ClaudioVentrella

Tomorrow is promised to no one.”― Clint Eastwood

We last took an in-depth look at Agenus, Inc. (NASDAQ:AGEN) back in June of last year. This small biotech always has had a lot of ‘moving parts’ and comes up frequently in comments from Seeking Alpha. Given that, it seems an appropriate time to circle back on this intriguing small cap concern.

Company Overview:

Agenus, Inc. is based just outside of Boston in Lexington, MA. This immuno-oncology company has an extensive pipeline of therapeutics designed to activate the immune response to cancers and infections. These candidates include immune checkpoint antibodies, adoptive cell therapies, and neoantigen vaccines. The stock currently trades at just under $2.50 a share and sports an approximate market capitalization of $700 million.

The company has a half dozen collaboration agreements including with drug giant Bristol-Myers Squibb (BMY). This is the company’s largest collaboration deal, for which the company received a $200 million upfront payment upon signing the agreement in spring of last year. The deal revolves around AGEN1777, which targets a major inhibitory receptor expressed on T and NK cells to improve anti-tumor activity. Agenus can also garner up to $1.36 billion in milestone payouts as well as royalties on any commercialized sales.

As can be seen by clicking here, the company has an extensive pipeline both in-house and via the collaborations noted above. In May of this year, management prioritized and focused on their most promising clinical programs, including botensilimab combinations, as well as preclinical programs with the highest potential for engagement from collaborators. This is helping to reduce costs.

March Company Presentation

The stock started to come off its skid in late June when Agenus reported encouraging early-stage data from Phase 1b study for its tumor candidates botensilimab and balstilimab in patients with a form of colorectal cancer. Colorectal cancer is the third leading cause of cancer-related that’s in the United States with over 50,000 Americans dying each year. Botensilimab is currently the company’s most advanced fully-owned program. It has the highest potential in Agenus’ portfolio, according to management.

March Company Presentation

This candidate was designed to deliver multiple functions in a single antibody. T cell priming, T cell activation, suppression of regulatory T cell and avoidance of complement-related toxicities among others is an activator of both innate and adaptive arms of the immune system. It binds to CTLA-4 but has a much broader activity by targeting both the adaptive and the – innate immune arms of the system.

The company’s strategy for botensilimab is to demonstrate clear superiority to existing checkpoint immunotherapies and/or other standards of care in a variety of indications.

Analyst Commentary & Balance Sheet:

In March, H.C. Wainwright reissued their Buy rating and $14 price target on AGEN. William Blair maintained its Buy on the stock in early June, and last month, B. Riley Financial reiterated its Buy rating and $8 price target on the equity that has been the only analyst firm activity around Agenus so far this year.

The company’s Chief Medical Officer sold nearly $120,000 worth of shares in mid-January. That has been the only insider activity in the stock so far in 2022. Approximately seven percent of the outstanding float is currently held short. The company ended the second quarter with just under $240 million worth of cash and marketable securities on its balance sheet. Agenus used $43 million worth of cash in the second quarter to support all operations. This is down from $56 million from the same period a year ago, thanks to the company recently prioritizing its development.

The company has licensed an adjuvant used in a Shingles vaccine, ‘Shingrix,’ which is due a $25 million sales-based milestone payment that will be recorded sometime before the end of this year. The company had $21 million worth of revenue in the second quarter. This consisted of payments around collaboration agreements, in 2022, milestones earned as well as revenue related to non-cash royalties earned. Non-cash royalties represent royalties from Shingrix sales which are passed to Hercules Capital under a royalty purchase agreement.

Verdict:

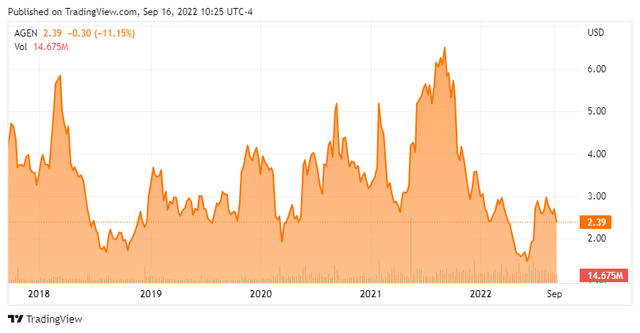

With few exceptions, the stock of Agenus has traded within a $2 to $6 range over the past half-decade. Every time the stock rallies, the rise fades soon thereafter on profit taking and/or disappointing news. In contrast, every time the stock goes to the lower end of that range, something always eventually pushes the stock back up on the hope for tomorrow.

March Company Presentation

Other than the adjuvant used in Shingrix, the company has not got any candidate across the FDA approved finish line yet. However, the company’s pipeline always is touted as having ‘great potential‘, which is validated by extensive collaboration deals. Its partnered antibody programs have the potential to trigger milestone payments to Agenus totaling close to $3 billion in addition to sales-based royalties for those molecules that reach commercial launch.

March Company Presentation

Given the company’s current market cap of $700 million, AGEN seems to have an attractive risk/reward profile at current trading levels. This is even as it is many years away from commercialization. Given the well-established trading range, the potential of the company’s pipeline and the very complex story around the company’s developmental programs, I continue to choose to hold my holdings in Agenus via covered call positions. Options against the equity are both liquid and lucrative in this name, and this has been a profitable trade for me for years when initiated around current trading levels.

Don’t lose today by worrying about tomorrow!!!“― John F. Herbert

Be the first to comment