Feverpitched

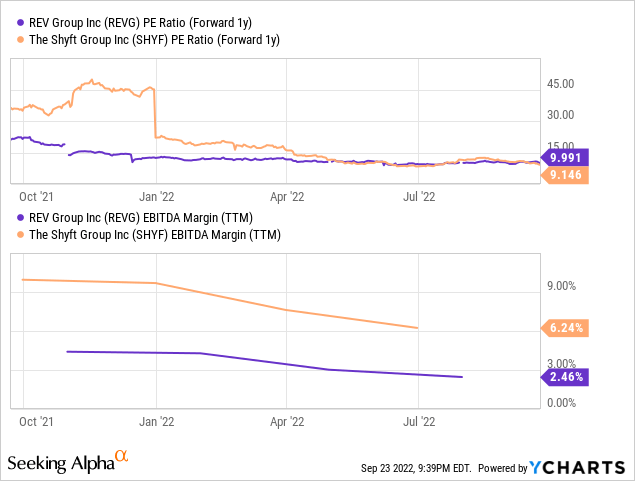

Recreational vehicle designer/manufacturer REV Group (NYSE:REVG) delivered another volatile quarter in Q3 2022, as much like many other manufacturers in the space, supply chain issues continue to hinder its ability to meet demand. While the backlog is as robust as ever, REVG’s component shortage problem looks severe enough to persist through the rest of the year as well. In the meantime, REVG’s cash generation will be welcomed by investors – free cash flow guidance was reiterated at a solid ~$64m (at the midpoint) for FY22, allowing the company ample capital allocation flexibility. Whether management opts to buy back shares, pursue M&A, or reduce debt, however, REVG’s track record of execution issues and the longer-than-expected supply chain disruptions are enough to keep me sidelined for now. The stock trades slightly below key peer Shyft Group (SHYF), but given the below-peer margin profile, I think the relative discount is warranted.

Quarterly Results Disappoint on Persistent Supply Side Issues

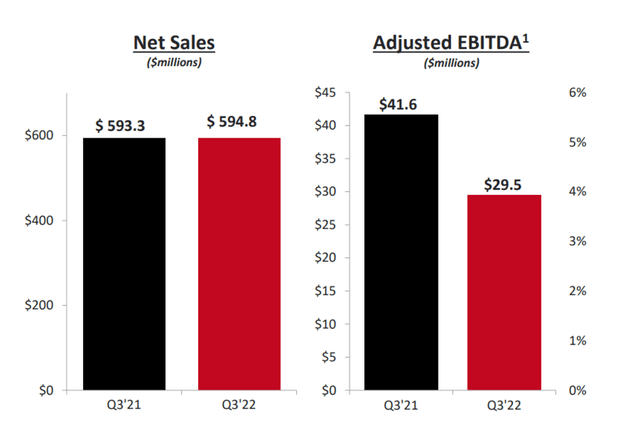

REVG’s Q3 2022 result was headlined by below-consensus revenues of $594.8m (+0.3% YoY) and adj EBITDA of $29.5m (-29% YoY). Yet again, the key headwind was continued supply chain challenges across key components, such as wiring harnesses, axles, and radiators, which disrupted starts and completions throughout the quarter. The silver lining is that demand remains strong across REVG’s end markets, helped by pent-up demand from recent quarters. In essence, customer needs are not being met, as REVG (and the rest of the industry) continues to experience difficulties shipping products on time. As a result, REVG’s backlog notched another record at ~$3.9bn (+46% YoY and +9% QoQ). With dealers’ inventories also remaining low and order cancellations unlikely, REVG has good visibility for the rest of the year and potentially into next year as well.

Overall profitability has not been stellar – adj EBITDA margin at 5.0% was down ~200 bps YoY, as plant efficiency remains well below last year even after accounting for the furloughs that have taken place. The crux of the opex issue is that REVG is carrying too much labor for now, although this could change should its efforts to optimize allocation efficiency at the Holden facility eventually pay off. The free cash flow generation is strong, though, and that gives REVG capital allocation optionality. The focus now seems to be on buybacks over tuck-in acquisitions or debt paydown – the company repurchased ~$24.1m of stock in Q3 and has ample capacity left in its $150m authorization. With the leverage ratio of 2.3x remaining well within the targeted 2.0–2.5x range and REVG also holding ample liquidity (including ~$287m available under its credit facility), all roads point to an upsized buyback down the line.

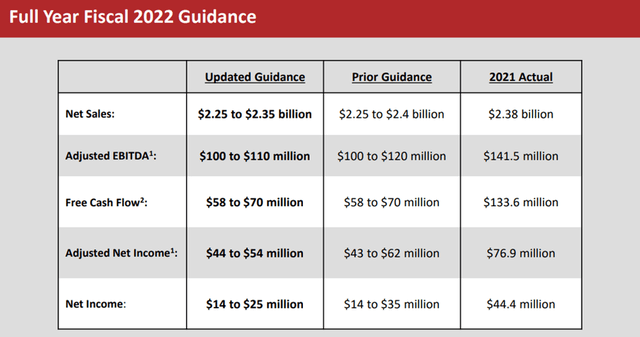

Guidance Revised Lower

Coming off the Q3 miss, REVG revised its FY22 guidance lower – the implied adjusted EPS range now moves to $0.72–0.88/share (vs. $0.68–0.98 previously), while net revenue is pegged at $2.25–2.35bn (vs. the prior $2.25–2.40bn). Similarly, the adj EBITDA range was narrowed to $100–110m (from $100–120m previously), with the free cash flow guide now assuming a seemingly optimistic ~130% conversion as a % of adjusted net income (well above management’s>90% target).

The midpoint of the updated guide reflects more of the same in Q4, as revenue and margin momentum are constrained by the supply chain bottleneck. In the meantime, investors will want to keep an eye on commentary from key suppliers like Ford (F) and General Motors (GM), given REVG’s supply-side issues have centered around components and the lack of available chassis. Additionally, accelerated progress on the restructuring and realignment programs (both of which have exacerbated margins thus far) offers potential upside to the near-term guidance numbers.

Looking Ahead to the ‘New REV’

REVG remains committed to its long-term plans – thus far, new CEO Rushing (appointed in 2020) has reshuffled key leadership positions and implemented structural changes to get EBITDA margins to the double digits % target over time. Of note, REVG has implemented enhancements through the REV Drive Business System and renewed its focus on parts sales. On the margin side, management is also streamlining by cutting underperforming businesses and product lines to unlock more profitability and cash generation.

The early fruits of these initiatives have led to a relatively strong FY21 performance across the commercial and recreation businesses, and some of the benefits have carried through to this year as well, albeit only for recreation. To recap, recreation sales were up 19.6% YoY to $254.1m in Q3, supporting ~39bps YoY of adj EBITDA margin expansion to 11.7%. Given RVIA’s latest forecasts for a double digits % decline in industry RV shipments for the year, REVG is clearly outperforming the industry here. Given the backlog also stands at ~$1.2bn (+7% YoY), the recreation business should continue to be the bright spot, with the ability to flex labor and operational costs also presenting incremental upside to future margins.

Supply Chain Issues Weigh on the Outlook

Net, this was a mixed quarter for REVG. On the one hand, the backlog is as robust as ever; yet, the continued supply chain disruptions and the longer-than-expected recovery (no improvement until 2023 per management) are concerning. No surprise then that management revised the guidance numbers downward and sounded the caution on margins – even with signs of pricing improvement in the backlog. While there is an exciting long-term story unfolding as management looks to get to its double-digit margin target, the macro challenges and the uneven execution track record makes it hard to look past the near-term headwinds. The valuation is currently below comparable peer SHYF, but a relative discount seems fair given that REVG also sustains below-peer margins.

Be the first to comment