seb_ra/iStock via Getty Images

Stocks still not fighting the Fed

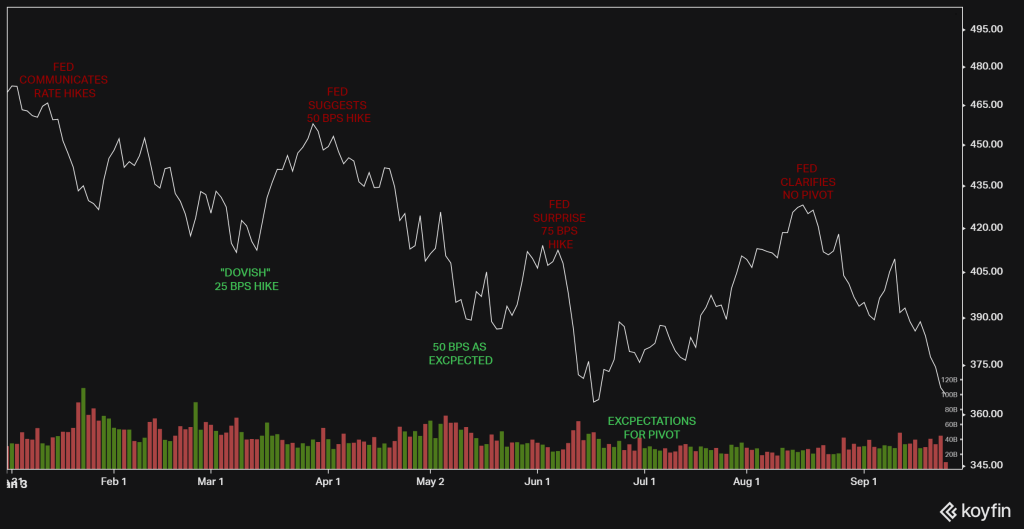

In September I wrote investors should heed the old market adage “don’t fight the Fed.” Through Q3, the U.S. stock market was hanging on the Federal Reserve’s every word.

Figure 1: S&P 500 and The Fed

S&P 500 Jan 1 to Sept 30 (Koyfin)

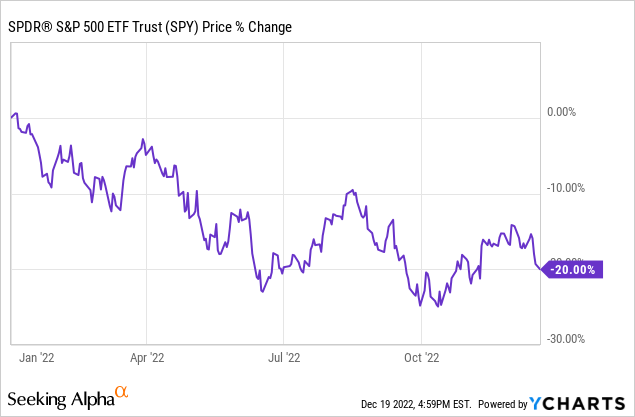

It is no different in Q4. Following the Fed’s policy meeting on December 14th. The S&P 500 abruptly reversed on another failed rally and is back below the -20% level for the year, shown below with the SPDR S&P 500 Trust ETF (SPY).

Figure 2: S&P 500 Year-to-Date Return

Fed focuses on what it can control

The Fed does not directly control the stock market, but it has an indirect influence through interest rates, commonly seen as the price of money and the grease that keeps the economy moving.

When rates are low, money is cheap; capital and economic growth flow freely. When rates are high, money is expensive; capital and the economy contract.

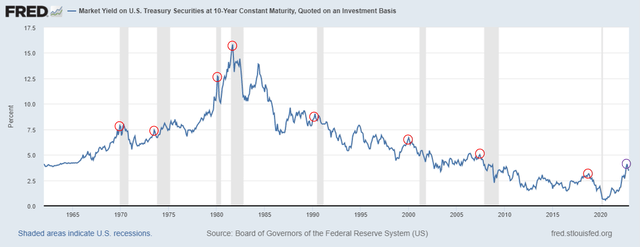

We can visualize the link between interest rates and the economy by comparing historical 10-year Treasury note (10YT) yields to U.S. business cycles.

Figure 3 shows how 10YT yields typically peak (red circles) before recessions (grey bars). There were head fakes like 1984 and divergences like 1974, but overall the 10YT yield has been a fairly good bellwether of economic contractions.

Figure 3: 10-Year Treasury Yields

Of course, the Fed also does not directly control the 10YT yield, long-term yields are determined by the market. But the Fed has an indirect influence from its control of short-term interest rates, vis-a-vis the federal funds rate (FFR).

The FFR is one of the few things the Fed controls directly. This is why so much attention is focused on rate policy. At its December meeting, the Fed reiterated its plan to continue raising the FFR in pursuit of a 2% annual inflation target and dashed recent hopes for a near-term policy “pivot.”

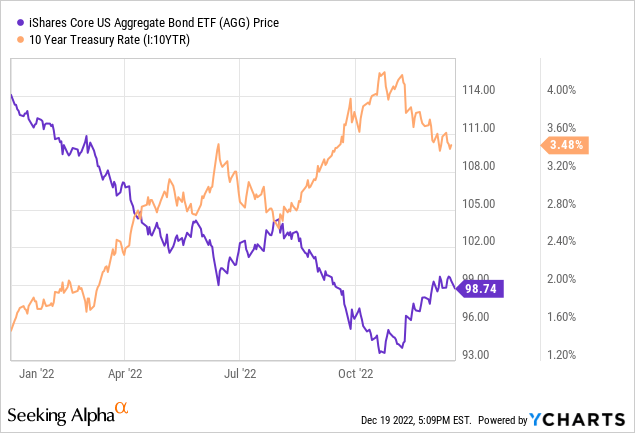

Bond market has a fighting spirit

Despite that, the 10YT yield declined over the past week and has done so ever since it peaked in October. Meanwhile, the bond market rallied off its October lows, shown below as the 10-year Treasury yield versus the iShares Core U.S. Aggregate Bond ETF (AGG).

Figure 4: Bond Yields vs. Prices

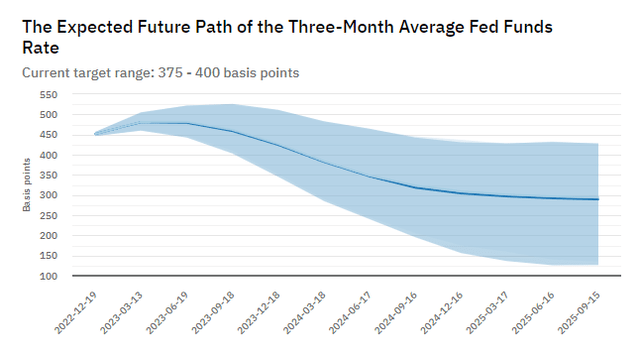

That implies the bond market thinks the Fed is nearing the end of rate hikes. Based on futures pricing, investors expect the Fed to be cutting the FFR within one year’s time.

Figure 5: Rate Expectations

As of 12/19/2022 (Federal Reserve Bank of Atlanta)

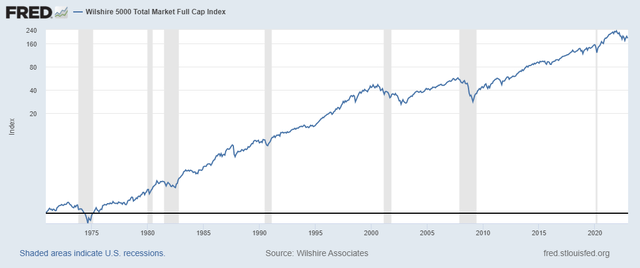

It may not even matter if investors are right or wrong about when the Fed moves. If investors are right and the Fed pivots to lower rates next year, that implies the economy will likely be in recession (see Figure 3). That is a bad look for equities because the stock market typically does not bottom until after recessions begin (Figure 6).

Figure 6: US Stock Market vs Recessions

Wilshire 5000, 1981 to 2022 YTD (FRED)

If the market is wrong, and the Fed does not pivot or cut rates, that could result in an even harder landing for the economy and stocks get punished in that scenario too (see Figure 1).

Either way, it appears the bond market is not buying into the Fed’s hawkish rhetoric and is betting the central bank will need to reverse course. The skepticism and fighting spirit are understandable. It was not long ago that Powell and company coined the infamous term “transitory” inflation.

The grey-ish bottom line

There are many possible scenarios, including one where the Fed gets policy just right, inflation falls to 2%, and the economy avoids a recession.

There are also technicalities. While the Fed has embarked on the most aggressive rate hikes in decades, inflation is also at multi-decade highs, resulting in negative real interest rates.

In other words, monetary policy is still loose after inflation so the Fed may need to tighten further than markets expect. In that case, similar to 2022, look out below for both stocks and bonds.

So, will the U.S. fall into recession next year? We would all prefer a definite, black or white, yes or no answer. Unfortunately, I do not know. Nobody really does. Markets and investing often work in relative shades of grey.

As I wrote before, the best we can do is develop reasonable approximations (roughly at that) based on current information. With respect to interest rates, the only thing we know for certain is the Fed is raising them and will stop, eventually.

That looks recessionary to me but in definite shades of grey.

Be the first to comment