AsiaVision

Investment Thesis

Shift4 Payments (NYSE:FOUR) is a fintech company, operating in the growing industry of digital payments. While digital payments enjoy growth for many years, there is still significant potential ahead. Shift4 took advantage of the coronavirus-related momentum that boosted digital payments numbers to go public and pursue further growth. The stock price went from ~$30 to ~$100, yet, then back to ~$30 due to the bubbly market conditions and the global macro environment. However, this isn’t another meme stock. The company is among the industry leaders, presenting consecutive wins, and offering quality, integrated solutions, while keeps posting strong reports. Moreover, not only the company operates in a favourable environment but it has just started executing its worldwide expansion. In addition, it is relatively undervalued and presents better performance than almost every one of its peers, despite the rate-hike, recession-spooked environment. The CEO, Jared Isaacman, is a strong asset to the company and should be considered a genius. There is also the fact that every time someone hits the $ symbol on the keyboard, unavoidably thinks of the company. Weighing everything up, it seems that Shift4 has what it takes to be an industry leader while having already started its profitable growth journey, something that places the company as a quite safe 2023 bet, assuming the current macro trends stay on track and nothing unexpected occurs.

Shift4 Q3 2022 ER Presentation

A brief company overview

In 1999, the 16-year-old wonderkid Jared Isaacman came up with a bright idea that evolved into the company that he now leads. Shift4 Payments is headquartered in Allentown, Pennsylvania, and has been publicly traded on NYSE since 06/09/2020 after its IPO at $23. There are 82,462,041 Shift4 shares (53,006,276 class A shares – 1 vote/share, 25,829,016 class B shares – 10 votes/share – no economic value, and 3,626,749 class C shares – 10 votes/share).

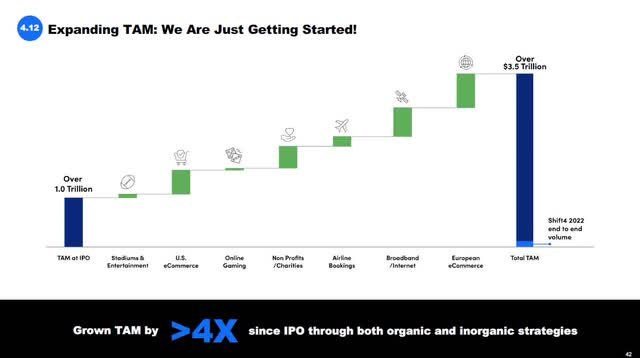

Shift4 history is a history of M&A. The original idea, United Bank Card, was rebranded as Harbortouch in 2012. In the coming years, the company acquired other payment processing and POS companies including Merchant Services Inc., the company where Jared Isaacman used to work. In 2017 the company rebranded once again as Lighthouse Network and, yet another time when it acquired Shift4 Corporation and used the brand name with which is currently known. In 11/2020 the company acquired 3Dcart, an e-commerce platform, which was rebranded as Shift4Shop in 01/2021 and is offered for free. In 03/2021 Shift4 acquired VenueNext, a payment service provider specialized in stadiums and other recreational activities. In 02/2022 the company acquired The GivingBlock, a cryptocurrency donation marketplace. In 09/2022 the company acquired Online Payments Group, a European payment service provider. In Q3 6 Restaurant Technology Partners were also acquired. Finally, the acquisition of Finaro, a cross-border eCommerce platform and bank specializing in solving complex payment problems for multi-national merchants, is expected to be finalized in Q1 2023.

Shift4 Q3 2022 ER Presentation

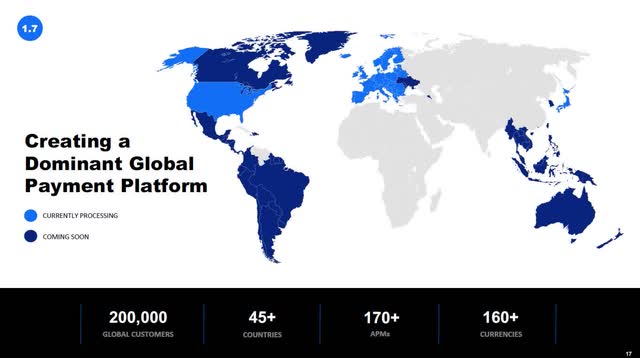

Shift4 offers integrated payment processing and technology solutions including card acceptance and processing, alternative payment methods, integrated POS solutions, free e-commerce solutions, cloud-based business intelligence tools, training and support services, and aspires to revolutionize the global payments ecosystem. Through Shift4, $200B is processed annually, while its customers exceed 200,000 in Food & Beverage, Travel & Hospitality, Sport & Entertainment, eCommerce, Casinos & Gaming, Retail, Specialty, Nonprofit, and Sexy Tech verticals. It currently operates in over 45 countries with its personnel exceeding a 2100 headcount. There are mid-term expansion plans to over 160 countries. Top-tier names are among its clientele, such as Caesars, Applebee’s, TGI Fridays, Hyatt, Hilton, SpaceX etc. Considering SpaceX in particular, it is worth mentioning that Jared Isaacman is a personal friend and partner of Elon Musk and also a spacecraft captain.

Shift4 Q3 2022 ER Presentation

Q3 Update

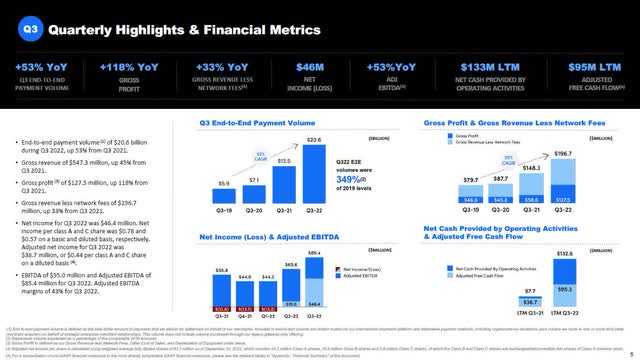

As can be seen in Form 10-Q filed on 11/08/2022, the company delivered strong results in every line for Q3 2022.

- End-to-end payment volume of $20.6B, +53% from Q3 2021.

- Gross revenue of $547.3M, +45% from Q3 2021.

- Gross profit of $127.5M, +118% from Q3 2021.

- EBITDA of $95.0M and Adjusted EBITDA of $85.4M for Q3 2022, +53% vs Q3 2021.

- Net income for Q3 2022 was $46.4M vs a loss of $13.8M YoY.

- Adjusted EBITDA margin of 43% for Q3 2022.

- For the 9 months that ended on 09/30/2022, the company produced a $135.9M operating cash flow.

- Cash stands at $672.7M and long-term debt at $1,739.8M

Shift4 Q3 2022 ER Presentation

In Q3 2022 the company also launched SkyTab POS, a hybrid-cloud-based, integrated hardware and software, restaurant POS solution.

Shift4 Q3 2022 ER Presentation

During the nine months that ended September 30, 2022, the company repurchased 3,887,191 shares of Class A common stock for $184.4 million, at an average price paid of $47.40 per share. Approximately $44.5 million remained available for future purchases. Jared Isaacman was also a buyer spending ~$12M for Shift4 shares. These should be considered positive facts, especially the CEO buys.

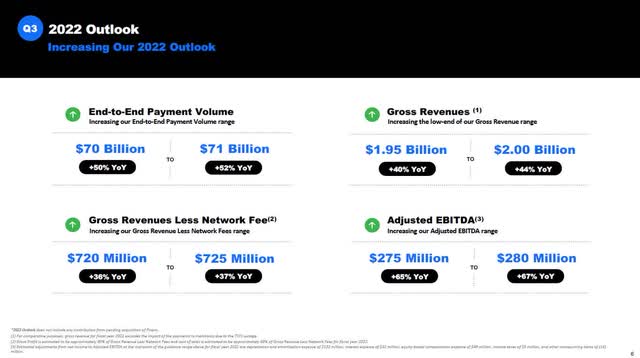

In tandem with the strong set of results, Shift4 announced a slightly positively revised 2022 guidance. Despite this may not look impressive at a first glance, in fact, it is, considering the whole macro condition that hits hard fintech companies, the majority of which were forced to announce negative guidance revisions.

Shift4 Q3 2022 ER Presentation

Valuation

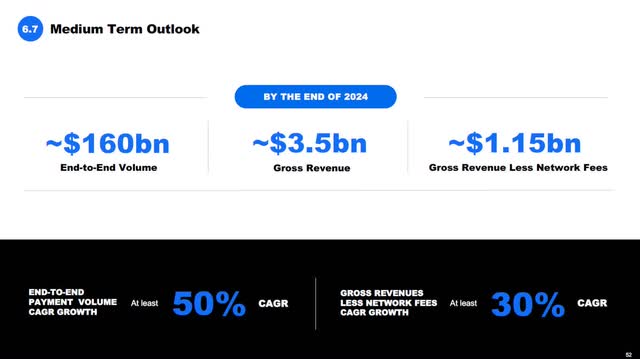

With a 4.67 SA Quant Rating, Shift4 stands among the best of its peer group. The company seems to be on track for profitable growth for the next couple of years at least. For FY 2022 revenue is expected at ~$2.0B and adjusted EBITDA at ~$280M. With an EV of ~$4.15B that would result in a 14.82 EV/EBITDA ratio. The adjusted EBITDA margin is ~14%, however, in the first half of the year, this margin was significantly lower and increased significantly during Q3. Profitability should be sustained from now on while growth will continue to be impressive. Thus, $3.5B of revenue should be expected for FY 2024 according to the company’s guidance. Applying a conservative 15% EBITDA margin would result in $525M of EBITDA for FY 2024. With an EV/EBITDA ratio of 15 a 2024 EV would be ~ $7.86B, yet, this should be considered conservative. The share price should be expected at all-time highs, over $100, by 2024 and is likely to do even better.

Shift4 Q3 2022 ER Presentation

Competition

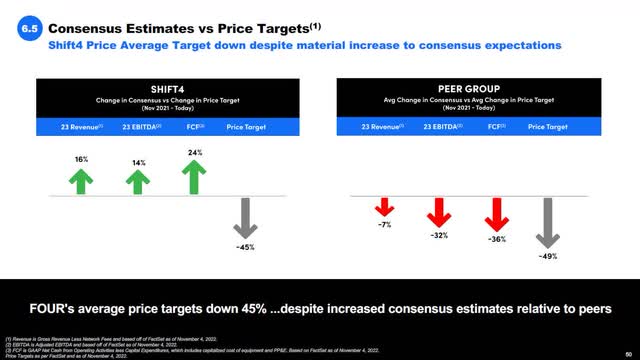

Shift4 claims to be a hot name in the sector, however, the company is not alone. There are many peers but there is a significant Shift4 advantage. Unlike almost everyone else, the company positively revised guidance, while achieving net profitability and positive FCF for FY 2022. This is a very important fact and a tailwind entering 2023, a possible recession year, and also a sign that Shift4 has something better to offer compared to the competition.

Shift4 Q3 2022 ER Presentation

Risks

Despite the healthy financial condition and the promising future developments, some factors could affect Shift4’s performance and have a negative impact.

- A rate-hike macro environment that will probably bring a recession during 2023 could hurt consumption and eventually most of Shift4’s clients.

- Management forecasts about profitability and growth prospect could prove optimistic in a forthcoming potentially recessionary year.

- Competitors may claim a larger market share than expected while the company may fail to continue winning clients

- The general market/macro environment could cause delays in business plan execution that could hurt growth and profitability.

Conclusion

The Coronavirus outbreak boosted digital payments and established them as a trustworthy alternative to physical money payments for almost every aspect of financial activity. This development will not cease, on the contrary, the world will move faster toward digital payments as more people become more and more familiar. In addition, younger generations will be born with digital payment proficiency. Shift4’s international expansion and M&A plans will fuel growth for the coming years, along with organic growth, while profitability is expected to be sustained. It is clear that the management is confident about the growth and profitability prospect of the company and this is the reason why increases guidance in a turbulent period, unlike peers do, while also buying Shift4 shares. The recent share price action also supports these assumptions compared to peers and overall market performance. Taking everything into account, with a view to 2024, investors who are looking for a winner in 2023 should consider Shift4 and seek momentum, exploiting possible market volatility that could bring down FOUR share price, to build up a position.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment