gorodenkoff/iStock via Getty Images

Thesis

Eaton Vance Tax-Managed Buy-Write Strategy Fund (NYSE:NYSE:EXD) is a buy-write fund from the Eaton Vance family. The fund is on the smaller side with only $100mm in assets and has a historic mediocre performance, especially when compared to other offerings from Eaton Vance. EXD has trailing annualized total returns that clock in at 6% and 3.97% respectively on 5- and 10-year look-back periods. These returns are substantially lower than what an investor would get from similar sister funds such as (ETB) or (ETV).

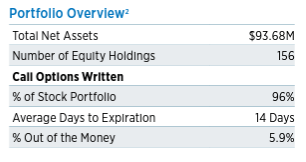

The CEF writes call options on 96% of its portfolio, and has short rolling windows of 14 days:

Portfolio (Fund Fact Sheet)

We can see that the options written are fairly “loose” being 5.9% out of the money. That simply means that the fund is taking a more risk-on view via its written options because it allows for more equity upside at the expense of the option premium. Simply put, the less out of the money an option is, the higher the delta and premium. If a market is range bound or downward moving, you want a very small number in the “% Out of the Money” section. We feel EXD’s stance is not an appropriate one for 2022 with the figure in the “% Out of the Money” needing to be much lower.

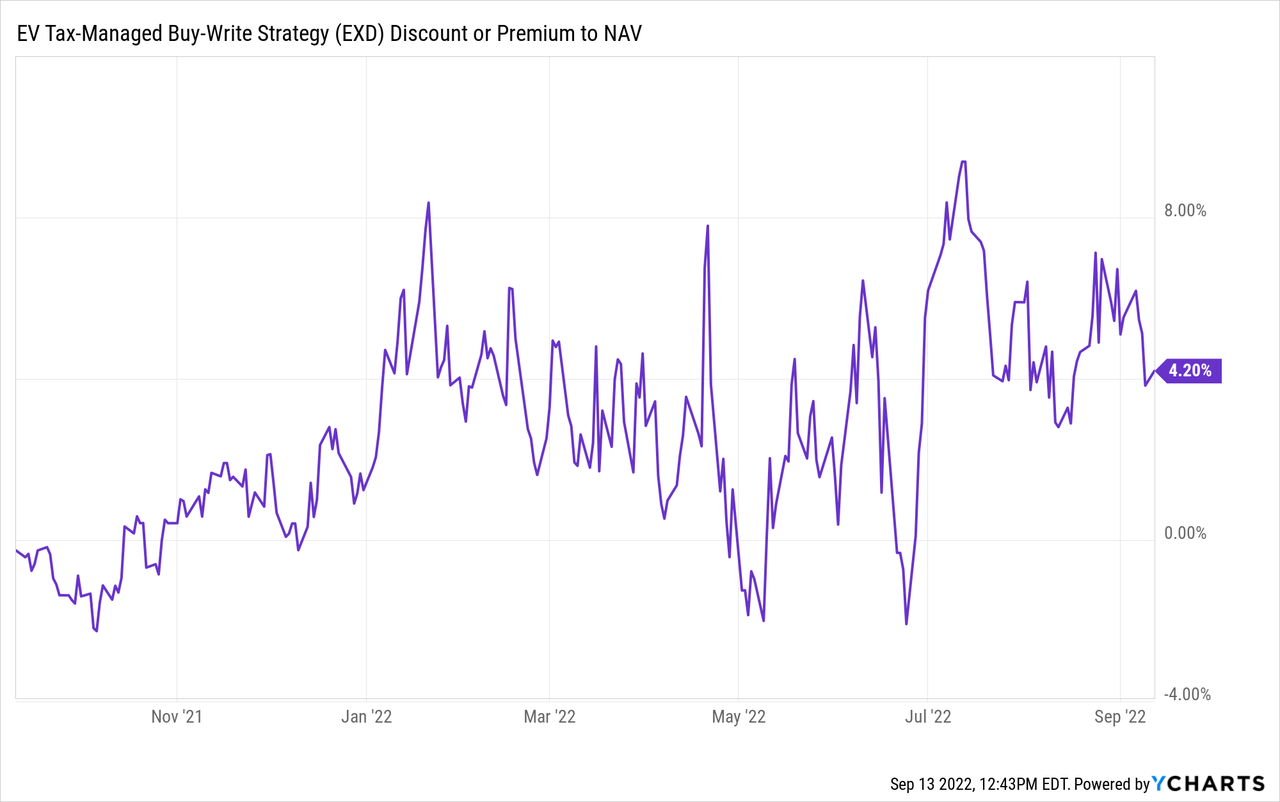

Investors have been, in our view, overpaying indiscriminately for selling volatility strategies this year. EXD had never traded at premiums to NAV prior to 2021, but in 2022, it has spent most of the time above net asset value. The fund currently trades with a 4.2% premium to net asset value, that was as high as 8% a few weeks back. This is expensive for 5.9%, rolling, out-of-the-money options. Selling volatility has been a very popular trade in 2022, especially in the CEF world. We have seen buy-write funds trade at historic premiums to NAV (as is the case for ETV and ETB, which recorded decade-high premiums to their NAVs in 2022). Some are more warranted than others (i.e., tight, dynamically managed out-of-the-money options, for example). In EXD’s case, we feel the current premium is expensive. The fund is overweight Tech versus the S&P 500 and has a mediocre historic performance. In 2022, it has barely outperformed the S&P 500, while its peers have shown significant outperformance.

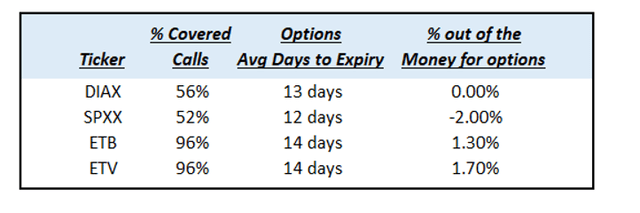

In our view, EXD’s set-up is not conducive to proper short volatility positioning due to the large “out-of-the-moneyness”. Let us compare it to some of its peers:

We can see that some of its peers display really tight figures for the “% out of the Money for options” column. In English, this means that as a retail investor, you are going to get better protection from these funds if the market sells off. With a mediocre long-term performance, we feel EXD’s premium to NAV is expensive for a poor performance in shorting volatility in today’s environment. A retail investor should look at funds with small premiums to NAV that have very tight “out-of-the-moneyness” strategies.

Premium/Discount to NAV

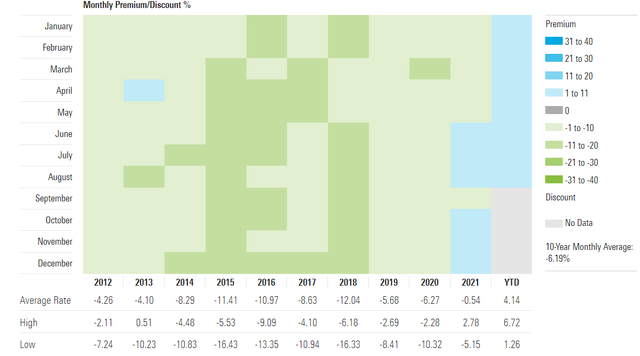

The fund has historically traded at a discount to net asset value:

Premium / Discount to NAV (Morningstar)

We can see that prior to 2021 the fund was trading at substantial discount levels to the NAV. We can see levels as wide as -16% in 2015 for example. This year, the story has been different:

The fund has spent most of 2022 at a premium to NAV, correlated with risk-on/risk-off environments. While we saw a discount during the June sell-off, the CEF moved to a substantial premium in July/August.

Performance

EXD is the laggard in the Eaton Vance family:

YTD Total Return (Seeking Alpha)

We can see that EXD has shadowed SPY’s performance while ETB and ETV have outperformed.

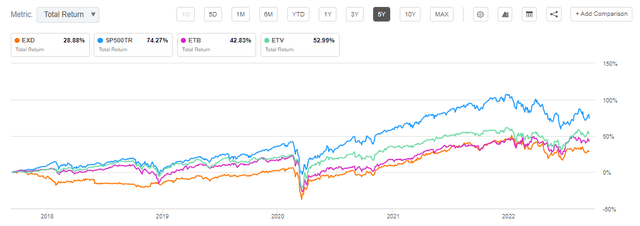

On a 5-year time frame, the performance is similar, with EXD at the bottom of the cohort:

5Y Total Return (Seeking Alpha)

Conclusion

EXD is a buy-write CEF from Eaton Vance. The fund is at the bottom of the cohort in terms of long-term performance, with mediocre long-term returns. The vehicle is currently trading at a premium to NAV, while historically it has shown market values below net asset values. We feel investors are overpaying in 2022 for short volatility strategies, and EXD has got caught up in this trend when it shouldn’t. The fund writes rolling 14-day calls that are 5.9% out of the money. That “out-of-the-moneyness” is very high and does not really protect the fund or do a proper job in monetizing the high implied volatility currently in the market. This poor positioning is reflected in the fund’s performance, which has shadowed the S&P 500 when its peers have excelled.

Be the first to comment