BrianAJackson/iStock via Getty Images

Usually, I tend to stay away from retail companies. The highly competitive nature and low margins, not to mention the exposure they have to shifting consumer sentiments, create an unfavorable risk to reward opportunity in most cases. But from time to time, you can find a rather appealing player in the retail space that is trading cheap enough and performing well enough to warrant some consideration. Such is the case right now, I believe, with Boot Barn Holdings (NYSE:BOOT). While I wouldn’t exactly call the company a top-tier prospect, its fundamental condition, general trajectory, and valuation, all suggest to me that some upside could very well be on the table. As a result, I have decided to rate the company a soft ‘buy’ at this time.

A small retail chain worth considering

According to the management team at Boot Barn Holdings, the company operates as the largest lifestyle retail chain devoted to western and work-related footwear, apparel, and accessories in the US. At present, the company has 321 stores in operation, spread across no fewer than 38 states. Based on its own particular niche, the company claims that the next largest direct competitor to itself is about one-third its size. On average, its stores are around 10,600 square feet in size and, as you can imagine already, the emphasis on western and country clothing is specific enough to allow the company to create for itself a rather unique and concentrated brand identity.

The company sells a variety of name brands through its stores, such as Ariat, Cinch, Cody James, Corral, Dan Post, Durango, and so much more. Perhaps the most famous name brand that it sells is Wrangler, which is one of the largest players in the jeans space on the planet. One major emphasis for the company is the sale of boots and other footwear. In fact, approximately one-third of the selling space located in each store, on average, is dedicated to this type of product. While it is true that this is a rather niche market, management has high hopes about the future. They believe that they can grow their domestic store base to roughly 900 stores if given enough time. This is a significant revision over their prior expectations, with the total addressable market for the company being revised from $20 billion to $40 billion.

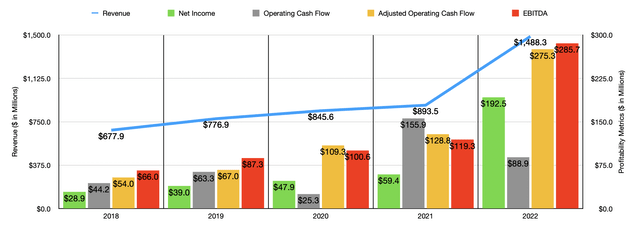

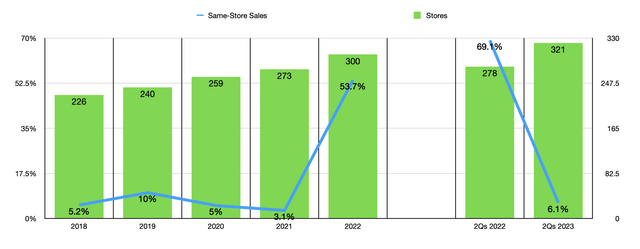

Over the past few years, the management team at Boot Barn Holdings has done a really good job growing the company’s top line. Revenue went from $677.9 million in 2018 to $893.5 million in 2021. Sales then spiked to $1.49 billion in 2022. The sales increase achieved by the company has been driven by a variety of factors. Acquisitions have been marginally helpful in growing the company’s top line. However, the bulk of the growth has come from organic expansion by opening new stores. The total store count for the company expanded from 226 in 2018 to 300 by the end of 2022. Over that same window of time, comparable store sales remained robust, averaging between 3.1% and 10% per year. But in 2022, comparable store sales skyrocketed by 53.7%. E-commerce same-store sales came in lower at 38.7%. Without that, same-store sales would have increased by 57.2%, driven largely by the fact that sales growth the year prior was somewhat depressed.

Profits for the company have also risen over this five-year window. Net income grew from $28.9 million to $192.5 million. The picture for operating cash flow has been a bit lumpier, with the metric peaking at $155.9 million in 2021 before dropping to $88.9 million in fiscal year 2022. But if we adjust for changes in working capital, it would have risen from $128.8 million in 2021 to $275.3 million a year later. A similar trajectory can be seen when looking at EBITDA. Over the past five years, it grew from $66 million to $285.7 million.

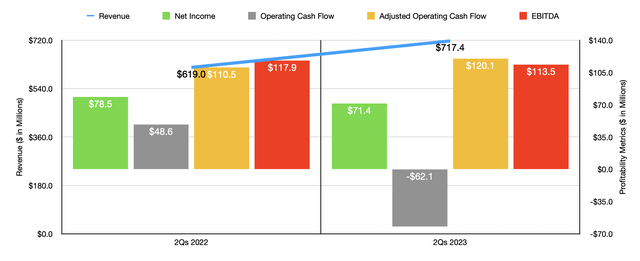

For the 2023 fiscal year, things have been a bit more mixed. Revenue is still rising, with sales during the first half of the year totaling $717.4 million. That’s 15.9% above the $619 million reported the same time last year. On this front, the company benefited from its store count rising from the 278 it had this time last year to 321 this year. Same-store sales also improved nicely, jumping by 6.1% year over year. This is not to say that everything has been great. For instance, net income in the first half of the year came in at $71.4 million. This is actually down from the $78.5 million reported the same time last year. The company suffered from its gross profit margin shrinking from 37.9% to 37.2%, a result of deleverage in buying, occupancy, and distribution center costs. Selling, general, and administrative costs also worsened, rising from 21.1% of revenue to 23.7% because of higher store payroll and other store-related expenses. Marketing expenses were also a pain point for the company. During this same window of time, operating cash flow dropped from $48.6 million to negative $62.1 million. But if we adjust for changes in working capital, it would have risen from $110.5 million to $120.1 million. Meanwhile, EBITDA worsened slightly, dipping from $117.9 million to $113.5 million.

When it comes to the 2023 fiscal year in its entirety, management expects 40 new store openings. This, combined with same-store sales of between – 1% and positive 5% should push overall revenue for the year up to between $1.65 billion and $1.67 billion. Same-store sales would be higher if not for the expectation that e-commerce revenue will drop by between 11% and 13% on a same-store basis. From a profitability perspective, management is forecasting earnings of between $173.3 million and $179.3 million. It is worth noting that all of these figures factor in an extra week for the year that management is estimating will result in additional revenue of $34 million and net profits of $5.8 million. So for the purpose of valuing the company, I did factor these adjustments into the equation by removing them from consideration.

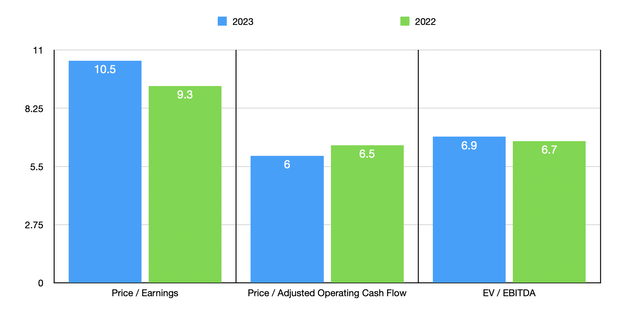

No guidance was given when it came to other profitability metrics. But if we annualize results experienced so far, we should anticipate adjusted operating cash flow of $299.2 million and EBITDA of $275 million. Based on these figures, the company is trading at a forward price-to-earnings multiple of 10.5. The price to adjusted operating cash flow multiple is 6, while the EV to EBITDA multiple should come in at 6.9. As you can see from the chart above, the company does look more expensive on a forward basis using two of the three valuation metrics. As part of my analysis, I also compared the enterprise to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 8.8 to a high of 50.6. In this case, only one of the five companies was cheaper than Boot Barn Holdings. Using the price to operating cash flow approach, the range was from 9.7 to 35, with our prospect being the cheapest of the group. Meanwhile, using the EV to EBITDA approach, the range was from 4.6 to 6.7. In this case only, our target ended up being the most expensive of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Boot Barn Holdings | 10.5 | 6.0 | 6.9 |

| The Buckle (BKE) | 8.8 | 9.7 | 5.4 |

| Guess? (GES) | 10.8 | 13.1 | 5.3 |

| Abercrombie & Fitch (ANF) | 50.6 | N/A | 4.6 |

| Urban Outfitters (URBN) | 14.8 | 19.2 | 6.3 |

| American Eagle Outfitters (AEO) | 24.7 | 35.0 | 6.7 |

Takeaway

As far as retail goes, Boot Barn Holdings strikes me as an interesting company that has a bright future. The company continues to open up new locations and the growth rate experienced recently has been promising. The company has done well by carving out for itself a rather interesting niche that should continue to attract the attention of consumers for the foreseeable future. On top of this, shares look quite cheap on an absolute basis and, for the most part, are cheap relative to similar firms. Given these factors, I feel as though a ‘buy’ rating is appropriate for the enterprise at this time.

Be the first to comment