JHVEPhoto

Introduction

Newell Brands Inc. (NASDAQ:NWL) is a company comprised of some of the United States’ most iconic home goods brands. Over the past few years, the business has been in the process of restructuring the company to enhance growth and profitability potential. Newell has tried to rid itself of non-performing or non-conforming brands to rein in operations.

In 2021, it seemed the turnaround was happening, but so far in 2022, that business has struggled with inflation and lower demand. At 9.5x earnings and a dividend yield over 7%, Newell does offer a fair value for a business that needs more consistent results to prove the turnaround is working.

Restructure & Rebound

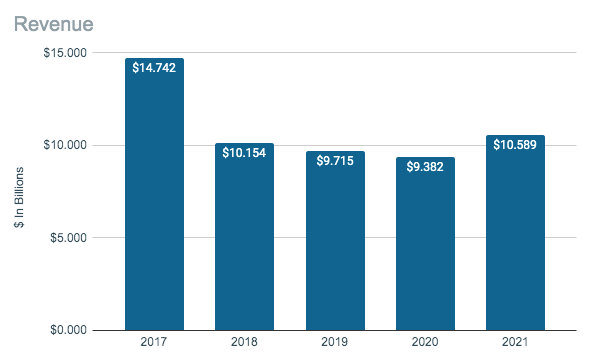

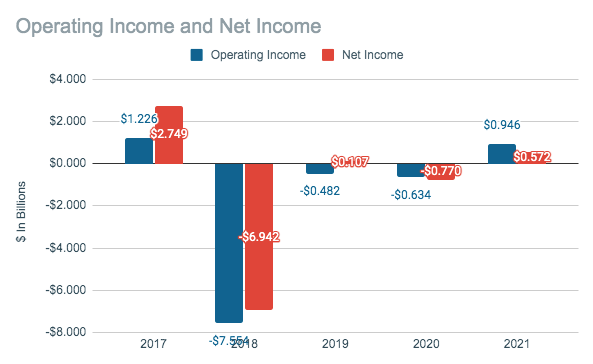

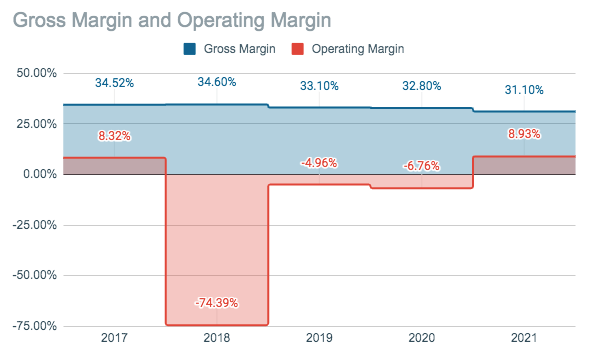

Newell Brands Revenue (SEC.gov) Newell Brands Operating & Net Income (SEC.gov) Newell Brands Margins (SEC.gov)

Newell Brands has seen a full reset over the past few years. The company has been making key divestitures and restructuring in hopes of achieving better growth and profitability. And looking at revenue, it seems this has started to happen in 2021. Revenue from 2017 to 2020 declined by 36.36% overall, but from 2020 to 2021, revenue finally grew by 12.8%. This is a great sign and a good showing of turnaround.

Looking at the past five years of operating and net income shows a similar trend. In the first four years, Newell Brands saw operating and net income decrease by 152% and 128% each. But again, in 2021, each has rebounded, sitting at $946 million and $572 million. This is close to the levels of 2017, and the operating margins are now just 61 basis points larger than in 2017. Overall a good showing for the year.

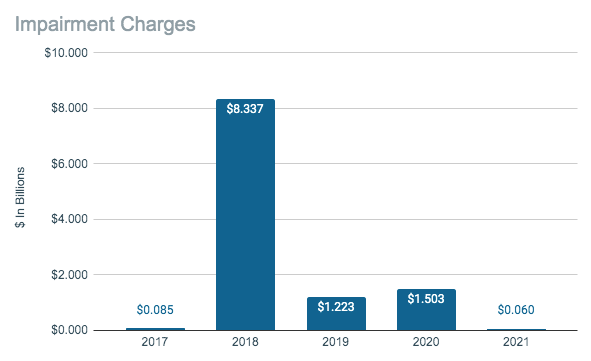

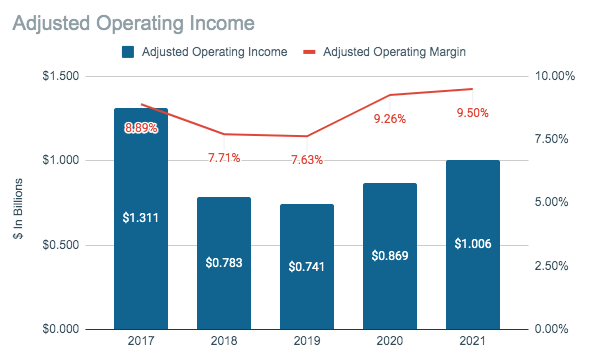

Newell Brands Impairment Charges (SEC.gov) Newell Brands Adjusted Operating Income (SEC.gov)

While the costs of restructuring, divesting, and impairment are very real, they tend to muddy the true operational financials per year. Adjusting out the large impairment costs Newell has posted in the past shows a much better view of actual results from operating the business. What can be seen is that the business posted adjusted operating income each year but also did see a 44% decline until 2020. This shows the rebound started a year earlier in 2020, and operating efficiency has increased by operating margins of over the 8.89% in 2017.

Again, impairment costs are very real and show the failure of bad purchases and forecasting on the company’s part. But with restructuring, I think it is fair to say we need to look more into the existing operations and future, which is looking brighter.

This Year So Far

Now with three quarters posted for the year 2022, has Newell continued this performance? It seems operations have softened a bit with the large increases in inflation. Revenue for the nine months is down 7.8%, with operating and net income down 26.9% and 1.5%. The operating margin looked a lot weaker at just 7.9%, but much of this was due to impairment charges of $148 million. Adjusting out this cost the operating margin matched last year’s 10%.

Each segment saw significant revenue declines. Commercial Solutions declined by 7.9%, Home Appliances by 17.2%, Home Solutions by 9.2%, Learning & Development by 2.7%, and Outdoor & Recreation by 6.4%. Overall it looks like Newell increased pricing to match the inflationary cost, as can be seen in the steady margins, but the result was softer demand for the products and resulting lower revenue. This is not the greatest result you want to see for a rebounding business.

Balance Sheet

Newell has a solid balance sheet with good liquidity and a low debt load. The current ratio sits at 1.25x, and the quick ratio is at 0.63x. The company also has an inventory turnover of 4x. Altogether pretty good liquidity and the ability to pay off short-term debts. The debt-to-equity ratio is also rather low at 2.89x and a times interested earned ratio of 3.7x, showing the ability to service debts. While the income statement didn’t meet expectations this year so far, the balance sheet is very stable.

Valuation

As of writing, Newell trades at the $15 price level. At this level, the stock trades at a P/E of 9.5x using the 2022 EPS estimate of $1.58. Also, the company trades a P/BV of 1.66x. Newell also offers a dividend yield of 7.31% and a payout ratio of around 58%. Overall, the business seems to be fairly valued, with a lower P/E and P/BV, as investors await more consistent rebound results. The company also offers a high dividend yield that has the potential to grow along with rebounding earnings. At 9.5x earnings, Newell seems to be at fair value.

Conclusion

Newell Brands has a portfolio of some stable home goods brands and has divested some non-performers over the last five years. This was all to enhance growth and profitability, which seemed to start to happen in 2021. That being said, 2022 is showing a business that is struggling with inflation and demand, but the margins are still intact. Trading at a 9.5x P/E and with a dividend yield of over 7%, Newell Brands could be a good buy if you believe the turnaround will result in consistent results over time.

Be the first to comment