naphtalina/iStock via Getty Images

Investment Thesis

General Motors (NYSE:GM) is clearly learning from its competitor, Tesla (TSLA), in creating a new business unit, GM Energy, with a direct focus on residential and commercial purposes. These include offering a one-stop service for new energy solutions, such as stationary battery packs, solar panels, electric vehicle chargers, and other energy-management products. Though TSLA has had little success and profitability in that segment, we expect things to improve moving forward, given the massive uplifting effect from the solar tariff exemptions and Inflation Reduction Act.

We are already starting to see an unprecedented demand explosion, with GM’s preferred partner, SunPower (NASDAQ:SPWR), recently reporting a massive backlog of 53K retrofit and new home customers in its FQ2’22 earnings call. The latter’s competitor, First Solar (NASDAQ:FSLR), also outperformed with all-time high new bookings YTD and record-high production backlogs through 2026. Globally, we expect renewable adoption to accelerate as well, with exponential growth in the solar energy demand from one Terawatt in April 2022 to 2.3 Terawatts by 2025.

GM’s automotive segment is not to be trifled with as well. The September CPI has shown a surprisingly sticky consumer demand for new vehicles within the US. The index rose by 0.4% sequentially and 9.4% YoY, pointing to the market’s tremendous spending power despite the rising inflation. Combined with the projected YoY growth of 21.5% in FY2022 revenues and 6.5% in adj net incomes, we expect GM to outperform indeed.

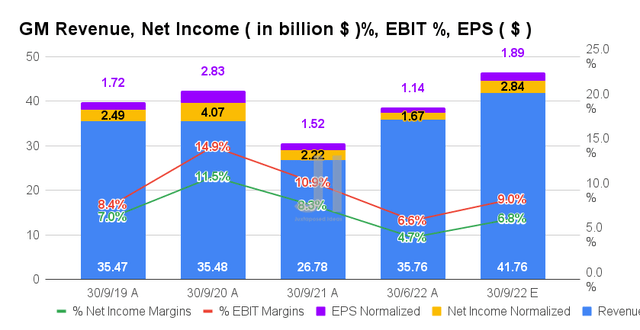

GM May Report A Monster Quarter In FQ3’22

For its upcoming FQ3’22 earnings call, GM is expected to report revenues of $41.76B and EBIT margins of 9%, indicating massive QoQ growth of 16.77% and 2.4 percentage points, respectively. Otherwise, a tremendous increase of 55.93% though a moderation of 1.9 percentage points YoY, respectively. In the meantime, the company is expected to report improved profitability, with net incomes of $2.84B and net income margins of 6.8% for the next quarter. It will indicate a remarkable growth of 70.05% QoQ and 27.92% YoY, respectively.

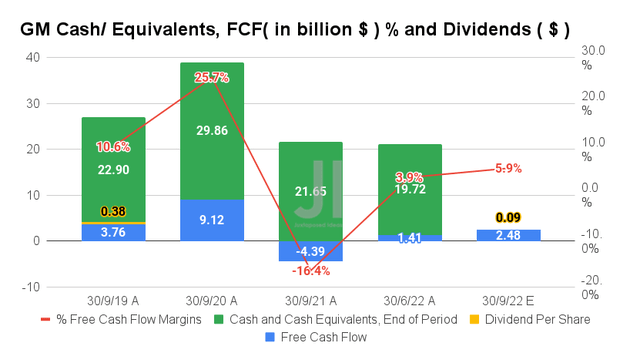

Therefore, it is not surprising to see GM reporting notable improvements in its Free Cash Flow [FCF] generation to $2.48B with an FCF margin of 5.9% in FQ3’22. It will represent a tremendous increase of 75.88% and 2 percentage points QoQ, respectively. Otherwise, a smashing YoY growth from FQ3’21 levels of -$4.39B and -16.4%, respectively. Therefore, insulating the company’s balance sheet during the worsening macroeconomics ahead, on top of its robust cash and equivalents of $19.72B in the last quarter. We may potentially see an increased dividend payout as well, though analysts are predicting an inline $0.09 quarterly sum ahead due to GM’s elevated capital expenditure.

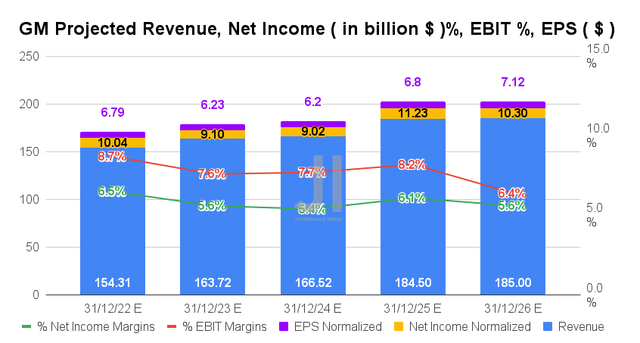

Over the next five years, GM is expected to report revenue and net income growth at a CAGR of 7.81% and -0.15%, respectively. Despite the perceived destruction of demand by UBS, Mr. Market has unusually upgraded the company’s bottom line growth by 10.16% since our previous article in September 2022. Otherwise, a tremendous upgrade of 18.8% since July 2022. Very “odd” indeed, given the worsening macroeconomics and the Fed’s likely aggressive rate hikes through 2023. In the meantime, consensus FY2022 estimates remain in line for now, indicating Mr. Market’s cautious optimism ahead.

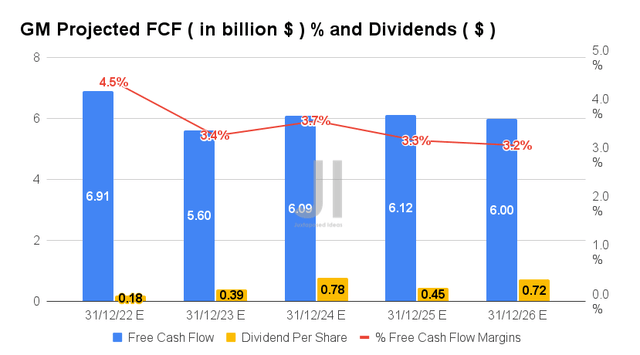

The projected improvement in GM’s profitability is excellent too, from adj. net income/ FCF margins of 5.1%/0.8% in FY2019, 8.2%/2% in FY2021, and finally to 5.6%/3.2% by FY2026. The growth in its FCF will directly contribute to the expansion of its dividend payouts at an impressive CAGR of 41.42% through FY2026, negating the effects of its suspended dividends during the height of the pandemic. Otherwise, still at an excellent CAGR of 11.24% between FY2020 and FY2026.

Since GM is trading well below its pre-pandemic and pandemic heights, we will also see excellent forward dividend yields of 2.14% by FY2026. This is almost matching its pre-pandemic 4Y average yields of 2.33%. Stellar indeed, given the company’s aggressive capital expenditure ahead toward its EV and Energy businesses.

In the meantime, we encourage you to read our previous article on GM, which would help you better understand its position and market opportunities.

- General Motors: Monster Acceleration Ahead

- General Motors Is Catching Up To Tesla

So, Is GM Stock A Buy, Sell, or Hold?

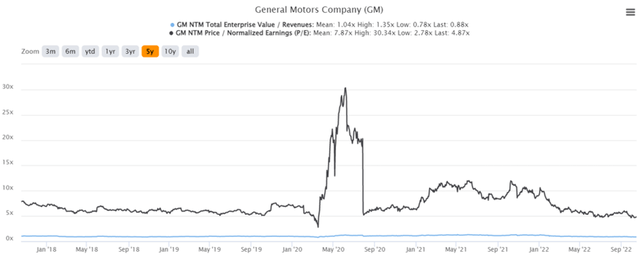

GM 5Y EV/Revenue and P/E Valuations

GM is currently trading at an EV/NTM Revenue of 0.88x and NTM P/E of 4.87x, lower than its 5Y mean of 1.35x and 7.87x, respectively. The stock is also trading at $33.57, down -50.05% from its 52 weeks high of $67.21, nearing its 52 weeks low of $30.33. Nonetheless, consensus estimates remain bullish about GM’s prospects, given their price target of $57.57 and a 71.49% upside from current prices.

GM 5Y Stock Price

Assuming promising results from its new GM Energy, AI capabilities, and Super Cruise, we may see an upwards rerating of GM’s PE valuations nearer to TSLA’s, currently at 43.42x. Even at half of that, GM’s price target is estimated at $154.57 based on its projected FY2026 EPS of $7.12, against TSLA’s FY2026 EPS of $7.40. Thereby, pushing GM’s market cap by more than 4 folds from $48.94B to $225.37B then, nearer to TSLA’s current market cap of $687.32B.

Of course, this is all speculative, since GM is still rated very much nearer to its automotive peers at a median PE of 4.09x. The market’s current peak levels of FUD are not helping matters as well, since the Feds are likely to raise its terminal rates beyond 5%, triggering more pain for the stock market in general. However, those pessimism has also plummeted GM’s stock prices to below pre-pandemic levels, despite the improved profitability ahead. That created the perfect opportunity for bottom-fishing investors that have been waiting patiently to add this next decade winner, further sweetened by its forward dividend yields of 2.14% by FY2026 ( if not more, once its capital expenditure eases from FY2025 onwards )

Therefore, we rate GM stock as a speculative Buy at current levels. Bottom-fishing investors may potentially wait after its upcoming earnings call, though we expect a moderate rally assuming an exemplary performance. Do not miss this low tide.

Be the first to comment