DKosig

Investment Thesis: A rising total assets to net debt ratio along with strong revenue growth could allow the stock to climb higher from here.

In a previous article back in June, I made the argument that should SBA Communications (NASDAQ:SBAC) be able to demonstrate growth in total assets relative to long-term debt – the stock could see upside from here.

My reason for making this argument was that while the continued rollout of 5G is expected to increase wireless infrastructure demand going forward – investors will want to see evidence that SBA Communications can comfortably scale its existing infrastructure without greatly increasing its long-term debt.

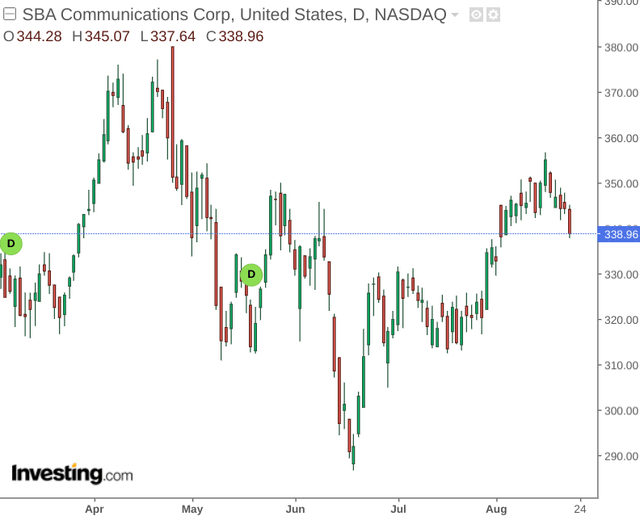

Since June, we have seen the stock trend upwards:

The purpose of this article is to assess whether upside can continue from here – given recent Q2 2022 results.

Performance

When comparing with December 2021 – we can see that total assets relative to long-term debt has increased in June 2022 – with total assets rising and long-term debt falling:

| December 2021 | June 2022 | |

| Total assets | 9,801,699 | 10,011,937 |

| Long-term debt | 12,278,694 | 11,817,504 |

| Total assets to long-term debt ratio | 79.82% | 84.72% |

Source: SBA Communications Corporation Second Quarter 2022 Results

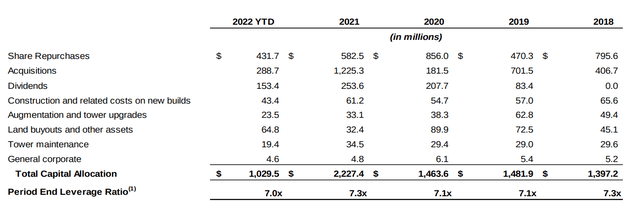

What is also encouraging is that the company’s period end leverage ratio – or net debt divided by annualized adjusted EBITDA – is currently at a five-year low, meaning that the company is taking on less debt relative to the earnings it is generating.

SBA Communications Corporation Supplemental Financial Data: Second Quarter 2022

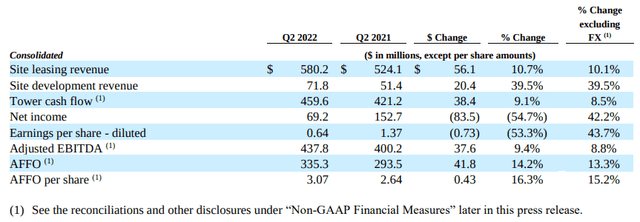

From a more holistic standpoint – we can see that site leasing and site development revenue are both up by double digits as compared to Q2 2021 – and in spite of a decrease in earnings per share due to FX losses – earnings growth excluding FX actually rose by over 40%.

SBA Communications Corporation Reports Second Quarter 2022 Results

In this regard, I take the view that the company’s recent quarterly results are quite encouraging and the stock could continue to see upside from here.

Looking Forward

Going forward, the main risk for SBA Communications – as for other companies in the industry – is inflation.

Directly, inflation could have the effect of increasing the costs of developing wireless infrastructure further. Indirectly, should telecommunications companies might choose to slow investment in telecoms infrastructure should higher prices mean lower usage or higher churn on the part of customers.

As one example, Verizon (VZ) has currently chosen to drop its previous $25-a-month Party Pay option in favour of both a $30-a-month Visible and $45-a-month Visible Plus plan. While the latter will make use of 5G Ultra Wideband – which SBA Communications is helping to develop along with Crown Castle (CCI) – Verizon’s main Visible plan makes use of the slower 5G network. In an inflationary environment, consumers might be content to trade off extra speed for the cheaper package – which might mean that Verizon would choose to limit the degree to which they prioritise further development of 5G Ultra Wideband – at least in the short to medium-term.

Conclusion

To conclude, SBA Communications has shown strong performance in the most recent quarter. While inflation might place some pressure on 5G infrastructure development going forward – I take the view that SBA Communications is managing its debt position quite well and can continue to grow earnings without having to significantly increase its debt load.

For these reasons, I take a long-term bullish view on the company.

Be the first to comment