Sneksy

Introduction

Mastercard Inc. (NYSE:MA) reported Q3 2022 results last Thursday (October 27); shares have fallen 3.2% since then.

We initiated our Buy rating on Mastercard in April 2019. After 3.5 years, MA stock has gained 34% (including dividends), though the share price is down 23% from its peak and down 13% since the end of 2020:

|

Mastercard Share Price (Last 5 Years)  Source: Google Finance (03-Nov-22). |

Q3 results showed why Mastercard will continue to be a long-term compounder. Adjusted EPS grew 12.9% year-on-year despite currency headwinds and the loss of operations in Russia. Cross-Border Volume Fees grew 41% as Travel continued to recover from COVID-19, but other revenue lines also showed strong growth. EBIT margin expanded again despite acquisitions and investments. Consumer spending has remained strong into October, but management is also confident about MA’s resilience in a downturn. Shares are at a 29x P/E relative to our estimated 2022 EPS, which is partly disrupted by the pandemic. Our forecasts indicate a total return of 92% (23.0 annualized) by 2025 year-end. Buy.

Mastercard Buy Case Recap

Our investment case on Mastercard has been based on a belief that its 15%+ EPS CAGR and premium valuation would continue, driven by:

- Electronic payment volumes are growing structurally, from both GDP growth and the continuing shift away from cash and cheques; even in the U.S. and Europe, a significant amount of consumer spending remains in cash; the potential is even greater in newer geographies

- Mastercard and Visa (V) are increasingly penetrating new payment verticals including Business-to-Business, Business-to-Consumer and Peer-to-Peer; they are also increasingly providing value-added services that utilise their platform status and wealth of data, adding further revenue growth

- Incumbent payment networks enjoy natural advantages in scale and network effects; regulations ensure a high barrier to entry

- Payment networks have natural operational leverage, being highly scalable and having largely fixed costs, so earnings grow faster than revenues

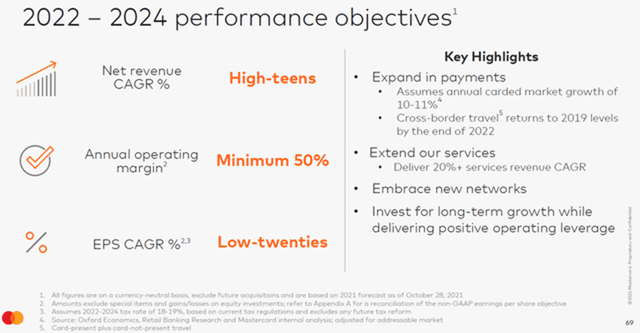

- Mid-term targets set out at the investor day in November 2021 include a revenue CAGR in the high-teens, an EBIT margin of at least 50% (compared to 54.3% in 2021), and an EPS CAGR in the low 20s, though our own investment case is more conservative:

|

Mastercard 2022-24 Targets  Source: MA investor day presentation (Nov-21). |

COVID-19 was a significant short-term negative for Mastercard, with travel restrictions disrupting high-margin cross-border volumes, but a long-term positive, accelerating the shift to electronic payments.

Q3 results were mostly in line with our investment case, with currency headwinds offset by the recovery in Travel.

Mastercard Q3 2022 Results

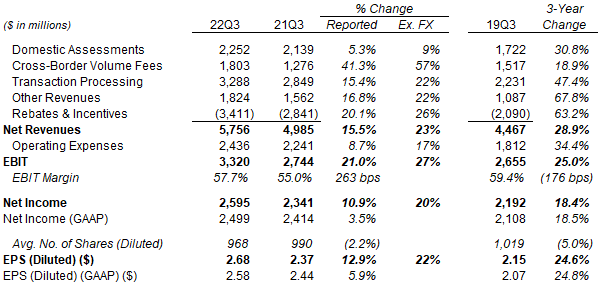

In Q3 2022, Mastercard’s Adjusted EPS grew 12.9% year-on-year, despite currency headwinds and the loss of operations in Russia after the Ukrainian invasion. Compared to pre-COVID Q3 2019, Adjusted EPS has grown 24.6% after three years, despite a still-incomplete recovery from the pandemic and 9 ppt of currency headwind this year alone:

|

Mastercard Adjusted P&L (Q3 2022 vs. Prior Periods)  Source: MA results release (Q3 2022). |

As a reminder, Russia contributed 4% of Mastercard’s revenues in 2021 (and Ukraine contributed 2%), and these revenues are believed to be higher-margin and faster-growing than the group average.

Net Revenues grew 15.5% in Q3, or 23% excluding currency, including 1 ppt from acquisitions. Within revenues, Cross-Border Volume Fees grew 57% thanks to a continuing recovery in Travel, with cross-border volume up 44% year-on-year and a favourable mix shift away from Intra-Europe. Transaction Processing and Other Revenues, both of which include revenues from value-add services, each grew 22%. Domestic Assessments revenues grew 9%, slightly less than Mastercard’s 11% Gross Dollar Value growth, due to mix.

Operating Expenses grew 17% at constant currency, including 3 ppt from acquisitions, with the rest of the increase “primarily” due to higher personnel costs, including investments to support strategic initiatives.

Adjusted EBIT grew 27% at constant currency, 4 ppt faster than revenues, showing again Mastercard’s natural operational leverage; Adjusted EBIT margin expanded 2.6 ppt year-on-year,

Adjusted Net Income grew 20% at constant currency, less than EBIT, due to a higher tax rate. (On a reported basis, the effective tax rate rose to 18.7%, compared to 14.3% in the prior-year quarter.)

Adjusted EPS grew 22% at constant currency, after buybacks reduced the share count by 2.2%.

Mastercard Q3 Year-to-Date Results

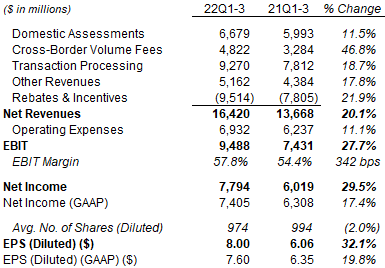

Year-to-date, Adjusted EPS is up 32.1% in U.S. dollars, thanks to much higher growth rates in Q1 and Q2 (57.9% and 31.6% respectively) on weaker prior-year comparables that had recovered less from the pandemic:

|

Mastercard Adjusted P&L (Q3YTD 2022 vs. Prior Year)  Source: MA results release (Q3 2022). |

Q1-3 Net Income of $7.79bn was just 6.5% lower than full-year 2021 Net Income of $8.33bn.

Mastercard Q4 2022 Outlook

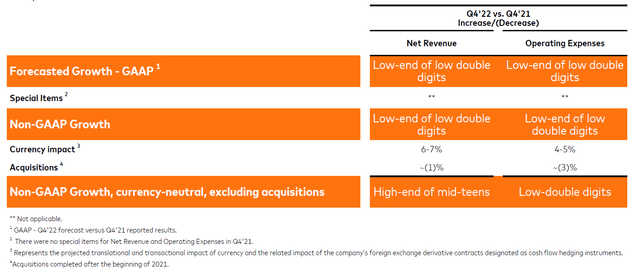

Mastercard provided a Q4 2022 outlook, with organic growth of “high-end of mid-teens” in Net Revenues and “low double-digits” in Operating Expenses. Including currency and acquisitions, growth is expected to be “low-end of low-double-digits” for both Net Revenues and Operating Expenses on an adjusted basis:

|

MastercardQ4 2022 Outlook  Source: MA results presentation (Q3 2022). |

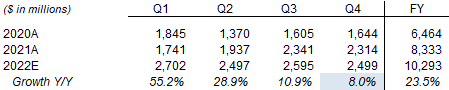

We believe the outlook implies Q4 Adjusted Net Income growth rate to be a few percentage points lower than “low-end of low-double-digits”, due to a higher tax rate (expected to be 19% in Q4, compared to 16% last year). If we assume an 8% growth, then full-year Adjusted Net Income growth will be 23.5%

|

Mastercard Net Income By Quarter (Since 2020)  Source: Company filings and Librarian Capital estimates. |

Management stated that this Q4 outlook was “very consistent” with the numbers implied by full-year outlook given at Q2 2022 results. We estimated at the time that the full-year outlook implied Adjusted EBIT would grow 23% year-on-year in 2022. This now looks too conservative, though offset by the worsening of currency headwinds since then.

Overall, we believe Mastercard Adjusted Net Income is likely to grow at about 23% year-on-year in 2022.

Mastercard Q4 2022 Outlook

Mastercard data shows that consumer spending has remained strong into October.

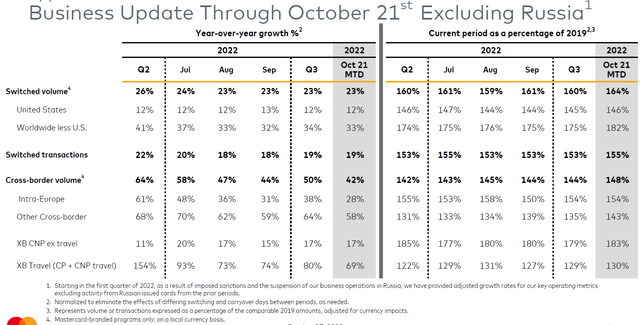

While year-on-year growth rates are distorted by the progressive recovery from the pandemic in 2021, comparisons with pre-COVID 2019 showed relatively consistent trends, with Mastercard’s global Switched Volume (excluding Russia) at 160% of 2019 levels in both Q2 and Q3, rising slightly to 164% in Oct 1-21:

|

Mastercard Volume Local Growth vs. Prior Years (Since Q2 2022)  Source: MA results presentation (Q3 2022). Key: XB = Cross-Broder, CNP = Card Not Present, CP = Card Present. |

Measured as a percentage of 2019 figures, there has been a notable acceleration in volumes in Other Cross-Border (i.e. not Intra-Europe) (131% in Q1, 135% in Q2 and 143% in October 1-21) and in Cross-Border Travel (122% in Q2, 129% in Q3 and 130% in October 1-21). Other volume indicators have been fairly stable since Q2.

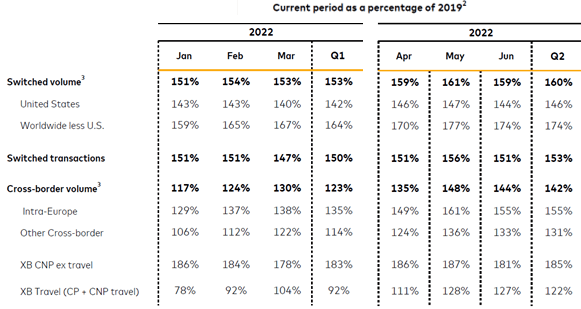

Compared to January, Mastercard’s Switched Transactions count has (as a percentage of 2019 figures) accelerated by 4 ppt by October (from 151% to 155%), but its Switched Volume has accelerated by 13 ppt (from 151% to 164%):

|

Mastercard Volume Local Growth vs. Prior Years (H1 2022)  Source: MA results presentations. Key: XB = Cross-Broder, CNP = Card Not Present, CP = Card Present. |

The implied increase in Mastercard’s average transaction size is likely have resulted from a combination of stronger consumer spending, a mix shift in purchases and higher consumer prices.

Mastercard’s Likely Resilience in a Downturn

Mastercard earnings will likely be resilient in a downturn, because it generates fees even on day-to-day non-discretionary purchases, has revenues from value-add services that are not dependent on volumes, and can adjust its costs to partially offset the impact of any revenue decline. As management explained on the Q3 earnings call:

“If I just look back over the last two years where we certainly had a slowdown on the payments side in the macroeconomic overall and services carried the day very significantly for us … in the end people will spend even in a downturn. It doesn’t actually matter for us what they spend on, but if they spend on a Mastercard, we give them more opportunities to do so, so diversification is the name of the game.”

Michael Miebach, Mastercard CEO

“As we demonstrated during the COVID environment, we do have the opportunity to flex our expenses, whether it’s around marketing, whether it’s around professional fees, whether it’s around T&E (Travel & Entertainment)… and we’ll continue to do that going forward.”

Sachin Mehra, Mastercard CFO

As a large component of Mastercard’s revenues are based on a basis point fee on transaction volumes (the others being based on transaction counts and value-add services), earnings are naturally protected against inflation, and should also be resilient in the event of a “stagflation” where low economic growth is accompanied by high inflation.

We continue to see Mastercard as one of the best investments in an uncertain world.

Valuation – Is Mastercard Stock Overvalued?

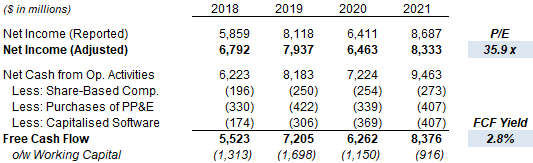

At $309.17, relative to 2021 financials, MA stock has a 35.9x P/E and a 2.8% Free Cash Flow (“FCF”) Yield:

|

Mastercard Net Income, Cashflows & Valuation (2018-21)  Source: MA company filings. |

Relative to our 2022 Net Income estimate of $10.3bn (up 23% year-on-year, and implying an EPS of $10.57), the P/E is 29.2x. The consensus sell-side estimate is currently $10.56.

Both 2021 and 2022 earnings were disrupted by COVID-19 and did not fully reflect Mastercard’s earnings power; both P/E multiples calculated above are therefore artificially high in our view.

The Dividend Yield is 0.6%, with a dividend of $0.49/quarter ($1.96 annualized). The Board declared an 11% raise in the dividend on November 30 last year, and we expect a similar announcement in the next few weeks.

As of October 24, Mastercard has repurchased $6.8bn of its shares year-to-date, equivalent to 2.3% of its current market capitalization. Its authorized repurchase program still has $5.1bn remaining, and we expect buybacks to continue.

Mastercard, with its earnings growth, long-term compounding potential and demonstrated dividend resilience, deserves a high multiple when compared with risk-free U.S. government bonds. After the Federal Reserve’s 75 bps rate hike and hawkish comments this week, 10-Year Treasury Notes currently have a yield of 4.136%, equivalent to a 24x multiple, on a fixed coupon. The corresponding U.S. 10-year Treasury Inflation-Protected Securities currently offer a yield of just 1.75%, or a 57x multiple, showing how much investors value an inflation-proof income.

Mastercard Stock Forecasts

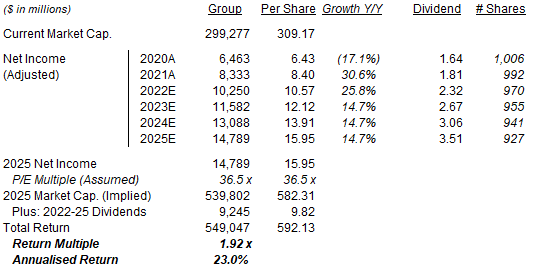

We reduce our exit multiple assumption, but keep most of our forecasts unchanged. We now assume:

- 2022 Net Income to grow 23% year-on-year (unchanged)

- From 2023, Net Income to grow by 13% each year (unchanged)

- 2022 share count of 970m (was 979m)

- From 2023, share count to fall by 1.5% each year (was 1.3%)

- Dividends to be based on a 22% Payout Ratio (unchanged)

- Exit P/E of 36.5x (was 41x)

Our forecasts imply a 2021-25 EPS CAGR of 17.4%, significantly more conservative than the low 20s included in management targets (before the Russian invasion of Ukraine), and should be achievable without Russia.

Our 2025 EPS estimate of $15.95 is 1.5% higher than before ($15.71):

|

Illustrative Mastercard Return Forecasts  Source: Librarian Capital estimates. |

With shares at $309.17, we expect an exit price of $582 and a total return of 92% (23.0% annualized) by 2025 year-end.

Is Mastercard Stock A Buy? Conclusion

We reiterate our Buy rating on Mastercard.

Be the first to comment