BlakeDavidTaylor/iStock Unreleased via Getty Images

Investment Thesis

- When presenting its 2Q22 results, Coca-Cola (NYSE:KO) raised its guidance for the future: the company now estimates its organic growth revenue to be between 12% and 13%.

- The Seeking Alpha Quant Ranking shows strong numbers for Coca-Cola: the company is ranked 5th (out of 16) within the Soft Drinks Industry and 47th (out of 187) in the Consumer Staples Sector.

- The HQC Scorecard confirms that Coca-Cola is attractive (60/100) in regards to risk and reward: Coca-Cola is rated as very attractive in terms of Profitability (100/100) and Economic Moat (80/100) and attractive for both Financial Strength (68/100) and Innovation (60/100). For Expected Return (40/100), the company is rated as moderately attractive. In terms of Growth, it’s rated as unattractive (30/100) and very unattractive for Valuation (8/100).

- I have changed my hold rating for Coca-Cola to a buy rating: this is due to the latest organic growth guidance in combination with the company’s high profitability, wide economic moat and strong financials. I consider the Coca-Cola stock to be attractive, especially for dividend income investors seeking to invest for their retirement.

Coca-Cola’s Results in 2Q22

Coca-Cola reported a 2Q22 non-GAAP EPS of $0.70 while topping estimates by $0.03. At the same time the company outperformed revenue estimates by $730M. Furthermore, Coca-Cola raised its guidance for the future: the company’s organic growth revenue is now estimated to be between 12% and 13%, it had previously made an estimate of 7% to 8%.

Coca-Cola CEO James Quincey, said the following regarding the company’s 2Q22 results:

“Our results this quarter reflect the agility of our business, the strength of our streamlined portfolio of brands, and the actions we’ve taken to execute for growth in the face of challenges in the operating and macroeconomic environment.”

Coca-Cola’s Valuation

Discounted Cash Flow [DCF]-Model

In terms of valuation, I have used the DCF Model to determine the intrinsic value of Coca-Cola. The method calculates a fair value of $52.89 for the company. The current stock price is $64.46, which results in a downside of 17.90%.

The Average EBIT Growth [FWD] Rate of the last 5 years for Coca-Cola is 4.22%. I assume a Revenue Growth Rate of 3% and an EBIT Growth Rate of 4% for the company over the next 5 years. Furthermore, I assume a Perpetual Growth Rate of 3%. I’ve used Coca-Cola’s current discount rate [WACC] of 7% and its Tax Rate of 21.2%. Moreover, I used an EV/EBITDA Multiple of 22.1x, which is the company’s latest twelve months EV/EBITDA.

Based on the above, I calculated the following results (in $ millions except per share items):

Market Value vs. Intrinsic Value:

|

Market Value |

$64.46 |

|

Downside |

17.90% |

|

Intrinsic Value |

$52.89 |

Source: The Author

Relative Valuation Models

Coca-Cola’s P/E [FWD] Ratio

Coca-Cola’s P/E Ratio is 28.06, which is 34.63% above the sector median (20.84). This provides us with an indicator that the company is overvalued; however, in my opinion, a premium price for the Coca-Cola stock in comparison to the sector median is justified due to its enormous brand image (which results in a higher pricing power for the company) as well as its enormous profitability (EBIT margin of 28.75%).

Coca-Cola’s 24M and 60M Beta

When considering Coca-Cola’s 24M Beta of 0.60 and 60M Beta of 0.54, we can see that an investment in the company can contribute to reducing the risk of your investment portfolio when investing for retirement.

Overview: Coca-Cola:

|

Sector |

Consumer Staples |

|

Industry |

Soft Drinks |

|

Market Cap |

$275.48B |

|

Employees |

79,000 |

|

Revenue [TTM] |

$41.32B |

|

Operating Income |

$11.88B |

|

Revenue Growth Rate 3 Years [CAGR] |

5.42% |

|

Revenue Growth Rate 5 Years [CAGR] |

1.24% |

|

Gross Profit Margin |

58.89% |

|

EBIT Margin |

28.75% |

|

Return on Equity |

39.21% |

|

Dividend Yield [FWD] |

2.76% |

|

Payout Ratio |

70.49% |

|

Dividend Growth Rate 5 Years [CAGR] |

3.62% |

|

Consecutive Years of Dividend Growth |

28 Years |

|

Dividend Frequency |

Quarterly |

Source: Seeking Alpha

Dividend Projections for Coca-Cola

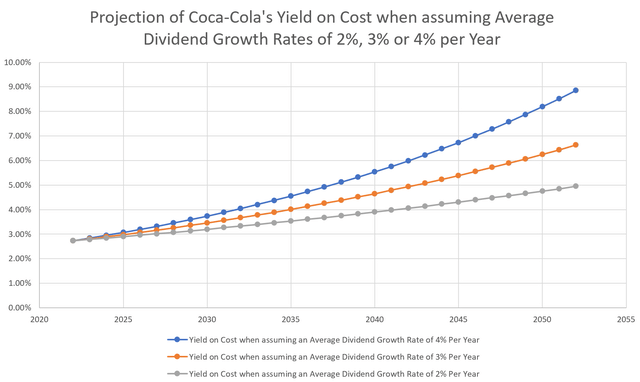

Projection of Coca-Cola’s Yield on Cost When Assuming Average Dividend Growth Rates of 2%, 3% or 4% per Year

In the graphic below, you can see different scenarios of how you would benefit from Coca-Cola’s dividend when having a long-term investment horizon: the graphic shows the results of Coca-Cola’s yield on cost when assuming different dividend growth rates and that you would invest in the company at the current stock price of $64.46. The yield on cost is a measure of dividend yield that is calculated by dividing a stock’s current dividend by the price that was paid for that stock.

I have made projections of an average dividend growth rate of 2%, 3% and 4% per year for Coca-Cola. I assume that the company will be able to raise its dividend in these ranges in the future. The company’s 5 Year Average EPS Diluted Growth Rate [FWD] of 3.62% indicates that these ranges seem to be realistic.

When assuming a dividend growth rate of 2% on average for Coca-Cola, you could expect a yield on cost of 3.33% in 2032, 4.06% in 2042 and 4.95% in 2052. If a dividend growth rate of 3% is assumed, you would have a yield on cost of 3.67% in 2032, 4.93% in 2042 and 6.63% in 2052. In the case of a 4% dividend growth rate being assumed, the result would be a yield on cost of 4.04% in 2032, 5.98% in 2042 and 8.86% in 2052:

|

Year |

Yield on Cost when assuming an Average Dividend Growth Rate of 2% Per Year |

Yield on Cost when assuming an Average Dividend Growth Rate of 3% Per Year |

Yield on Cost when assuming an Average Dividend Growth Rate of 4% Per Year |

|

2022 |

2.73% |

2.73% |

2.73% |

|

2032 |

3.33% |

3.67% |

4.04% |

|

2042 |

4.06% |

4.93% |

5.98% |

|

2052 |

4.95% |

6.63% |

8.86% |

Source: The Author

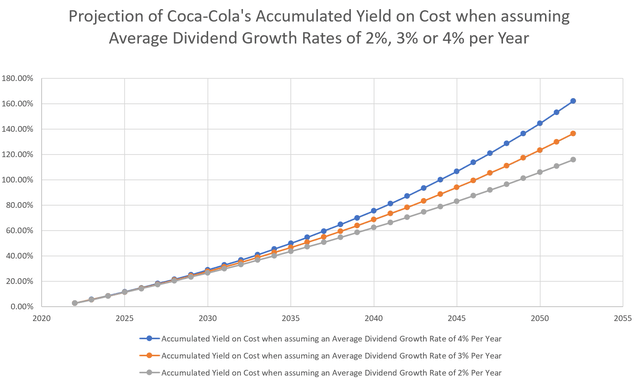

Projection of Coca-Cola’s Accumulated Yield on Cost When Assuming Average Dividend Growth Rates of 2%, 3% or 4% per Year

In the graphic below, you can see that you could generate a relatively high accumulated yield on cost when aiming to invest in Coca-Cola with a long investment horizon.

When assuming an average dividend growth rate of 2% per year for Coca-Cola, you would receive 115.71% of your initial investment by dividend payments after 30 years. For 3%, you would receive 136.56% of your initial investment in the form of dividend payments after 30 years. If an average rate of 4% was assumed, you would get 161.99% of your initial investment via dividend payments by 2052 (no withholding taxes considered in all of the calculations above).

The graphic shows us that you would receive all of your initial investment in the form of dividends by 2049 at the latest, even if a dividend growth rate of just 2% is assumed (again, no withholding taxes are considered in this calculation). Due to Coca-Cola’s dividend payout ratio of 70.49% as well as its Average EPS Diluted Growth Rate [FWD] of 4.52% over the last 5 years, I do not expect a dividend cut for the company in the near future.

|

Year |

Accumulated Yield on Cost when assuming an Average Dividend Growth Rate of 2% Per Year |

Accumulated Yield on Cost when assuming an Average Dividend Growth Rate of 3% Per Year |

Accumulated Yield on Cost when assuming an Average Dividend Growth Rate of 4% Per Year |

|

2022 |

2.73% |

2.73% |

2.73% |

|

2032 |

33.23% |

34.97% |

36.82% |

|

2042 |

70.40% |

78.30% |

87.29% |

|

2052 |

115.71% |

136.53% |

161.99% |

Source: The Author

Coca-Cola According to the Seeking Alpha Factor Grades

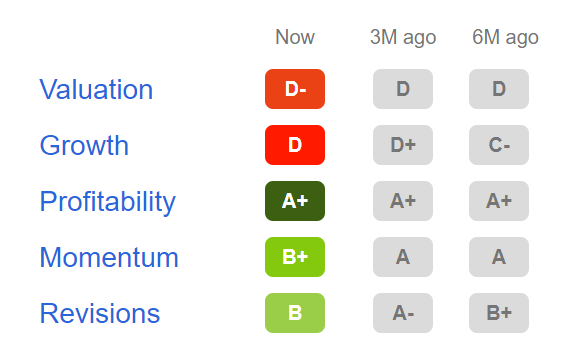

According to the Seeking Alpha’s Factor Grades, Coca-Cola is rated with a D- in terms of Valuation. For Growth, the company gets a D. In terms of Profitability, it’s rated with an A+. For Momentum, the company receives a B+ rating, and for Revisions, a B.

Source: Seeking Alpha

Coca-Cola According to the Seeking Alpha Quant Ranking

Considering the Seeking Alpha Quant Ranking, Coca-Cola is ranked 5th (out of 16) within the Soft Drinks Industry and 47th (out of 187) within the Consumer Staples Sector.

Source: Seeking Alpha

The Seeking Alpha Quant Ranking reinforces the theory that Coca-Cola can be considered as attractive when compared to its competitors.

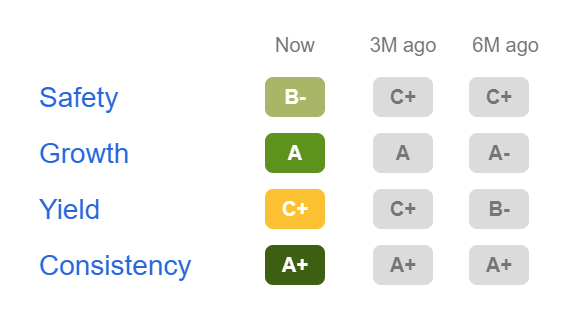

Coca-Cola According to the Seeking Alpha’s Dividend Grades

According to the Seeking Alpha Dividend Grades, Coca-Cola is rated with a B- in terms of Dividend Safety and an A in terms of Dividend Growth. For Dividend Yield, the company gets a C+ rating and for Dividend Consistency an A+.

Source: Seeking Alpha

The fact that Coca-Cola has increased its dividend for decades in a row, underlines the strength of its dividend. Coca Cola’s excellent rating from the Seeking Alpha Dividend Grades, strengthens my opinion that the company is an excellent choice for dividend income investors who are investing for retirement.

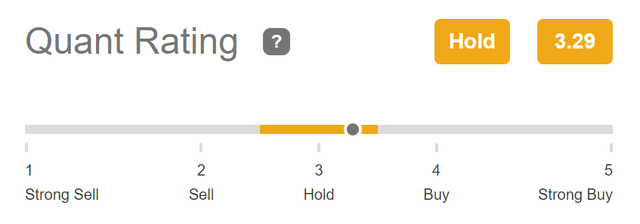

Coca-Cola According to the Seeking Alpha Quant Rating

According to the Seeking Alpha Quant Rating, Coca-Cola currently receives a hold rating.

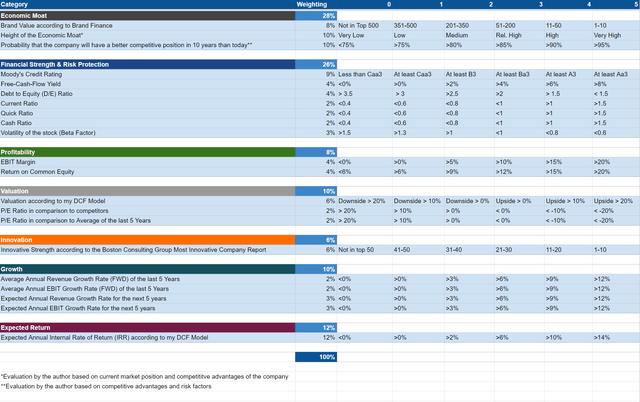

The High-Quality Company [HQC] Scorecard

“The HQC Scorecard aims to help investors identify companies which are attractive long-term investments in terms of risk and reward.” Here, you can find a detailed description of how the HQC Scorecard works.

Overview of the Items on the HQC Scorecard

“In the graphic below, you can find the individual items and weighting for each category of the HQC Scorecard. A score between 0 and 5 is given (with 0 being the lowest rating and 5 the highest) for each item on the Scorecard. Furthermore, you can see the conditions that must be met for each point of every rated item.”

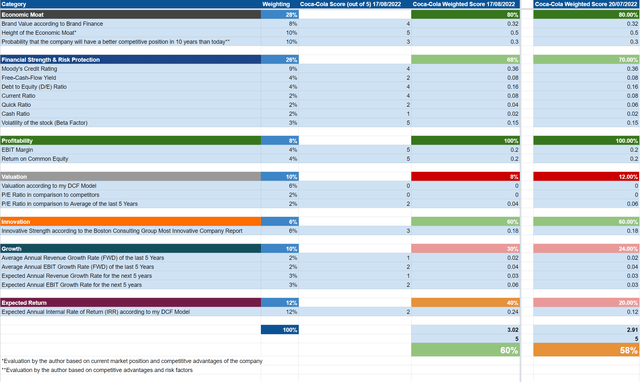

Coca-Cola According to the HQC Scorecard

According to the HQC Scorecard, Coca-Cola’s overall score is 60 out of 100 points. This means the company can be classified as an attractive investment in terms of risk and reward.

The HQC Scorecard indicates that Coca-Cola is rated as very attractive in the categories of Profitability (100/100) and Economic Moat (80/100), and attractive for Financial Strength (68/100) and Innovation (60/100). Furthermore, Coca-Cola is rated as moderately attractive in the category of Expected Return (40/100). For Valuation (8/100), it is rated as very unattractive.

When I wrote about Coca-Cola back in July, the company only had a moderately attractive rating in terms of risk and reward (58/100) as according to the HQC Scorecard. The reason why its rating is higher today is due to the fact the company shows slightly higher growth expectations (underlined by raising its future organic growth revenue guidance during the 2Q22 results presentation). Therefore, this has resulted in higher ratings for the categories of Growth and Expected Return.

The fact that this overall scoring as according to the HQC Scorecard has changed from only moderately attractive to attractive in terms of risk and reward contributes to my updated rating on the Coca-Cola stock: while rating Coca-Cola as a hold back in July, I have now altered my rating to a buy.

Risk Factors

In my opinion, one of the main risk factors for Coca-Cola would be a damaged brand image. In this case, it would affect the financial results of the company and its profit margins could decline significantly.

Another risk factor I see is the fact that the company only operates in the Soft Drinks Industry, which limits its growth perspectives. For example, Coca-Cola’s competitor PepsiCo (NASDAQ:PEP) has a much broader product portfolio by operating not only in the Soft Drinks Industry but also in the Snack and Food Businesses Industry.

Another potential risk factor for Coca-Cola is that its dividend could be cut. If this happens, it could adversely affect the company’s stock price. However, due to its current payout ratio of 70.49% as well as its Average EPS Diluted Growth Rate [FWD] of 4.52% over the last 5 years, I don’t expect this to occur in the near future. Therefore, I believe the risk of investing in Coca-Cola is relatively low. This theory is also underlined by the company’s results as according to the HQC Scorecard, where it’s rated as being attractive in terms of risk and reward.

The Bottom Line

I consider Coca-Cola to be an excellent choice when looking for a dividend income stock that contributes to the risk reduction of your investment portfolio (Coca-Cola has a 60M Beta of 0.54) and when investing for retirement. I expect the company to grow its dividend between 3% and 4% per year on average over the long term (which is underlined by Coca-Cola’s Average EPS Diluted Growth Rate [FWD] of 4.52% over the last 5 years).

Coca-Cola’s strong competitive position is underlined by the results of the Seeking Alpha Quant Rating: it is ranked 5th (out of 16) within the Soft Drinks Industry and 47th (out of 187) within the Consumer Staples Sector.

Furthermore, the results of the HQC Scorecard show that Coca-Cola is rated as attractive in terms of risk and reward. The company scores 60 out of 100 points according to the Scorecard: Coca-Cola shows excellent results in the categories of Profitability (100/100) and Economic Moat (80/100) and is rated as attractive in the categories of Financial Strength (68/100) and Innovation (60/100).

I rate Coca-Cola as a buy: the company has a wide economic moat; enormous financial strength and profitability and its management has recently confirmed their optimism regarding the company’s future organic growth guidance.

Be the first to comment