Olivier Le Moal

Article Thesis

Skyworks (NASDAQ:SWKS) is a high-quality semiconductor company that has grown at a compelling pace in the long run. Its shares are very volatile, however. Today, Skyworks trades at one of the lowest valuations ever as its share price has crashed on fears about a semiconductor industry slowdown. Even if a slowdown occurs, Skyworks will likely get back on the growth track in the foreseeable future, which is why I believe that SWKS could be an attractive contrarian investment today.

Sentiment Is Very Weak In SWKS Stock

Skyworks has always had volatile shares. Over the last couple of months, the direction was clearly downwards:

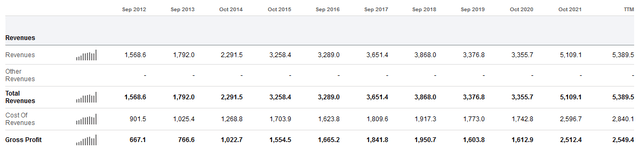

Year-to-date, Skyworks has dropped by 45%. Relative to the highs seen in 2021, the share price performance is even worse, as SWKS has dropped by more than 50% from those levels. Over the last five years, Skyworks is now down by 15%, before counting dividends. Is that due to Skyworks now being a smaller company and generating lower profits? Not at all, as the following tables show:

Skyworks grew its revenue by a hefty 240% over the last decade. Even better, its gross profit grew 280% over the same time frame. That makes for a mid-teens annual growth rate, maintained for a whole decade — clearly, Skyworks has been a strong growth investment in that time frame. Looking at the last five years, when Skyworks saw its shares drop by 15%, we see that revenue grew by 48% in that time frame. In other words, Skyworks is now a much bigger and more profitable company, and yet its shares are trading at a lower share price today.

What is even more surprising is to see that Skyworks has reduced its share count quite a lot over that time frame. Shares outstanding declined from 187 million to 165 million over the last five years, which pencils out to a 12% decline, or roughly 2.5% per year. Each remaining share’s portion of the company’s revenues has thus grown, which is why revenue per share is up by 68%, while company-wide revenue is up 48% over the last five years. If a company sees its revenue per share grow by 68% in five years, and yet its shares are now trading at a lower price than five years ago, that looks like a pretty wide disconnect.

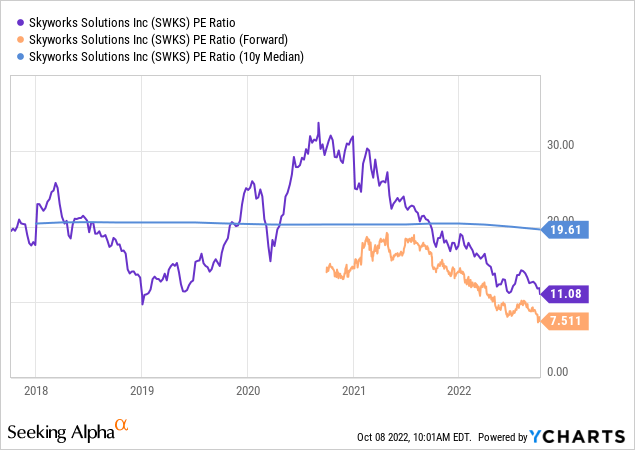

Of course, overvaluation five years ago could be a reason for that. But looking at Skyworks’ earnings multiple over time, Skyworks didn’t seem like an expensive pick five years ago:

Five years ago, Skyworks traded at a high-teens earnings multiple, in line with its 10-year median earnings multiple. For a growth stock that is growing its revenue at 10%+ per year that’s far from a high valuation, I believe. But more recently, Skyworks became way cheaper. Right now, it is trading with an 11x trailing twelve months earnings multiple, while its forward earnings multiple for the current year stands at an even lower level of just 7.5. That pencils out to an earnings yield of 13.3% at current prices. In other words, if Skyworks were to never grow its profits again, it could still be an attractive investment, assuming the company returns the majority of those profits to its shareholders.

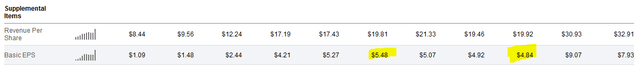

With an earnings yield this high, the market is pricing Skyworks for a huge earnings decline. And I would say that the market is pricing Skyworks like this earnings decline will be permanent. That’s very unlikely, I believe. In fact, one could argue that there will likely not be an earnings decline at all. But even if it occurs, it will likely be a temporary, short-term dip comparable to what the company experienced between 2017 and 2020, when its earnings per share dropped by around 10%:

Despite this moderate pullback in Skyworks’ earnings per share in that time frame, overall EPS were still up by a massive 8x between 2012 and 2021. In other words, there was no reason to panic when Skyworks experienced profit pullbacks in the past — the long-term growth story remained intact, no matter what. Those that bought SWKS at the bottom in 2019 saw their shares rise by around 200% over the next two years while receiving some dividends on top of that. Buying Skyworks during downturns when its profits pull back slightly can thus generate highly compelling total returns. Similar patterns exist for other semiconductor companies as well, such as Micron (MU), although the latter’s earnings per share are way more cyclical compared to those of Skyworks.

Skyworks’ Long-Term Outlook Is Compelling

In the long run, I believe that there is a very high chance that Skyworks will continue to grow its earnings per share. The first factor for that is market growth. Skyworks is a major supplier for Apple (AAPL), although it sells to a range of other companies on top of that. Its products include antenna tuners, wireless analog SOC products, amplifiers, modulators, and so on. Skyworks benefits from growth in the smartphone market, especially in higher-end categories such as Apple’s iPhone line. With many people in the world owning a smartphone already, it’s unlikely that this market will experience exponential growth. But some growth should be achievable, between price increases and market expansion especially in developing and emerging markets. A mid-single-digit revenue growth rate seems achievable even without market share gains, in the long run, I believe.

Market share gains aren’t unlikely, however. Skyworks has had those regularly in the past and has recently been expanding in markets such as automotive, data centers, and high-end 5G-enabled smartphones. Automotive is a market where Skyworks has a lot of growth potential, as megatrends such as the expansion of the electric vehicles market and the emergence of autonomously driving vehicles will result in a lot of market growth — EVs and AVs require many more chips than normal/legacy vehicles from the past.

Skyworks’ earnings per share growth will not solely rely on revenue growth, however. Instead, the company will continue to lower its share count at a meaningful pace. In fact, I believe that there is a high chance that the company’s buyback pace will be way higher than it used to be. Over the last five years, Skyworks has bought back 2.5% per year. But its average valuation in that time frame was way higher than today. Right now, Skyworks’ earnings multiple is less than half as high as the median earnings multiple SWKS has historically traded at. Its buybacks thus should be more than twice as efficient today, meaning Skyworks could likely buy back more than 5% of its shares per year even with a similar buyback payout ratio (buyback spending versus net profit) as it had in the past.

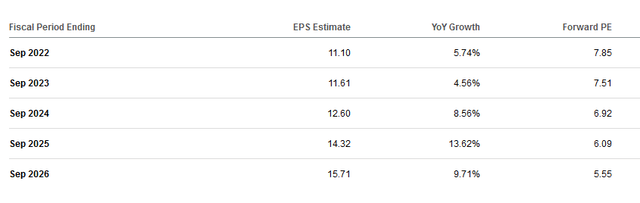

Between revenue growth and its buybacks, Skyworks could achieve a 10% annual earnings per share growth rate in the long run, I believe. In the near term, the current economic slowdown could lead to a somewhat lower earnings per share growth rate, as consumers may use their old phones a little longer during times of economic uncertainty. But a recession won’t last forever, and eventually, the positive growth drivers should lift the earnings per share growth rate higher. That aligns well with what analysts are forecasting right now:

We see that the analyst community is also forecasting growth of around 10% in 2024-2026, while near-term EPS growth will be lower. If those estimates are close to what will actually happen, then SWKS will continue to deliver positive EPS growth even during the current economic slowdown. With SWKS trading at just 7x net profits right now, that would still be a very positive outcome.

In fact, I believe that a 10%-20% EPS decline in both 2022 and 2023 would still be far from disastrous, considering how cheap Skyworks is trading today, and based on the fact that the company should eventually get back on growth track. If EPS were to drop by 15% in 2022 and 2023, before rising by 10% a year in 2024-2026, EPS would total $10.50 in 2026. Put a 12x earnings multiple on that, which would be more than 30% below the 10-year median earnings multiple of 19, and Skyworks could trade at $126, or 45% higher than today. Add some dividends, and Skyworks could return more than 50% over five years, even if its actual performance over the next couple of years is much weaker than the historic performance and current Wall Street estimates.

Risks To Consider

No investment is without risk, and that also is true for Skyworks. If the current/coming economic slowdown is much deeper than currently expected, Skyworks could see its profits fall more than what has happened in the past. In a very harsh recession, sales for phones and other consumer products could fall meaningfully, which would impact Skyworks and other suppliers to this industry.

Skyworks’ reliance on Apple is also a potential risk factor. While this can also be seen as a positive factor due to Apple’s above-average resilience and ability to pay premium prices, Skyworks would be vulnerable in case Apple ever decides to switch suppliers. In that scenario, Skyworks would lose its most important customer, which would represent a significant hit to its top and bottom line. While I do not believe that this is a very likely scenario, investors should still keep an eye on any hints that Skyworks might be losing some of its Apple business.

Takeaway

Skyworks is a very high-quality semiconductor company, showcased, for example, by its excellent profitability grade as well as by its strong long-term growth track record. The company also has shareholder-friendly management that offers regular buybacks and dividends, and Skyworks benefits from exposure to growing end markets.

Today, shares are very inexpensive and priced for a disaster. I do believe that the market has oversold Skyworks, making the company’s shares an attractive contrarian investment today. Its low RSI reading of around 30 also suggests that shares are currently oversold, strengthening my belief that this is an opportune against-the-grain investment right here.

Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!

Be the first to comment