Justin Sullivan

Roku’s (NASDAQ:ROKU) shares soared 8% on Thursday after rumors spread that the streaming company could once again get acquired. Roku’s change-of-control language in a customary disclosure with the SEC revived take-over rumors which are likely unfounded. Take-over rumors regularly spread, including during the summer of 2022 when an acquisition of Roku by streaming giant Netflix (NFLX) was apparently on the table, but they rarely have any credibility. I don’t see Roku getting acquired any time soon, but believe the stock remains undervalued nonetheless!

Change-of-control language is driving acquisition rumors

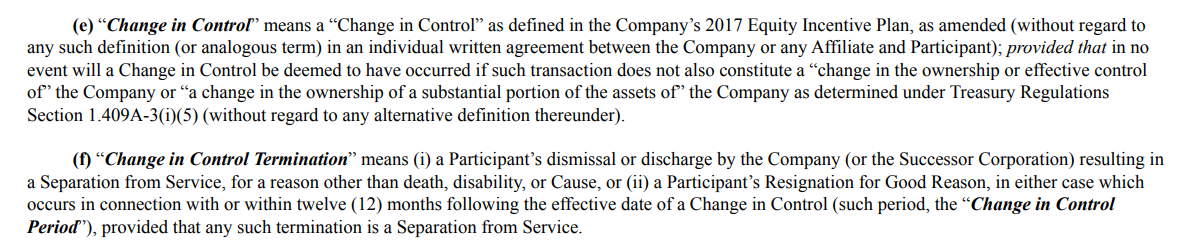

Roku made an 8-K filing with the SEC on September 14, 2022 regarding severance benefits of executives related to a “change-in-control” event, prompting speculation that the disclosure was made because Roku may be in some sort of acquisition negotiations. The filing explained how a potential acquisition would affect pay and benefits eligibility of Roku’s senior executives. The change-in-control section of the 8-K filing also specifically mentioned a “Successor Corporation” which is likely why the filing caused a lot more excitement than it deserves.

Roku: 8-K Disclosure, Change-Of-Control Termination

Roku’s 8-K disclosure resulted in shares of Roku revaluing 8% higher on Thursday. Roku is no stranger to acquisition rumors, however, and a similar situation unfolded over the summer months: Roku’s share prices soared 10% in June on speculation that Netflix was apparently interested in swallowing up Roku’s streaming device business. These kinds of rumors occasionally appear in the market, but they rarely are true.

Should you react to Roku’s latest acquisition rumors?

No, you shouldn’t. As I said, acquisition rumors are more often than not completely unfounded and Roku’s 8-K filing is a customary filing into which the market is reading way too much, in my opinion.

Roku’s value as a streaming platform

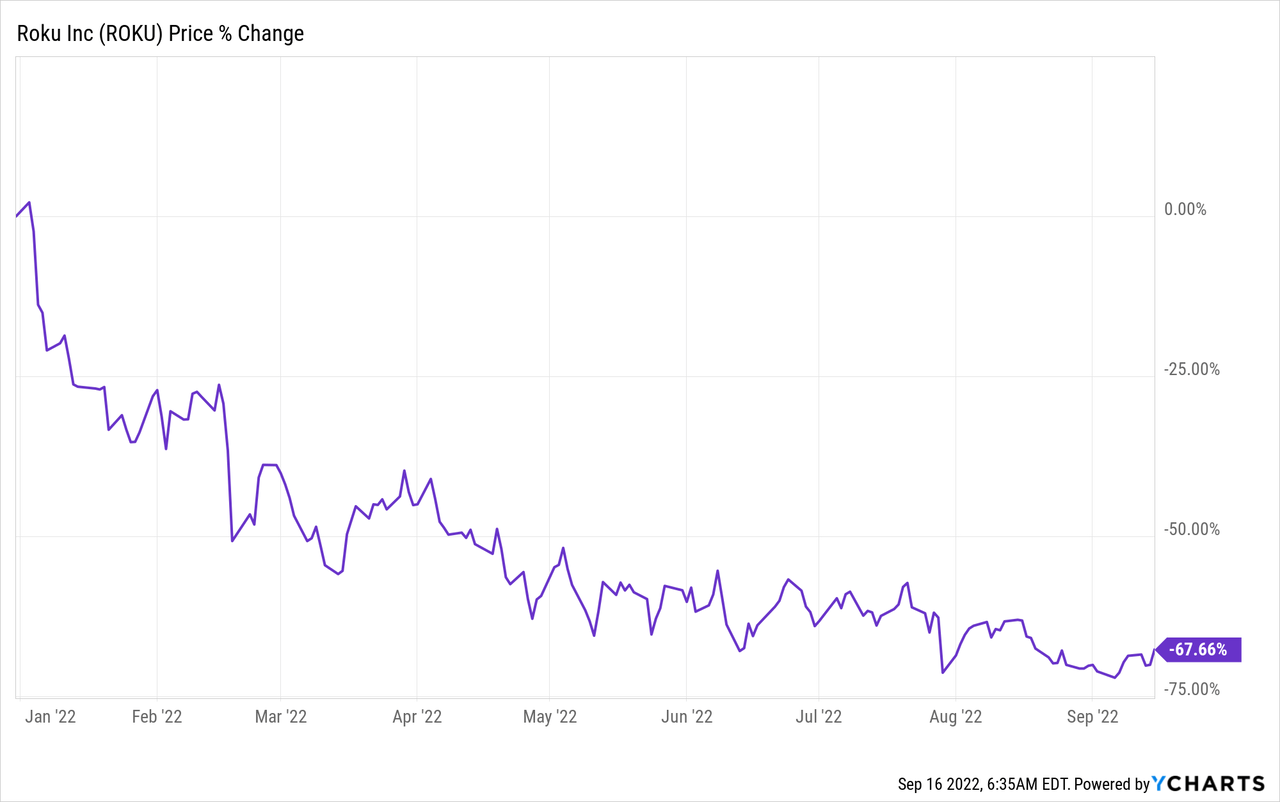

As I indicated in my work “Roku: The Valuation Is Just Silly“, I believe Roku’s potential in the streaming device market is very attractively priced after the firm’s market cap decreased 68% just in 2022…

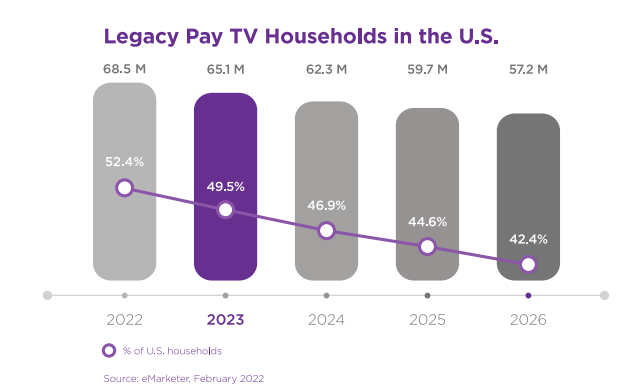

While it is true that Roku has seen a slowdown in its post-pandemic growth, the streaming device pioneer will continue to grow its revenues and its active accounts rapidly. One reason for that is that subscriptions for pay-TV continue to decrease while the share of TV streaming is increasing… which is a trend that profoundly supports Roku’s growth runway. Less than half of US households are expected to have legacy pay-TV subscriptions in 2023 and beyond.

Roku: Pay-TV Share US Households

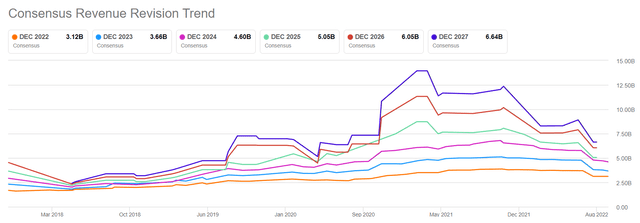

Nonetheless, growth is slowing at Roku and estimates have been falling, both for EPS and revenue. In the last 90 days, there were 25 downward revisions for Roku’s forward annual revenue estimates (zero upward revisions) and more downgrades may follow if the streaming company continues to see slowing active account growth and weakening customer monetization.

Seeking Alpha: Roku Annual Revenue Estimates

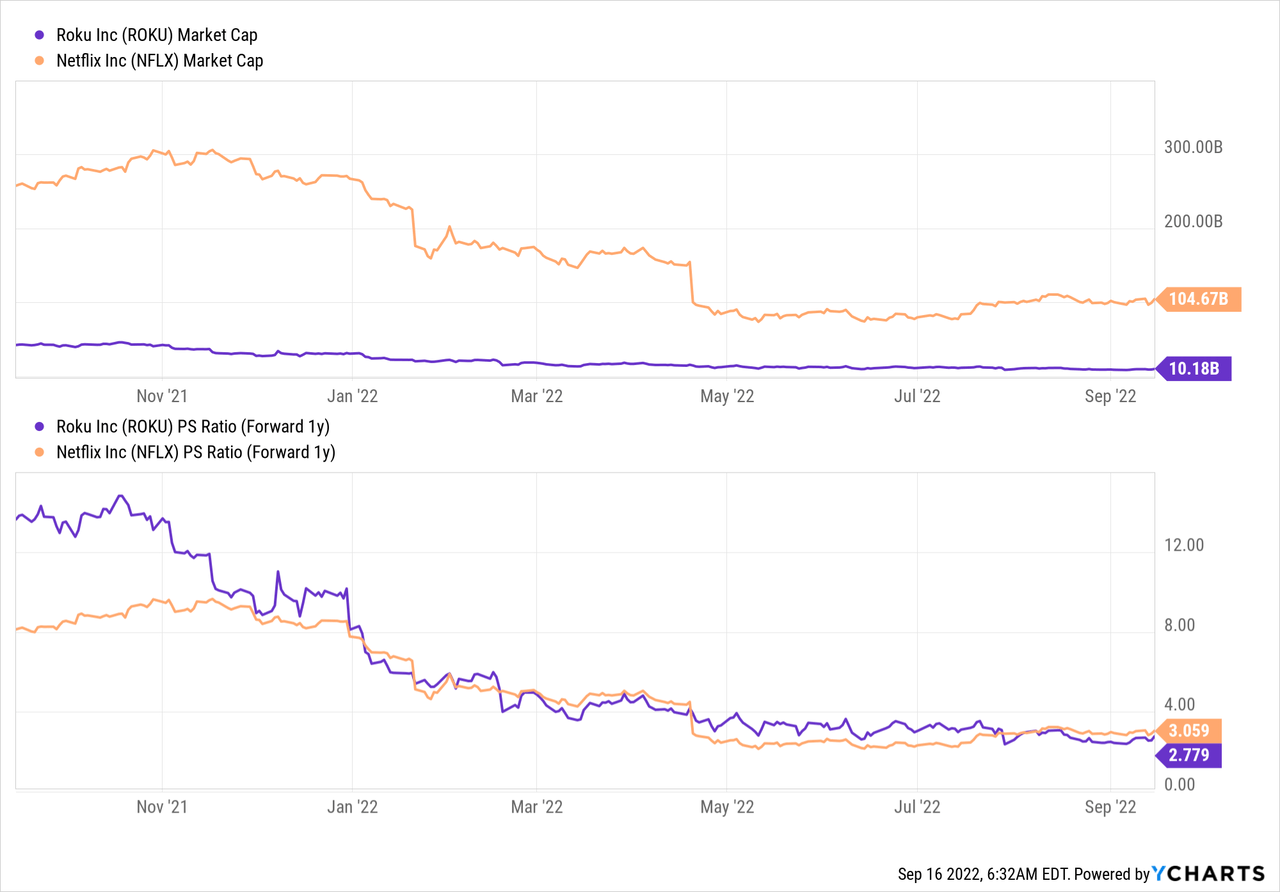

Roku is not expected to be profitable on an adjusted EPS basis until FY 2026. However, Roku is expected to see revenue growth rates of 13% this year and 17% next year, so the company is still going grow at quite a rapid pace despite post-pandemic challenges. Netflix, on the other hand, is expected to see top line growth rates of 7% and 8% this year and next year, so while Roku may not be profitable yet, the company does have more attractive growth prospects in the streaming industry than its rival. Because of the drop in pricing this year, Roku now has a lower P-S ratio (2.8 X) than Netflix (3.1 X).

Risks with Roku

The biggest commercial risk for Roku is not the rumor mill, but a deterioration of platform metrics. Roku’s key platform metrics like average revenue per user and active account growth have deteriorated in recent quarters, a reflection of changing consumer behavior post-pandemic. Although Roku kept adding a decent number of new active accounts to its platform in FY 2022 (+3 million, year to date), a slowdown in growth and weaker monetization would likely affect Roku and its stock negatively. What would change my mind about Roku is if the company’s prospects to achieve profitability were to deteriorate and top line growth were to see a more severe slowdown.

Final thoughts

Rumors about a potential acquisition, due to Roku’s 8-K disclosure, are nothing but a distraction and shouldn’t be taken seriously. Roku shouldn’t be bought merely because the streaming pioneer may receive an acquisition offer in the near future. Rather, I believe, Roku should be bought for its potential in the streaming business and its ability to develop its platform in the long term which is fundamentally supported by ongoing cord-cutting trends. While the 8% increase in pricing was nice to see yesterday, chances are the rumors are unfounded and no acquisition will happen, in my opinion!

Be the first to comment