AlbertoChagas/iStock via Getty Images

(Today’s piece was originally published on the afternoon of June 17, 2022, for Second Wind Capital members. Carvana shares were then trading in the low $23s. Please note, today’s piece only covers the interesting technical setup whereas I wrote a fairly comprehensive piece, part 2, on the business and the fundamentals. Part 2 was published this morning (June 21, 2022), before the bell, for SWC members.)

I love value investing as well as contrarian investing. As we find ourselves in a fierce bear market, I would argue there are a number of tremendous opportunities and this very well could be an optimal time to put capital to work, as a contrarian. Today, I write to discuss one of the biggest battleground stocks in the entire market, Carvana Co. (NYSE:CVNA). In the span of less than one year, shares have gone from the best of times ($377 per share on August 10, 2021) to the worst of times ($19.80 per share on June 13, 2022).

Incidentally, if you read the commentary threads, within a number of fairly recent free site Carvana articles, you can’t miss the extreme bearishness. A few bearish readers go as far as suggesting this business is most assuredly destined for bankruptcy. Also, although impossible to precisely measure, perhaps an objective observer, that studied the commentary threads from the summer of 2021 as well as the present day, might quickly work out and recognize the extreme swings in sentiment, from both time periods.

In today’s piece, as a contrarian investor, I want to share a bullish supply/demand and net change analysis. There are five components to this setup.

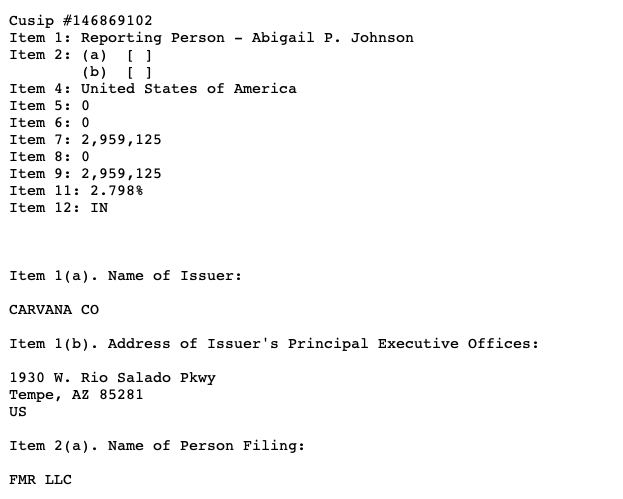

1) A nice increase in insider buying

As you can see, since mid-May 2022, insider buying has picked up nicely. This includes a few million dollars plus purchases by a few different insiders as well as a recent $42 million purchase by Ernie Garcia II (the father of the CEO).

Who’s Sitting At The Poker Table?

As of June 13, 2022, there are roughly 188.6 million shares of Carvana in existence. After Ernie Garcia II picked up another nearly two million shares (June 10th and 13th), the Garcia’s now own 78.46 million shares.

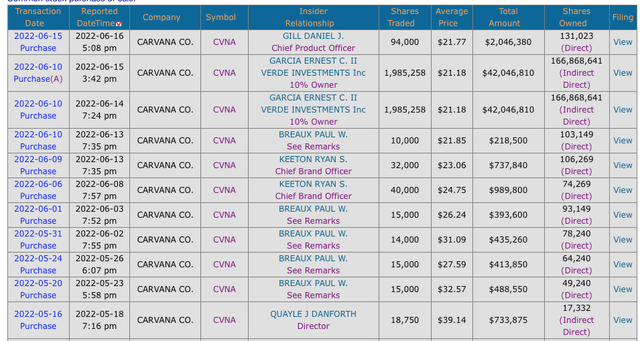

See Exhibit A:

So 188.6 million – 78.5 million shares equals 110.2 million shares, in the public float.

As of March 31, 2022, enclosed below is a list of the largest holders.

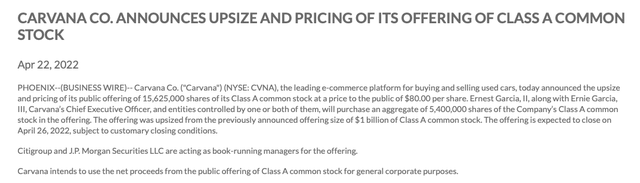

However, in late April 2022, Carvana issued 15.625 million shares, in a secondary offering, to help fund its $2.2 billion ADESA deal. Net of the Garcia’s 5.4 million shares, the supply of additional CVNA shares increased by 10.225 million, post the secondary offering.

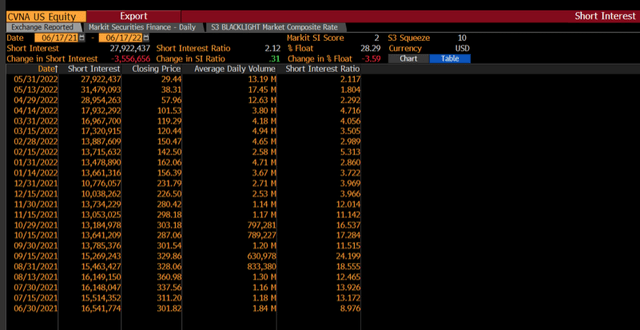

2) Big increase in Short Interest

Since January 1, 2022, the net change in Carvana’s short interest has been an increase of 17.2 million from January 1, 2022 – May 31, 2022.

Here is the math:

10.776 million (as of 12/31/21) and 27.992 million (as of 5/31/22).

Moreover, from April 1, 2022 through May 31, 2022, the net change has been an increase of 11.02 million shares.

Here is the math:

16.968 million (as of 3/31/22) and 27.922 million (as of 5/31/22).

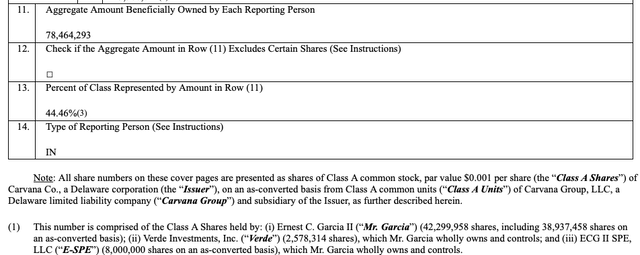

3) Fidelity (Fido) Sold 7.48 million shares in Q2 2022

On June 10, 2022, Fidelity filed an updated SC 13G/A that they decreased their stake in Carvana from 10.438 million (March 31, 2022) to 2.959 million shares (June 9th). That is a net change of -7.48 million.

sec.gov

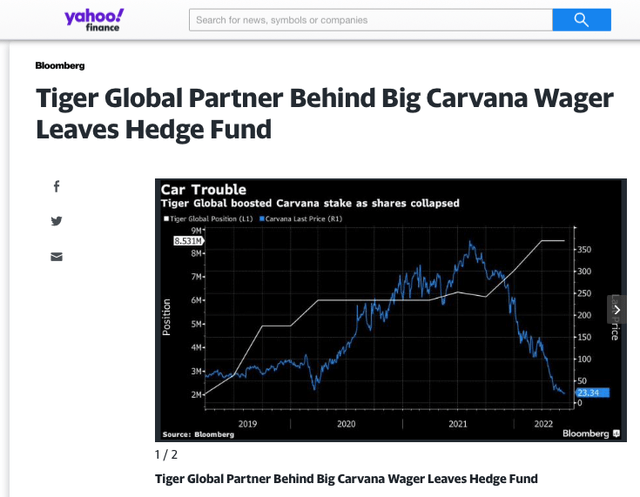

4) The Massive Tiger Global Management hedge fund is down 50% YTD through May 2022 and its Carvana analyst left the firm (early June 2022)

Moving along, there are media reports that Chase Coleman’s once $50 billion plus hedge fund is severely struggling. Media reports suggest, year-to-date, the fund is down north of 50% through May 2022. As of March 31, 2022, Tiger Global owned 8.35 million shares, of Carvana, which is less than a 5% equity ownership stake in the business. Therefore, as less than a 5% equity holder, Tiger doesn’t need to file within two days of selling any of its stake.

Last week, there was a Bloomberg report, Sam Harland, age 33, the analyst behind the Carvana bet, recently left the firm.

Given Tiger’s super weak 2022 performance, and the fact that its covering analyst left the firm, it doesn’t take a rocket scientist to work out that there is a strong possibility that Tiger very well might have aggressively sold down its Carvana stake (and might be close to entirely out), especially given the threat of the shop closing/redemptions, etc.

So if we are being conservative, in light of the facts floating around in the public domain, I think it is reasonable to estimate that upwards of four million shares of Carvana were sold by Tiger during Q2 2022 (possibly more).

5) Net Change Analysis

Therefore, using logic, let’s do some math and a basic net change analysis.

Since April 1, 2022, we know the following:

- Carvana’s public share count increased by 10.22 million (secondary offering).

- Fidelity sold 7.48 million shares.

- Short interest increased by 11 million shares (April 1, 2022 – May 31, 2022).

- Tiger might have sold nearly all or some of its stake (so maybe four million to eight million shares). I am assuming they sold four million shares (but that is an educated guess).

- Moreover, given the massive drawdown in the Nasdaq (down 32% YTD through June 16, 2022), there must have been other net redemptions that might have, cumulatively, amounted to five million to 10 million shares. However, I am not going to include that as that is conjecture.

- The Garcia’s recently purchased nearly two million shares.

So by my back-of-the-envelope math, my conservative net change analysis suggests that at least 30.7 million shares of CVNA were aggressively sold, on a public float of 110.6 million shares. That is a lot of selling.

(-10.22 million (secondary) – 7.48 million (Fido) – 11 million (increase in short interest) – 4 million (Tiger) + 2 million (the Garcia’s)).

Now for every seller, there is a buyer. However, during normal times, outside of bear markets, shares held by a stable institutional holder, like a Fido or Tiger, are very different than shares held by transient day traders swinging this around to capture 5% to 15% moves (either long or short).

Again, given that this intense selling pressure took place in a backdrop where the 10 YR hit 3.45% (earlier last week), oil got to $120 per barrel, war in continental Europe for the first time since 1945, and the lowest consumer sentiment readings in the history of the University of Michigan survey, among other fears, we have a good part of the explanation for the dramatic move lower.

Therefore, it is no wonder that Carvana shares have gone from $119 per share (April 1, 2022) to $20 per share (June 16th).

If there is any good news (fundamentals, sentiment, or even a new 5% holder), I would argue that Carvana shares will be back to $40 before you can blink your eyes.

As a contrarian investor, I am also very bullish on the business and its fundamentals, and I wrote a fairly in-depth piece on that aspect of the business, but that is reserved for part two. Either way, if there are any Carvana bulls left in the wilderness, as the bullish herd has been culled, for the surviving bulls, just know you are not alone, even though the howls of the bearish wolves have been deafening.

Be the first to comment