in the U.S. wine market, STZ has steadily been improving its product mix for thirsty consumers. Strong margins and solid free cash flow promote upside earnings risk and shareholder accretive activity potential. Its 39% ownership in Canopy Growth (CGC) is a liability to me, however, given that company’s struggles since early 2021.

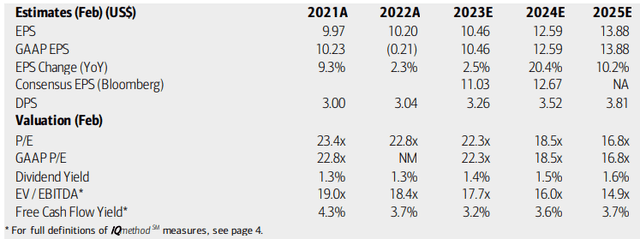

On valuation, analysts at BofA see steady growth in 2023 following a below-inflation earnings increase in its previous fiscal year. Per-share profits should grow at a high rate in 2024 if BofA and the Bloomberg consensus forecasts are right. Dividends are also expected to rise in the coming years.

Unfortunately, STZ trades at lofty GAAP and operating earnings valuations of 22.3 times the next 12-month profits. The S&P 500’s forward P/E is just slightly above 15, for comparison. Constellation’s EV/EBTIDA multiple is also very elevated at more than 17x while its free cash flow yield is solid and steady in the 3% to 4% range. Overall, the stock is expensive for operating in what should be a slower-growth industry.

STZ: Earnings, Valuation, Dividend Forecasts

BofA Global Research

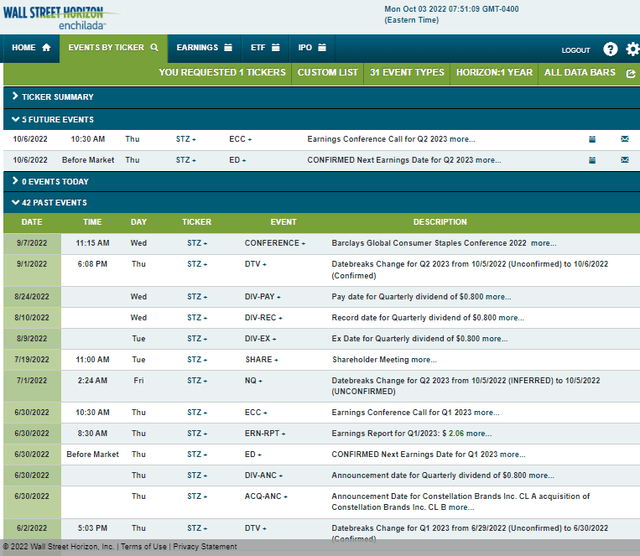

Looking ahead, Constellation has a confirmed Q2 2023 earnings date of Thursday, October 6, before the open, according to Wall Street Horizon’s corporate event data. A conference call is scheduled for 10:30 am ET. You can listen live here.

Corporate Event Calendar

Wall Street Horizon

The Options Angle

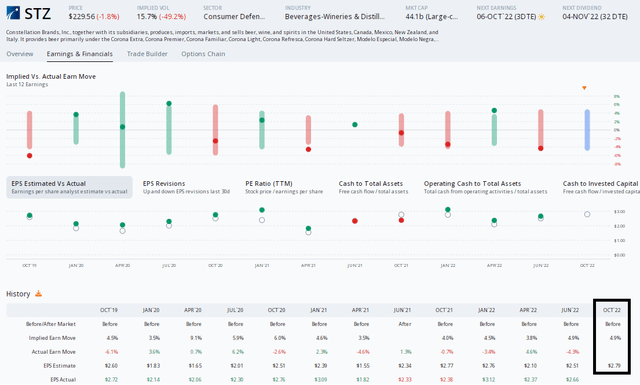

Digging into the earnings expectations and anticipated stock price move, data from Option Research & Technology Services (ORATS) reveal a consensus EPS forecast of $2.79, which would be a 17% jump in earnings from the same quarter a year ago.

Since the June quarterly report, there have been four analyst upgrades and just two downgrades. That is impressive given the declining S&P 500 earnings picture over recent months.

The options market has priced in just a 4.9% earnings-related stock price move, using the nearest-expiring at-the-money straddle, following Thursday morning’s announcement. That’s about on par with implied swings in past earnings announcements. Being a Consumer Staples stock, premium is not priced too high.

The company has a decent beat rate history but did miss on earnings forecasts in two of its last five reports. Overall, it’s hard to expect a monster move out of STZ, so let’s look to the charts for clues on where the directional bet should be made.

Constellation: A Small Earnings Move Expected, Solid EPS Growth

ORATS

The Technical Take

Constellation has resistance around $260 while buyers come about when shares dip to near $205 to $210. Currently, it appears the stock wants to revisit the lower end of that range after failing to climb above resistance in August. Thus, I see bearish near-term risks with STZ, so perhaps buying puts at the $230 strike while selling puts at the $210 strike, or simply waiting to buy shares near that level, makes sense based on the options picture and chart setup.

A breakout above $260, particularly on a weekly closing basis, would result in a bullish price objective to near $310 while a bearish breakdown could send shares to $160 (the late 2020 low).

STZ: Shares Rejected At Resistance

Stockcharts.com

The Bottom Line

Constellation Brands is an expensive Consumer Staples stock that has seen impressive relative strength this year as investors seek safety. Heading into Thursday morning’s earnings report, I’d lean bearish and look to play a move toward the previous low at $210. Buying there with a stop under about $190 could make sense. Long-term investors might want to avoid this name given the high valuation, though.

Be the first to comment