JHVEPhoto

Elevator Pitch

I continue to rate Shopify Inc.’s (NYSE:SHOP) stock as a Buy. In my previous May 31, 2022, update for SHOP, I highlighted why investors should be bullish on Shopify prior to its stock split in late-June 2022. I evaluate the prospects of a share price recovery for Shopify in the second half of this year with this latest article.

There is a good possibility of a rebound in SHOP’s stock price for the rest of 2022, as I am of the view that Shopify’s GMV, revenue, and operating losses for the second half of the current year should surprise the market in a positive way. In the long run, I am optimistic that SHOP’s take rate can rise further from the 1.98% it registered in Q2 2022. These factors provide support for my positive view and Buy rating for Shopify.

SHOP Stock Key Metrics

As a start, I will assess SHOP’s key metrics for the most recent quarter.

Shopify released the company’s Q2 2022 financial results in late-July, and its headline numbers weren’t as good as what the market had hoped for.

Revenue growth for SHOP slowed from +57% YoY in Q2 2021 and +22% YoY in Q1 2022 to +16% YoY for Q2 2022. Furthermore, the company’s actual Q2 2022 top line of $1,295 million turned out to be 3% lower than the sell-side’s consensus revenue estimate of $1.33 billion. Shopify generated a non-GAAP adjusted net loss per share of -$0.03 in Q2 2022 as compared to positive non-GAAP EPS of +$0.22 for Q2 2021. Before the company reported its second-quarter results, investors had expected SHOP to deliver a positive adjusted EPS of +$0.03 in the recent quarter. Also, Shopify’s Gross Merchandise Volume, or GMV, of $46.9 billion for the second quarter of 2022 came in 4% below Wall Street’s consensus Q2 GMV of $48.9 billion as per S&P Capital IQ.

But there were a quite a number of bright spots within Shopify’s most recent quarterly financial performance that investors should pay attention to.

Firstly, Shopify’s offline GMV increased by a strong +47% YoY in the recent quarter as compared with an 8% YoY growth in online GMV, as disclosed at its Q2 2022 earnings briefing on July 27, 2022. In other words, SHOP’s lower-than-expected overall GMV (as indicated above) for Q2 2022 is largely attributable to the fact that consumers are shifting their spend from online to offline, as the modest increase in online GMV is not fully compensated for by offline GMV’s rapid growth. More importantly, SHOP also stressed at the company’s second-quarter investor call that “we continue to take (market) share in both (offline and online retail).”

Secondly, SHOP’s penetration rate of payments (calculated as Gross Payments Volume or GPV divided by GMV) expanded by 2% QoQ and 5%YoY to 53% in Q2 2022. Going forward, payments’ penetration rate for Shopify should continue to rise, as the company introduces “Shopify Payments” and “Shopify POS (Point-Of-Sales) with integrated payments” in more markets.

Thirdly, subscription solutions revenue for Shopify increased by 10% YoY from $334 million in the second quarter of last year to $366 million in the most recent quarter, and this also beat the market’s consensus forecast of $362 million by 1% according to S&P Capital IQ. A key driver was the increase in the take-up rate for Shopify Plus, as Shopify Plus’ proportion of Monthly Recurring Revenue or MRR grew from 26% in Q2 2021 to 31% in Q2 2022.

It is noteworthy that the YoY growth for SHOP’s subscription solutions revenue in Q2 2022 could have been even higher. Shopify mentioned at its recent second-quarter results call that “the change in app and theme revenue share model for partners that we implemented in Q3 (2021)” had a negative impact on its subscription solutions revenue growth to the tune of approximately -400 basis points.

I look at the short-term financial expectations for SHOP in the subsequent section.

What Is The Prediction For Shopify Stock?

In this section, I outline the expectations for Shopify’s financial performance for 2H 2022 and full-year fiscal 2022 as per management guidance and the sell-side’ consensus numbers.

Shopify’s Updated FY 2022 Management Guidance

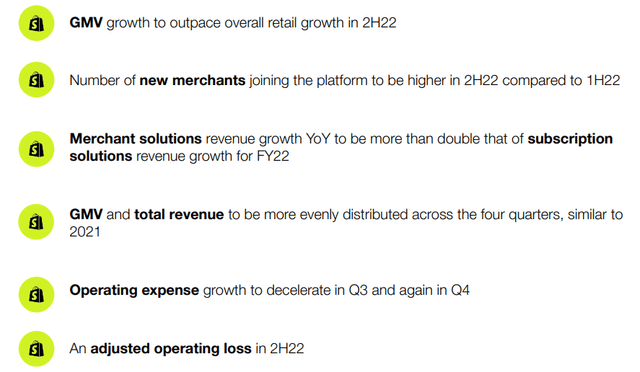

SHOP’s Q2 2022 Results Presentation

As indicated in the chart presented above, Shopify’s management appears to be predicting that there will be a moderation in the company’s revenue growth and SHOP will return to losses this year. Specifically, the management guidance relating to “GMV and total revenue to be more evenly distributed across the four quarters” implies that an acceleration in GMV and top line growth for 2H 2022 is less likely. Also, SHOP guided for “an adjusted operating loss in 2H22”, and the company was already loss-making at the operating profit level for the first half of the year.

Wall Street analysts’ financial projections are in line with the guidance provided by SHOP’s management. Based on data sourced from S&P Capital IQ, Shopify’s top line expansion is estimated to slow from +57% YoY in fiscal 2021 to +19% in FY 2022, while it is expected to generate a loss of -$136 million at the EBIT level in the current fiscal year as compared to an EBIT of +$718 million for FY 2021.

In the next section, I touch on Shopify’s stock price outlook for the rest of the year.

Will Shopify Stock Rebound In 2022?

In my view, Shopify’s stock will rebound for the remainder of 2022, as I see SHOP delivering a better-than-expected financial performance for the second half of this year. Shopify’s shares have fallen by -70% thus far this year, which represents a significant underperformance as compared to the S&P 500’s -12% correction in 2022 year-to-date.

Shopify’s POS network expansion and increased localization should be supportive of stronger-than-expected revenue and GMV growth in 2H 2022.

SHOP’s offline GMV as a proportion of total GMV increased from 8% in Q2 2021 to 10% in Q2 2022, and Shopify attributed this to the fact that “our POS Pro locations are increasing in the thousands year-over-year” in 1H 2022 at its Q2 2022 investor briefing. Looking ahead, SHOP has guided at the recent quarterly earnings call that the number of POS Pro locations will “continue to increase into the back half” of 2022. This puts Shopify in a good position to benefit from the shift in consumer spending from online to offline as the economy reopens in a post-pandemic environment.

Separately, Shopify continues to put in a lot of effort in the area of localization as indicated in the chart below. This is the key reason why SHOP has noted in its FY 2022 outlook (highlighted in the preceding section) that it expects the “number of new merchants joining the platform to be higher in 2H22 compared to 1H22.”

Shopify’s Localization Efforts

SHOP’s Q2 2022 Results Presentation

In terms of costs and profitability, Shopify has mentioned in its fiscal 2022 outlook that the company’s “operating expense growth” is expected to “decelerate in Q3 and again in Q4” of 2022. Prior to the company’s recent quarterly earnings announcement, Seeking Alpha News had made reference to a Wall Street Journal article on July 26, 2022 which highlighted that SHOP “plans to cut ~1K jobs or 10% of its global workforce.” In my opinion, this suggests that Shopify is trying its best to strike a good balance between profitability improvement driven by cost control and supporting future growth with new investments. As such, I think that SHOP’s operating losses for 2H 2022 might turn out to be narrower than what is expected, and this could be a positive surprise.

In summary, I see Shopify’s actual GMV, revenue and operating losses for 2H 2022 coming in better than what investors are anticipating, which should act as a re-rating catalyst for the stock.

Is SHOP A Good Long-Term Investment?

SHOP is a good long-term investment, because the company has a long growth runway ahead. The key metric indicative of Shopify’s growth potential is its take rate.

Shopify’s merchant solutions GMV take rate was estimated to be around 1.98% for the second quarter of 2022, which was equivalent to a YoY increase of +0.12 percentage points as compared to its Q2 2021 take rate of 1.86%. But there is huge potential for the company’s take rate to increase from current levels.

A June 8, 2022 sell-side research report (not publicly available) titled “A Foundation To Build On” published by National Bank Of Canada quoted Shopify President, Harley Finkelstein as saying in a “virtual fireside” that he thinks that SHOP’s “take rate can keep moving up within the single digits” in the future. According to this same report, Harley Finkelstein also highlighted at the “virtual fireside” that the company’s strategy is to “keep increasing take rate by offering more services.” My own estimate is that SHOP’s merchant solutions GMV take rate should grow to 3% within the next five years.

Is SHOP Stock A Buy, Sell, Or Hold?

I rate SHOP stock as a Buy. The short-term catalyst is positive surprises with respect to Shopify’s 2H 2022 financial performance. The long-term growth driver for Shopify is the increase in its take rate.

Be the first to comment