gremlin

Dear readers,

You know it’s sometimes time for an Exchange Income Corp (OTCPK:EIFZF) update. I continue to view this company as one of the more interesting out there in its sector. It has proven, to my mind, over and over again that it has the ability to withstand and triumph in extreme situations and environments, and has stayed with its consistent, growing monthly dividend.

This dividend is consistent and safe, confirmed not that long ago because it was actually very recently raised by 0.12 CAD per year, or 0.01 CAD per month as it is a monthly dividend. This comes to a 5% raise.

Let’s see, therefore, what we have to contend with and look at the most recent set of results and valuation.

Exchange Income Corporation – An update

EIF keeps being very underfollowed despite what I view as extreme company quality on display here. The adage that the “proof is in the pudding” is really one that should be considered here. Just look at the financials that this company is able to deliver, quarter after quarter and year after year.

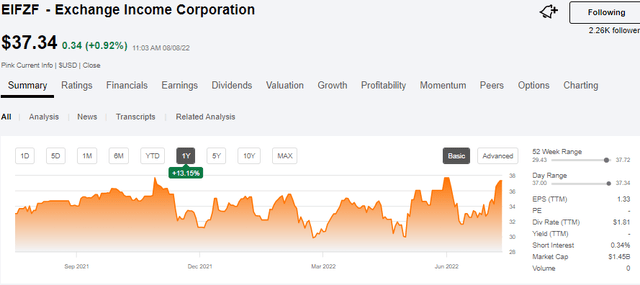

There’s a bit of volatility to the company – there is no doubt about that. Exchange Income is correlated both to aviation and to the general macro, though it also seems to have a higher-than-usual correlation typical to small companies when it comes to momentary ups and downs. Take a look at the last year.

Exchange Income Price (Seeking Alpha)

Most of those ups and downs have only very minimal correlation to any sort of significant news that the company has posted. Rather it seems that there’s an inherent up and down to the valuation, which we can actually use to make sure that we buy the business at a great price.

For those of you uninitiated to the great business that is EIF, Exchange Income Corporation is an M&A-focused business with a historical primary focus on aviation, aerospace, and manufacturing. You might expect that this turns the company into a horror show given what aviation has been exposed to for the past few years – but this is not the case. Not in the least.

The company focuses on:

- small players with high moats

- attractive margins,

- defensible positions,

- low CapEx, and

- good competitive advantages.

Historically speaking, their acquisitions were almost purely small airlines and aerospace operators. The operations in Aerospace/Aviation which by some are viewed as the areas with most risk, are primarily focused on scheduled airline/charter services/emergency transport/medical services for remote communities in Canada.

Because I come from a nation with remote areas myself, I know what it takes to get supplies from A to B – and I’ve visited Canada, so I know what transporting to Nunavut, Manitoba or some areas of Ontario entails. This is neither easily done nor cheaply done.

The company has large operations here, provided by fully-owned subsidiaries Calm Air, Perimeter, Keewatin, Bearskin, Custom Helicopters, Carson Air, and other aviation supporting businesses. These businesses are what’s known as “Legacy Airlines” for the company.

After having established a very comfortable foothold in this country-specific aviation subsector that’s unlikely to go anywhere (Because alternatives for logistics aren’t really feasible year-round), the company moved into a logical adjacent sector.

The company expanded into Regional One, a business focusing on supplying smaller, regional airlines with not only aftermarket parts but aircraft as well. Then we have Provincial, providing scheduled airline and charter service in Newfoundland and Labrador, Quebec, New Brunswick, and Nova Scotia and through its aerospace business Provincial designs, modifies, maintains, and operates custom sensor-equipped aircraft. Provincial has maritime surveillance and support operations in Canada, the Caribbean, and the Middle East.

These operations are extremely specialized, but highly attractive given their government contract characteristic. Together all of these operations make up the Aerospace & Aviation segment. This is one part of Exchange Income Corporation.

We also have a second segment of the company – the manufacturing arm.

The company owns several subsidiaries in this business segment, and it’s here that most of the company’s recent investments have been going – not aviation. These subsidiaries primarily focus on communications infrastructure, technical services, stainless steel manufacturing, processing equipment, precision parts, heavy-duty pressure washing/steam systems, water recycling tanks, and transportation tanks for various energy products.

There are also operations focusing on the “window wall system”, used in high-rises in the NA markets. So, there’s some overlap to aviation here where the company owns manufacturing capacities with that profile, but not much. I would therefore no longer consider the company as being somehow “aviation-specific.” More accurately, I would consider it perhaps a bit of a split between the one and the other.

However, the company’s fundamentals, make EIF a very diversified sort of business that generates annual sales revenue of about 1.3B CAD while running a mixed average GM of 40% and operating margins at close to 15% on the high-end. Even with the pandemic, we’re still at 11-12% on a company-wide average basis.

The company’s operations are still heavily Aviation focused from an EBITDA or earnings basis. For 2020, over 70% of company EBITDA came from Aerospace/Aviation, even though the Manufacturing segment is closing in on a 50% share of the company-wide annual revenues. This reflects the company’s investment ambitions of making the manufacturing segments more profitable while keeping its Aerospace/Aviation operations working well.

The company has no peers – no public comp does this. You can’t put it to aerospace because revenues and earnings aren’t just Aerospace, and even if you did that, the aerospace operations of EIF are too specific to be considered to either a parts manufacturer or something like Airbus (OTCPK:EADSY). Believe me, I’ve looked, and the only company that would come close to EIF would be a business that does charter as well as contract flights as well as transportation, then mixes it with something else.

Not much like that out there.

Comparing the company to a manufacturing business doesn’t really work either, because on an individual basis most of their subsidiaries are quite small, and again, 70% of EBITDA comes from contract-based/charter/service-based Aerospace operations.

EIF also completely lacks any serious-level sort of credit rating. This is a big one – and often a dealbreaker for me, but not for Exchange Income. As I view the company, they have time and time again proven their ability to handle both leverage and little leverage, and their credit/debt covenants reflect confidence from their creditors. Long-term debt is up around $1B Canadian, and it has been at that level for around 3 years at this point.

The company has zero maturities until 2025 – and even that one is just a $100 debenture which the company is already expected to retire. Despite the situation in terms of interest, there is low refinance risk, and this allows EIF to execute on its growth targets.

The company has been a superb long-term performer, yielding 10-year returns of over 380%, and annualized 14% returns with a monthly payout. The company has also never, not once, cut the dividend. Even during COVID-19, income and adjusted payout ratios never rose to a level that would necessitate such a cut – and payout ratios are stronger than ever.

Many expected the company to deteriorate going into 2022. The exact opposite happened. The company gave the 15th dividend increase, and the important TTM FCF Ex-CapEx payout ratio improved to 59% from 62% for the last quarter. This makes Exchange Income a monthly dividend payer with a well-covered payout at 59%.

The 2022 guidance stands – and it’s excellent.

We expect adjusted EBITDA of between $410 million and $430 million for fiscal 2022 and for fiscal 2023 adjusted EBITDA of between $500 million and $530 million.

Finally, based on the strength of the results, the acquisitions and our balance sheet, we’re able to announce the increase in our dividend to $0.20 a month or $2.40 per annum. This is our 15th dividend increase in our history and the first since the onset of COVID.

(Source: Mike Pyle, Exchange Income Corporation Earnings Call 1Q22)

With that, let’s look at the current valuation.

Exchange Income Corporation – The Valuation

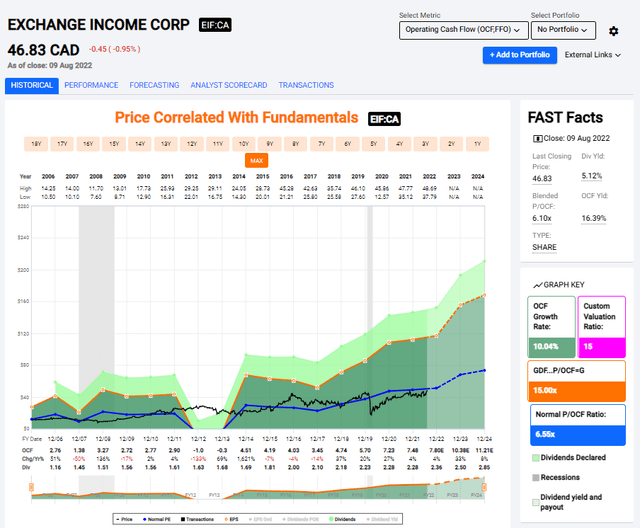

We look at EIF on the basis of P/FFO, generally, as well as looking at analyst targets and forecasts. In each of these perspectives, the company despite climbing since my last article still trades at a good valuation.

I would furthermore like to draw your attention to the fact that the company is not set to decline, but to grow – and fairly significantly.

On the back of increased manufacturing, increased contract, and organic growth, the company is expected to grow FFO by around 14% on average until fiscal 2024. This spells a 5-year FFO average of 7.44x with an annual upside of no less than 31.17%, or a 91.5% total RoR until 2024 if that 7.5x P/FFO multiple is upheld. Even if we consider it coming in at closer levels of 5-6x where we’ve been trading the past 2 years, this would still imply a current forecast upside of at least 14.4%, and around 22% at a 6x P/FFO.

In layman’s terms, there’s still plenty of upside to the company if those projections hold even close to true – which I happen to believe that they do.

I personally staked out 80%+ of my current EIF holdings at COVID-19 lows with the determination of a tactical airstrike. This has resulted in a 2.4% portfolio stake in EIF that’s at a YoC of close to 8.5% after the dividend raise. This is a great company that traded like dirt – and I went in deep. I would not hesitate to do so again, even if this takes my position up to 5%.

EIF is the best example I own outside of Sweden of why sometimes market cap and credit rating isn’t the only deciding factor in an investment. Exchange income has proven – again and again – through diligent management and actions, that it has what it takes to grow in virtually any market. I reward this clear message and confidence and dependability with my investments and my continued interest in the business.

I would not even come close to considering rotating my holding below anything near 8x P/FFO, likely at around 9-10x or so. S&P global analysts have followed suit for the company. The average PT for EIF is now CAD$58, which is a 25% upside at today’s price even from the company rising from the low $40’s to up to close to $47 and above where it trades today. All 10 out of 10 analysts have either a “BUY” or “Outperform” rating on the stock at this valuation.

My rating continues to be a “BUY”. My own price target, conservative, is $52/share for the Canadian ticker of the shares.

Thesis

My thesis for Exchange Income is fairly simple.

- This is a small operator with a big upside. Fundamentals are solid, and I like their operations and their niche. At an attractive price, and for the right investor, this is a definite “BUY” at a $52 PT.

- Risks do exist, but they’re on a more subjective and “what-if” level, with very few actual logical risks to the company’s balance sheet or operations.

- My stance is a “BUY”, and I’m excited for the 2Q22.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

This process has allowed me to triple my net worth in less than 7 years – and that is all I intend to continue doing (even if I don’t expect the same rates of return for the next few years).

If you’re interested in significantly higher returns, then I’m probably not for you. If you’re interested in 10% yields, I’m not for you either.

If you however want to grow your money conservatively, safely, and harvest well-covered dividends while doing so, and your timeframe is 5-30 years, then I might be for you.

Exchange Income Corporation is currently in a position where #1 is possible in my process, through #3 and #4.

Thank you for reading.

Be the first to comment