adaask

Both STORE Capital (NYSE:STOR) and National Retail Properties (NYSE:NNN) have investment-grade credit ratings with impressive dividend growth track records, vaulting them into the upper echelon of quality REITs. Given that they also offer attractive current dividend yields and boast highly defensive business models, they are particularly intriguing investments during this period of high inflation and growing recession risk.

In this article, we will review their Q2 results and then compare them side by side and offer our take on which one is a better buy.

Q2 Results

STOR’s Q2 results prompted management to raise guidance by 2% on the strength of 16% year-over-year AFFO per share growth in Q2 and over 19% AFFO-per-share growth year-to-date. The CEO highlighted the company’s strong acquisition volume as being one of the key drivers of its strong growth performance, stating:

Our momentum continued into the second quarter as we acquired $392M in profit center real estate, while at the same time driving higher cap rates and lease escalations

Meanwhile, NNN saw its AFFO per share grow by over 5% year-over-year in Q2 and by 4.5% year-to-date. It also maintained a 14.2-year weighted average remaining debt maturity schedule, illustrating just how conservatively positioned the REIT is to weather any economic headwinds moving forward as well as the fact that it should not be impacted negatively by rising interest rates as much as some of its peers.

Business Model

Both businesses have generally identical conservative business models in that they both purchase and then rent out commercial real estate under multi-decade triple net lease terms that generally include fixed annual rent bumps.

For example, STOR’s portfolio provides real estate to 573 customers across 121 industries. STOR targets non-investment grade tenants so that it can generate greater returns on investment while picking properties that provide strong unit-level profitability and rent coverage in order to mitigate downside risk.

NNN’s portfolio, meanwhile, services 370 customers and also targets non-investment grade tenants in a manner similar to STOR. A specific reason why NNN does this is because they have typically found that tenant credit quality changes over the course of a lease, while the lease terms remain fixed. As a result, NNN has found that lease terms are often a more reliable predictor of total return generation than tenant credit quality at the outset of the lease.

Balance Sheet

As was already stated, both STOR and NNN have investment-grade credit ratings, though NNN’s (BBB+) is one notch better than STOR’s (BBB).

NNN’s biggest focus is on minimizing dependence on capital markets to run the business and it also prioritizes having the liquidity necessary to react opportunistically to market downturns. Finally, NNN prioritizes minimizing its cost of capital in order to maximize the profitability of its investments as at its heart, triple net lease real estate is about maximizing the spreads on investments.

Some of the top strengths of NNN’s balance sheet at the moment are its aforementioned 14.2-year weighted average debt maturity term as well as the fact that 99.8% of its assets are unencumbered. The REIT has $1.2 billion in debt that does not expire until 2050 or later at a weighted average interest rate of 3.21%, giving it access to a substantial amount of very cheap capital for a very long time to come. Given that its market cap is currently just $8.4 billion, NNN will be able to significantly juice the returns on shareholder equity with that low interest rate long-term debt.

STOR’s balance sheet is also in excellent shape with hardly any debt maturities in 2022 or 2023, very strong interest coverage, and a reasonably low debt to EBITDA ratio. In fact, its BBB rating comes with a positive outlook, so it is very possible that it will get upgraded to BBB+ in the not-too-distant future.

Dividend Safety

Both businesses boast very safe dividends. Thanks to their strong balance sheets, neither should be pressed into slashing their dividend due to liquidity concerns, and their very stable cash flowing business models should enable them to continue covering their dividends for years to come, especially given that their payout ratios are quite conservative at 68% (for NNN) and 70.5% (for STOR).

Track Record

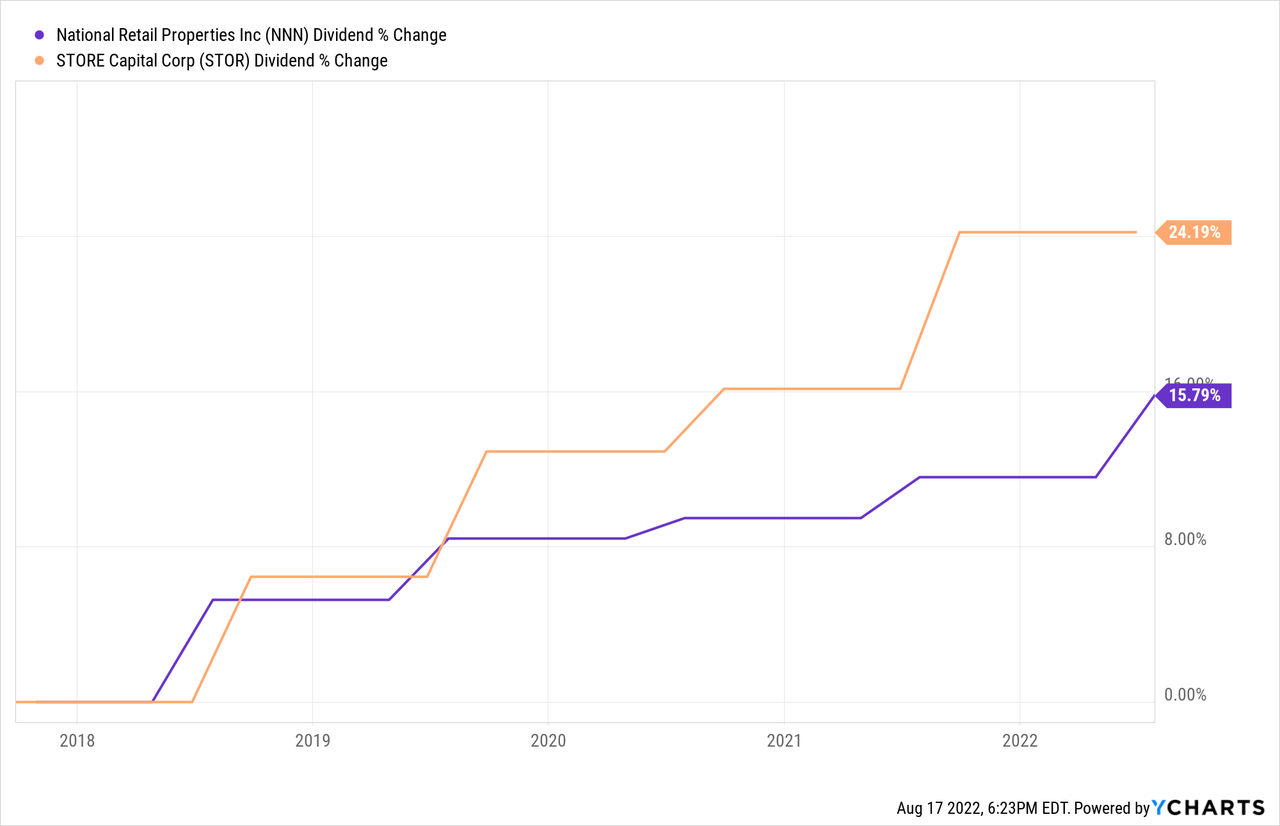

NNN has been around for considerably longer than STOR and as a result has built up an impressive dividend growth track record of 21 years compared to STOR’s of just 8 years. However, since STOR has gone public, it has grown its dividend at a much faster pace, including over the past five years:

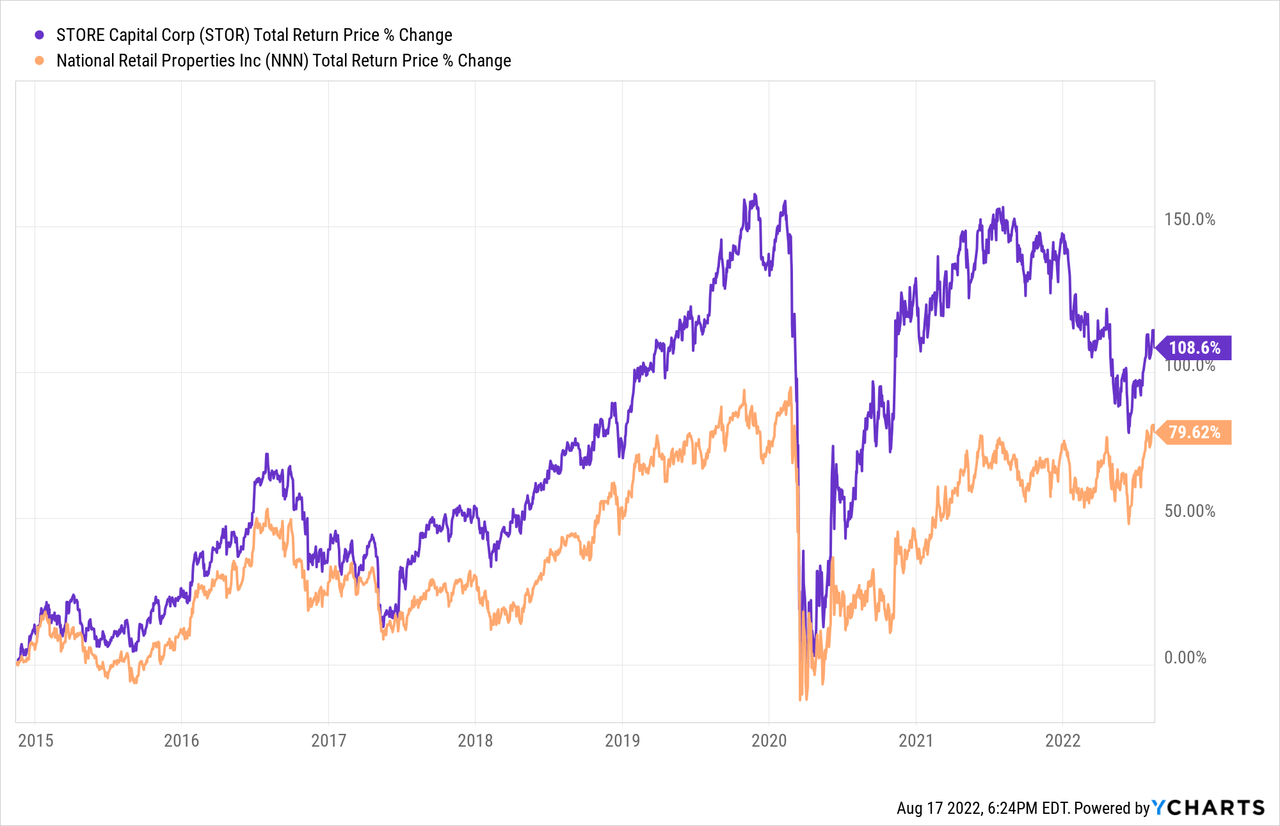

Overall total returns have also favored STOR over time, indicating that thus far its model is superior:

Catalysts And Risks

Both STOR and NNN face the same catalysts and risks. As triple net lease REITs with minimal exposure to CPI-linked rent bumps, they are often viewed as bond-proxies and therefore very sensitive to inflation and rising interest rates, at least in the short-term. However, over the long term, they hold up better than bonds because they reinvest cash flows into new properties typically every year and cap rates tend to rise whenever interest rates and/or inflation rates rise, thereby helping to offset some of the headwinds.

Meanwhile, strong catalysts for these stocks would be falling inflation and/or interest rates and they are both positioned to outperform most other REITs in the event of the economy stumbling into a recession.

Valuation

Here is a side-by-side comparison of the two businesses based on several valuation metrics:

| NNN | STOR | |

| EV/EBITDA | 17.13x | 14.97x |

| EV/EBITDA (5-Yr Avg) | 17.58x | 16.66x |

| P/AFFO | 14.90x | 12.91x |

| P/AFFO (5-Yr Avg) | 16.02x | 15.50x |

| P/NAV | 1.05x | 1.01x |

| P/NAV (5-Yr Avg) | 1.06x | 1.15x |

| Dividend Yield | 4.6% | 5.4% |

Overall, STOR looks to be the clear winner in terms of cheaper valuation, as it is also trading at a larger discount to its historical average EV/EBITDA, P/AFFO, and P/NAV multiples than NNN is, despite recently increasing its AFFO per share guidance for the year and outperforming NNN since inception. That said, NNN also remains an attractive value relative to its historical value.

Investor Takeaway

Both NNN and STOR offer investors similar investment theses: investment grade balance sheets and high-quality triple net lease real estate portfolios with strong track records of delivering reliably strong dividend growth. On top of that, both are undervalued at the moment.

While NNN does look to be a little bit lower risk largely due to its vaunted balance sheet, STOR also has a strong balance sheet and is clearly cheaper at the moment. As a result, we rate STOR a Strong Buy and NNN a Buy.

Be the first to comment