AlexLMX

ABB (NYSE:ABB) shareholders are set to receive shares in a new company called Accelleron, which specializes in turbo-chargers. This will be a 100% spin-off transaction in the form of dividend in kind, with a 1:20 split, i.e. ABB shareholders will receive one Accelleron share for every 20 ABB shares held. This is subject to ABB shareholder approval at EGM and market conditions, but preparations for the spin-off are well advanced. The EGM is scheduled to take place on September 7th, with prospectus publication expected around September 23rd, and the planned spin-off and first trading day of Accelleron on the SIX exchange expected to happen on October 3rd.

With that in mind we thought it would be useful to analyze the company prior to it starting trading as an independent business, that way ABB shareholders will be more familiar with the company they will be receiving shares in.

Company Overview

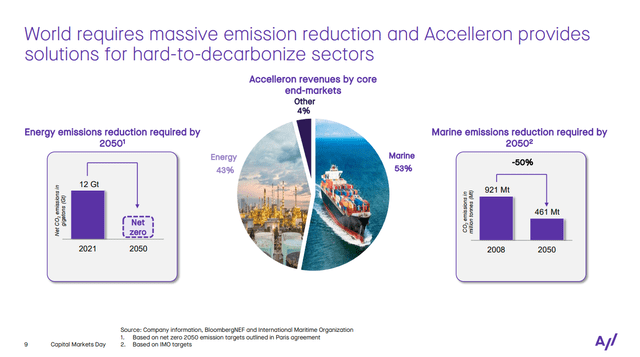

Accelleron will be a global leader in high-power turbochargers, with industry leading technology, and >180 thousand turbocharger installed base. This is a business with very significant recurring service-driven revenues, and strong cash conversion characteristics. It is not a growth business, but it is not in terminal decline either. It is expected to grow at a GDP-like growth rate of 2% – 4% per year, and to develop new technologies for cleaner fuels, fuel-cells, and other next-generation cleaner fuels. The company has a strong ESG angle in that it provides solutions for hard-to-decarbonize sectors. These sectors include maritime transportation, cruises, and ferries, among others.

Adding a turbocharger to an engine helps to increase power by up to 300%, lower fuel consumption and CO2 emissions by up to 10%, and reduce NOx emissions by up to 60%. It also provides financial benefits as it reduces fuel consumption, with the cost savings potentially being multiple times the initial outlay.

Accelleron has a very comprehensive range of products, that go from the smallest ones like TPX which is the size of a microwave, to the largest like A100 / 200-L that can be the size of a truck and weight 10 tons.

Competitive Advantages

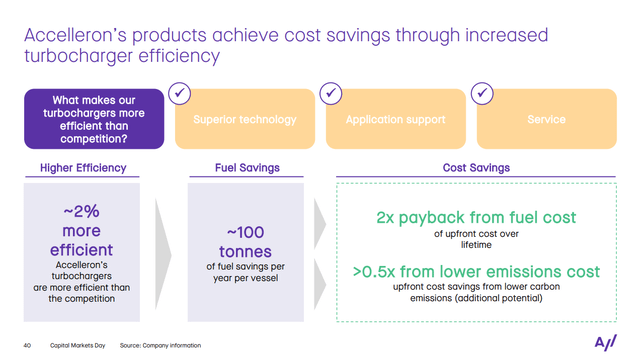

Accelleron products have best-in-class efficiency (up to 2% above peers) with up to 25% higher power density compared to the closest peer. The company has also heavily invested in digital capabilities enabling predictive maintenance and remote monitoring.

In addition to being more efficient thanks to the cutting-edge technology, Accelleron also has significant competitive advantages from its scale. This is particularly important in its global service business, where having significant scale allows the company to provide better service to customers in a more efficient way. This service business is particularly attractive, with recurring revenues that provide resilience and predictability.

Financials

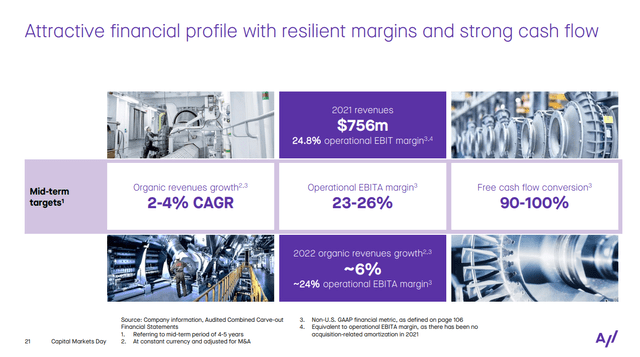

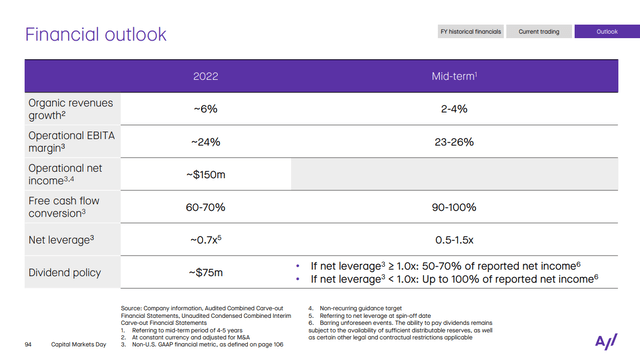

The company’s financials show attractive margins and strong cash generation. The organic revenue growth target is relatively low at 2% to 4% CAGR, but the operational EBITA margin target of 23% to 26% is high, and the 90% to 100% free cash flow conversion target is also high. Overall we would characterize the business as a low-growth “cash cow”, that should be able to deliver significant dividends to its shareholders.

The company has revenue of $783 million in 2019, which was then considerably affected by the Covid crisis in 2020 and reduced to $711 million that year, and it made an almost full recovery in 2021 to $756 million. So far in the first half of 2022 the company has generated $383 million in revenue, which is ~4% higher than the first half of 2021.

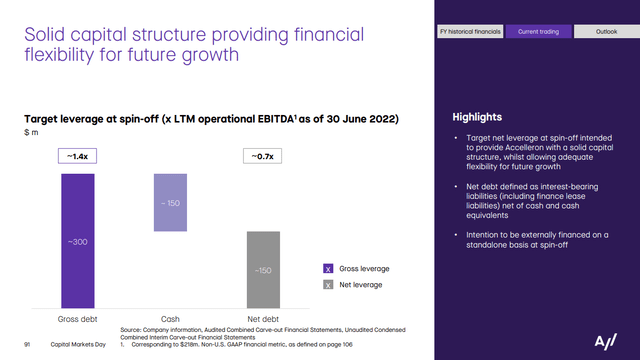

Balance Sheet

The company is expected to have a decent balance sheet at spin-off, with net leverage of ~0.7x thanks in part to ~$150 million in cash reducing net debt. The company will in part use its leverage to determine the dividend, considering a payout of up to 100% of reported net income if net leverage is below 1.0x operational EBITDA.

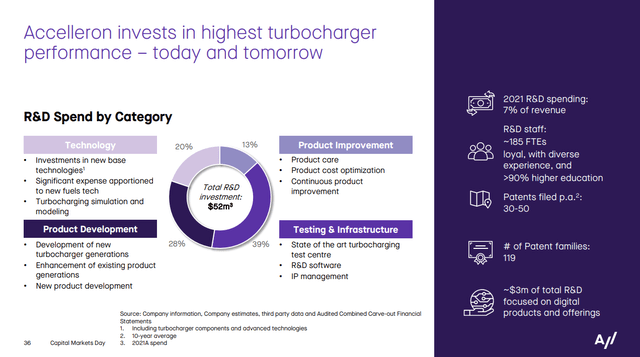

R&D

Accelleron has been investing heavily in R&D, with ~7% of annual revenues spent on R&D. This has resulted in 119 patent families and ~30 to 50 new patents filed per year. The slide below breaks down where the company directs its R&D dollars, and it goes from new product development, to new technologies. Particularly interesting is the spent on advanced technologies, which includes fuel cells, where turbocharges can also be used to improve efficiency. Another interesting research area is using 3D technologies to print some of the parts used in the turbochargers.

Valuation

The company is committing itself to an attractive dividend policy of 50-70% of reported net income, with a payout of up to 100% of the reported net income if net leverage is below 1.0x operational EBITDA. This should make the company attractive to income investors.

In terms of net income, the company generated $159 million in 2019, $112 in 2020, and $144 in 2021. We believe 2022 should be a little bit higher, so we can round it to ~$150 million. Given the company’s low growth, but solid profitability and cash generation, we believe it deserves a P/E ratio of at least ~10x. That would place the market cap at around $1.5 billion.

Risks

In the short term the biggest risk we see is ABB shareholders seeing the spin-off as a dividend, and selling the shares to convert into cash. That could put a lot of pressure on the share price in the short term. Longer-term we believe the biggest risk to be that of a migration to electric propulsion systems. The company is working to mitigate this risk by designing products that can work with clean fuels and even fuel cells. However, we do believe that the electrification of transportation will eventually reach cargo ships, cruises, and ferries, reducing the market size for Accelleron.

Conclusion

We believe ABB shareholders should familiarize themselves with the company they are set to receive shares in soon. Accelleron is a global leader in turbochargers, and it is a very profitable business with “cash cow” characteristics. That said, there are risks to consider, in the short term there might be a lot of selling pressure from ABB shareholders selling their shares, and in the long-term there is a significant risk that the electrification of transportation will reach many of Accelleron clients, including cruise ships and ferries.

Be the first to comment