Adene Sanchez

Investment Summary

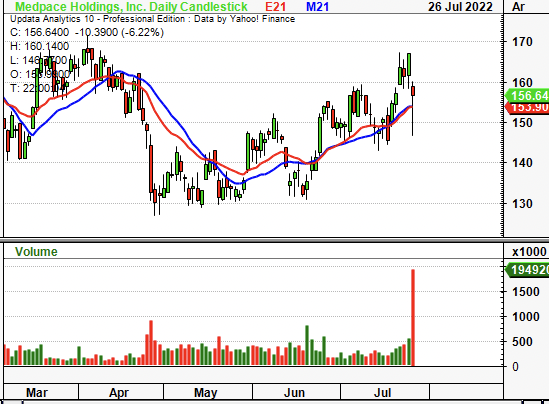

Medpace Holdings, Inc. (NASDAQ:MEDP) reported Q2 FY22 earnings yesterday with a solid beat throughout the P&L. We remain bullish on MEDP shares and note the stock has caught a bid since late June whilst strengthening against peers within the sector.

We note MEDP displays a number of desirable characteristics amid the current macro-landscape, and this most recent set of earnings adds further bullish weight to the risk/reward calculus. In particular, the company is a long-term cash compounder that is growing return on capital geometrically on an annual basis. Rate buy, PT $171.

Exhibit 1. MEDP 6-month price action

Data: Updata

Q2 earnings illustrate fundamental momentum

Q2 results came in strong with upside on revenue and operating income. Revenue came in strong at ~$351 million, ~26% YoY growth schedule. New business awards in Q2 was up 16% YoY and landed at $450 million. Net-net, this results in a book to bill of ~1.3. Moreover, ending backlog at the exit of Q2 was ~$2.2 billion, representing a ~24% YoY increase. As a potential tailwind, management expect ~$1.15 billion ($35/share) of this backlog to convert to the top-line within the next 12 months, which would be ~52%, slightly behind with Q2 conversion of ~17%.

The 26% gain at the top-line came through to a 17.1% quarterly operating margin (~$2.70/share), in line with Q2 FY21 down ~210bps sequentially. Capital expenditures were also in line with long-term averages at ~$15 million whilst MEDP printed $135 million ($4.35/share) in CFFO this quarter, a 65% YoY gain. As a result, the company pushed ~$120 million (~$3.88/share) in FCF below the bottom line, a gain of more than 62% YoY and 34% of turnover. Investors now realize a 4.5% FCF yield on this

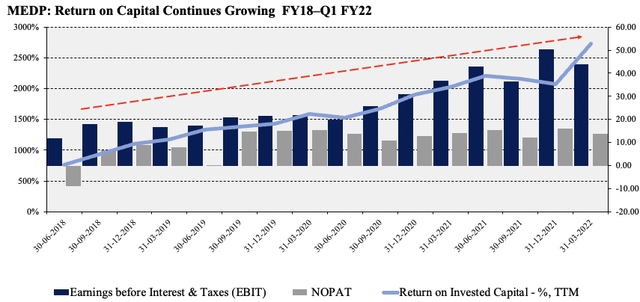

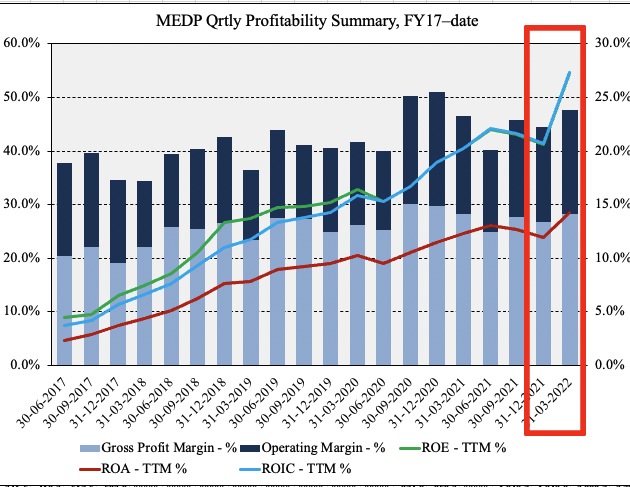

Moreover, MEDP is what we define as a long-term cash compounder, consistently generating a return on capital that beats the hurdle. It was no different this quarter, with ROIC surpassing 30% from net operating profit after tax (“NOPAT”). Here we examined how much NOPAT is generated from last year’s invested capital from FY18–to date on a sequential basis. As observed in Exhibit 2, MEDP has consistently grown the return on its investments in near-linear fashion. This is incredibly important, as it has a relatively high WACC of ~14.8%. Hence, the ROIC/WACC ratio is 2.02. This demonstrates superb capital management, and is a factor investors are paying a premium for in FY22.

Exhibit 2.

Data: HB Insights, MEDP SEC Filings Data & Image: HB Insights, portfoliovisualizer

In addition, MEDP continued to reward shareholders in completing its buyback program. It repurchased ~3 million shares at an average price of $137.86. It repurchased 5.5 million shares this YTD, representing ~15% of common stock outstanding at the end of 2021. It now has no share repurchase authorization remaining.

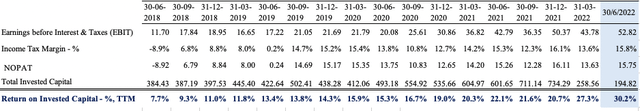

Profitability continues to support such capital management initiatives, as seen in Exhibit 3. With both ROA and ROIC ticking upwards, MEDP has ample opportunity to redistribute surplus capital to shareholders in further buybacks and such. It also presents with a resiliency quality, one very clear factor we are chasing in FY22.

MEDP therefore brings a great deal of fundamental momentum to the table. Management now expect full-year revenue growth of ~25%, calling for $1.4–$1.435 billion at the top. It also expects ~$280 million in GAAP EBITDA at the upper end and EPS of ~$6.07–$6.36.

Exhibit 3. MEDP delivers above-average quarterly profit numbers, continues to drive profitability higher

Data: HB Insights, MEDP SEC Filings

One headwind from the quarter was and continues to be initial award notifications. This is a term defined by CEO August Troendle, referencing the 2nd step in new business opportunities in the industry. Per Troendle on the call:

“Step two I’m going to call is the winning CRO is given an award notice, and I’m going to call this an initial award notification… If I look at step two, initial award notifications, our initial award notifications are down in Q2 meaningfully, they’re down 45% year-on-year, and 42% sequentially. So, they’re substantially down and, however, on the other hand, July initial award notifications have recovered quite a bit and look to be tracking more in line with the prior 12-month average. And we’re hopeful that the marked weakness seen in Q2 is not lasting.”

The headwind is specifically to do with new business flow into MEDP’s pre-bookings ‘bucket’. The company has seen ~45% reduction in YoY flows into this segment that has not yet advanced into the backlog. Hence, management note this could be a reflection of funding weakness in the industry.

Valuation

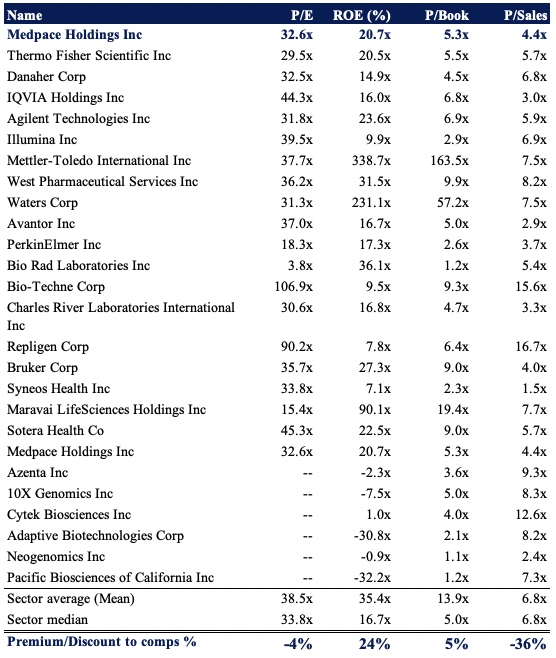

Shares are trading at 5.3x book value and come in at ~33x trailing P/E. Investors are also paying ~4x sales and the stock is priced at 40x FCF. MEDP is priced at a premium to GICS industry peers across key multiples, as seen below. With quality names such as Avantor Inc. (AVTR) and Thermo Fisher (TMO) at ~5x book value, it doesn’t scream relative value.

Exhibit 4. Multiples and comps

Data: HB Insights

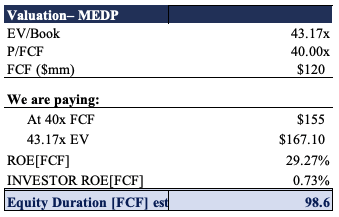

We are in the search for long-term cash compounders and must analyze MEDP from this perspective. In that vein, at 40x P/FCF we would theoretically be paying $155, leading us to believe there could be upside potential to be realized. Whilst this is a small price asymmetry, it also illustrates the stock could be trading at a discount to cash-based valuation measures, as seen below. This sees us price MEDP at $157 on this level.

Exhibit 5. MEDP mispricing to the upside, ~$1 value gap on FCF-based valuation

Data: HB Insights Estimates

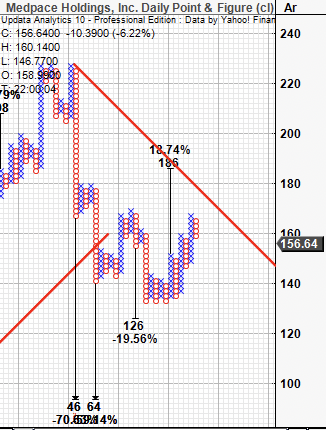

From the price action observed in Exhibit 6, shares are now drifting north and heading towards a long-term resistance level. The culmination of upthrusts from lows in H1 FY22 sees a cluster of upside targets to $186 per share. Price action is therefore bullish towards this target, in our estimation.

Exhibit 6. Multiple upside targets pointing to objective price target of $186

Data & Image: Updata

Combining both measures on an equal weighted basis, this sees us price MEDP at $171. Whilst this is below the 20% threshold we are seeking, we note this is still $15 per share in potential upside capture to consider.

In Short

After a robust set of Q2 FY22 earnings, MEDP looks on pace to deliver outsized return. Findings from this examination illustrate MEDP presents with premia investors are paying a premium for this year. We are attracted to the company’s fundamental momentum, particularly its long-term cash compounding ability. Moreover, it consistently generates a high return on its invested capital and attractive profitability statistics.

Moreover, we feel there is a mispricing opportunity to be realized, with a potential value gap of ~10% to the upside. Whilst this is below our threshold of safety margin, this still offers ~$15 per share in upside capture. With the culmination of these factors in mind, we rate MEDP a buy.

Be the first to comment