designer491/iStock via Getty Images

By Robert Hughes

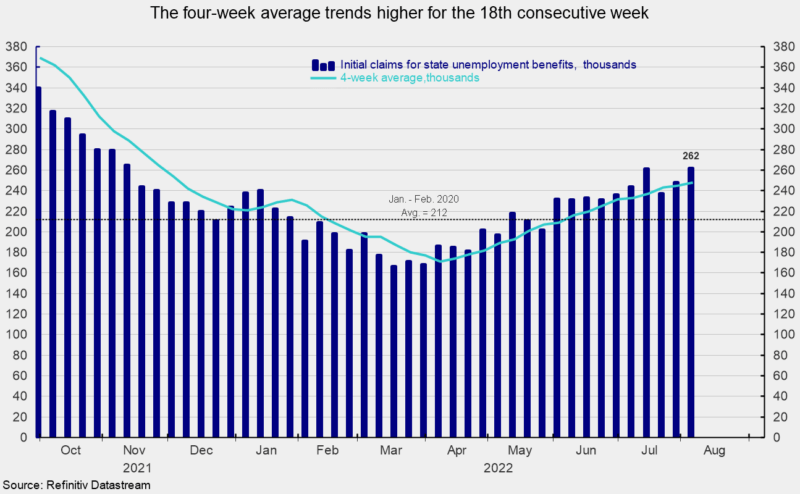

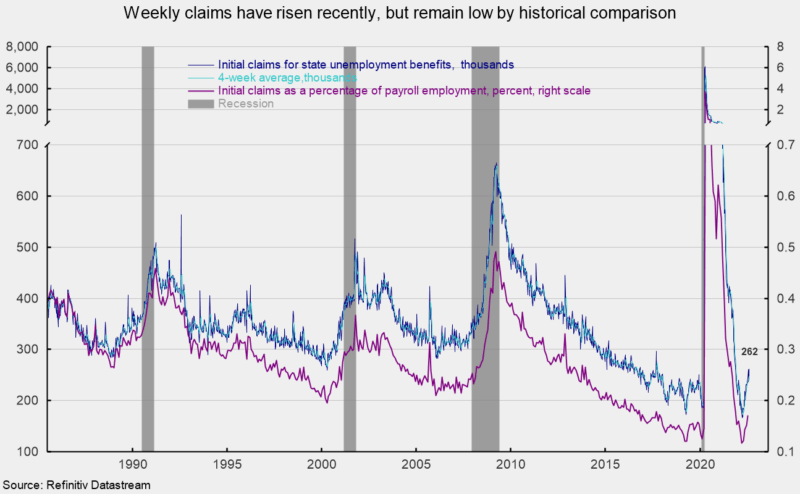

Initial claims for regular state unemployment insurance rose 14,000 for the week ending August 6th, coming in at 262,000. The previous week’s 248,000 was revised down from the initial tally of 260,000 (see first chart). When measured as a percentage of nonfarm payrolls, claims came in at 0.171 percent for the month of July, up from 0.152 in June and a record low of 0.117 in March, but still very low (see second chart).

The four-week average rose for the seventeenth time in the last eighteen weeks (the four-week average was unchanged in one week), coming in at 252,000, up 4,500 from the prior week. Weekly initial claims data continue to suggest a tight labor market, though the recent sustained upward trend indicates some easing. Continued elevated rates of price increases, an aggressive Fed tightening cycle, and fallout from the Russian invasion of Ukraine represent risks to the economic outlook.

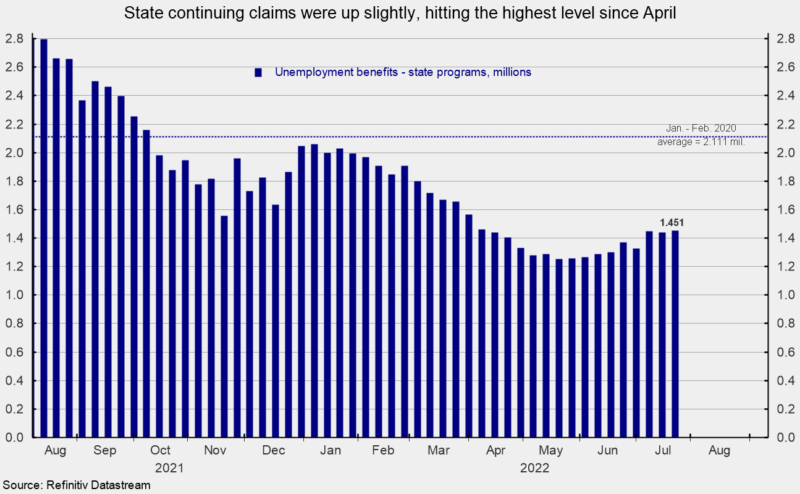

The number of ongoing claims for state unemployment programs totaled 1.451 million for the week ending July 23rd, a rise of 10,067 from the prior week (see third chart). State continuing claims are also trending higher over the last several weeks but remain very low (see third chart).

The latest results for the combined Federal and state programs put the total number of people claiming benefits in all unemployment programs at 1.479 million for the week ended July 23rd, an increase of 9,206 from the prior week. The latest result is the twenty-fourth week in a row below 2 million.

Initial claims remain at a very low level by historical comparison, but a clear upward trend has emerged, suggesting that, on the margin, the labor market has begun to loosen. Weekly initial claims for unemployment insurance are an AIER leading indicator and remained a favorable contributor in the July update. However, given the upward trajectory, it will likely turn to a neutral position in coming updates. Furthermore, the number of open jobs in the country has receded for three consecutive months, though the level remains very high by historical comparison.

While the overall low level of claims combined with the high number of open jobs suggests the labor market remains solid, both measures are showing signs of softening. The tight labor market is a crucial component of the economy, providing support for consumer spending. However, persistently elevated rates of price increases already weigh on consumer attitudes, and if consumers lose confidence in the labor market, they may significantly reduce spending. The outlook remains highly uncertain.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment