PeopleImages

By Valuentum Analysts.

Republic Services, Inc. (NYSE:RSG) is a high-quality income growth idea with an incredibly stable cash-flow profile due to the essential nature of its offerings. The company’s waste management operations are largely irreplaceable due to the difficulties involved with building new waste management operations, such as landfills, in the U.S. We view Republic Services’ dividend growth potential quite favorably, and the firm is well-positioned to ride out major inflationary pressures while being able to continue rewarding investors.

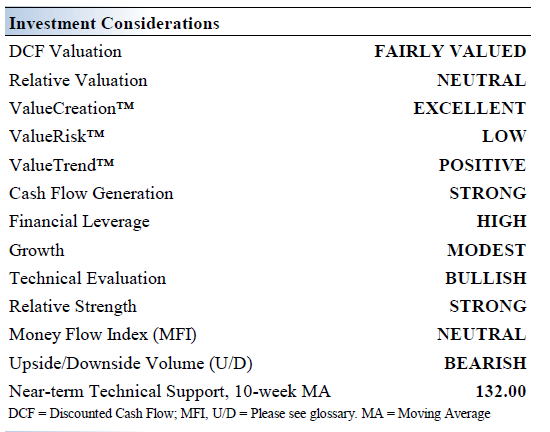

Republic Services’ Key Investment Considerations

Image Source: Valuentum

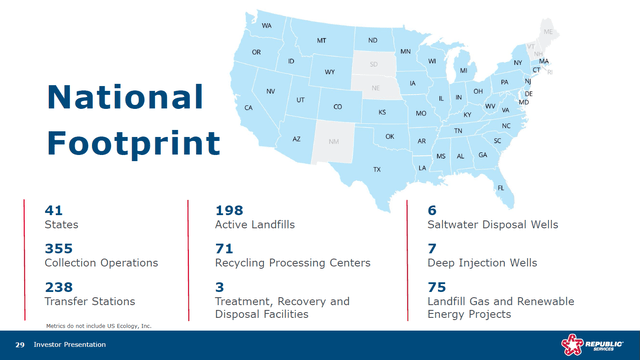

Republic Services is the second largest provider of services in the domestic non-hazardous solid waste industry, as measured by revenue. The firm has ~355 collection operations in 40+ U.S. states and Puerto Rico. It also owns and operates ~200 active solid waste landfills and ~240 transfer stations, among other assets. The firm was founded in 1996 and is based in Phoenix, Arizona.

Republic Services has an expansive asset base in the realm of waste management services. (Republic Services – June 2022 IR Presentation)

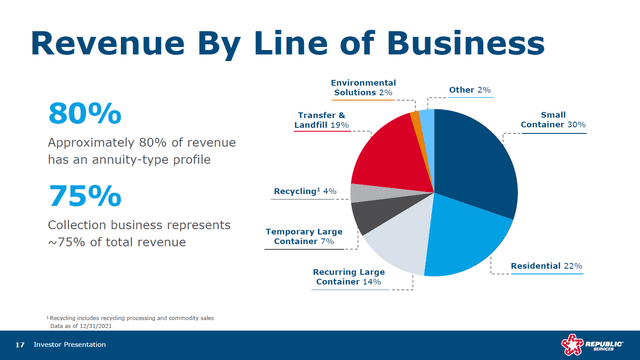

The waste industry is characterized by solid revenue and earnings visibility thanks to the nature of the multiyear contracts utilized. The industry continues to consolidate, and roughly 35% of industry revenue is generated by private entrepreneurs. Given the essential nature of Republic Services’ offerings, roughly 80% of its revenue is considered annuity-like in the eyes of the company, resulting in an incredibly stable cash flow profile. We appreciate that its collection business represents the lion’s share of Republic Services’ total annual revenues.

Republic Services’ has an incredibly stable cash flow profile. (Republic Services – June 2022 IR Presentation)

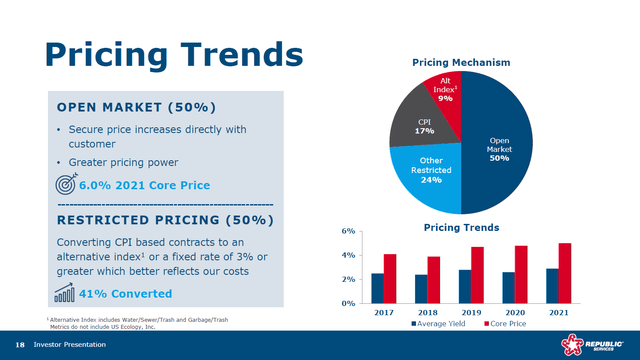

Republic Services is focused on developing the best vertically integrated market position as it works to increase density. The firm’s disposal assets represent a long-term strategic benefit that will only become more valuable over time due to an increasingly onerous regulatory environment and continued citizens’ group opposition to greenfield sites. The company possess meaningful pricing strength which the firm sees as enabling margin expansion over time. Cost control measures will also be key here.

Republic Services possess ample pricing power, which helps offset headwinds arising from inflationary pressures. (Republic Services – June 2022 IR Presentation)

The firm owns the Apex landfill in Nevada, one of the largest in the world, which we view as the crown jewel of its waste disposal business. In May 2022, Republic Services completed its ~$2.2 billion acquisition of U.S. Ecology and material synergies are expected going forward. The acquisition is expected to unlock roughly $40 million in cost saving synergies within the first three years of closing while also generating around $75-$100 million in cross-selling revenue synergies. Republic Services is further supported by its investment grade credit rating (BBB+/Baa2/BBB).

Earnings Update

On August 4, Republic Services reported second quarter 2022 earnings that beat both consensus top- and bottom-line estimates. Pricing and volume trends at the company have been moving in the right direction of late, while Republic Services has also been effective at rolling out digital initiatives and keeping its cost structure contained. Its strong performance enabled Republic Services to raise its full-year guidance for 2022 during its second quarter earnings update.

Republic Services’ GAAP revenues rose 21% year-over-year in the second quarter of 2022 to reach $3.4 billion. That included 11% organic revenue growth on a year-over-year basis along with the boost provided by acquisitions, such as its recent deal for U.S. Ecology. Its GAAP operating income rose by 14% year-over-year to reach $0.6 billion last quarter. Republic Services posted $1.17 in diluted GAAP EPS in the second quarter, up 14% year-over-year. Its adjusted non-GAAP EPS rose 21% year-over-year to reach $1.32 last quarter.

Within its latest earnings press release, Republic Services noted that “second quarter revenue growth from average yield was 5.0 percent and volume increased revenue by 2.4 percent” while “second quarter core price increased revenue by 6.2 percent. Core price consisted of 7.8 percent in the open market and 3.5 percent in the restricted portion of the business.”

For reference, “average yield is defined as revenue growth from the change in average price per unit of service, expressed as a percentage. Core price is defined as price increases to our customers and fees, excluding fuel recovery fees, net of price decreases to retain customers” according to the company. We are big fans of Republic Services’ pricing power.

Volume growth at its collection business came from small-container and large-container operations offsetting weakness at its residential volumes on a year-over-year basis last quarter. Its landfill business saw volume growth across municipal solid waste, construction and demolition waste, and special waste on a year-over-year basis in the second quarter of this year. Republic Services’ average yield benefited from strength across its collection and disposal businesses last quarter.

Republic Services generated $0.9 billion in free cash flow during the first half of 2022 (defined as net operating cash flow less capital expenditures) and spent $0.3 billion covering its dividend obligations along with $0.2 billion buying back its stock. However, we caution that the firm exited June 2022 with $11.8 billion in net debt on the books (exclusive of restricted cash and marketable securities, inclusive of short-term debt). Given its strong cash flow generating abilities and the highly visible nature of its future cash flows, we view that burden as manageable.

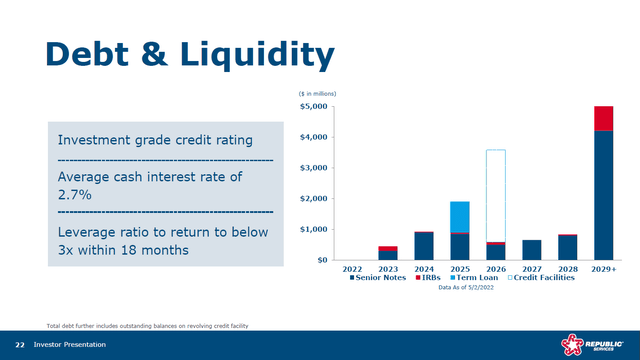

Republic Services’ debt load is well-staggered. (Republic Services – June 2022 IR Presentation)

Guidance Update

Looking ahead, Republic Services now aims to generate $4.77-$4.80 in adjusted EPS this year (as of its August 4 guidance), up from the $4.58-$4.65 forecast that Republic Services laid out in February 2022, though that guidance did not take the U.S. Ecology deal into account. At the midpoint of its current adjusted EPS forecast, that would represent 15% annual growth if realized. Republic Services’ growth outlook is quite bright.

The waste management firm also aims to generate $1.7-$1.725 billion in adjusted free cash flow this year, up from the $1.625-$1.675 billion guidance laid out in February 2022. If realized, its current adjusted free cash flow forecast would represent 13% annual growth at the midpoint. We appreciate Republic Services’ ability to generate substantial cash flows in almost any operating environment.

Rewarding Income Seeking Shareholders

Republic Services is incredibly shareholder friendly. Beyond its substantial share buyback programs, the company recently pushed through several large dividend increases. In July 2022, Republic Services raised its per share dividend by 8% sequentially and in August 2022, it further raised its per share dividend by another 8% on a sequential basis. Its current quarterly payout now sits at $0.495 per share or $1.98 per share on an annualized basis. Shares of RSG yield a nice ~1.3% as of this writing.

Management’s commitment to income seeking investors underpins one of the reasons why we are huge fans of Republic Services. Additionally, the company’s forward-looking dividend strength is rock-solid due to its stable cash flow profile, which should enable Republic Services to keep growing its payout going forward.

Republic Services’ Economic Profit Analysis

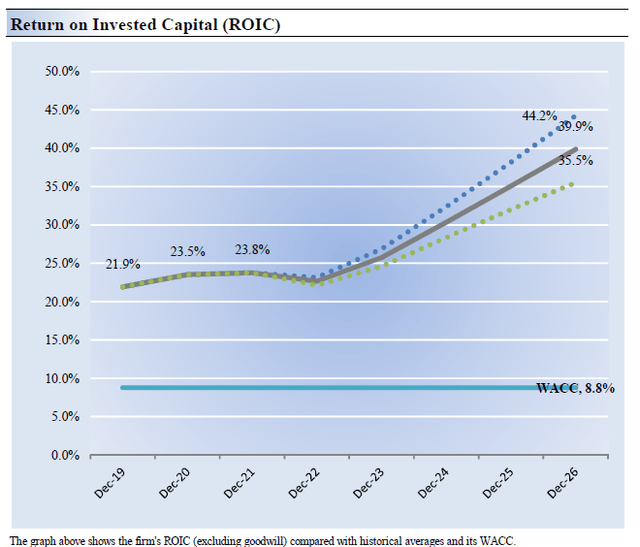

The best measure of a company’s ability to create value for shareholders is expressed by comparing its return on invested capital [“ROIC”] with its weighted average cost of capital [“WACC”]. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. Republic Services’ 3-year historical return on invested capital (without goodwill) is 23.1%, which is above the estimate of its cost of capital of 8.8%.

In the chart down below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate. Historically, Republic Services has been a rock-solid generator of shareholder value and we forecast that will keep being the case over the coming years.

Republic Services’ Cash Flow Valuation Analysis

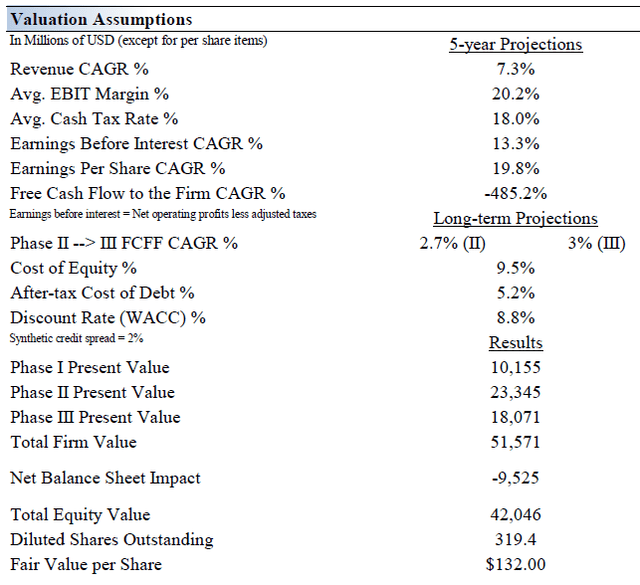

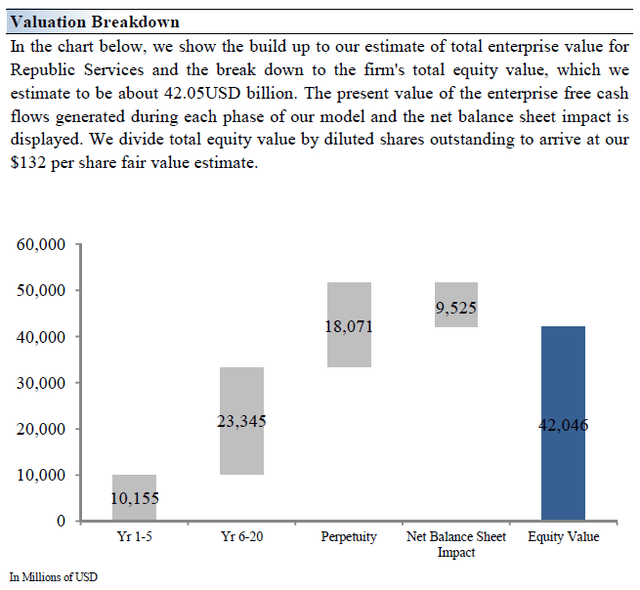

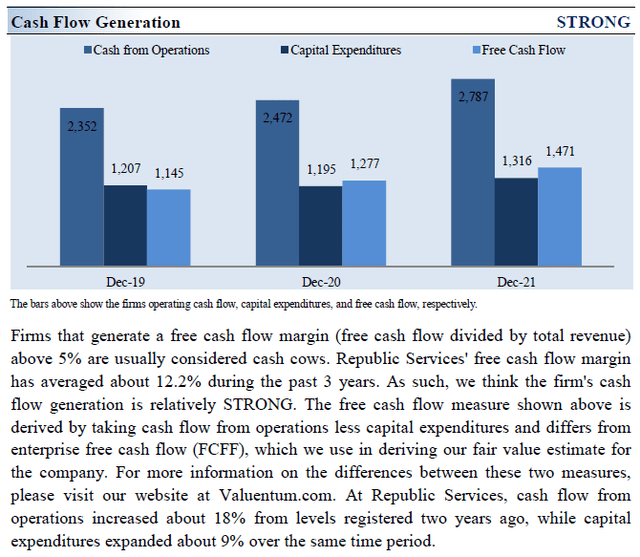

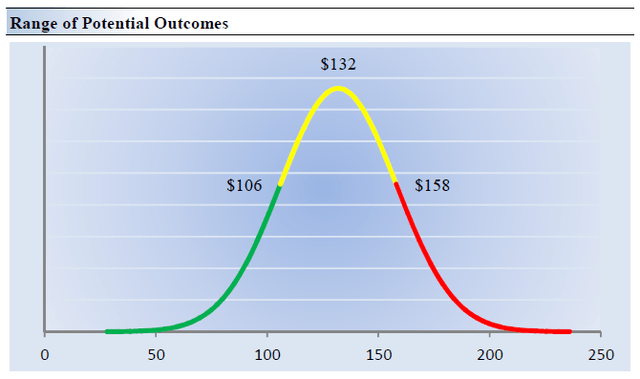

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows, including the company’s net balance sheet considerations. We think Republic Services is worth $132 per share with a fair value range of $106.00 – $158.00. Given that Republic Services has put up stellar performance up late, we see room for the firm to test the upper end of that range.

The near-term operating forecasts used in our enterprise cash flow model, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our model reflects a compound annual revenue growth rate of 7.3% during the next five years, a pace that is higher than the firm’s 3-year historical compound annual growth rate of 4%.

Our model reflects a 5-year projected average operating margin of 20.2%, which is above Republic Services’ trailing 3-year average. Beyond Year 5, we assume free cash flow will grow at an annual rate of 2.7% for the next 15 years and 3% in perpetuity. For Republic Services, we use a 8.8% weighted average cost of capital to discount future free cash flows.

Image Source: Valuentum Image Source: Valuentum

Republic Services’ Margin of Safety Analysis

Although we estimate the firm’s fair value at about $132 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

In the graph up above, we show this probable range of fair values for Republic Services. We think the firm is attractive below $106 per share (the green line), but quite expensive above $158 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

Concluding Thoughts

Republic Services benefits significantly from its long-term disposal assets as these operations grow more attractive as time passes thanks to the increasing regulatory nature of the waste business, as well as citizen groups opposed to greenfield sites growing in number and strength. These disposal assets, including its Apex landfill in Nevada, which is the busiest facility in the US, represent the material barriers to entry that give the company a large portion of its moaty characteristics. Its acquisition of U.S. Ecology further enhances the resilience of Republic Services’ business model, and expected synergies should help improve its cash flow generating abilities going forward.

Republic Services’ net debt load is quite large and remains a key concern, though its investment-grade credit rating and the well-staggered nature of its maturity schedule provides it with some financial flexibility. Tuck-in acquisitions have the potential to impact the pace of dividend expansion going forward, as does the pace of its stock buyback program, but we continue to expect modest increases in its payout on the back of its stable, free cash flow generating operations. The nature of Republic Services’ contracts (some are linked to CPI) and its ample pricing power help offset inflationary pressures, to a degree.

We view Republic Services as a top-notch dividend growth idea with a bright growth outlook and a resilient business model. The waste management company is well-positioned to ride out exogenous shocks and major inflationary pressures with its growth runway intact.

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Be the first to comment