Bank OZK

Dear readers,

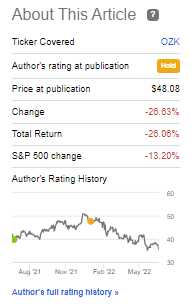

In this article, we’re going to do a solid update on Bank OZK (NASDAQ:OZK), a business I’ve been busily writing on for quite some years now. The company had excellent performance up to my last article – since that time it has underperformed the S&P 500 by quite a fair margin.

OZK Article (Bank OZK)

But such underperformance opens the company to all kinds of potential outperformance based on the considerably more attractive valuation we have to play with here. At least, that is the case once we ensure that the company’s underperformance doesn’t hail from any sort of significant fundamental deterioration.

Let’s take a look.

Updating on Bank OZK

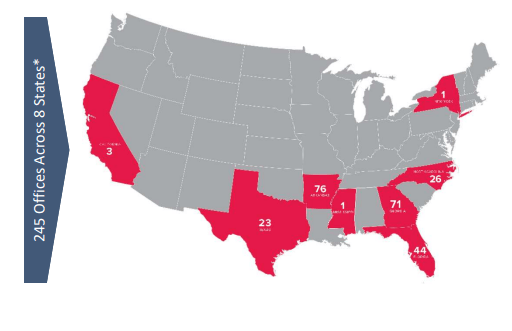

The latest results on Bank OZK we have are the 1Q22 results, though 2Q22 are not that far off here. Once the Ukraine crisis came, and macro started to deteriorate, that’s when OZK reported the company’s 1Q22 results. It’s unlikely that Ukraine in any way affected OZK, given its geographical exposure, which is only to American states, and primarily to a few select ones of them.

Bank OZK Locations (Bank OZK IR)

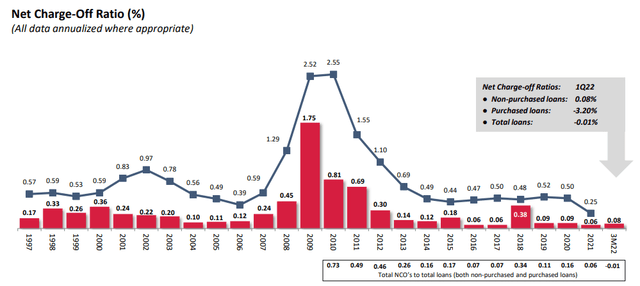

The company continued its superb performance, further increasing its comparative asset quality, which can be put into context using a bank’s net charge-off ratio, which remains well below the overall industry average. By well below, i mean less than a third of the industry average here.

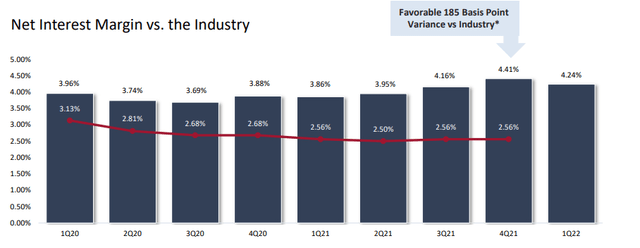

The company continues to show off favorable ratios of Non-performing loans, assets and past-due loans, all of which are significantly below the industry average going into this current situation. For most of those comparisons, OZK numbers are close to 0%. The rising interest rate will also do fantastic things to OZK’s net interest income numbers – which usually are the largest category of revenue for the bank. This is already increasing, with 1Q22 NII up 6.3%. Loans are the largest category of assets to this particular bank, and the company’s average loan yield has stayed above 5% despite the cheap cash situation we’ve been seeing for years. This is likely to increase in this new environment.

The tax-equivalent yield of the company’s investment securities is also rising from trough levels in 2021, and in 1Q22 these rates were up above 1.45% again. This increased exposure to investment securities is a result of the bank’s high liquidity position, which meant it loaded up on high-quality (mostly short-term) securities.

OZK is close to a margin leader in the industry. The bank is not far from having almost double the usual FDIC-insured institution NII margin.

The core spread and cost of interest-bearing deposits are also some of the better numbers in the industry, and OZK is expecting the COIBD to start increasing substantially in 2Q22. In short, OZK is one of the most efficient banks out there. OZK has actually been officially ranked here based on FDIC quarterly banking profiles and has consistently ranked in the top decile in the industry for 20 consecutive years.

If you want a bank in your portfolio, you could really go for this one – because there aren’t that many better banks out there, to be perfectly clear, at least not according to those numbers.

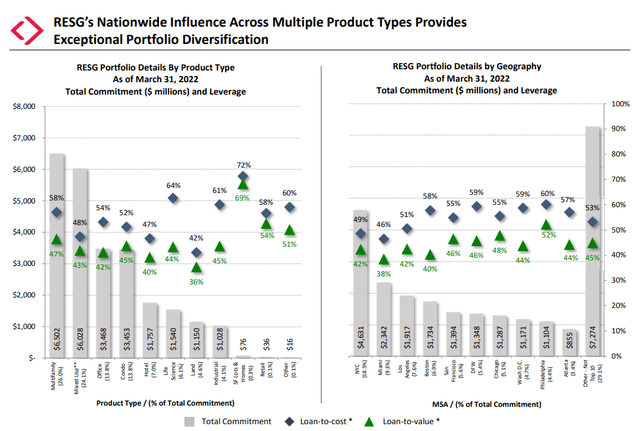

The company has issued yet more RESG loan originations, with 1Q22 levels coming in at record amounts, with originations of close to $3.15B, with a 4Q run rate of close to $10B. The bank’s pipeline continues to be strong here, and repayments have been strong as well, and the company expects RESG loan repayments to exceed the record level seen in 2021.

These loans are still well-diversified in both product types and industry, as well as geographies.

You can look at these numbers and see that OZK only takes on relatively conservative risk, and that the diversification here is pretty good. the company has one remaining substandard RESG loan of around $66M, an accrual credit for an SF Lots & Home Loan with an almost insane LTV of close to 85%, all of the company’s loans have LTV ratios of below 69%.

From that perspective, OZK is very good at managing risk, and there are limited risks to the company’s loan portfolio here. The company also retains good access to high-quality and cheap capital, with a current deposit total of $21.3B, with cash and equivalents of $1.6B.

The company has a baa2 from Moody’s and a A- rating from Kroll, though this is only for senior unsecured debt, and it’s from a smaller player. Still, it bears mentioning and considering here.

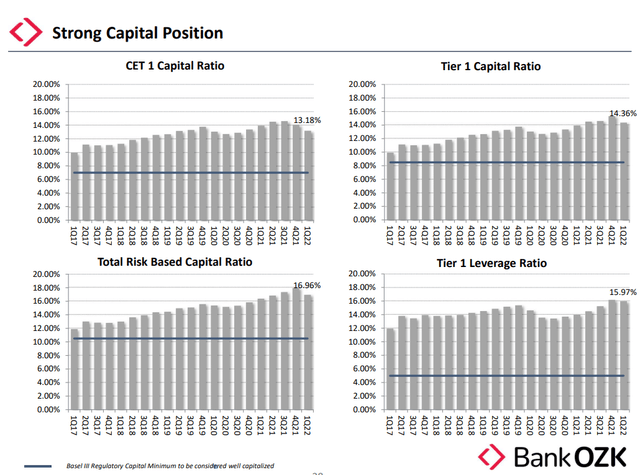

Ratios are excellent.

So there are no worries for this bank that I see, that would be of news to me going into 2Q22 or this new, and riskier macro. If anything, OZK seems better prepared than other banks going into this environment and should be treated as such.

On a high level, OZK is a bank that carefully outperforms. It doesn’t take excessive risks (though there have been some risks in the RESG portfolio over time), and it wants to make sure that its returns continue to outperform while keeping that quality. Being a nimble player in less than half of the states in the US gives it a smaller market, and expertise in these markets.

The current CEO has been in his role for going on 40+ years at this point (1979), making him one of the longest-serving managers in the entire industry. Management gets a solid “gold star” from me.

Bank OZK – Valuation

I wrote about OZK back all the way in 2019-2020. As we move into more uncertain times, we need to make sure that our investments are in fact well-protected – and indeed, OZK’s seem to be.

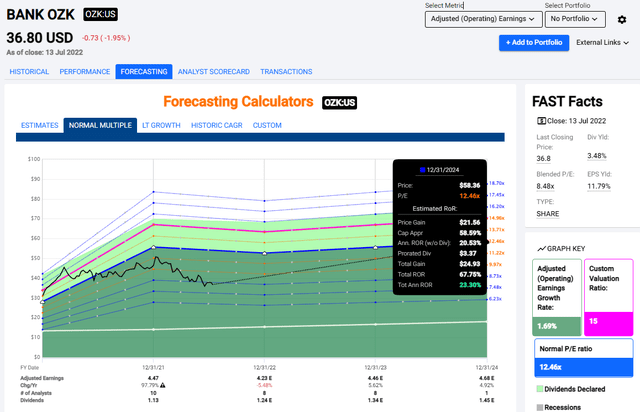

Bank OZK, following the 25%+ decline from my last article, is trading at around 8.5X P/E. This is along the lines of several undervalued quality companies I cover. At a 3.5% yield, OZK is perhaps a lower-yielding company on that list – but it’s a very safe yield at less than 30% payout ratio, and a forecast of 1-5% annual EPS growth for the next few years.

Whenever the company traded at 8X P/E, it was an excellent idea to “BUY” OZK. The current upside to OZK, based on said earnings growth and the current undervaluation, is now 67% RoR, or 23.3% annually.

Now that is a pretty great upside for a bank, even if it’s not as massive as some of its peers.

There are two ways to view OZK here.

One way is to view it as an above-average Banking institution that in fact deserves a bit of a premium of around 15-16x P/E due to its outperformance.

While I understand this sentiment and way of viewing the bank, I would say that expecting this ignores every public comp, as well as the no credit rating and low yield that OZK offers. Quality is excellent – but your returns could still be sub-par if you overpay for that quality.

The other way to view OZK, therefore, is at a 5-6 year average discount of around 11-12X, in which case your annualized RoR is now over 20%. This is not to be underestimated in the least.

Which of them is right?

That depends on how you want to discount for the company’s advantages and assign premiums for its strengths. Being a conservative DG investor, I prefer to discount for risks and whatever shortcomings I can find – because every company has them.

The S&P global average targets are currently between $42 on the low side and $57 on the high side. The company’s average based on 7 analysts is currently $47.57/share. Compare this to the company’s $36.8 current share price, and you’re looking at a pretty amazing upside of at least 30% from the current share price.

Yet despite every single target being higher than the current share price, the analysts following this company only have one “BUY” target. The remaining 6 analysts are all at “HOLD” ratings, indicating the analysts’ current care and hesitation to approach the market in the current situation.

OZK has been trading very volatile since 2018 – but the one common denominator of these downturns is that the company turns back up eventually.

I firmly believe that it will do so again – and the results when it does, will be outperformance.

I’m going to discount my price target appropriately by around 10%. This brings us to around $48/share, which aligns with the lower end of S&P Global coming in at $46/share. For that reason, I consider OZK a “BUY” here once again.

Thesis

Because of this, my OZK thesis is:

- This business is below its valuation targets. I see enough upside to give this a $48 PT, making it a “BUY” following market action on Friday.

- For the common share though, I’m now moving to a “BUY” with my overall PT.

Remember, I’m all about:

-

Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

-

If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

-

If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

-

I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

This process has allowed me to triple my net worth in less than 7 years – and that is all I intend to continue doing (even if I don’t expect the same rates of return for the next few years).

If you’re interested in significantly higher returns, then I’m probably not for you. If you’re interested in 10% yields, I’m not for you either.

If you however want to grow your money conservatively, safely, and harvest well-covered dividends while doing so, and your timeframe is 5-30 years, then I might be for you.

Bank OZK is currently a “BUY”.

Thank you for reading.

Be the first to comment