tuachanwatthana/iStock via Getty Images

Thesis

Overview

We believe CECO Environmental (NASDAQ:CECE) is one of the most compelling turnaround stories in the small-cap universe. It is led by an excellent management team with a focus on margin expansion, accretive M&A, and building out the business lines where secular tailwinds are abound. For investors new to CECE, it had previously been plagued by past management mistakes such as botched acquisitions and focusing too much on cyclical, low margin, and slowing business lines. Even though the culprits of the past are no longer in the picture, with a refresh across the c-suite having hired new CEO, CFO, COO, CSO, and CLO in the past 2 years, the market has yet to fully price in these major changes that CECE has undergone and the runway for growth they have. We believe that over the coming quarters as CECE continues to execute on its strategic plans market participants will wake up to the transformational turnaround and the stock will move up accordingly.

Our thesis on CECE can be sliced into these five buckets:

- Business transition from cyclical, long-cycle projects to secular growth shorter-cycle projects.

- New management team with excellent sector experience that are well aligned with shareholders.

- Margin expansion and profitable double-digit growth for the next several years.

- Recession resilient business.

- Increased attention to the stock through future index inclusion and expanded Wall Street coverage.

CECE is in an interesting spot where its ability to execute has been proven; yet the realization of this by the market is still in the early innings. Along with this, there are still many levers for CECE to pull going forward to grow and further this turnaround. With all this in mind, we believe CECE is a strong buy. We have a price target of $21.50 which is based on a 14x EV/EBITDA multiple on our 2023 estimates.

Business Transition

CECE was previously predominantly focused on cyclical long-cycle projects that were very hard to predict and replicate. Also, under previous management, there was a particular focus within the energy sector, leading to having roughly 70% of CECE’s revenue stemming from long-cycle energy projects. This focus was the main factor in the stock’s decline in the years leading up to the hiring of Todd Gleason in June 2020.

Since joining CECE, Mr. Gleason has led an impressive transformation that has seen revenue growth, margin expansion, diversification of revenue, successful M&A, and new shareholder return programs. This transformation has been centered around CECE’s new focus on the serving the Industrial Air and Water sectors. These sectors are seeing powerful secular tailwinds as both governments and businesses look too make these historically pollutive industries more environmentally friendly, this is where CECE steps in. CECE’s high quality products provide a vast array of solutions for their customers such as; filters, water pumps, dust collectors, storm water expansion joints, ducts, and liquid separation units. Another advantage of focusing on Industrial Air and Water projects is they are a much shorter cycle then CECE’s previous focus, Energy. Along with this, these projects provide higher margins and more visibility on future revenues as parts are replaced at a much higher frequency. We believe these secular tailwinds afoot will continue to spur spending in the end markets that CECE serves. Along with this, we believe that the new emphasis of on-shoring supply chains will also serve a catalyst for CECE’s growth, as more industrial plants are built in the United States.

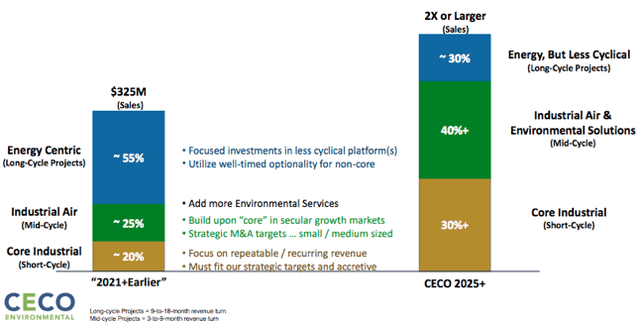

The focus on serving the Industrial Air and Water sectors has led to stellar revenue growth and margin expansion, most recently highlighted by 1H 22′ revenue growth of 31% and EBITDA margin expansion of 160bps. We also note that management called out EBITDA margins would have been even better if gross margins hadn’t been affected by higher wages and raw material costs. CECE has laid out their target goals for 2025, which perfectly highlight their focus on diversification of revenue,

CECE 2025 Targets (CECE Investor Relations)

Led by Mr. Gleason, CECE has begun to execute on their plan of M&A in order to vertically expand their product portfolio, increase their shorter cycle sales mix, and become a one-stop shop for all industrial environmental needs. This begun with the March 2022 acquisition of GRC, which added expansion joints and flow control products to CECE’s portfolio. CECE has followed this up with the acquisitions of Western Air, Index Water, and Compass Water Solutions. All these acquisitions were with a focus on expanding the Industrial Air and Water businesses lines along with targeting high-teen EBITDA margin businesses. The acquisitions also opened the door to new markets for CECE to cross sell into. For example, the acquisition of Compass Water gave them Coast Guard approved wastewater treatment products, which would have taken years to achieve otherwise. The new certification gives CECE the opportunity to enter into a new market and the excellent opportunity to cross-sell. These accretive acquisitions we believe will be a major spur to future growth, as they increase the ability for CECE to cross-sell along with the ability to take a larger share of the dollars spent on projects where they are already a supplier.

CECE initiated the first share buyback program in the company’s history back in August of 2021 that authorized the repurchase of $5M worth of stock. More recently, with the announcement of 1Q earnings, CECE installed another repurchase program for $20M. As of their 2Q report they had exercised $4.3M at an average price of $5.96, which looks very smart with the stock currently trading at $9.56. We believe that share buyback programs will continue to be a way CECE further enhances shareholder returns.

New Management

CECE has undergone one of the most aggressive refreshes of c-suite level management that we have seen in the small-cap space in recent memory. In the two years since Mr. Gleason became CEO, CECE has also brought on a new CFO, COO, CSO, and CLO in addition to other new key business unit managers below the c-suite level. The key theme throughout these new hires is their extensive experience in growing businesses lines and M&A specifically within the industrial sector, two major keys of CECE’s future plans. We also call out that management’s financial interests are very aligned with shareholders with 16% insider ownership and significant insider buying recently. However, more specifically, we call out that Mr. Gleason chose to take 70% of his compensation in stock, including a large amount of options with a strike price of $12.72.

Todd Gleason, CEO – Previous to joining CECE in July 2020, Mr. Gleason was in Venture Capital with DARI Motion acting as an operating partner, with his most recent role as the CEO of portfolio company Scientific Analytics. Prior to his time in VC, Mr. Gleason served from June 2007 to March 2015 in a number of senior officer and executive positions for Pentair (PNR), a water treatment company. During his tenure, Mr. Gleason served as Senior Vice President and Corporate Officer from January 2013 to March 2015, President, Integration and Standardization from January 2010 to January 2013, and Vice President, Global Growth and Investor Relations from June 2007 to January 2010. During his time at PNR he oversaw the growth of revenue from $3B to $8B and a market capitalization of $3B to $16B. Before joining PNR, Mr. Gleason served as Vice President, Strategy and Investor Relations for American Standard Companies Inc. (later renamed to Trane Inc.), a global, diversified manufacturing company, and in a number of different roles (including as Chief Financial Officer of Honeywell Process Solutions) at Honeywell (HON). Mr. Gleason holds a master’s degrees in Management and Public Policy from Carnegie Mellon University. He also has his Six Sigma Black Belt.

Ramesh Nuggihalli, COO – Mr. Nuggihalli was named CECE’s COO in April 2021, after being a consultant to CECE for 5 months. He brings extensive experience in operational and general management across several industries, with expertise in driving profitable growth in industrial businesses and international operations. From July 2018 to November 2019, Mr. Nuggihalli served as the Chief Operating Officer of NovaTech, LLC, a privately held industrial automation company. Prior to his recent role, Mr. Nuggihalli was based in Singapore and served as President and Managing Director of Greater Asia for Xylem (XYL), a global water solutions company. Before XYL, he was based in Dubai and served as Managing Director of Middle East for Pentair. Earlier in his career, Mr. Nuggihalli held a number of leadership positions with increasing responsibility at leading diversified industrial companies, including Tyco International, Ametek (AME), General Electric (GE) and Babcock & Wilcox (BW). Mr. Nuggihalli holds a Masters Degree in Engineering from McGill University, an MBA from Wilfrid Laurier University, and a bachelor degree in Engineering from University of Mysore.

Peter Johansson, CFO/CSO – Mr. Johansson joined CECE in August of 2022 after being an independent consultant to the company since October 202. Previous to his consulting, he was EVP, Strategy, Corporate Development & Marketing for Accudyne Industries, LLC where he was responsible for the formulation and execution of growth, value creation, business development, product line, M&A strategies, and deployment of new, product-line based operating model for an industry-leading portfolio of industrial air and gas compressors, broad pump solutions, rotary mixers, and valves. Prior to joining Accudyne, Mr. Johansson led the corporate, product-line, and M&A growth strategy and implementation of a new differentiated business line operating model for IDEX Corporation. He has also held senior business, strategic business development, commercial and engineering leadership roles with ITT Inc. (ITT), Trane Technologies PLC (TT), WABCO Holdings, Inc., and Honeywell International, Inc. and its predecessor AlliedSignal Inc. Mr. Johansson has a bachelor degree in Mechanical Engineering from Southern Methodist University, a master degree in Mechanical Engineering from California State University at Fullerton, and an MBA from UCLA.

Lynn Watkins-Asiyanbi, CLO – Mrs. Watkins-Asiyanbi joined CECE in June 2022. She leads CECE’s legal strategy, as well as the human resources and corporate communications functions, and also serves as General Counsel and Corporate Secretary. Mrs. Watkins-Asiyanbi brings more than 25 years of industrial business experience, with global industrial companies such as John Bean Technologies (JBT), W.W. Grainger, Inc., U.S. Foods, Inc., Mars, Inc. and General Mills (GIS). She holds a joint J.D. and MBA from Northwestern University’s Pritzker School of Law and the Kellogg School of Management as well as a bachelor degree in Engineering and Economics.

Durable Growth, Margin Expansion, Recession Resilient

We believe that CECE has laid the groundwork in becoming a $500M revenue company generating well north of $50M in EBITDA within the next ~3 years. This growth will be spurred by the focus on serving secular growth end-markets and accretive M&A. Margin expansion will also be led by operational efficiencies, M&A through acquiring businesses with high-teens EBITDA margins, and overcoming the current issues with inflation and supply chain.

While CECE has been growing revenue significantly, they have also been growing the backlog at a rapid pace as well. 2Q revenues grew sequentially at 34% while the backlog grew 33% to $288M, which represents CECE’s largest backlog since 1Q 2016. We note to investors that following that record backlog, CECE’s stock more than doubled in the following months after. While we don’t anticipate an exact move to mirror what happened in 2016 we do believe that the robust growth in their backlog signals continued growth into the future. We also point out that management has iterated their confidence that when the current backlog flows through to revenue it should provide a boost to margins as price increases were applied to those projects.

While we are in a very unpredictable macroeconomic environment with a risk of a recession looming over it, we vehemently believe that CECE will continue to grow regardless of the backdrop. This is because the products that they provide are often not discretionary but rather mission critical or mandatory by government regulations. For example; CECE provides air filters for Tesla (TSLA) manufacturing plants, when these filters die out TSLA has to replace those immediately, there isn’t an option. When a wastewater pump for Duke Energy (DUK) is no longer up to government regulations, they must replace it there is not a choice. The end markets that CECE serve are far from discretionary. We also believe the tailwinds in their end markets will remain robust even in a weak macroeconomic environment. We also highlight that CECE has a very diversified revenue base, as no single customer represents more than 10% of its revenue.

Attention and inflows to stock should provide a boost

CECE is a very under the radar name. CECE has coverage from only 3 Wall Street banks, not included in the Russell 2000 index, and because of this lack of exposure is largely unknown and un-owned by institutional investors. However, because of this dynamic we believe CECE stands to benefit greatly from it when it changes. CECE has already picked up coverage from one new bank this year and with its market cap gains so far this year, CECE looks primed to be added to the Russell 2000 next year. When more banks pick up coverage on a stock, that inherently means more investors will become aware of CECE as both the analyst and sales team will begin to pitch the name to their institutional investor clients. As we have previously stated, CECE is one of the most compelling turnaround stories in the small-cap space we have come across and we firmly believe once other investors are exposed to the name they will agree and become buyers of the stock

With an inclusion to the Russell 2000 index this will both increase the awareness by investors and it will also vastly expand the number of investors who can buy it. This is because many Hedge Funds, Mutual Funds, and RIAs alike have guidelines that prohibit them from buying stocks that aren’t in the Russell 2000. On top of this, passively managed funds will be forced to buy CECE once it enters the Russell 2000 as they have to mirror the index itself. With both of these factors in mind, we believe it will lead to significant inflows to the stock further pushing it higher.

Peer Group

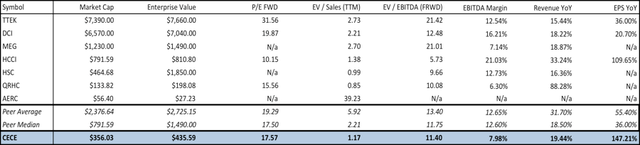

We accumulated a peer group consisting of companies who range in market capitalization but are all focused on servicing and providing solutions for Industrial Air and Water projects. To find proper comps, we used both Seeking Alpha’s industry feature and the SEC’s SIC code. What we find most impressive when comparing CECE its peers is its discounted valuation even though its growth statistics are far above the peer group.

We believe that through a combination of continued growth, increased attention, and continued execution by management that CECE’s discounted valuation will not persist, and will eventually CECE will receive a premium valuation in regards to its peers.

CECE Peer Table (SEC EDGAR/Seeking Alpha)

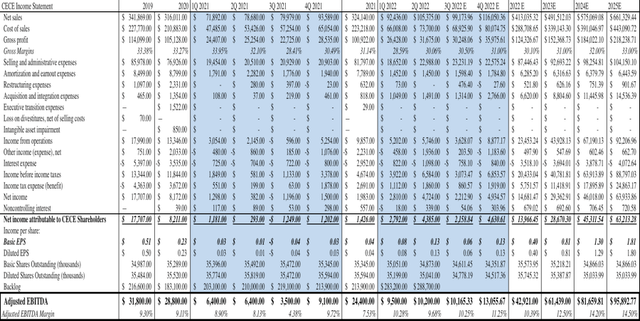

Valuation – Price Target

We derive our estimates by modeling out CECE’s income statement through 2025. However, we use our 2023 EBITDA estimates for our price target as the peer group’s EV/EBITDA valuations are based on 2023 estimates. We model CECE’s EBITDA margins steadily expanding from 10.39% in 2022 to 14.50% by 2025. We want to point out that we believe there is a significant opportunity for CECE to be a beat and raise story over the next several years. This is because the street’s estimate for CECE, in our opinion, are very conservative as analysts barely have any EBITDA margin expansion over the coming years. EBITDA margin expansion is one of the key goals of management and they have already proven their ability to execute on this goal, going from 7.53% in 2021 to 9.7% through the first half of 2022.

We also note that our own estimates could also prove to be conservative. As we forecast acquisition and integration expenses growing into the future while not specifically layering in any additional revenue from future acquisitions. We chose this conservative approach because we find it nearly impossible to project how revenues will be affected by future unknown acquisitions. While on the other hand it is prudent to model in the payment of past acquisitions and possible future acquisitions. If CECE can effectively integrated and recognize revenue from future acquisitions, which we believe will be the case, our estimates will prove to be too conservative.

BxB CECE Model (BxB estimates & SEC EDGAR)

Risks

We believe an investment in CECE include the following risks.

- Management Leaving – While we find it highly unlikely after our multiple talks with management that any of them leave for another company, if it were to happen, that would lower our conviction in CECE’s ability to execute its strategic growth plan going forward.

- Cyclical Business Lines – While it is becoming a smaller part of CECE’s overall revenue, its business lines serving the energy sector do tend to be cyclical. Also, when there is a high utilization rates of rigs, as there currently is, that means there is less of a chance to sell new parts to those rigs. As a rig must be offline to perform maintenance.

- Acquisition Risks – CECE has plans to aggressively expand via acquisitions over the coming years. While the results thus far have been impressive, even one or two acquisitions where they are unable to effectively streamline it into the overall business could lead to slower than expected growth or a failed acquisition. Causing the stock to miss expectations and move lower

- Supply Chain Issues – CECE is a smaller OEM, so they do not have as much power as larger OEMs when it comes to getting in front of the line and getting what they need. While management has commented and said their supply chain issues have softened, they could flare up more and negatively affect the company’s financial results.

- Stronger Dollar, International Business - CECE sees roughly a 1/3 of its revenue from international customers. If the US dollar continues to strengthen, that leaves CECE exposed to a worsening foreign exchange rate that will negative impact the financials.

Technicals

While we often have a deep technical analysis on our reports, CECE’s technicals do not require such. However, CECE is still in an intriguing place. It is more than doubled from its 52-week lows, but it is no longer overbought on the RSI. CECE has already tested two key long-standing resistance levels ($9.80/10.75) stemming back from 2017. We believe it is now poised to break out above those levels now that the RSI is no longer in overbought territory. We also note that CECE has seemed to develop a more recent support level at $8.90 since gapping up after their 2Q earnings. From a tactical basis, we want to add to our position under $9, but we acknowledge we may not get the opportunity to do so. With that in mind, we still strongly believe that the risk-reward scenario for longer-term investors still skews positively for those adding the stock in the $10 range.

Final Thoughts

CECE is a compelling story that has several positive factors prompting our bullishness. A stellar new management team that is well aligned with shareholders and has robust experience in growing industrials companies. A fundamental business shift that is focused on higher margin, secular growth verticals. A focus on pursuing accretive M&A that allows them to expand their dollar share on these higher margin projects or opens the door to new opportunities to cross sell. Recession resilient business that will continued to grow even if macroeconomic conditions deteriorate. These are just a few of the factors that cause our bullishness.

We believe that CECE checks the boxes for a vast number of investors whether they are focused on growth, value, ESG, or any number of other strategies. We believe that CECE is an excellent opportunity for long-term investors who are looking for growth in a market full of uncertainty.

Be the first to comment