Ian Tuttle/Getty Images Entertainment

Roblox (NYSE:RBLX) is a pioneer in the metaverse gaming space. Users and creators can build and play immersive games using the platform. The company makes most of its money selling in-game currency dubbed “Robux” and through advertising, licensing, and royalties.

The company’s popularity catapulted during the pandemic with many people stuck indoors and a shortage of other entertainment options.

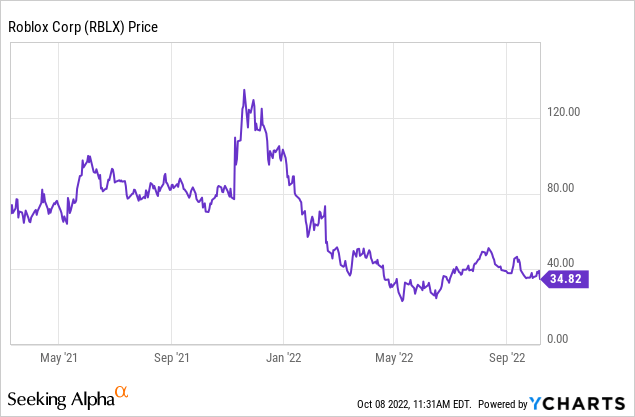

Roblox stock history

Roblox was a Wall Street darling for a short period as a so-called “pandemic stock.” This identification alone suggests that this was a short-term trade, not a long-term investment.

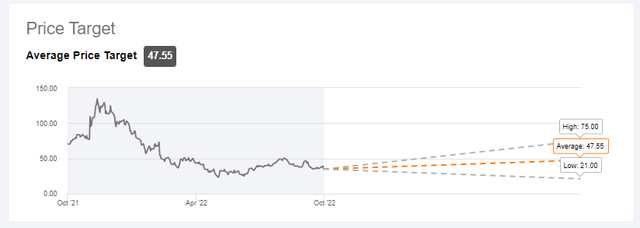

The company took advantage of its pandemic boost and went public in March 2021 through a direct listing. The stock opened at a steep valuation and peaked in late 2021, along with much of the tech stock market, before crashing back to Earth, as shown below.

The stock is now 75% down from its 52-week high and nearly 50% down from its closing price on the day of its direct listing.

This does not mean it cannot go much lower.

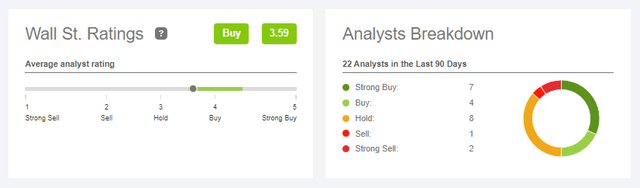

Prevailing sentiment

Wall Street is currently bullish on Roblox stock, with an average price target of $47.55. This implies an upside of 37%.

Similarly, three of the last four Seeking Alpha contributor articles have buy ratings on the stock. The most recent author with a sell rating also states that they “remain bullish long term.” These authors have delivered high-quality commentary, and I encourage everyone to read those articles.

I do not share their optimism.

There are warning signs related to several key performance indicators (KPIs). I expect Roblox stock to underperform the market in the medium to long term. If the market continues to see panic selling in the short term, I expect Roblox stock to decline more than the broader market.

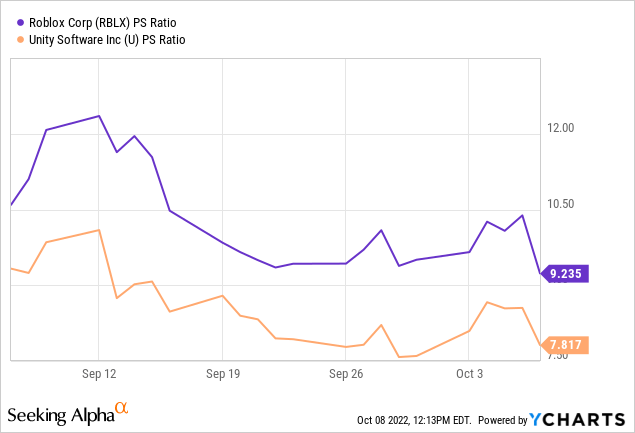

RBLX priced as a growth stock

Roblox is currently losing money – a lot of money. It lost more from operations in the last quarter than it ever has and has never posted a single quarter of positive operating income. On an annual basis, the company reports growing operating losses of $76 million, 266 million, and 495 million in 2019, 2020, and 2021. But profitability isn’t the issue – growth is.

Since it is getting further from profitability, Roblox is a pure growth stock, and the valuation reflects this.

Roblox is trading at a price-to-sales (P/S) ratio over 9 despite its 75% drop. This is well over its metaverse brethren, Unity Software (U), as shown below.

Wall Street will give premium valuations to growth stocks with long runways. But here’s the catch: you better keep growing. If not, the stock will get trampled as it is re-rated based on slowing growth. And that is a massive risk.

I will focus on three KPI themes that should concern investors:

- Slowing revenue growth and user decline

- Bookings are receding

- Where has all the cash flow gone? I’ll explain.

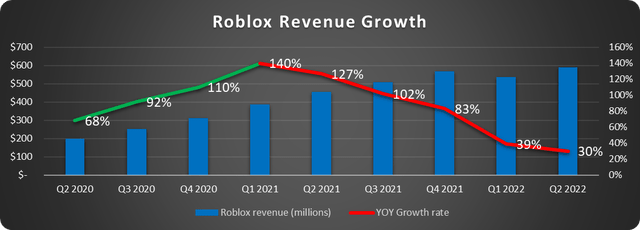

Sales growth

Since Roblox is in a growth phase and trading like a growth stock, let’s start with the obvious; sales growth. Revenue exploded during the pandemic, and no one reasonably expects this to continue. However, the rate of declining growth rates is alarming.

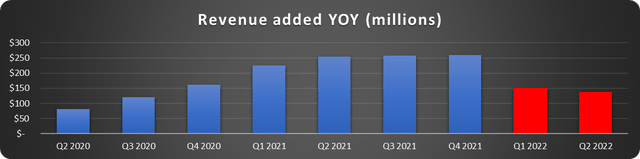

You might be thinking, “of course the growth rate is slowing; that’s how percentages work as numbers get bigger. But surely absolute growth is still climbing.” Right? Well…absolutely not.

The chart below shows the amount of revenue added year-over-year in each quarter. As we can see, it is not just a trick of percentages showing a declining growth rate. Dollar-to-dollar growth is slowing significantly as well.

This is a metric I look at when I write about growth stocks. Take CrowdStrike (CRWD), for instance. Its growth rate is slowing somewhat as the numbers get bigger, but its absolute growth (the total sales added over the prior period) is accelerating rapidly. Not so for Roblox.

Finally, after slowing for some time, daily active users (DAUs) fell for the first time in the company’s short history from $54.1 million to $52.2 million in Q2. Without user growth, this company is sunk.

Some might chalk this up to springtime weather; however, DAUs grew in Q2 2021, and the decline follows a pattern of slowing growth.

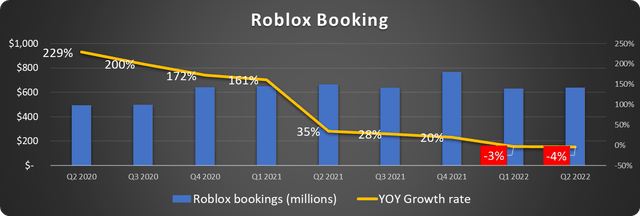

Bookings are receding

The vast majority of Roblox’s sales of from Robux, and it provides investors with information on these sales as “bookings.” What is the difference between bookings and revenue? Because of accounting guidelines relating to revenue recognition, some sales get recognized as income over time rather than all at once.

In plain English, and in general, bookings are a terrific barometer of future revenue growth or decline. If bookings rise, sales will likely increase in future periods. Similarly, if bookings fall, it is a bad sign for future sales.

As seen below, bookings growth has not just slowed; it has declined for two straight quarters.

This makes it unlikely that sales growth will suddenly take off in future quarters. Some believe that advertising will save the day; however, this is highly speculative.

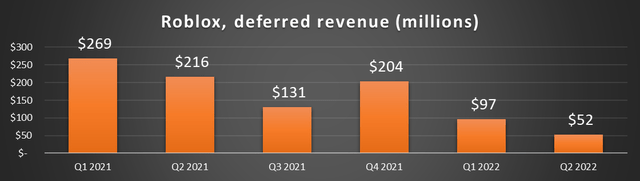

Where’s the cash?

While Roblox wasn’t making profits in 2021 and 2020, it produced gobs of free cash flow. This is assisted mightily by stock-based compensation but also by something else: deferred revenue. Simply put, cash is collected upfront for revenue recognized in future periods.

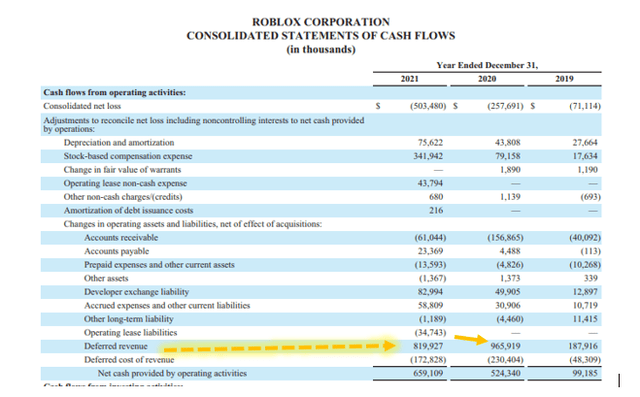

Seen below is the company’s statement of cash flows.

The deferred revenue is exceptionally healthy in 2021 and 2020.

Rising deferred revenue is a terrific sign of future growth, much like increasing bookings.

Unfortunately, through two quarters of 2022, deferred revenue has dropped from $485 million last year to just $149 million this year. This is a 70% decline. As we can see below, aside from a holiday boost in Q4, deferred revenue has steadily slowed to a trickle.

Data obtained from Roblox SEC filings. Chart by author.

This has led to a steep drop in cash from operations despite nearly doubling stock-based compensation so far this year.

Cash from operations fell to its lowest level since Q3 2019 last quarter with just $26.5 million produced. Remember that Q3 2019 is before the pandemic and Roblox’s popularity explosion.

What does it all mean?

Roblox is a pure growth stock with no near-term avenues for actual profits. No problem here, necessarily. Some of the strongest companies in the world started this way. The issue is that the growth is drying up like a puddle in the desert – and that’s enormously risky for shareholders.

If the company continues to report declining metrics, the stock will continue to take a beating. The KPIs that hint at future growth, like bookings and deferred revenue, are all pointing the wrong way. And the declines are jarring.

The quantitative metrics are flashing red.

Qualitatively Roblox contends with a fickle market long term. Many people tried the platform during the pandemic, and the hardcore fans will stick around. Others will get busy, play less, and eventually stop altogether and move on to something else.

This happens over and over again in the popular culture and entertainment world. Examples that come to mind are the online poker craze of the early to mid-2000s, fantasy sports, Pokémon, and sports betting. All of these will be around for a long time, but eventually, only the enthusiasts will remain.

Unmentioned so far is the looming recession and rapidly rising interest rates. Neither of these will be kind to Roblox’s top or bottom lines.

Roblox stock has plummeted from its highs, and many investors may see it as a bargain at these prices. Several contributors on Seeking Alpha and Wall Street agree. I take the contrarian position.

This is only my third markedly bearish article on Seeking Alpha. It isn’t that I don’t have negative opinions on many popular stocks; I do. But, I generally focus my writing on those on which I am bullish. Of my two previous strong bearish calls, the first is down 94%, and the other is down 50% in just over four months.

Roblox must prove that it isn’t just a flash in the pan. Key indicators are sounding alarms. Just because a stock has fallen a lot doesn’t mean it can’t sink much more. Investors should be wary of Roblox stock.

Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!

Be the first to comment