Spencer Platt/Getty Images News

September 16th proved to be a rather unpleasant day for shareholders in logistics company FedEx Corporation (NYSE:FDX). After the market opened, shares of the business plummeted by around 23%, driven by management’s decision to withdraw guidance for the rest of the 2023 fiscal year and in light of the firm’s decision to release preliminary financial results covering the first quarter of said fiscal year.

Short term, this development, combined with its CEO’s rhetoric regarding the broader global economy, has stoked a tremendous amount of fear in the investment community. The absence of guidance is particularly worrisome and lends to the pessimistic aura the company is now giving off. It should not be surprising for investors to anticipate further pain in the near term. Having said that, management remains optimistic about the future and, once the worst of the pain is over, shares might offer investors a nice amount of upside moving forward.

FedEx Stock – Short-term pain, but long-term potential

Back in the middle of June of this year, I wrote an article that took a rather bullish stance on FedEx. At that time, I was impressed by some developments the company had announced, and I felt as though shares were valued at a low enough price to warrant attractive upside. At the end of the day, I ended up rating the company a “buy,” reflecting my belief that it should generate returns that outpace the broader market for the foreseeable future. Unfortunately, things have not played out exactly as I would have liked. While the S&P 500 is up by about 2% over that timeframe, shares of FedEx have realized a loss of 30.1%.

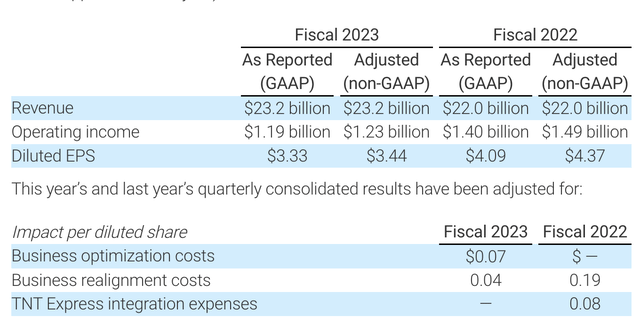

Such a significant amount of downside in such a short window of time was driven almost entirely by the plunge the company saw on September 16th in response to some developments provided by management. First and foremost, the firm came out with preliminary results covering the first quarter of its 2023 fiscal year. Assuming these preliminary results are what the company ultimately will release later this month, sales for the quarter should come in at $23.2 billion. This level of revenue should translate to a nice increase over the $22 billion generated the same time last year. On the other hand, it would imply that the company missed analyst expectations to the tune of $319.2 million.

The weakness, management said, was due to how the company was impacted adversely by global volume softness. What made the matter worse was the fact that the volume softness accelerated in the final weeks of the quarter, indicating that future pain might be in store for the enterprise. In terms of operating segments, the biggest pain involved FedEx Express, which was hit by macroeconomic weakness in Asia, as well as by service challenges throughout parts of Europe. This ultimately led to a revenue shortfall for that segment alone of $500 million compared to what management anticipated. Meanwhile, revenue from FedEx Ground came in $300 million below what management had forecasted.

This pain also was experienced on the bottom line for the company. Earnings per share came in at $3.33. That’s down from the $4.09 in earnings the company generated the same time last year. Operating income, meanwhile, should be $1.19 billion. That compares to the $1.40 billion reported for the same quarter of 2022. Although revenue increased, the company dealt with significant cost increases during this time, plus it had to contend with about $0.11 per share in business optimization and business realignment costs. To combat this, the company launched a series of cost initiatives aimed at reducing expenses. This includes reducing flight frequencies and temporarily parking its aircraft because of lower volume, reducing labor hours, focusing on sorting operation efficiency, reducing Sunday operations at some of its FedEx Ground locations, canceling some planned network capacity and other projects, deferring the hiring of some staff, closing more than 90 FedEx Office locations, and identifying 5 corporate office facilities and other assets that can be closed and potentially sold. Unfortunately, the benefit seen from what initiatives the company has implemented lagged the decline in volume and, in turn, revenue.

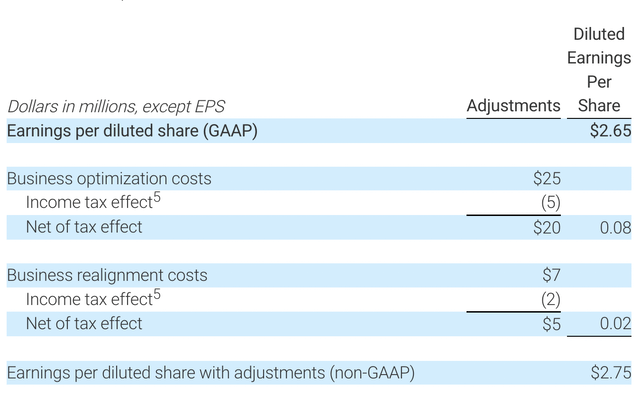

Because of these issues, management has decided to withdraw guidance for the entirety of the 2023 fiscal year. Previously, management had forecasted earnings per share of between $22.45 and $24.45. But the company did offer up guidance for the second quarter of the year. At present, revenue is forecasted to come in at between $23.5 billion and $24 billion, while adjusted earnings per share should be $2.75 or more. The revenue figure compares to the $23.47 billion generated in the second quarter of 2022, while the earnings per share figure compares to the $3.88 per share reported last year.

It’s important to note, however, that management was very clear in stressing that this outlook assumes that the firm’s current economic forecast and fuel price expectations, as well as other factors, all show no signs of worsening. But this seems to be an assumption that can change rather quickly. I say that because, on September 15th, the company’s CEO, Raj Subramaniam, told CNBC’s Jim Cramer that he believes a recession is impending for the global economy. He even went so far as to say that economic conditions are not good and that the weekly numbers the company is seeing are not looking good either.

On a bright note, the company did say that it still expects to repurchase $1 billion worth of its stock during the second quarter. So while the pain is bad, it’s not likely to be enough for the company to cut its distribution or stop those near-term stock repurchases. Or at least that is the case for now.

Despite all of this pain, there does still exist some opportunity for investors. I would not be surprised to see shares fall further from here. However, shares of the company are currently very affordable. As an example, if the company were to see its financial performance for the second quarter come to fruition and if it were to see that be representative of the year-over-year change for total earnings per share, then the company would currently be trading at a forward price to earnings multiple of 15.7. For a large player and an industry leader with attractive long-term growth, that’s not a horrible price to pay by any means. There’s also the fact that management currently has faith in its ability to deliver on the targets that they set for the 2025 fiscal year.

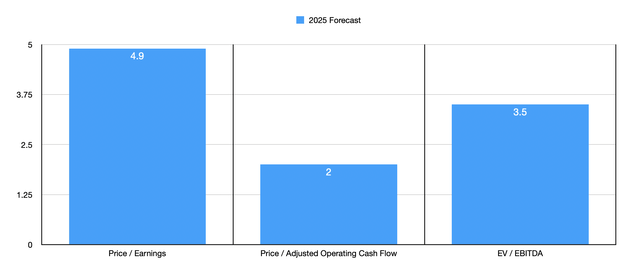

Due to continued long-term demand growth for the company’s services as well as driven by continued investment by the company in growing, the expectation is for the business to grow its revenue at a compound annual rate of between 4% and 6%, while share buybacks and improved operating efficiencies should help increase earnings per share by between 14% and 19% per annum, all occurring through the 2025 fiscal year relative to what the company saw in 2022. Earnings for the company have been historically volatile, but this guidance focuses on adjusted earnings. Assuming that comes to fruition, the company would, at that point, be trading at a price-to-earnings multiple of just 4.9 if we use midpoint expectations. Applying that same annual growth rate to adjusted operating cash flow and EBITDA would give us forward multiples of 2 and 3.5, respectively.

Takeaway

Right at this moment, things are looking very painful for FedEx. Having said that, management remains optimistic about the longer-term future, even though the near-term future is slated to be rather uncomfortable. Yes, this could result in a year or so of subpar returns. And investors who need to rely on short-term investing to achieve their financial objectives should tread very cautiously here. But for those focused on the long haul and who believe in the business model that has propelled FedEx to the point that it is today, now might be an excellent time to consider buying in.

Be the first to comment