MF3d

Welcome to the September 2022 cobalt miners news.

The past month saw some improvement in the cobalt price and a quiet month for news. The August 2022 passing of the U.S. Inflation Reduction Act was a positive for North American cobalt projects as well as for projects in U.S. free trade countries (details here). In September the European Commission revealed they are working on their own version – The Critical Raw Materials Act.

Cobalt price news

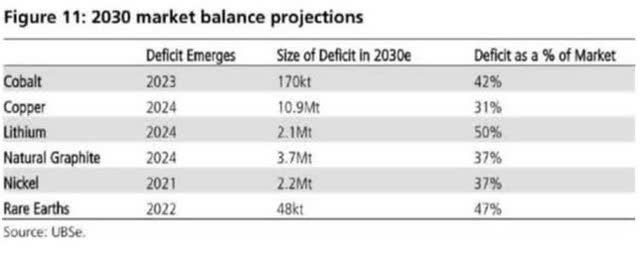

As of September 23, the cobalt spot price rose slightly to US$23.25/lb, from US$22.11/lb last month. The LME cobalt price is US$51,020/tonne. LME Cobalt inventory is 178 tonnes, lower than 190 last month. More details on cobalt pricing (in particular the more relevant cobalt sulphate), can be found here at Benchmark Mineral Intelligence or Fast Markets MB.

Cobalt spot prices – 5-year chart – USD 23.25

Source: Mining.com

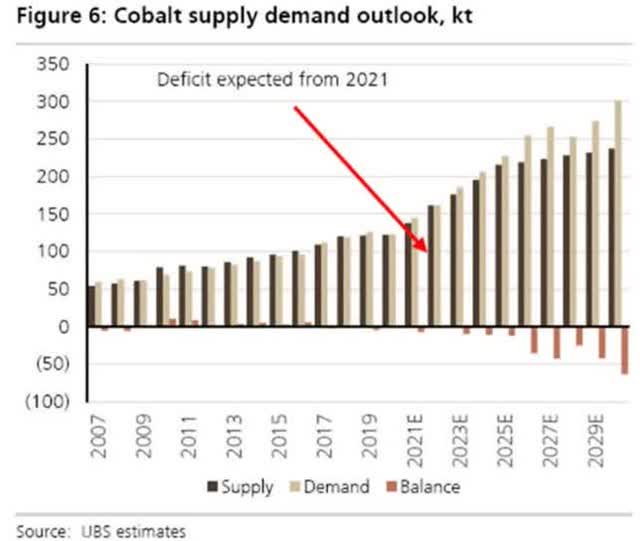

Cobalt demand v supply forecasts

UBS cobalt supply and demand forecast – Growing deficits from 2023

Source: Fortune Minerals company presentation

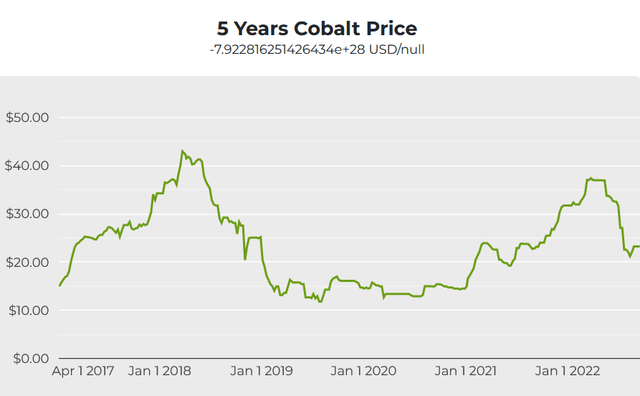

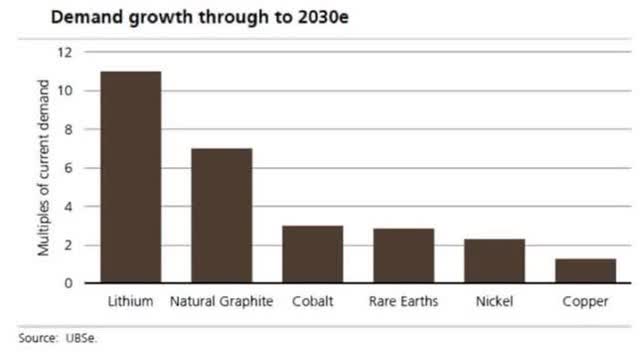

UBS’s EV metals demand forecast (from Nov. 2020)

UBS forecasts Year battery metals go into deficit

UBS Source: UBS courtesy Carlos Vincens LinkedIn

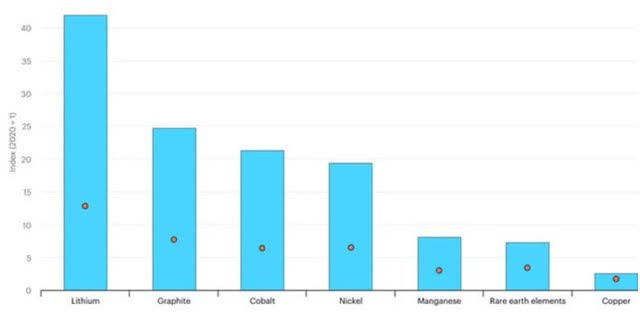

2021 IEA forecast growth in demand for selected minerals from clean energy technologies by scenario, 2040 relative to 2020 – Increases Of Lithium 13x to 42x, Graphite 8x to 25x, Cobalt 6x to 21x, Nickel 7x to 19x, Manganese 3x to 8x, Rare Earths 3x to 7x, And Copper 2x to 3x

Source: International Energy Agency 2021 report

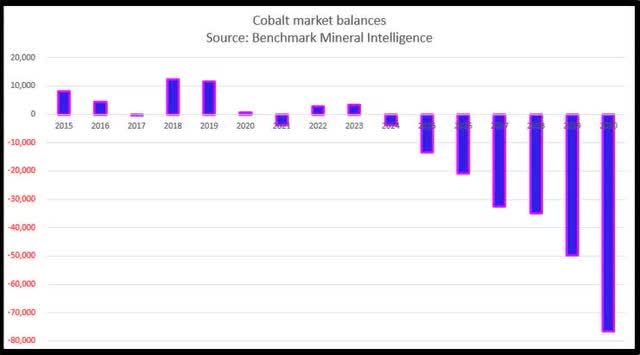

BMI 2022 forecast for cobalt – Deficits building starting from 2024

Source: Reuters and courtesy Benchmark Mineral Intelligence

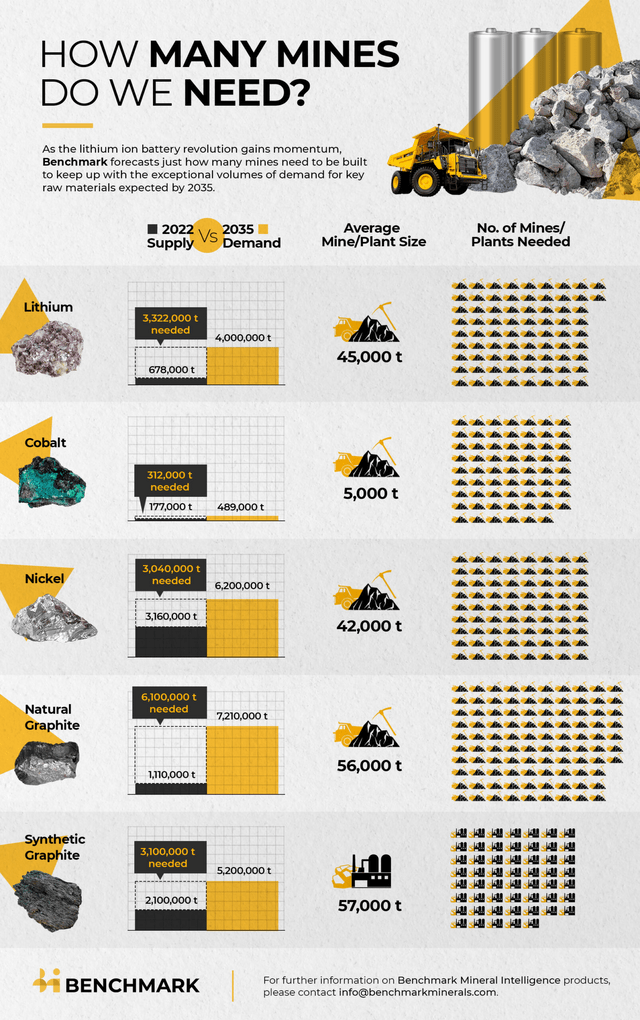

We need 330+ new EV metal mines from 2022 to 2035 to meet surging demand – 62 new 5,000tpa cobalt mines (drops to 38 if include recycling)

Source: Benchmark Mineral Intelligence

Cobalt market news

On August 23 Reuters reported:

VW aims to take stakes in Canadian mines, mine operators – Handelsblatt… “We are not opening any mines of our own, but we want to acquire stakes in Canadian mines and mine operators,” Thomas Schmall told the daily on Tuesday.

On September 1, Kallanish reported: “Ford urges Biden administration to expedite battery metals mining in US.”

On September 1 Seeking Alpha reported:

Tesla appears to be ramping up interest in manufacturing in Canada. Tesla is continuing to look at potential advanced manufacturing sites in Canada, according to filings related to lobbying activities.

On September 6 Benchmark Mineral Intelligence reported:

…More than 300 new mines could need to be built over the next decade to meet the demand for electric vehicle and energy storage batteries, according to a Benchmark forecast. At least 384 new mines for graphite, lithium, nickel and cobalt are required to meet demand by 2035, based on average mine sizes in each industry, according to Benchmark. Taking into account recycling of raw materials, the number is around 336 mines… Recycling, however, is set to have the biggest impact on cobalt mining. Without recycling, the world would need to build 62 new cobalt mining projects of 5,000 tonnes each by the end of 2035. With forecast recycled volumes, however, that number falls by almost half to 38.

Note: Bold emphasis by the author. See large BMI chart just above market news heading.

On September 14 Investing News reported:

Cobalt Stocks: 5 Biggest Producers (Updated 2022)… Glencore is the world’s largest cobalt-producing mining company by a long shot, achieving estimated total production of 25,320 metric tons [MT]in 2021… Eurasian Resources Group, which is a privately held diversified international miner, produced an estimated total of 20,700 MT of cobalt in 2021… Partially owned by the Chinese government, China Molybdenum produced an estimated 14,800 MT of cobalt in 2021… Gecamines, a state-controlled cobalt-mining company in the DRC, produced an estimated 13,860 MT of cobalt in 2021… China-based Zhejiang Huayou Cobalt produced an estimated 5,390 MT of cobalt in 2021.

Cobalt company news

Glencore [HK:805] [LSE:GLEN] (OTCPK:GLCNF)

No cobalt related news for the month.

China Molybdenum [HKSE:3993] [SHE:603993] (OTC:CMCLF)/CMOC Group Limited (English name change)

On September 2, CMOC announced:

2022 interim report… The Company recorded an operating revenue of approximately RMB91.77 billion, representing a year-on-year increase of 8%. EBITDA amounted to approximately RMB11.28 billion, representing a year-on-year increase of 59%. Operating cash inflow amounted to approximately RMB8.50 billion, representing a year-on-year increase of 545%. Net profit attributable to the parent company amounted to approximately RMB4.15 billion, representing a year-on-year increase of 72%, of which IXM’s net profit attributable to the parent company contributed USD98 million.

Zheijiang Huayou Cobalt [SHA:603799]

On September 13 Reuters reported:

Nickel miner Vale Indonesia signs HPAL deal with China’s Huayou… Under the heads of agreement, Vale and Huayou plan to build an $1.8 billion HPAL plant in Sorowako, South Sulawesi, to produce 60,000 tonnes of nickel in mixed hydroxide precipitate (MHP), chief executive Febriany Eddy told reporters.

Jinchuan Group International Resources [HK:2362]

No significant news for the month.

Chemaf (subsidiary of Shalina Resources)

No news for the month.

GEM Co Ltd [SHE: 002340]

No news for the month.

Investors can read more about GEM Co in the Trend Investing article: “A Look At GEM Co Ltd – The World’s Largest Battery Recycling Company” when GEM Co was trading at CNY 5.08.

Eurasian Resources Group (“ERG”) – private

ERG own the Metalkol facility in the DRC where ERG processes cobalt and copper tailings with a capacity of up to 24,000 tonnes of cobalt pa.

No cobalt related news.

Umicore SA [Brussels:UMI] (OTCPK:UMICY)

On September 15, Umicore SA announced:

Umicore secures long-term renewable energy supply for its European battery materials precursor and refining hub through PPAs with Statkraft and Gasum…

On September 21, Umicore SA announced:

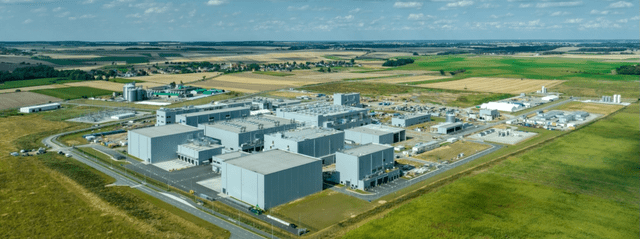

Umicore inaugurates Europe’s first battery materials gigafactory. Umicore today inaugurates its carbon neutral production facility for cathode active materials for electric vehicles in Nysa, Poland. This makes Umicore the first company in Europe with a complete circular and sustainable battery materials value chain. The gigafactory will supply battery materials to Umicore’s car and battery cell customers in Europe and marks an important step in achieving the European Union’s ambition of having its own battery ecosystem that is both sustainable and competitive on a global scale.

Umicore opens Europe’s very first gigafactory for cathode active materials (in Nysa, Poland)

Source: Umicore news

Sumitomo Metal Mining Co. (TYO:5713) (OTCPK:SMMYY)

No significant news for the month.

MMC Norilsk Nickel [LSX:MNOD] [GR:NNIC] (OTCPK:NILSY) (ADRs to remain in circulation until April 28, 2023)

On August 23, MMC Norilsk Nickel announced: “Nornickel to add new innovative nickel and cobalt alloys to its range…”

On September 16, MMC Norilsk Nickel announced: “Nornickel provides further update on noteholders’ consent solicitation.”

OZ Minerals [ASX:OZL] (OTCPK:OZMLF)

On August 26, OZ Minerals announced: “OZ Minerals 2022 half year financial results.” Highlights include:

- “Net Profit After Tax (NPAT) of $109 million despite a challenging first half due to one-off weather and equipment interruptions, together with COVID productivity impacts. Operating momentum regained and performance now improving. On track to meet group annual production and cost guidance.

- Net revenue of $909 million.

- EBITDA of $358 million at a healthy operating margin of 40% despite softer start and industry-wide inflationary pressure.

- Operating cash flows of $375 million; net cash position of $82 million.

- Increased working capital liquidity from $480 to $700 million.

- Growth strategy advancing, focused on long-life, low-cost assets in quality jurisdictions: Carrapateena: Block Cave expansion development underway. Prominent Hill: Wira Shaft mine expansion advancing well; work approved to further evaluate additional near-surface mineral resources. West Musgrave: On track for final investment decision H2 2022 with $60 million funding approved to end 2022 to maintain schedule; progressing Life of Province study. Carajás East: Hub strategy progressing; Pedra Branca ramped up ahead of schedule; accelerated Santa Lucia study under way.

- 8 cents per share fully franked interim dividend maintained.

- $86 million cash benefit in second half from government TFE1 eligibility.”

On August 26, OZ Minerals announced:

OZ Minerals set to ride electrification growth wave… Global demand for copper and nickel set to reach unprecedented highs during this decade and beyond. OZ Minerals uniquely positioned for the oncoming electrification and decarbonisation era… OZ Minerals today outlined a clear pathway to doubling production, amid growing demand for modern minerals driven by global electrification.

On August 31, OZ Minerals announced: “Havilah shareholders approve Kalkaroo Option.”

Sherritt International [TSX:S] (OTCPK:SHERF)

No news for the month.

Nickel 28 [TSXV:NKL] [GR:3JC] (OTCPK:CONXF)

No news for the month.

Investors can view the company presentations here.

Possible mid-term producers (after 2022)

Jervois Global Limited [ASX:JRV] [TSXV: JRV] (OTCQX:JRVMF) [FRA: IHS] (formerly Jervois Mining)

No news for the month.

Upcoming catalysts include:

- Sept. 2022 – Idaho Cobalt Operations commissioning, with full production in February 2023.

- 2023 – First production targeted from the São Miguel Paulista Refinery.

Electra Battery Materials [TSXV:ELBM] (ELBM)

On September 8, Electra Battery Materials announced:

Electra’s study on integrated EV Battery Materials Facility in Ontario demonstrates compelling economics – Provides path to growing nickel refining capacity in North America… that would include nickel, cobalt and manganese refining, recycling of battery black mass material, and precursor cathode active material (pCAM) manufacturing. The scoping study assessed the economics and carbon footprint of various nickel feed options to develop an integrated facility producing 10,000 tonnes per annum of battery grade nickel sulfate and nickel equivalent pCAM…

On September 22, Electra Battery Materials announced:

Electra and LG Energy Solution sign three-year cobalt supply agreement – Marks Electra’s first commercial agreement in EV supply chain… Electra has agreed to supply LGES with 7,000 tonnes of battery grade cobalt from 2023 to 2025. The material will be supplied from the only cobalt sulfate refinery in North America, located north of Toronto, Ontario. Electra will supply 1,000 tonnes of cobalt contained in a cobalt sulfate product in 2023 and a further 3,000 tonnes in each of 2024 and 2025 under an agreed pricing mechanism.

Upcoming catalysts include:

Early 2023 – Target to have their Ontario cobalt refinery operational with ore feed from Glencore.

Investors can view the company presentations here and a good Crux Investor CEO interview here.

Sunrise Energy Metals Limited [ASX:SRL](OTCQX:SREMF)(formerly Clean TeQ)

Sunrise Energy Metals has 132kt contained cobalt at their Sunrise project.

No news for the month.

Upcoming catalysts include:

2022 – Possible off-take agreements and project funding/partnering.

Investors can also read the latest company presentation here.

Fortune Minerals [TSX:FT] (OTCQB:FTMDF)

No news for the month.

Upcoming catalysts include:

- 2022 – Possible off-take or equity/strategic partners, project financing.

Investors can read the latest company presentation here, or a company pitch video here.

Australian Mines [ASX:AUZ] (OTCQB:AMSLF)

On September 5, Australian Minerals announced:

Appointment of Chief Executive Officer. Australian Mines Limited (“Australian Mines” or “the Company”) is pleased to announce the appointment of Michael Holmes as Chief Executive Officer (CEO) of the Company, effective immediately. Mr Holmes was former President and Chief Executive Officer of Toronto Stock Exchange listed OceanaGold Corporation, a mining company with a current market capitalisation of over $1.3 billion Canadian Dollars…

Investors can read the latest company presentation here.

Upcoming catalysts include:

- 2022 – PFS on alternative nickel-cobalt laterite ore processing.

Ardea Resources [ASX:ARL] (OTCPK:ARRRF)

In total, Ardea has 5.9mt of contained nickel and 380kt of contained cobalt at their KNP Project near Kalgoorlie in Western Australia. Ardea is also exploring for gold and nickel sulphide on their >5,100 km2 of 100% controlled tenements in the Eastern Goldfields region of Western Australia.

No cobalt related news for the month.

Upcoming catalysts include:

- 2022 – Possible off-take partner and funding for the GNCP Project. Further exploration results.

Investors can read the latest company presentation here.

Cobalt Blue Holdings [ASX:COB] (OTCPK:CBBHF)

In total Cobalt Blue currently has 81.1kt of contained cobalt at their 100% owned Broken Hill Cobalt Project [BHCP] (formerly Thackaringa Cobalt Project) in NSW, Australia. LG International is an equity strategic partner.

On September 1, Cobalt Blue Holdings announced: “Demonstration plant – Ore extraction completed.” Highlights include:

- “Bulk sample extraction completed delivering some 4,000–4,500 tonnes of ore for processing via the Demonstration Plant.

- Drilling commences for installation of groundwater monitoring bores – geotechnical drilling to follow.“

On September 20, Cobalt Blue Holdings announced: “Annual report 2022.” Highlights include:

Broken Hill Cobalt Project

- “Construction and commissioning of Demonstration Plant.

- Dispatch of Sample Partner Program samples.

- Major Project Status recognition.

- $15m Commonwealth Critical Minerals Accelerator Initiative grant

- Selection of DFS Engineering team.”

COB Partnerships

- “Commencing of Cobalt in Waste Streams Project testwork.”

Corporate

- “$16m of new capital raised.

- Promotion of COB to senior South Korean and US government representatives.

- COB website overhaul.”

Upcoming catalysts include:

- 2022 – Possible off-take agreements. Feasibility Study & project approvals. Final Investment decision. Project Funding.

Investors can watch a CEO interview here and a recent presentation here.

Havilah Resources [ASX:HAV] [GR:FWL] (OTCPK:HAVRF)

Havilah 100% own the Mutooroo copper-cobalt project about 60km west of Broken Hill in South Australia. They also have the nearby Kalkaroo copper-gold-cobalt project (optioned to Oz Minerals), as well as a potentially large iron ore project at Grants. Havilah’s 100% owned Kalkaroo copper-gold-cobalt deposit contains JORC Mineral Resources of 1.1 million tonnes of copper, 3.1 million ounces of gold and 23,200 tonnes of cobalt.

On August 30, Havilah Resources announced: “Quarterly activities and cash flow report – Period ended 31 July 2022.” Highlights include:

- “…Planning activities in preparation for Strategic Alliance exploration drilling near Kalkaroo commenced.

- Resource expansion drilling program at the Mutooroo copper-cobalt deposit continued to intersect massive sulphide lode rocks largely where expected. Laboratory assay results are awaited.

- Havilah has obtained Accelerated Discovery Initiative (ADI) funding for an exploration project (‘Exploration Drilling – Benagerie Dyke’) amounting to $175,000.

- 6,792,453 new fully paid ordinary shares were issued at $0.265 per share via a share placement that raised $1,800,000 from a sophisticated investor.“

On August 31, Havilah Resources announced: “Havilah shareholders approve Kalkaroo Option.” Highlights include:

- “Havilah Resources shareholders approve the grant of the option for OZ Minerals to acquire the Kalkaroo project.

- Kalkaroo is at pre-feasibility study stage and is potentially one of Australia’s largest undeveloped open pit copper-gold deposits.

- Havilah PFS demonstrated potential 30ktpa copper and 72koz gold over initial 15-year mine life.

- OZ Minerals to commence optimisation study prior to considering whether to exercise the Kalkaroo option.

- Potential for a scalable, low-cost, long-life asset in South Australia with province potential.”

Upcoming catalysts include:

- 2023 – Progress towards the OZ Minerals option to buy Kalkaroo.

Investors can learn more by reading the Trend Investing article “Havilah Resources Has Huge Potential and/or the update article. You can also view a CEO interview here, and the company presentation here.

Aeon Metals [ASX:AML](OTC:AEOMF)

Aeon Metals 100% own their Walford Creek copper-cobalt project in Queensland Australia.

No news for the month.

Investors can view the latest company presentation here.

Upcoming catalysts include:

- Q1 2022 – Walford Creek revised PFS due.

GME Resources [ASX:GME][GR:GM9] (OTC:GMRSF)

GME Resources own the NiWest Nickel-Cobalt Project located adjacent to Glencore’s Murrin Murrin Nickel operations in the North Eastern Goldfields of Western Australia. The NiWest Project which has an estimated 830,000 tonnes of nickel metal and 52,000 tonnes of cobalt.

On September 20, GME Resources announced: “Financial report for the year ended 30th June 2022.”

Investors can read a company investor presentation here.

Global Energy Metals Corp. [TSXV:GEMC][GR:5GE1] (OTC:GBLEF)

On September 8, Global Energy Metals Corp. announced: “Global Energy Metals identifies new cobalt, copper, nickel targets at the Lovelock and Treasure Box Projects using Earthlabs’ AI and Machine Learning Technology.” Highlights include:

- “Earthlab’s AI and geological interpretation highlights cobalt, nickel, copper potential at GEMC’s Nevada based projects.

- A total of 30 exploration targets have been identified, 15 on the Lovelock Project and 15 targets identified on the Treasure Box Project…”

On September 13, Global Energy Metals Corp. announced:

Global Energy Metals mobilizes field crew to ground truth new cobalt, copper, nickel targets at the Lovelock and Treasure Box Projects…

Giga Metals Corp. [TSXV:GIGA][FSE: BRR2] (OTCQX:HNCKF) (Turnagain Nickel Deposit now held via Hard Creek Nickel Corporation [TSXV:HNC] (OTCQX:HNCKF)

On September 1, Giga Metals announced:

Giga Metals and Mitsubishi Corporation complete Joint Venture transaction…to form a new joint venture company, Hard Creek Nickel Corp. (“Hard Creek”), to jointly pursue the development of the Turnagain Nickel Deposit in northern British Columbia, Canada. Further to the announcement on August 15, 2022, MC has now acquired a 15% equity interest in Hard Creek in exchange for cash consideration of Cdn $8 million. Giga received an 85% equity interest in Hard Creek in exchange for contributing all related assets for the Turnagain Project. Pursuant to the terms of a shareholders’ agreement governing Hard Creek, Giga, with support from MC, will operate the joint venture, reporting to the board of directors of Hard Creek, and will work on a Pre-Feasibility Study [PFS] for the Turnagain Project with completion expected in the first half of 2023.

The Metals Company (TMC)

On September 7, The Metals Company announced: “The Metals Company subsidiary, NORI, receives ISA recommendation to commence pilot nodule collection trials in the Clarion Clipperton Zone of the Pacific Ocean.” Highlights include:

- “The completion of the ISA’s review of the Collector Test Environmental Impact Statement [EIS] paves the way for TMC subsidiary, Nauru Ocean Resources Inc (NORI), to conduct its planned pilot collection system trials on its NORI-D exploration area in the Clarion Clipperton Zone of the Pacific Ocean beginning later this month.

- An integral part of the ISA’s regulatory and permitting process, the trials will be monitored by independent scientists from a dozen leading research institutions, providing critical environmental impact data to inform NORI’s application to the ISA for an exploitation contract.

- Upcoming integrated nodule collection system trials will mark the first such trials to be conducted in the CCZ since the 1970s.”

Other juniors and miners with cobalt

Happy to hear any news updates from commentators. Tickers of cobalt juniors we will also be following include:

21st Century Metals (CSE: BULL) (OTCQB:DCNNF), African Battery Metals [AIM:ABM], Alloy Resources [ASX:AYR], Artemis Resources Ltd [ASX:ARV] (OTCPK:ARTTF), Aston Minerals [ASX:ASO] (OTCPK:WMNNF) (formerly European Cobalt), Auroch [ASX:AOU] [GR:T59], Azure Minerals [ASX:AZS] (OTC:AZRMF), Bankers Cobalt [TSXV:BANC] [GR:BC2] (NDENF), Battery Mineral Resources [TSXV:BMR] (OTCQB:BTRMF), Blackstone Minerals [ASX:BSX] (OTCQX:BLSTF), BHP (NYSE:BHP), Brixton Metals Corporation [TSXV:BBB](OTC:BXTMD), Canada Nickel [TSXV:CNC] (OTCQX:CNIKF), Canada Silver Cobalt Works Inc [TSXV:CCW] (OTCQB:CCWOF), Canadian International Minerals [TSXV:CIN], Carnaby Resources [ASX:CNB], Castillo Copper [ASX:CCZ], Celsius Resources [ASX:CLA] [GR:FX8], Centaurus Metals [ASX:CTM] (OTCQX:CTTZF), CBLT Inc. [TSXV:KBLT] (OTCPK:CBBLF), Cobalt Power Group [TSX:CPO], Cohiba Minerals [ASX:CHK] (OTCQB:CHKMF), Corazon Mining Ltd [ASX:CZN], Cruz Battery Metals Corp. [CSE:CRUZ][FSE: A2DMG8] (OTCPK:BKTPF), Cudeco Ltd [ASX:CDU] [GR:AMR], DeepGreen Metals Inc. (TMC)/ Sustainable Opportunities Acquisition Corporation (SOAC), Dragon Energy [ASX:DLE], Edison Battery Metals [TSXV:EDDY], Electric Royalties [TSXV:ELEC] (OTCQB:ELECF), First Quantum Minerals (OTCPK:FQVLF), Fuse Cobalt Inc [CVE:FUSE] (WCTXF), Galileo [ASX:GAL], GME Resources [ASX:GME] (OTC:GMRSF), Stillwater Critical Minerals Corp. [TSXV:PGE] (OTCQB:PGEZF), Hinterland Metals Inc. (OTC:HNLMF), Hylea Metals [ASX:HCO], Independence Group [ASX:IGO] (OTC:IIDDY), King’s Bay Res (OTC:KBGCF) [TSXV:KBG], Latin American Resources, M2 Cobalt Corp. (TSXV: MC) (OTCQB: MCCBF), MetalsTech [ASE:MTC], Meteoric Resources [ASX:MEI], Mincor Resources (OTCPK:MCRZF) [ASX:MCR], Namibia Critical Metals [TSXV:NMI] (OTCPK:NMREF), Pacific Rim Cobalt [BOLT:CSE], PolyMet Mining [TSXV:POM] (NYSEMKT:PLM), OreCorp [ASX:ORR], Power Americas Minerals [TSXV:PAM], Panoramic Resources (OTCPK:PANRF) [ASX:PAN], Pioneer Resources Limited [ASX:PIO], Platina Resources (OTCPK:PTNUF) [ASX:PGM], Quantum Cobalt Corp [CSE:QBOT] GR:23BA] (OTCPK:BRVVF), Regal Resources (OTC:RGARF), Resolution Minerals Ltd [ASX:RML] (OTCPK:RLMLF), Sienna Resources [TSXV:SIE], (OTCPK:SNNAF), and Victory Mines [ASX:VIC].

Conclusion

September saw cobalt spot prices slightly higher and LME inventory was lower.

Highlights for the month were:

- VW aims to take stakes in Canadian mines, mine operators.

- Tesla appears to be ramping up interest in manufacturing in Canada.

- BMI – More than 300 new mines could need to be built over the next decade to meet the demand for EVs and energy storage batteries. The world will need 62 new cobalt mining projects of 5,000tpa by 2035, 38 if recycling is factored in.

- Vale and Huayou plan to build an $1.8b HPAL plant in Sorowako, South Sulawesi, Indonesia to produce 60,000t of nickel in mixed hydroxide precipitate.

- Umicore inaugurates Europe’s first battery materials gigafactory in Poland.

- OZ Minerals set to ride electrification growth wave… outlined a clear pathway to doubling production.

- Electra Battery Materials’ study on integrated EV Battery Materials Facility in Ontario demonstrates compelling economics. Electra and LG Energy Solution sign three-year cobalt supply agreement for a total of 7,000 tonnes of battery grade cobalt from 2023 to 2025, from their Ontario refinery.

- Havilah Resources shareholders approve Kalkaroo Option to OZ Minerals.

- Giga Metals and Mitsubishi Corporation complete Joint Venture transaction. Turnagain Nickel Deposit now held via new JV company Hard Creek Nickel Corporation.

- The Metals Company subsidiary, NORI, receives ISA recommendation to commence pilot nodule collection trials in the Pacific Ocean.

As usual all comments are welcome.

Be the first to comment