jroballo/iStock via Getty Images

Despite the recent rally in share price, Lithium Americas (NYSE:LAC) is still considered undervalued when considering the company’s future growth prospects. From an asset and financial standpoint, Lithium Americas is one of the best poised lithium companies to take advantage of the growing electric vehicle market. Not only does the company have the personnel and the technical experience needed to development multiple lithium mining sites, but the company also has multiple assets in various stages of development, low levels of debt and a war chest of cash to weather future storms.

Growing Demand

Lithium Americas is a company poised to benefit from the growing lithium demand. This lithium demand is primarily being driven by the growing number of lithium-ion batteries that are required for new electric vehicles. For anyone who follows these industries, electric vehicles and lithium-ion batteries have made a splash in the news in the past few years and are gaining significant attention and support quickly. Take a look at Tesla’s share price from 2020 going forward and it is easy to understand that other companies want to get in on the fun. Toyota has committed >$3 billion by 2030. Ford has committed >$11 billion by 2025. Volkswagen has committed to spending >$80 billion to revolutionize their future fleet. The list goes on.

Not only are companies committing to electric vehicles, but whole countries are also following in lock step. The United States has a target to make half of all new vehicles solid in 2030 zero-emissions vehicles (i.e. more electric and hybrid vehicles). The European Union has inked a deal to phase out combustion engines by 2035 (i.e. more electric and hybrid vehicles). Both of these landmark decisions pave a way for electric vehicles to become more affordable and more developed for the average consumer in the years to come.

Personnel and Technical Knowledge

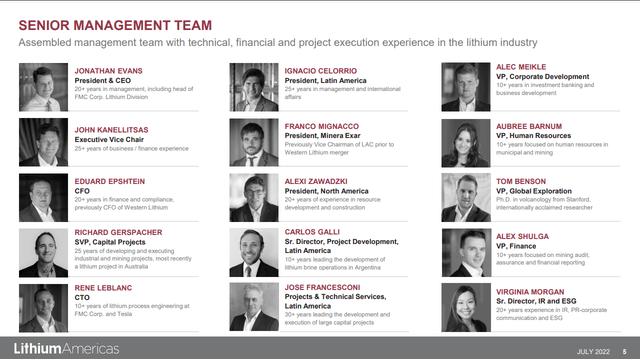

Corporate Leadership Team from 2022 Corporate Presentation

While most individuals likely skip the Senior Management Team slides in company presentations, we want the reader to take a minute to glance at the years of experience the senior management team has in the technical space and the mining industry. This is not a thrown-together rag tag group of people who want to try their hand at leading a company. These are individuals who have been hand selected based on their experience and expertise to help develop Lithium Americas as a company and the assets it owns. While the combined years of experience the senior management team has may not say much, it does account for a combined 235 years of experience in various technical, finance and support roles needed for a company such as LAC.

Debt Levels and Cash

As of the July 2022 corporate presentation, total debt sits at a comfortable level of $213 Million while the cash and cash equivalents on hand is around $441 Million. Insolvency should not be an issue at the current levels and given the current playing field. Couple this with the Cauchari Olaroz site getting ready to come online in early 2023 and LAC will suddenly start to have a consistent revenue stream to lean. What that revenue stream will ultimately go to is anyone’s guess, but my hunch is it will go towards the development of the other assets in the pipeline.

Asset Highlights

Let’s take a look at the four main assets that are in development for Lithium Americas:

Cauchari-Olaroz: This is an Argentina-based lithium mine that is slated to come online in early 2023. The site has a plant capacity of 40,000 tpa LCE, and a potential expansion to bring capacity up to 60,000 tpa by 2025. While LAC owns 44.8% of the site, with the remainder being owned by Ganfeng Lithium (46.7%) and JEMSE (8.5%), this asset will begin producing revenue by 2023.

Pastos Grandes: This South American site is located in Argentina’s lithium triangle and in close proximity to the Cauchari-Olaroz site. It was fully acquired in December of 2021 and has the potential to be developed into a lithium site with an initial capacity of 24,000 tpa LCE and is currently being evaluated by internally by the company.

Arena Minerals: Arena Minerals is an independent publicly traded company with various lithium assets across Argentina and Chile. Lithium Americas has entered into multiple agreements with Arena Minerals over the past year and currently owns 18% of the company.

Thacker Pass: The potential flagship of LAC, this Nevada based site is fully owned by LAC and has a phase 1 capacity of 40,000 tpa LCE with a potential phase 2 expansion to bring capacity up to 80,000 tpa LCE. We estimate site completion for phase 1 in late 2025 and a potential phase 2 completion in late 2027, pending any further court delays.

There are multiple irons in the fire for Lithium Americas with a significant amount of potential in the mid-late 2020s as many of these sites become further developed and come online.

Future Valuation Estimates

While we have touched on a few key fundamentals and important topics around LAC, this article is also designed to evaluate the company from a quantitative perspective and to gauge potential value given the recent run up in share price over the past two years. To do this, we will be comparing LAC to its potential future competitors. I say “potential future competitors” as these are companies who are currently in operation, or nearing operation, of lithium mining sites and will be competing with Lithium Americas for the sale of their lithium.

Peer Comparison

Mr. Market can be a fickle creature and it is impossible to predict with 100% accuracy what a stock’s price will look like in the future. However, it is possible to get a rough picture of what things will look like by evaluating competitors and considering what Lithium Americas could look like once industrial scale production begins. To do this, we will be comparing LAC to its potential future competitors. I say “potential future competitors” as these are companies who are currently in operation, or nearing operation, of lithium mining sites and will be competing with Lithium Americas for the sale of their lithium. The companies we have selected are Albemarle (ALB), Livent (LTHM), Ganfeng Lithium (OTC:GNENF) and Sociedad Quimica (SQM). All four of these companies have measurable revenue, EBITDA and valuation ratios that are readily available. The next step we need is to estimate/model what LAC’s revenue, EBITDA and valuation ratios will look like at some point in the future.

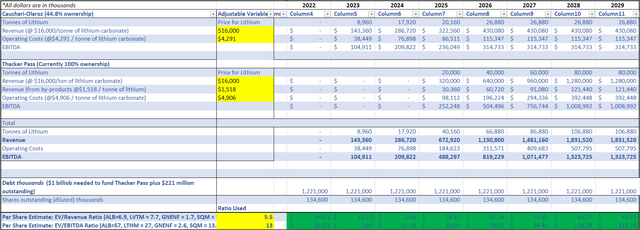

To start, there will need to be some assumptions around future sales prices, operating costs, debt and production timing. I have tried to err on the side of conservativism, but people are welcome to consider their own variables to match their thoughts, if desired.

Modelling Assumptions

- Cauchari-Olaroz Phase 1 reaches full production (40,000 tpa) by start of Q3 2023 (LAC ownership is 44.8%)

- Cauchari-Olaroz Phase 2 reaches full production (60,000 tpa) by start of Q2 2025

- Lithium carbonate sale price @$16,000/tonne due to positive tail winds and contracting negotiations

- Operating Costs @$4,291/tonne (20% increase from Feasibility study due to higher costs and shipping)

- Thacker Pass site proceeds with construction and is fully funded by LAC through cash and federal loan program.

- Assume LAC takes out a $1 billion loan to complete Thacker Pass (currently has >$400 million in cash)

- Thacker Pass Phase 1 (40,000 tpa) achieves completion and full production by start of Q3 2025

- Thacker Pass Phase 2 (80,000 tpa) achieves completion and full production by start of Q2 2027

- Lithium carbonate sale price @$16,000/tonne due to positive tail winds and contracting negotiations

- Revenue from by-products @1,518/tonne of LCE (from pre-feasibility study)

- Operating Costs @$4,906/tonne (20% increase from pre-feasibility study due to higher costs and shipping)

- Currently shares outstanding (~134,600,000) remains constant going forward (no additional dilution)

- Pastos Grandes modelling not evaluated due to the early stages of the project

- Arena Minerals modelling not evaluated due to the early stages of the project

Modelled Financials for LAC

Using the above assumptions for sales price, operating costs, debt and project timing, one can easily arrive at rough numbers for an annual revenue and annual EBITDA. Revenue and EBITDA paint a good picture without diving into too much detail of how a company appears on a financial front. For the sake of simplicity, we will be focusing on the year 2027 where the projected revenue and EBITDA is estimated to be ~$1.48 billion and ~$1.07 billion, respectively.

Personal Excel Model of LAC Future Revenue and EBITDA

These financial numbers alone don’t offer the full picture as we want to arrive at an estimated future share price. This is where comparing LAC to its future peers and future competition comes into play. I say “future peers” as we don’t want to compare them to a current peer that has no revenue or EBITDA. Rather, we want to look at what does a company look like who is currently achieving production and will be a “competitor” once LAC achieves commercial production.

Peer Valuation Ratios

Using Yahoo Finance, we are able to quickly capture the select competitor’s valuation ratios in the below table. The ratios we will be considering are the Enterprise Value / Revenue and Enterprise Value / EBITDA. If one is able to estimate future revenue and EBITDA value for LAC, then these ratios can be used to help calculate an estimated future share price for LAC. These ratios are important because they allow individuals to look at what a company is physically worth and compare it to the physical revenue or physical EBITDA that the company makes.

Please note the “Future Ratio Selected for LAC” is a rough average of the competitor’s ratios and is designed to be conservative in nature.

|

Enterprise Value / Revenue |

Enterprise Value / EBITDA |

|

|

ALB |

6.9 |

57 |

|

LTHM |

7.7 |

27 |

|

GNENF |

1.7 |

2.6 |

|

SQM |

5.9 |

13.3 |

|

Future Ratio Selected for LAC |

5.5 |

13 |

Source: Valuation Measures & Financial Statistics

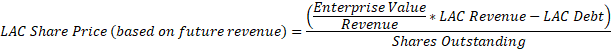

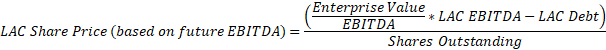

At this point, we have everything we need to plug and chug to arrive at an estimated future share price for LAC. The below equations have been used in the evaluation:

Share Price Equation using Enterprise Value and Projected Revenue

Share Price Equation using Enterprise Value and Projected EBITDA

Depending upon which year and what equation you are evaluating, the share price can vary significantly (see below table for summarization).

|

LAC Future Ratio |

Full Year 2022 |

Full Year 2023 |

Full Year 2024 |

Full Year 2025 |

Full Year 2026 |

Full Year 2027 |

Full Year 2028 |

|

|

Revenue Estimate |

5.5 |

$0 |

$0 |

$3 |

$18 |

$37 |

$51 |

$66 |

|

EBIDTA Estimate |

13 |

$0 |

$1 |

$11 |

$38 |

$70 |

$94 |

$119 |

Sticking with our simplified method of focusing on 2027, we feel confident that LAC should be within the $51 – $94 share price range. This is dependent upon LAC achieving the previously estimated revenue and EBITDA values summarized in the above sections.

Risks

No investment is without its potential risks. The numbers presented above are estimates based on current market information and could be materially different in the future. In addition, there is no guarantee that the potential opportunities for LAC (Pastos Grande, Arena Minerals, Thacker Pass) will materialize in a positive manner. If delays occur for the current mining sites, this will hinder LAC in the form of asset development and meeting the future lithium demand. To cap things off, litigation and financing are burdens for any company. While LAC has had to deal with both of these topics at various times, it is impossible to peer into a crystal ball and predict smooth sailing for all opportunities going forward.

Conclusion

While our valuation approach and company outlook are not foolproof methods, we believe it allows individuals a rudimentary, but conservative, approach to value a company from a quantitative standpoint while taking a broad qualitative point of view. Given the current share price in the $20 to $30 range, we see significant upside given a long-term time horizon.

What is important to remember is that LAC is a company that is laying the groundwork to be a future world scale lithium supplier across the globe. These processes take time and are not a get rich quick scheme. However, looking at the big picture and understanding the future potential, there appears to be a large upside for those who are patient and can weather the storm of Mr. Market. There is an immense amount of upward growth potential given the current climate, and we are extremely bullish given at the current levels of LAC.

Be the first to comment