Just_Super

Intro

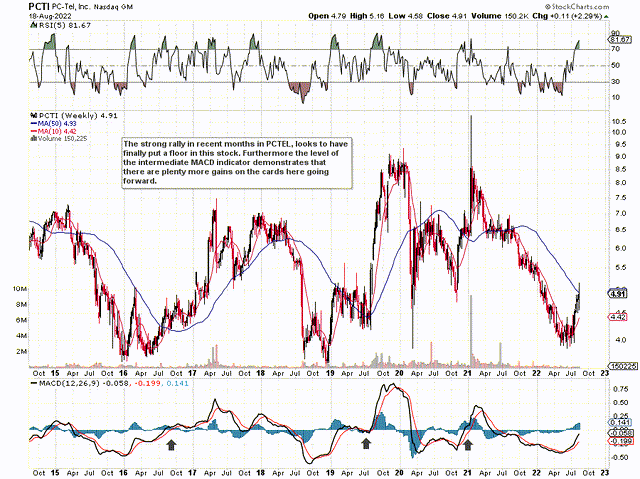

We wrote about PCTEL, Inc. (NASDAQ:PCTI) back in mid-June, when we stated that longstanding shareholders were close to being rewarded. The reason behind our premise from a technical standpoint was the very strong underside support on the technical chart. What is depicted below with respect to this support is only an eight-year chart, but in reality, long-term support in PCTEL dates back the best part of two decades at this stage.

As we see below, shares have been in bull mode since June, tacking on more than $1 a share since that mid-year bottom. Furthermore, this rally has resulted in a convincing crossover of the weekly MACD indicator and a rise above the stock’s 200-day moving average of approximately $4.73. Investors who believe they have missed their opportunity in this play should think twice for the following reason. The intermediate MACD indicator remains in deeply oversold territory which means we expect more gains to come when that decisive “center-line” is taken out to the upside.

We state this because the chart below not only informs us on how PCTEL´s fundamentals are changing for the better but it also is an excellent read on human psychology. For example, look how investors got on board the momentum trade in PCTI when we had convincing MACD “center-line” crossovers in late 2016, mid-2019, and then in late 2020. In all three circumstances, a strong rally ensued to the upside. We believe the same conditions if not much stronger are on the cards here for PCTEL as we see through the company´s recent trends on its income statement.

PCTEL Prints a long-term bottom (Stockcharts.com)

Growth Ramping Up

Essentially it all boils down to growth rates, which is something PCTEL has suffered with down through the years but not anymore. We see this clearly in the company´s recent second-quarter earnings where sales of $25 million for the quarter were both an 11% sequential increase as well as a 25% gain over the same period of 12 months prior. Furthermore, the $26 million top-line estimate for the third quarter means that it will most likely become seven straight quarters of consecutive year-over-year sales growth which the market is obviously beginning to price in at this stage.

Sales are essentially the lifeblood of any company as, without sufficient sales, positive earnings become an impossibility. Although PCTEL´s profitability may not be buoyant at present, remember the market is a forward-looking predictive mechanism and is pricing in the ramifications of how the company´s growing sales will change the company.

Over the past four quarters, for example, PCTEL is actually not profitable but near-term trends show the company reporting GAAP earnings of $0.02 per share in Q2 with a further +$0.05 per share expected for the third quarter. In fact, bottom-line earnings are expected to grow by 11% this year followed by much higher expected bottom-line growth in fiscal 2023 (40%+).

Dividend Well Covered By Growing Earnings & Margins

Sales on the other hand are expected to grow by roughly 14% this year followed by roughly 10% in fiscal 2023. Suffice it to say, the glaring trend with respect to present income statement trends, management´s guidance, as well as analysts´ expectations, is that margins are expected to grow meaningfully going forward. This is all coming off the back of successful product releases as well as far more encouraging market conditions. Through being innovative concerning the value that PCTEL is adding to the marketplace and growing distribution, the runway for growth here is long and the market is beginning to price this in.

This is why any fears over the affordability of the company´s generous dividend are overblown because PCTEL´s growing sales and earnings will produce the cash flow necessary to pay for the dividend. We already saw signs of this in the company´s second quarter as cash on the balance sheet still increased by some $400k as an adequate $1.6 million of free cash flow was generated in the quarter to pay the dividend to qualifying shareholders. Again, investors need to work off what is coming down the track here instead of focusing on trailing numbers.

Therefore, to sum up, the combination of PCTEL´s growing sales, improving margins, and bullish technicals all point to higher prices for the company here going forward. We look forward to continued coverage.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment