SweetBunFactory

The share price of Camtek (NASDAQ:CAMT), a supplier of metrology and inspection systems to the semiconductor market, has been under pressure since early 2022 when it hit a double top of approximately $48.60 (which it also hit on November 15, 2021) and has since been in a gradual freefall, bottoming out at $21.13 on October 13, 2022.

Since then, it has traded in a range of about $22.00 per share to $24.00 per share, with a brief foray above that level for about a week from November 10, 2022, to November 16, 2022.

The major thing for investors to watch closely with CAMT is in relationship to the level of the effect the expected economic downturn in 2023 will have on the specific performance of the firm, and the semiconductor industry in general.

With about 60 percent of its business being in Advanced Packaging and Heterogeneous Integration, the company sees itself as being more resilient to an economic downturn than the semiconductor industry as a whole.

Even if that’s how it plays out, much of the rest of the company’s business will subject to an economic downturn in 2023, which I think will put significant downward pressure on its share price, especially if continues in the current low range it’s been moving in.

In the current quarter the company may do okay and possibly get a boost in its share price if its earnings report confirms that, but under present investor sentiment and economic concerns, and upward move is unlikely to last outside of an unforeseen positive catalyst that drives its share price sustainably upward.

Since I see nothing like that on the horizon, I think investors should view CAMT as a company that is probably going to struggle to gain any traction in the first half of calendar 2023, and very possibly throughout the entire year.

In this article we’ll look at some of its recent numbers, how its major business could offset some of the economic weakness of 2023, and how to view the company going forward.

Some of the numbers

Revenue in the third quarter was $82 million, up 16 percent year-over-year. Of that revenue, Asia accounted for 73 percent, while the Europe and the U.S. accounted for the remaining 27 percent.

With new regulations that restrict the sale of semiconductor equipment for advanced nodes in China in Memory and Logic, it is a concern with almost 75 percent of CAMT’s business coming from China.

Pointing out that its Chinese customers are primarily in the Advanced Packaging segment, management stated that at this time it doesn’t believe the new regulations will have much if any impact on sales. That of course doesn’t mean it won’t, and that is definitely something to watch closely if it does turn out the regulations apply to some of CAMT’s business in China. Under that scenario, its share price would get crushed.

Gross profit in the reporting period was $40.2 million, with gross margin falling to 49 percent against the 50.9 percent in the third quarter of 2021. The decline in gross margin was attributed to several large orders that resulted in a less favorable product mix. In other words, the larger customers asked for and received better prices because of the size of the orders.

With the company saying margins are going to return to normal, it suggests that revenue is likely to decline because of the lack of large orders in the near future in comparison to those in the reporting period, unless it is offset by many smaller orders.

Operating profit in the quarter was $23.2 million in comparison to the $21.7 million in operating profit from the third quarter of 2021. Operating margin in the third quarter was $28 million

Net income in the third quarter was $22.3 million, or $0.48 per share, compared to net income of $20 million or $0.45 per share in the third quarter of 2021.

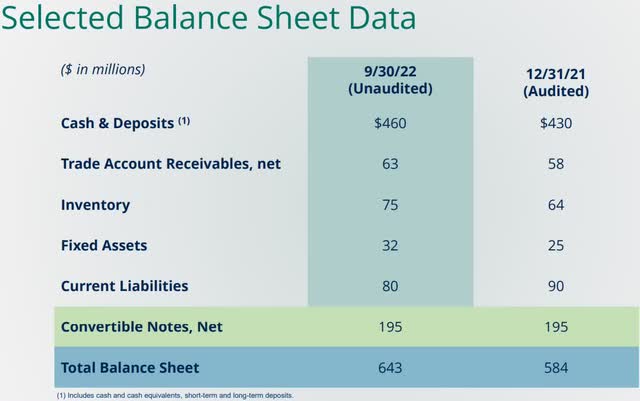

Cash and cash equivalents at the end of the quarter was $460.3 million.

Economic headwinds

With expectations there will be an economic downturn in 2023, the question is how much that will have an impact on the performance of CAMT for next year. According to management, it is resilient in comparison to the semiconductor industry because of the company’s business model

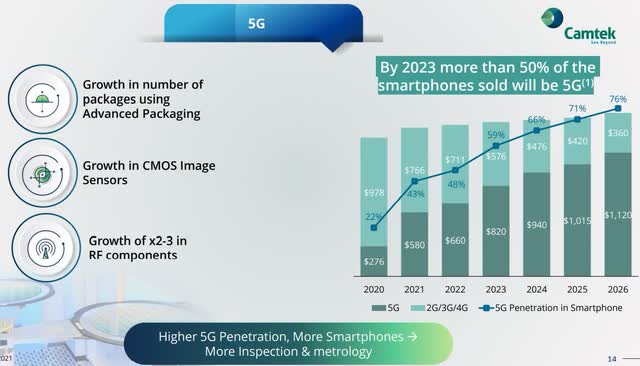

The major reason for the assertion is its support for the technology that is transitioning the industry to Advanced Packaging and Heterogeneous Integration. With 60 percent of its business associated with that segment of the market, the company believes the trend will continue, which could offset some of the potential response to an economic downturn if that’s how 2023 plays out. The company states that the trend is expected to continue over the next couple of years.

Another reason for being more optimistic in light of a weak 2023 economy is that the Memory segment, which is expected to take a hit, is limited to DRAM alone, which has represented under 5 percent of CAMT’s overall business on a historical basis. In this segment the company mostly supports the transition to the high bandwidth Memory, which has been increasing in orders, with sales expected to climb in 2023.

Another positive catalyst brought up by management in relationship to the company being more resilient to a recession in 2023, is the fact that wafers are becoming even more complex than they were in the past and consequently require more inspection systems to deal with that.

Last, it thinks that its increasingly diversified customer base will help mitigate much of the risk of a deepening 2023 recession. For these reasons the company believes it won’t be affected as much by a weakening economy than many of its peers. While these could support the performance of CAMT in 2023, the concern isn’t whether or not it’ll do better than most of its competitors, assuming it does, but how it performs in and of itself. Doing better than its peers in a weak economic environment could still easily result in underperformance by the firm.

Mitigating risk

Management has been optimistic about its ability to navigate inflationary and recessionary waters, but still understands that next year is going to be a tough one, and there’s no guarantee their belief in resiliency will end up with strong results.

With that in mind, the company is watching its balance sheet elements such as accounts receivable, headcount, and inventory levels for clues as to which direction the potential impact of a changing economy will have on the company, and what it must do to respond to that eventuality.

All positive outlooks and fundamentals aside, the bottom line is management sees the semiconductor industry having the strong probability of declining in 2023, and the question is what level of impact it’ll have on the company, not whether it’ll have a negative impact.

Conclusion

I believe the semiconductor industry is in a secular bull trend at this time, but just as there are bear markets in a secular bull stock market, so there are in industries.

The reasons given for being resilient in an economic decline make sense, but they won’t save CAMT from taking a hit on the top and bottom lines in 2023, assuming the economy gets worse before it gets better.

Until there’s more clarity, the share price of CMAT is probably going to bounce around in a range of approximately $22.00 to $24.00 per share until it receives more direction.

If there is a decent fourth quarter it would probably push the share price of CMAT up temporarily, but I don’t see any near-term catalyst that would support a higher share price once it pulls back.

The only thing that will change the narrative for CMAT is if the economy does better than expected, and demand for its products and services remain strong, or even grow across its segments.

Outside of that, I think CMAT is going to be in for a challenging year, and at best should operate in a defensive manner and continue to prepare itself for when the economy finally turns around.

Be the first to comment