Wachiwit

Since we first wrote advising investors to sell Netflix (NASDAQ:NFLX) shares in February, the stock has been down about 41%. Netflix continues to suffer from multiple problems, including elevated churn, slowing subscriber growth, and increasing competition. Netflix also has to spend heavily to create content both for domestic and international audiences. Content is expensive and larger players such as Amazon (AMZN), Apple (AAPL), and Disney (DIS) have the advantage due to large cash piles to lock up the best content creators. We believe Netflix’s best days are likely behind, and there is more downside to the stock at these levels.

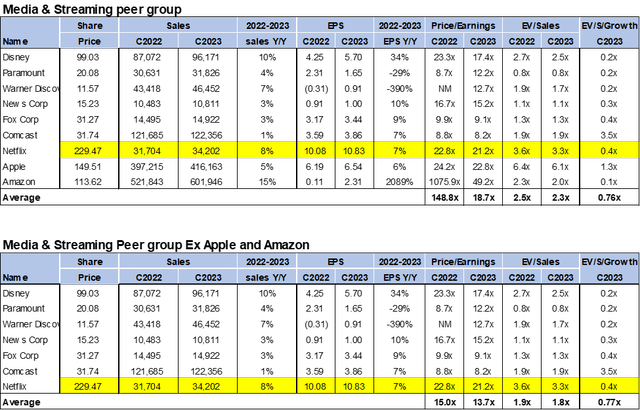

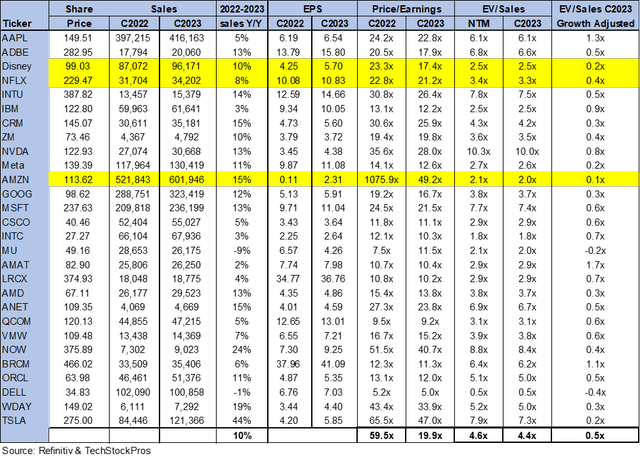

Netflix stock is expensive and is trading around 21.3x C2023 EPS compared to peer media and the streaming group that is trading at 13.7x. If we include both Amazon and Apple in the peer group, the peer group average is 18.7x, still well below Netflix’s multiple. Viewing Netflix as a media company, we believe the stock is expensive. Hence, we advise investors to sell shares at the current valuation.

Lots of competitors and too many problems to deal with

Netflix faces principal threats from Disney+ (DIS) and Hulu, Amazon Prime Video (AMZN), Apple TV (AAPL), and Paramount (PARA). Netflix’s traditional competitors have large cash hoards and are known for their large catalogs and expertise in attracting the best content makers. Newer players like Apple and Amazon have deep pockets and can use cash to buy the best content. We are worried about Netflix keeping up with the competition because it is the only company that does not have a more significant alternate business with revenue streams to provide a cushion. We expect Amazon, Apple, and Disney to eventually lock up talent or bid up prices for the best content on the planet, making Netflix’s position challenging. While the company is set to launch a service supported by an advertising tier, we still believe the problems don’t go away with respect to competition, content creation, and valuation.

We are not too optimistic that the company can keep up with the competition or stanch subscriber churn, even with an ad-supported tier. In 2Q22, the company lost nearly 1M subscribers, and we expect subscription growth to slow down going forward. While Netflix became a household name during the pandemic, we believe the company is giving back its pandemic gains and recommend investors exit the stock before it dips further.

The best days may be in the rearview mirror.

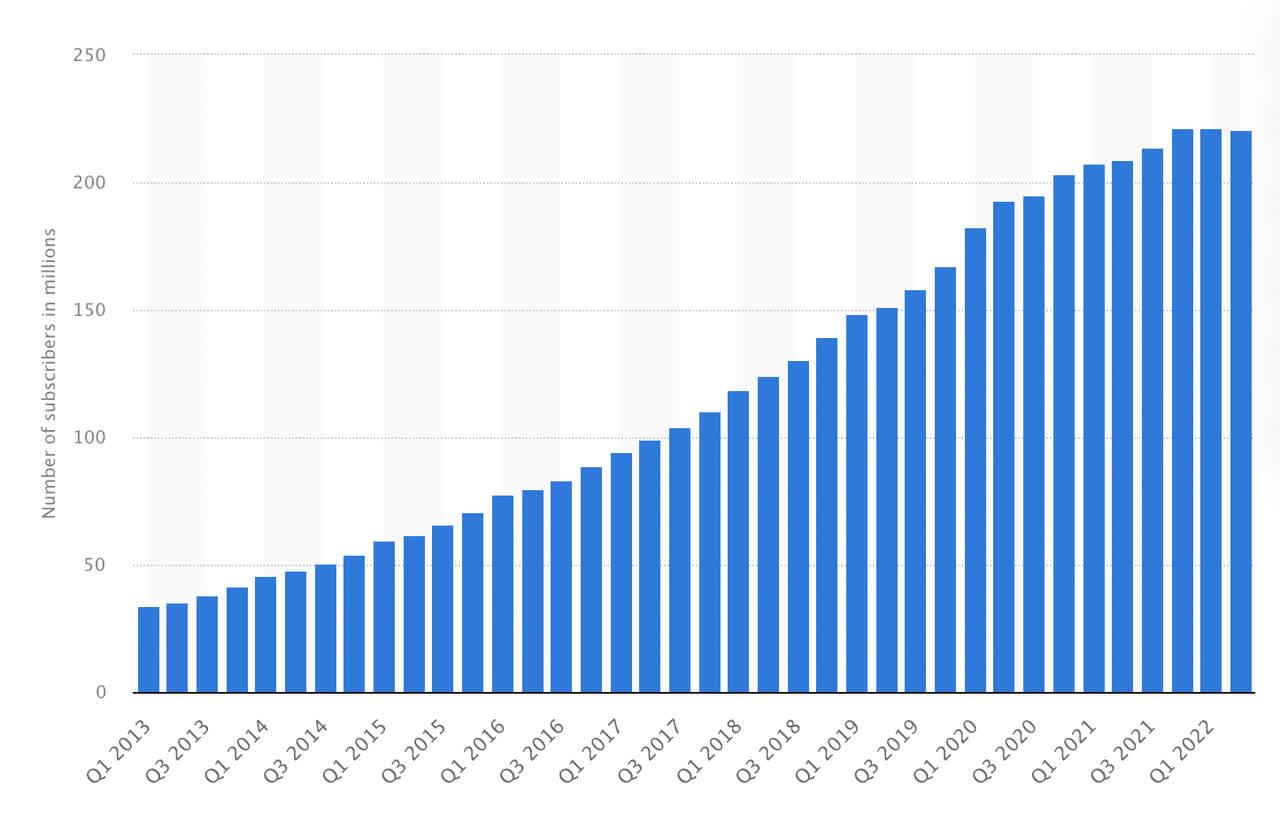

Netflix is, first and foremost, a subscription streaming service dependent on user subscription. Netflix’s 2021 10K report specifies that the company “operate(s) as one operating segment… revenues are primarily derived from monthly membership fees.” Netflix’s most recent quarter marked the third time the company lost subscribers in the previous five quarters, and we don’t expect it’ll be the last. Netflix CEO Reed Hastings announced in the 2Q222 earnings call that he was excited the company lost 1M users instead of the predicted 2M. However, we believe this is a less bad result instead of a good one. We expect Netflix’s subscription growth to slow compared to the pandemic period. Netflix grew from 192.9M subscribers in 2020 to 219.7M in 2021. In comparison, Netflix only grew to 220.7M in 2Q22. We do not expect the company to see the same subscription growth enjoyed in the pandemic. The following graph outlines the number of Netflix paid subscribers worldwide from 2013 until 2Q22.

Statista

For its 3Q22 guide, Netflix forecasted it would add just 1M subscribers, which is lower than analysts’ estimates at 1.8M. This may be overly cautious, and the company is setting itself for a beat again. We believe that Netflix’s subscription slowdown results from multiple issues; pandemic-driven viewer fatigue, expensiveness of getting new subscribers, rising costs for producing content, inflationary pressures, and strong competition.

Not immune to churn

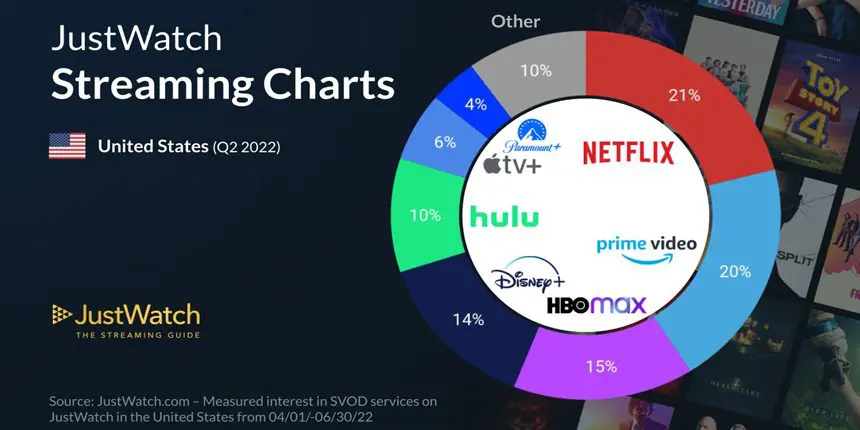

While almost everyone has access to a Netflix account, whether their own or a friend’s, we believe more and more people are switching to alternative streaming services. Subscribers subscribe to a service to watch a show and then promptly disconnect it after they finish watching the show. The barriers to switching between various services have been low and will likely remain low for the forseeable future. Disney has edged ahead of Netflix with 221.1M subscribers compared to Netflix’s 220.7M. Subscribers. HBO, Discovery+, Hulu, Apple TV, Prime Video, Peacock and Disney+ all offer quality programming that subscribers can choose from. We expect subscriber growth to slow down as competition penetrates the market. Netflix still maintains the highest market share in the US streaming market, but we believe the company is feeling the effects of the increasingly competitive market.

The following graph outlines the US streaming market share in 2Q22.

JustWatch

Good content is not enough

Netflix has a great variety of produced content, but we don’t believe this will be enough to retain subscribers. Since there are low barriers to switching, subscribers move around various subscription services. Many subscribers binge-watch shows and promptly disconnect their service. Netflix’s 2Q22 report was slightly better than expected, and we attribute this to subscriber loyalty to specific series- i.e., The Witcher, Arcane, and Stranger Things- and not to Netflix. Other streaming companies are also in the business of creating quality content and are actively allocating budgets towards acquiring the same talent. We don’t believe quality content is Netflix’s holy grail. We expect the churn continues to be elevated, and Netflix will need to find alternate sources of revenue to smooth revenue volatility. Except for Amazon Prime and Disney, we believe other services face the same challenges with churn. Amazon uses its delivery service to anchor subscribers, while parents are generally reluctant to cut Disney+ in households with children.

Ads plan, cutting costs, and more red flags

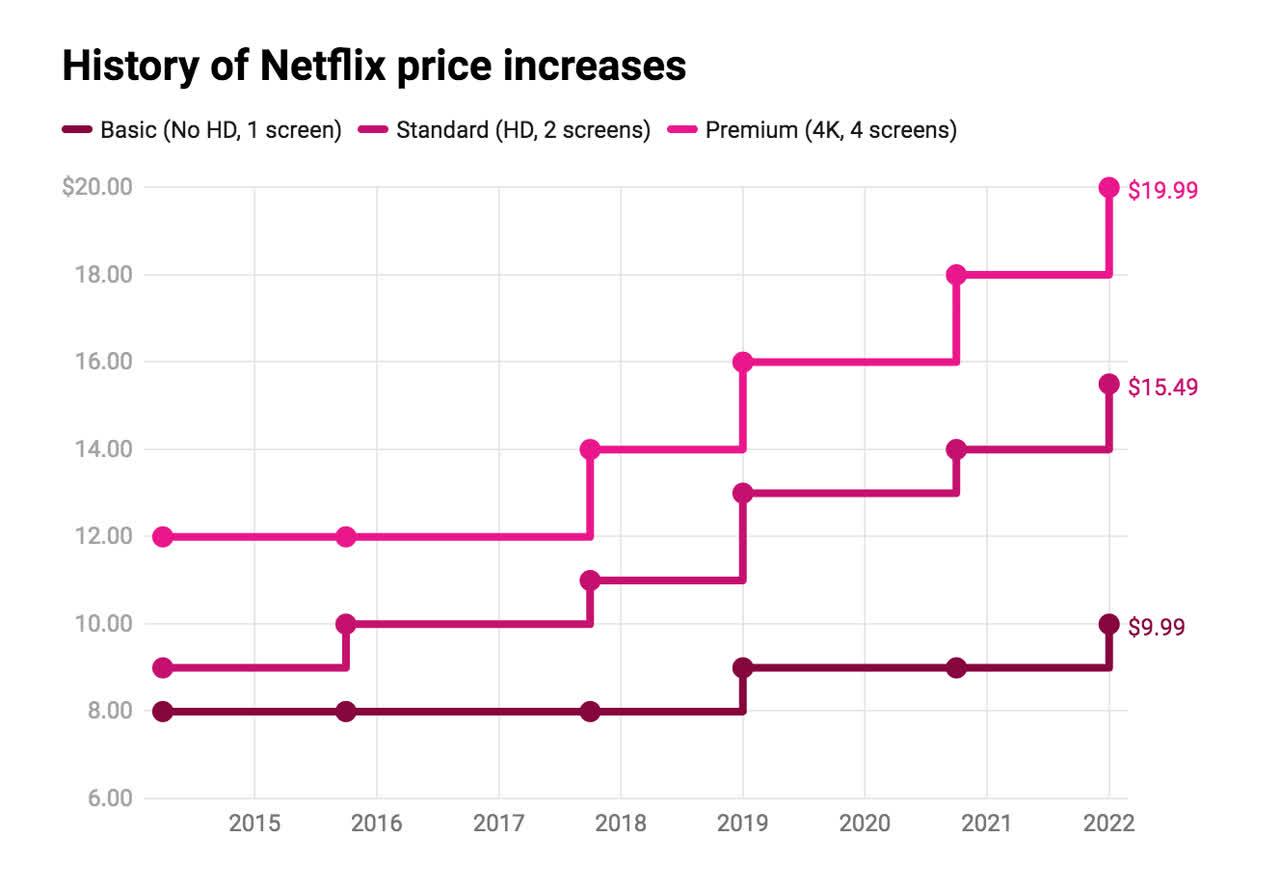

Netflix is still looking to cut some costs and simultaneously trying to boost revenue. More than 400 employees were laid off recently to cut costs. Netflix plans to offer a tier of service with advertisements laid in. Under the plan, Netflix’s subscribers would have a more affordable subscription of $7-9 but would have to watch advertisements. Netflix also hiked the subscription price earlier this year. Netflix now charges subscribers up to $19.99 monthly, a significant change for streaming services. The following graph outlines Netflix’s price history:

The Verge

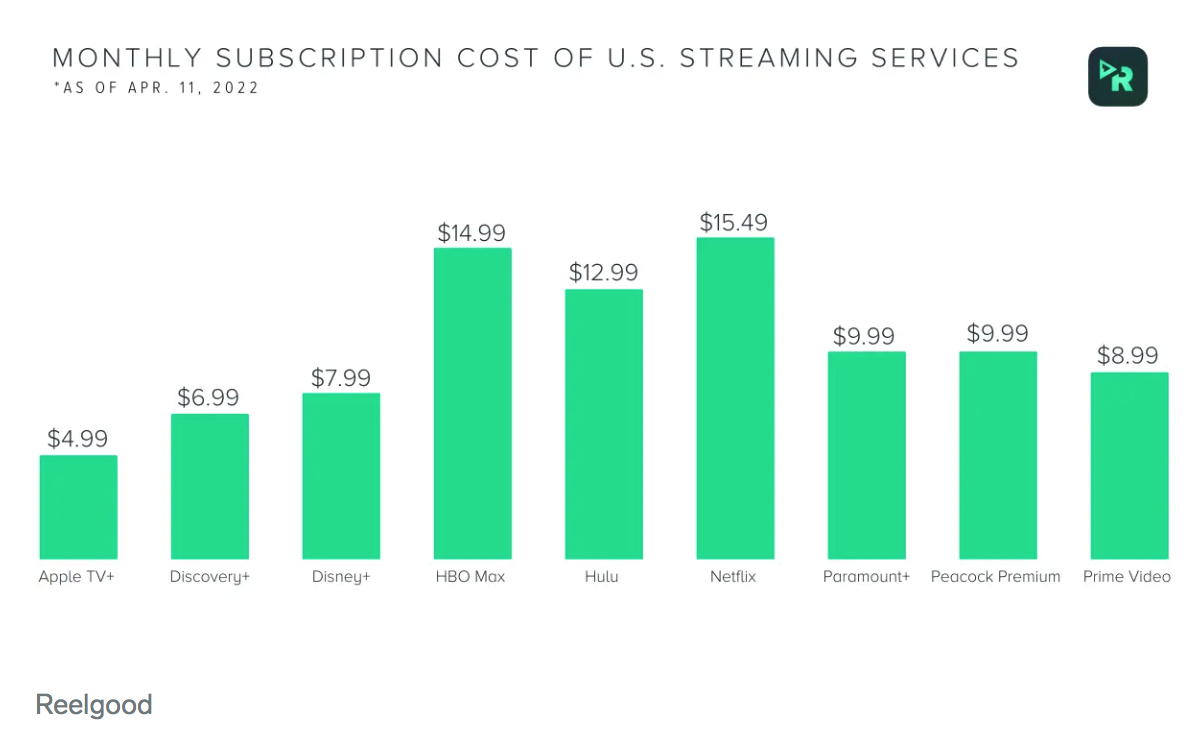

Competition is also offering arguably better pricing options. For a package of all three, Hulu, Disney+, and ESPN+, the customer can pay $13.99/month, which is a great deal compared to Netflix.

The following graph shows the monthly subscription fees of the top streaming services in the US.

Reelgood

Stock performance:

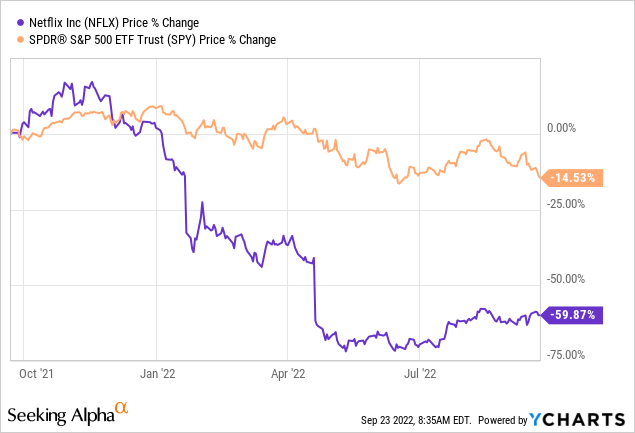

Netflix stock declined about 60% over the last 12 months, while the S&P 500 dropped around 15% in comparison. Over the last five years, Netflix appreciated about 27%. Netflix soared during the pandemic, appreciating 167% between 2020 and 2021. We believe Netflix is now giving back its pandemic gains. Even after the pull back in shares, we believe Netflix is trading above peer group averages. The following charts show Netflix’s stock performance over the past one and five years.

Ycharts Ycharts

Valuation:

We believe Netflix’s stock is overpriced given intensifying competition. On a P/E basis, Netflix is currently trading at 21.2x C2023 EPS of $10.83 compared to the peer group trading at 18.7x. On an EV/Sales, Netflix is trading 3.3x C2023 sales versus the peer group average of 2.3x. We recommend investors sell the stock at current prices as we expect more downside ahead.

The following chart illustrates Netflix’s valuation relative to its peer group.

Techstockpros & Refinitiv Refinitiv & Techstockpros

Word on Wall Street:

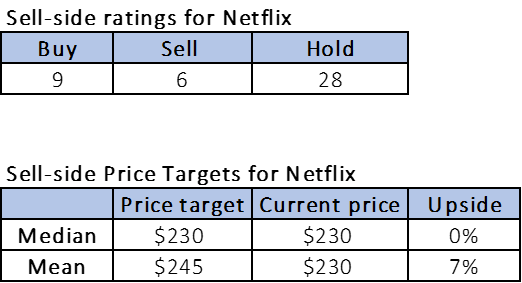

Of the 43 analysts, 28 are hold-rated, nine are buy-rated, and six are sell-rated. Netflix is currently trading at $230. The median price target is $230, and the mean price target is $245, with a potential upside upto 6%. The following chart indicates NFLX’s sell-side ratings and price targets.

Refinitiv & Techstockpros

Risks to our sell thesis

Risks to our sell rating include faster-than-expected growth of subscribers, leading to better-than-expected revenue and earnings. In addition, Netflix can produce content for subscribers to watch on an ongoing basis, leading to lower churn. The market can ascribe a higher multiple, leading the stock to grow from these levels.

What to do with the stock

We are sell-rated on Netflix and believe the company’s best days are behind it. We expect subscription growth to continue to slow down. We also believe the company is stretching itself thinly from a financial standpoint, investing in ad plans, the video gaming industry, and more. The streaming industry has changed, and Netflix is not the only game in town. We recommend investors sell the stock at current levels.

Be the first to comment