Koki Nagahama/Getty Images News

Introduction & Thesis

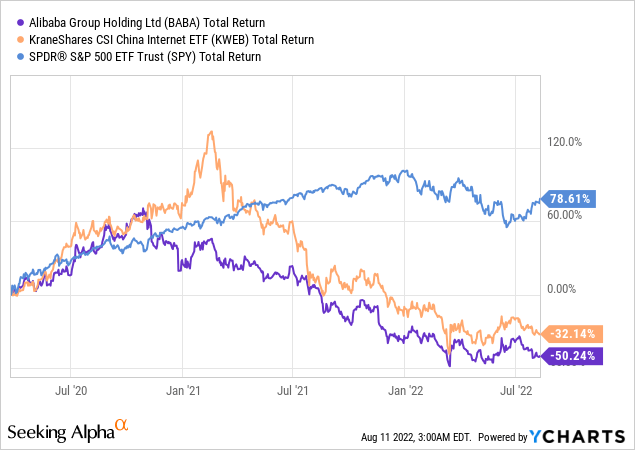

On March 24, 2020, Bloomberg wrote about Softbank CEO Masayoshi Son’s plans to sell $14 billion worth of Alibaba shares (NYSE:BABA) to shore up the bank’s businesses, which had been battered by the coronavirus pandemic. This was not the first news of attempts by Masayoshi Son, who was one of the first investors in BABA in 2000, to get rid of the company’s shares – according to a press release from the bank, derivative trades have been made since 2016. However, $14 billion in 2020 was quite a large amount, and in the medium term, BABA shares began to correct more than the main benchmarks:

Now we see that Softbank faced the problem of deflating the bubble in high-growth companies after the Corona crisis, and will now further reduce its stake in Alibaba stock (from the current 23.7% to 14.6% after settling $34 billion in prepaid forward contracts).

As from the very beginning of my coverage of Alibaba stock here on Seeking Alpha, I still believe that investors should not follow on the heels of Charlie Munger – there are too many risks in buying this stock, both geopolitical (U.S.-China tensions, Taiwan) and economic (China’s GDP growth slowdown and housing crisis). The pressure on BABA’s quotes is likely to continue due to these two factors, and Softbank’s sale of forward contracts for such a large amount may add to the headwinds for shareholders.

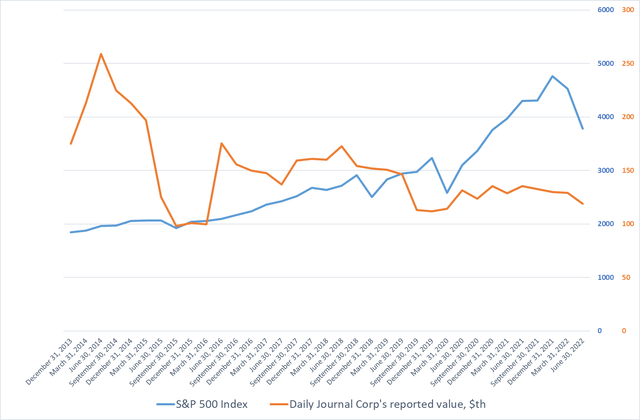

Masayoshi Son vs. Charlie Munger

One of the most frequently cited arguments for buying BABA after its phenomenal >50% off high dip is the fact that one of the most famous Western investors, Charlie Munger, bought and held the stock. According to the 13-F filings by his Daily Journal Corp, the 98-year-old investor began buying BABA in the first quarter of 2021 and gradually increased his position throughout 2021 (from 165,320 shares in the first quarter to 602,060 shares in the fourth quarter) until he decided to sell half of the position in the first quarter of 2022 and has not touched BABA since (which is interpreted by some as a bullish sign).

In my subjective opinion, a 50% reduction of BABA’s position in Daily Journal Corp. in the first quarter is already a sign of Mr. Munger’s capitulation, as this act is not typical of his position in BofA (BAC) or Wells Fargo (WFC) – compare the position size as of the last reporting date [link above] with the portfolio at the end of 2013 to see for yourself.

Concerning the unchanged amount of BABA shares in the last reporting quarter, it should be noted that other positions have also remained unchanged – Munger has simply decided not to buy or sell anything. The great investor of the 20th century will likely continue to get rid of his position in Alibaba stock, in my view, if the risks in China escalate. Remember what he said about Russian stocks many years ago (emphasis added):

When asked about Russia, Charlie Munger, Warren Buffett’s partner at Berkshire Hathaway (BRK.A) (BRK.B), harrumphed: “We don’t invest in kleptocracies.” One investor famously declared after the market’s meltdown in 1998: “I’d rather eat nuclear waste than invest in Russia.”

[Source]

If you have been buying BABA solely on Munger’s moves, then I must warn you: if you look at the performance of his Daily Journal Corp [based on Fintel data from 13-Fs], he has not been able to boast of excessive returns for many years:

Author’s calculations, based on Fintel data

Important note: the reported value (RV) above should not be used as a substitute for Assets Under Management (AUM), as it does not include cash held in accounts. However, RV depletion is also an important criterion to consider.

I think the risks of investing in the Chinese market are becoming more evident every year. While the country’s GDP grew 6-10% annually from the early 1990s until the pandemic began, these risks were ignored by many Western investors. We saw it even more positively when the Chinese GDP began to recover sharply after the 2020 lockdowns. Now, however, the prospects for similar growth rates are vague, as the real estate market, which has largely allowed China to report huge GDP growth rates in the past, is highly leveraged and in crisis, and the country’s overall population is likely to start shrinking due to the low birth rate (which largely precludes the growth of the economy extensively).

As recently as 2019 the China Academy of Social Sciences expected the population to peak in 2029, at 1.44 billion. The 2019 United Nations Population Prospects report expected the peak later still, in 2031-32, at 1.46 billion.

The Shanghai Academy of Social Sciences team predicts an annual average decline of 1.1% after 2021, pushing China’s population down to 587 million in 2100, less than half of what it is today.

[Source]

The accumulated problems of the Chinese regime drive Xi to continue trying to expand his sole power, because at first glance it seems more reliable to keep everything in one hand. Given the level of corruption in the country, we are dealing with a kleptocratic state – the reason why Munger avoided investing in Russia after 1998.

Aside from Masayoshi Son being forced to sell his shares in Alibaba, I think Softbank would have dumped its high stake in the company anyway, feeling the pressure from the Communist Party.

Exactly one year ago, Nikkei Asia published an article citing Son as to how he sees the pressure on China’s tech sector.

“I strongly believe that China’s AI technology and business model will continue to innovate,” Son said in a news conference. “However, in investment activities, various new regulations have begun, so I want to wait and see what kind of regulations are implemented and what kind of impact they have on the stock market.”

[Source]

A year later, he waited, looked around, and decided to reduce his stake in Alibaba from 23.7% to 14.6%.

This is a smart move that is not about flooding the market with shares all at once – under the terms of the forward contract, Mr. Son will have the right to buy back his BABA shares. However, it is unlikely that he will do so – in any case, we have not seen this happen since 2016. So, in the coming months, there will be a greater supply of Alibaba shares on the market, which will put additional pressure on prices against the backdrop of geopolitical and macroeconomic risks specific to China.

The company’s financial profile doesn’t help

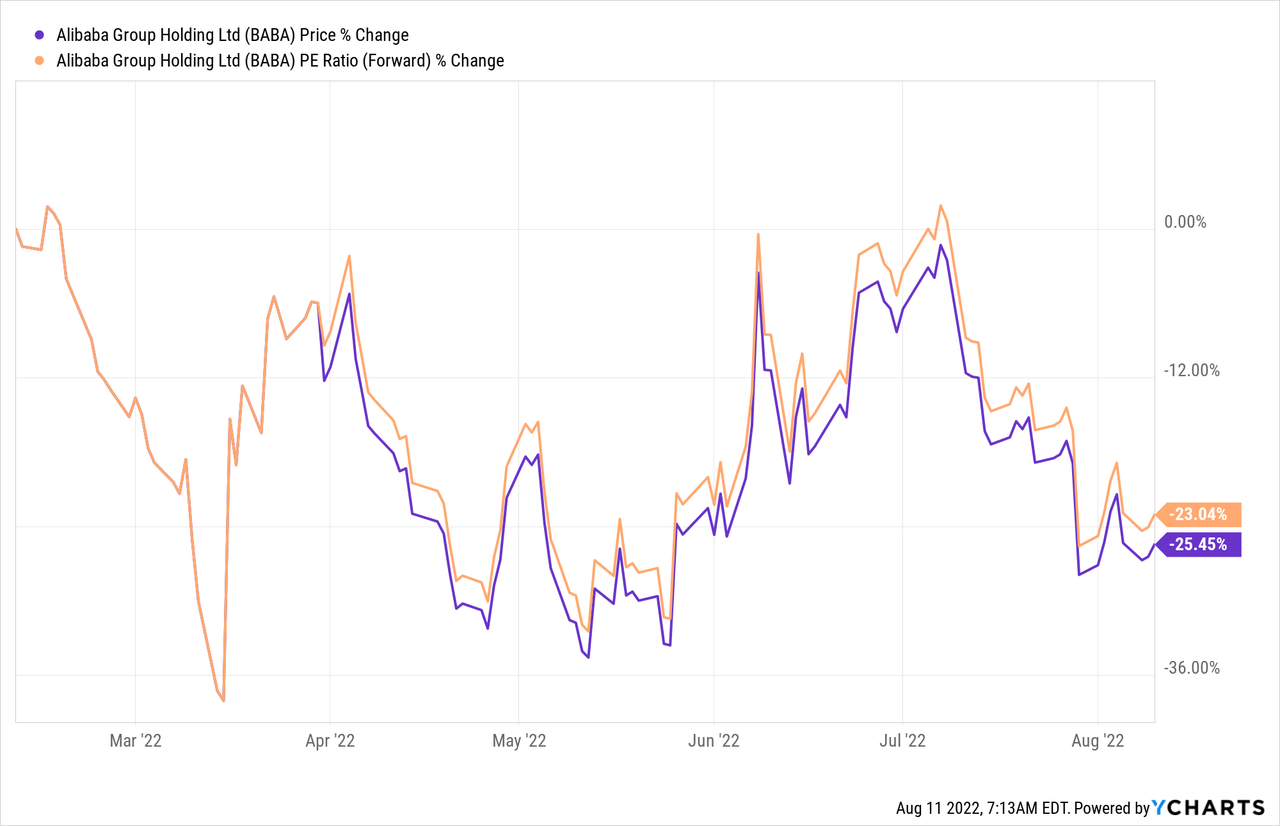

The low multiples that made BABA’s stock seem undervalued compared to U.S. tech giants have gotten even lower over the past six months – in line with the stock price:

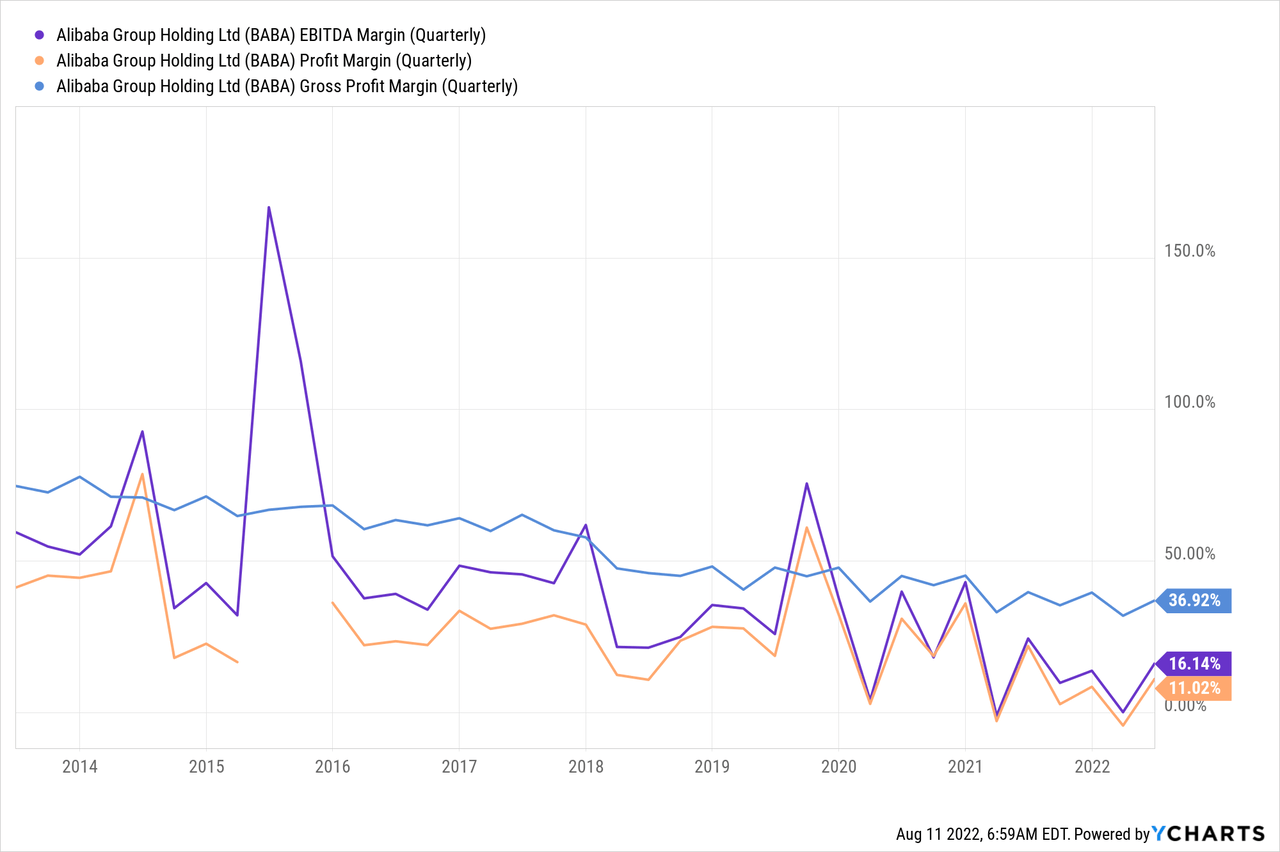

However, it turned out that this underestimation was evidence of the value trap – the slowdown in economic growth and regulatory problems were making themselves felt. Margins continued their downward trend, and the ratio of EBITDA to sales did not return to the level seen before COVID.

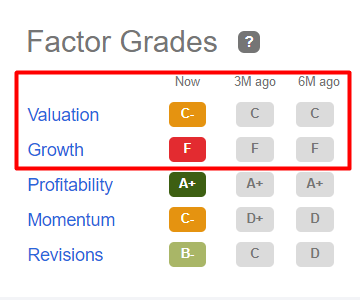

Sales and earnings growth did not improve as investors expected, so the denominators for most valuation metrics became smaller than the numerators – Seeking Alpha’s factor grade system changed the valuation metric in a negative direction for the company:

Seeking Alpha, author’s notes

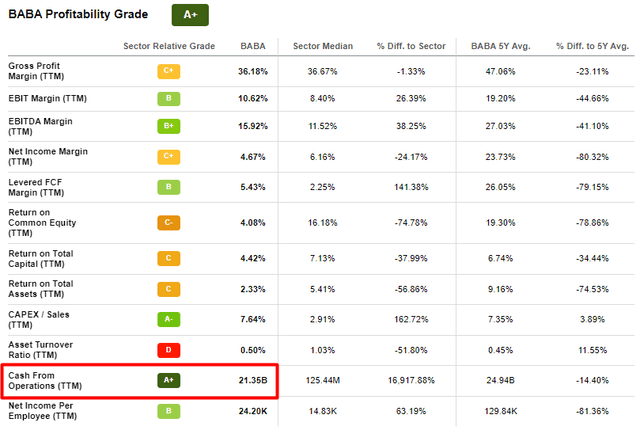

Readers will rightly wonder why the “Profitability” criterion is still rated “A+” against a backdrop of declining business margins and less than stellar ROE / ROA / ROIC indicators. The answer to this question lies in the elements of this criterion – the company’s cash flow from operations (CFO) is the only reason for this superiority over the rest of the sector:

BABA’s Profitability metric, Seeking Alpha

Indeed, in the Internet and direct marketing retail industry, of which Alibaba is a part, only 58.62% of companies have a positive CFO. Such companies have a CFO to TTM ratio of 7% (median), while BABA has a similar ratio of 17%, making it a true cash cow. However, for a cash cow, the margin of safety of BABA is highly controversial in terms of DCF modeling:

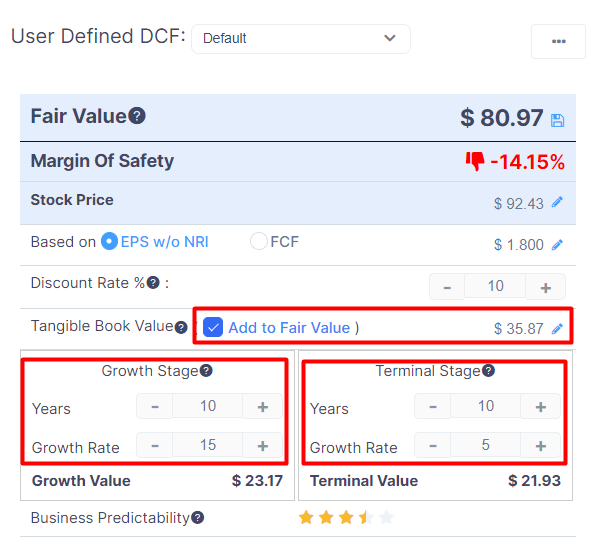

Gurufocus, author’s inputs

Even with a fairly optimistic discount rate (10% is low given the risks for the Chinese tech giant) and a very generous assumption of a 15% growth rate over the next 10 years (which is already not the case), there is a downside of 14%, even when adding the tangible book value to the final share price.

Of course, I could be wrong and the listing of BABA’s shares on the Hong Kong Stock Exchange will create additional demand from investors in mainland China, but it’s not entirely clear what U.S. investors with their ADRs will actually get out of it.

From this, I conclude that investors shouldn’t be fooled by Alibaba’s “low multiples” but to take a broader look at this company and consider all the risks involved. Then, the desire to follow the example of Masayoshi Son rather than Charlie Munger seems more logical to me.

Final note: Hey, on September 27, we’ll be launching a marketplace service at Seeking Alpha called Beyond the Wall Investing, where we will be tracking and analyzing the latest bank reports to identify hidden opportunities early! All early subscribers will receive a special lifetime legacy price offer. So follow and stay tuned!

Be the first to comment