Sundry Photography

Thesis

ServiceNow’s (NYSE:NOW) recent Q2 card initially disappointed the media and some investors, but not us. As a result, we updated members of our marketplace service that we were ready to turn bullish on NOW, as we added right after its earnings sell-off. As a result, we have managed to ride its recovery back up, as NOW has surged nearly 14% since we added.

Investors should recall that we updated in our late June article that NOW could continue to underperform. As we posited, the stock also fell back to its near-term support ($405) in July. However, the market rejected further downside, as it held its July lows firmly. Furthermore, we also presented in our July articles on the UltraPro QQQ ETF (TQQQ) and Tech ETF (XLK) that we believe the market has bottomed.

As a result, we are confident that a high-quality enterprise cloud SaaS stock like NOW has also staged its medium-term bottom at its $405 support. We also believe the market has been astutely accumulating at those levels. Therefore, we were not going to miss the opportunity to accumulate with the market, as we think a re-rating in NOW should be on the cards.

We urge investors to look past the near-term concerns regarding the looming economic downturn as the market looks forward. Notwithstanding, NOW has recovered sharply back to its near-term resistance ($500), which has seen sustained selling pressure since June.

Therefore, we believe a short-term pullback should occur, given its near-term overbought levels. However, we are not concerned with the resistance and think it should be taken out by further buying upside in the medium-term, given the tech bottom.

Therefore, we revise our rating on NOW from Hold to Buy. But, we encourage investors to wait for a pullback first, given the near-term overbought technicals.

Look Past ServiceNow’s Q2, as Growth Could Reaccelerate

The market initially seemed concerned with ServiceNow’s Q2 performance, as NOW sold off post-earnings. The company’s Q2 revenue came below the Street’s consensus, and management revised its guidance, given the macro and forex headwinds. CEO Bill McDermott cautioned (edited):

We have always said no one is outrunning the strength of the dollar in this environment. And we also acknowledge that, especially in theaters of operation that are more affected by the macro, you’ll see a lengthening of the sales cycle because, especially in markets that have grown accustomed to doing things a certain way, now they’re in the great reprioritization. There is a time equation there, but there’s also an expansion of the power of our platform that’s not factored into the numbers. And we’ll have to see how that plays out in the back half. (ServiceNow FQ2’22 earnings call)

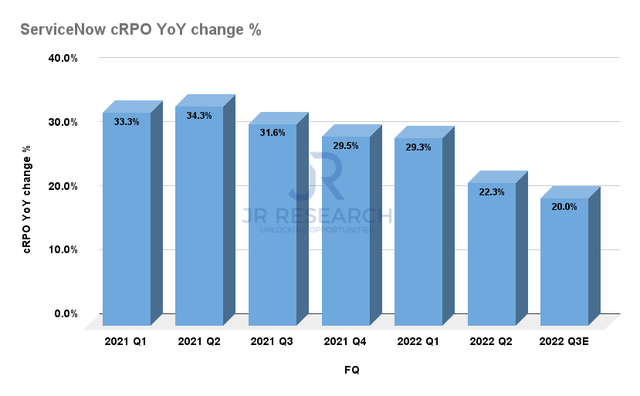

ServiceNow cRPO change % (Company filings)

Notably, ServiceNow’s current remaining performance obligations ((cRPO)) have been trending down, with Q3’s guide coming in at 20% YoY growth (also impacted by forex headwinds). However, we believe it’s also likely to bottom out here, as CFO Gina Mastantuono emphasized (edited):

We’ve been talking about this for several quarters now that the renewal cohort was going to be at the bottom in Q3, right? It’ll pop back up in Q4. And so Q3 is absolutely the bottom of that renewal cohort, and we’ll see that reacceleration as we move into Q4. (ServiceNow earnings)

Also, investors should recall that the company guided to revenue of $16B by FY26 at its Analyst Day presentation. Accordingly, it implies a TTM revenue CAGR of 21.74% through FY26. Therefore, we believe the company’s guidance of a cRPO growth bottom in Q3 is credible.

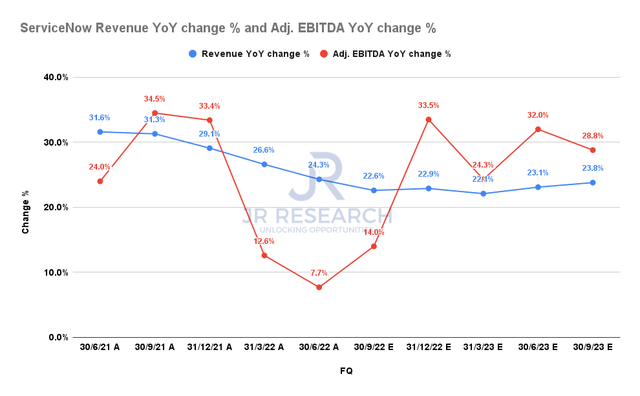

ServiceNow revenue change % and adjusted EBITDA change % consensus estimates (S&P Cap IQ)

The consensus estimates (very bullish) also indicate that its revenue growth cadence could recover through FY23. The headwinds impacting its profitability growth should also be transitory and improve from Q3 onwards.

Notwithstanding, given the company’s 35% global revenue base, forex headwinds could still impact its ongoing revenue and profitability. However, our analyst of the dollar index suggests that the surge in the dollar index should reverse itself as the Fed moves back into a less hawkish mode. But, it could also come sooner, given that the market usually anticipates the Fed’s moves ahead of time. So the forex headwinds should reverse into tailwinds moving forward.

Is NOW Stock A Buy, Sell, Or Hold?

We revise our rating on NOW from Hold to Buy. We have already taken the opportunity at its post-earnings sell-off to add positions.

While we expect a pullback, given its overbought near-term technicals, we believe a re-rating is on the cards in the medium-term. Therefore, it bodes well for NOW’s buying upside moving ahead, and we encourage investors to capitalize on its recovery.

NOW last traded at an FY24 free cash flow (FCF) yield of 3.66%. It’s certainly not cheap, suggesting an embedded growth premium for its high-growth opportunity. Therefore, investors should be prepared for volatility when adding positions in NOW.

Be the first to comment