Noam Galai

Thesis

UiPath Inc.’s (NYSE:PATH) FQ3’23 release led to a post-earnings surge that sent bears fleeing. However, before we conclude that PATH bears have suffered from the post-earnings implosion, PATH bulls should think again.

The unprofitable robotics process automation (RPA) leader’s stock posted a YTD total return of -67% and lost nearly 90% of its value at its November lows from its 2021 highs. Therefore, early buyers in PATH have been decimated. “Weak” holders who disembarked earlier are likely sneering at the “diamond hands” left holding the bag at its November bottom. Meanwhile, PATH bears sitting on significant gains could have used the post-earnings selloff to cut some exposure, taking well-rewarded profits off the table.

If a so-called market leader has found it so challenging to chart its path toward profitability since its founding in 2005, we urge investors to consider very carefully why it could be any different now.

Notwithstanding, PATH’s valuation (in terms of its revenue multiples) has moderated significantly from its 2021 highs, as the market justifiably de-rated it.

Despite that, PATH’s forward earnings multiples remain highly aggressive (and that’s on an adjusted/non-GAAP basis), while free cash flow (FCF) margins are expected to remain relatively languid.

Hence, we believe investors looking to cut exposure should capitalize on the recent post-earnings reversion. Moreover, with growth potentially slowing as UiPath embarks on its drive toward profitability, there are plenty of SaaS companies with stronger competitive moat, more robust profitability, and proven business models to invest in, given the tech bear market.

Maintain Hold.

UiPath: Focusing Its Go-To-Market Strategy On Enterprise Sales

UiPath reported healthy growth in its pipeline of larger customers in FQ3. Accordingly, the company posted 1,711 large customers (>$100K in annualized renewal run-rate, or ARR) in FQ3, up from last year’s 1,363.

Notably, UiPath has also been making solid gains in the larger enterprise customers (>$1M ARR), reaching 201 customers in FQ3, up from last year’s 135.

The company also accentuated that it will continue to sharpen its edge and focus on its go-to-market (GTM) in more significant enterprise deals moving forward, seeing it as instrumental in its drive toward profitability. Co-CEO Robert Enslin articulated:

The majority of the churn is in the smaller customers. We are getting more success with more positive signs in the Global 2000, and that’s going to continue to be our focus. And that’s how the segmentation is actually set up. We’ll move more over time into the distribution side with the smaller customers. We also mentioned that as we change the segmentation, we will start to use propensity and graduation. That will drive the deal sizes up. (UiPath FQ3’23 earnings call)

However, it’s also critical for investors to note that even enterprise sales have moderated across the SaaS space in Q3, with the slowdown likely to continue.

UiPath: Could It Still Deliver Its High-Growth Cadence?

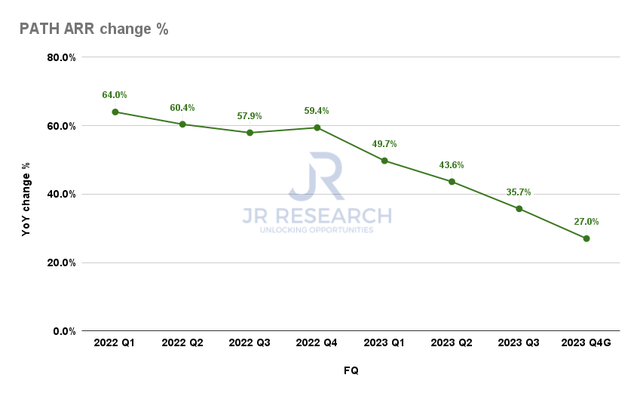

UiPath ARR change % (Company filings)

UiPath’s Q4 ARR guidance likely reflected worsening macro headwinds, as the company expects ARR growth to moderate to 27%, down from Q3’s 36% uptick.

Furthermore, a focus on enterprise sales would likely elongate its sales cycle further as it reaches into larger deal values. Deal values could also be more volatile and less predictable as UiPath seeks to accelerate its path toward profitability by scaling faster through larger enterprise contracts.

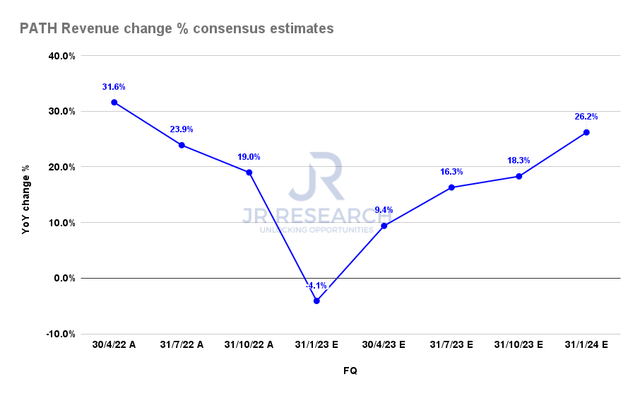

UiPath Revenue change % consensus estimates (S&P Cap IQ)

Hence, we believe the consensus estimates (bullish) credible, as Wall Street analysts modeled for its revenue growth cadence to slow further.

However, the critical question is whether the market has priced in a potential inflection in its revenue growth from FY24 as UiPath laps less challenging comps next FY.

Coupled with its renewed drive toward profitability, which has seen relative success in FQ3, it could spur the return of stronger buying sentiments if UiPath could execute well.

PATH: But At What Valuation?

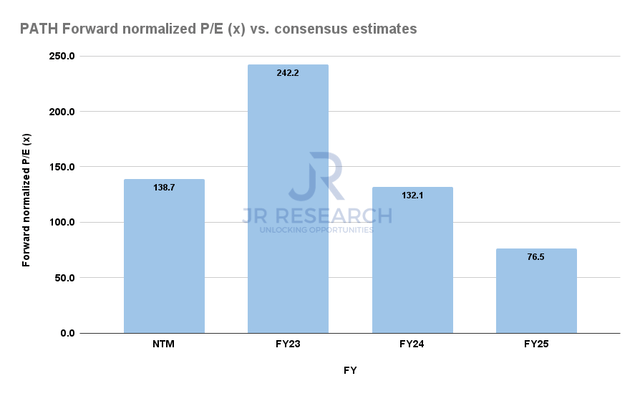

PATH Forward normalized P/E consensus estimates (S&P Cap IQ)

We gleaned that PATH last traded at an NTM normalized P/E of nearly 140x. That’s way above its direct peers’ median of 22.8x (according to S&P Cap IQ data).

Hence, UiPath still has a significant growth premium embedded in its valuation. However, its drive toward profitability could crimp its revenue growth significantly. Based on the revised consensus estimates, Wall Street’s modeling suggests that UiPath could deliver revenue growth of just 18% in FY24 and 19% in FY25.

With an estimated FY25 EBITDA margin of 11.2% or a free cash flow margin of 7.2%, we believe its FY25 normalized P/E multiple of 76.5x is unjustified.

Is PATH Stock A Buy, Sell, Or Hold?

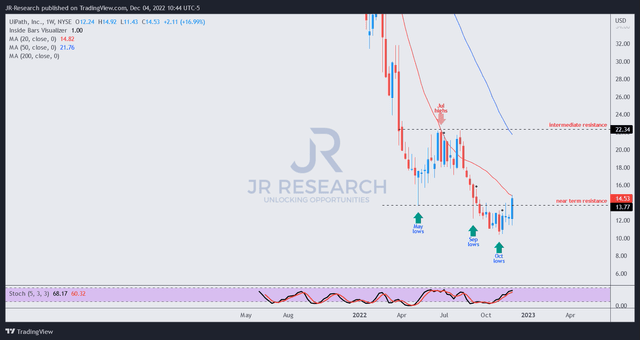

PATH price chart (weekly) (TradingView)

If investors followed Wall Street’s consensus Buy ratings since its May 2021 highs, they would have faced near-complete destruction at its November 2022 lows (down nearly 90%).

PATH buyers have attempted numerous attempts over the past year to force a recovery but to no avail. Its last significant endeavor led to a rejection from its July highs, which sent PATH down rapidly toward its November lows.

Hence, the positive post-earnings reaction last week was not a surprise, with PATH’s price action suggesting some covering was in play.

However, we remain unconvinced of PATH’s revised GTM motion while renewing its focus on driving profitability with potentially markedly slower topline growth.

Maintain Hold.

Be the first to comment