audioundwerbung/iStock via Getty Images

Note:

I have covered Plug Power (NASDAQ:PLUG) previously, so investors should view this as an update to my earlier articles on the company.

After the close of Tuesday’s session, Plug Power reported just another set of abysmal quarterly numbers as the company’s core material handling business remains an unmitigated disaster.

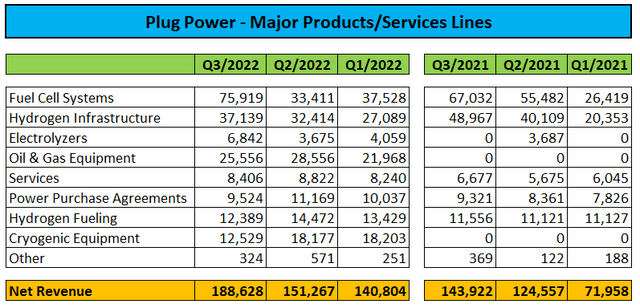

Core Business Down Year-Over-Year

Revenue and earnings per share missed consensus expectations by a mile, while GenDrive shipments decreased by approximately 23% year-over-year and hydrogen infrastructure installations lower by almost 20%.

Thanks to an improved product mix, material handling product revenues decreased just slightly relative to Q3/2021.

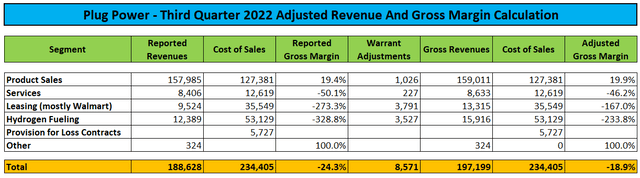

Poor Gross Margin Performance

Even when adjusting for $8.6 million in warrant charges mostly related to the recent green hydrogen supply agreement with Amazon (AMZN), consolidated gross margin showed very little sequential and year-over-year progress.

Please note that in Q3, Plug Power released another $9.6 million from the so-called “loss accrual for services” established last year to reserve for anticipated, massive losses in the service business going forward. Adjusted for the release, service gross margins would have been negative 164.1%, essentially in line with last quarter.

The lack of tangible progress in service margins is also visible in the company’s leasing business which the company labels “Power Purchase Agreements” or “PPAs.” As accounting rules do not permit upfront loss recognition on service contracts attached to leased equipment, the segment’s poor gross margin performance continues to reflect the true state of the company’s service business.

Aggressive Q4 Projections

After missing Q3 consensus estimates by a mile, Plug Power will require Q4 revenues to increase by at least 75% sequentially to reach the very low end of its recently revised full-year projections.

On the conference call, management projected Q4 product sales to approximately double quarter-over-quarter which would be sufficient to achieve the mid-point of the revised range.

Unfortunately, management remains notorious for its constant pattern of over-promise and under-deliver so investors should take these statements with the usual grain of salt.

Missing Out On Electrolyzer Shipment Targets

For example, in July, CEO Andy Marsh claimed 200MW in electrolyzer shipments for 2022. On the Q2 conference call in August, he projected $140 million in electrolyzer shipments for the second half of this year but in the Q3 investor letter, the company only refers to being “on track to produce 60 to 100 MW of electrolyzer stacks in Q4/2022” without providing any sort of shipment guidance. But even when assuming:

- Q4 electrolyzer production at the high end of the range

- all electrolyzers being sold to third parties

- timely shipment

- timely revenue recognition,

the company’s Q4 electrolyzer revenues would likely still be a fraction of the $140 million projected by management just three months ago.

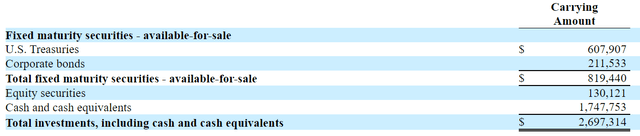

Cash Usage and Liquidity

Negative free cash flow for the quarter was close to $300 million, but at the end of Q3, Plug Power still had approximately $2.7 billion in unrestricted cash and available-for-sale securities:

Assuming the company using $200 million in the current quarter and another $1.5 billion next year, liquidity would be down to approximately $1.0 billion by the end of 2023.

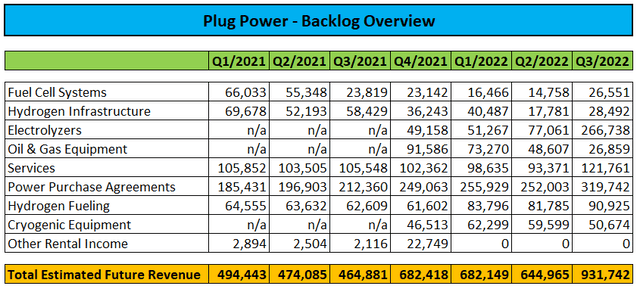

Strong Backlog Increase

That said, not everything was bad about Plug Power’s third quarter as the year-over-year decline in the core material handling business wasn’t as pronounced as in Q2.

In addition, the company managed to increase backlog by almost 45% sequentially to $931.7 million mostly driven by electrolyzer bookings soaring from $77.1 million at the end of Q2 to $266.7 million.

The increase was likely driven by a large order received from New Fortress Energy (NFE) related to its proposed green hydrogen plant in Beaumont, Texas.

Key Green Hydrogen Project in Limbo

Unfortunately, there’s still a huge mismatch between the backlog number provided in the company’s quarterly report on form 10-Q and the 1,5 GW electrolyzer backlog celebrated by management in the investor letter which would translate to approximately $750 million in revenues using Morgan Stanley’s (MS) most recent assumptions.

The eye-catching difference is likely caused by the ongoing lack of a final investment decision for H2 Energy Europe’s proposed 1GW green hydrogen plant in Esbjerg, Denmark.

At this point, the project is unlikely to proceed due to lack of renewable energy supply and required pipeline infrastructure.

Even in case the Danish government sanctions additional offshore wind tenders and pipeline construction in the very near term, required infrastructure won’t be operational before 2026 according to Peter Kristensen, head of strategy and development of state-owned gas supplier Evida.

Original Green Hydrogen Production Targets To Be Missed

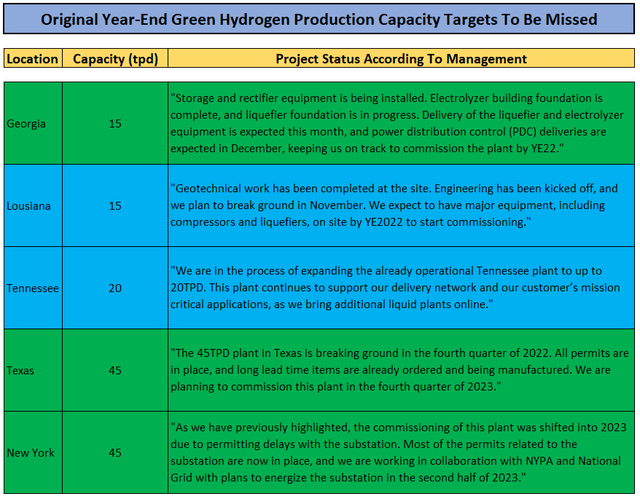

Management also provided an update on its hydrogen plants currently under construction:

Remember that only the plants in Georgia, Texas and New York will actually produce green hydrogen while the facilities in Tennessee and Louisana will utilize byproduct hydrogen from strategic partner Olin (OLN).

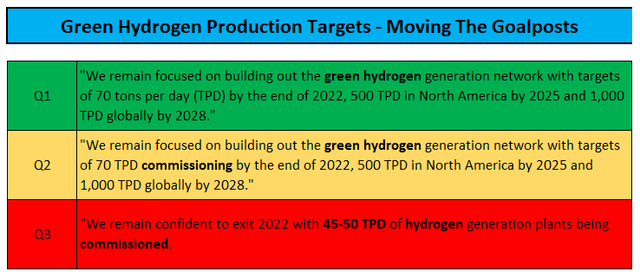

Please see below how management has moved the goalposts on its targeted production capacity over the course of the year:

On Plug Power’s Q1 conference call, CEO Andy Marsh projected 70 tons per day of green hydrogen production capacity at year end. On the Q2 call, the target was watered down to “commissioning 70 tons of green hydrogen in 2022.“

On the company’s annual symposium last month, the target was reduced to “about 50 tons of commissioning this year” while Tuesday’s investor letter states “We remain confident to exit 2022 with 45-50 TPD of hydrogen generation plants being commissioned.“

Investors should particularly note the absence of “green” in the latest update.

In layman’s terms: Plug Power is likely going to end 2022 with a paltry 2.5 tons per day of green hydrogen production at its Georgia plant as compared to 70 tons projected by management at the beginning of the year.

Bottom Line

More of the same at Plug Power with management touting the company’s future prospects while the core material handling business remains a mess.

In addition, the company’s much-touted transformation hasn’t played out as projected by management so far as the company will miss its targets for both electrolyzer shipments and year-end green hydrogen production capacity by a mile.

While backlog was up substantially quarter-over-quarter, there’s still a huge delta between the 1.5 MW claimed by management in the investor letter and the actual bookings number disclosed in the company’s regulatory filings.

Given ongoing execution issues, it’s difficult to envision Plug Power coming even close to management’s 2023 projections of $1.4 billion in revenue and the company exiting the year at an operating break-even margin run rate.

Investors should remain on the sidelines until Plug Power Inc. finally starts hitting the aggressive targets provided by management on an ongoing basis.

Be the first to comment