JasonDoiy

Builders FirstSource (NYSE:BLDR) has seen strong financial outperformance in the first half of the year on the back of high commodity prices, successfully realizing synergies of past acquisitions, and an overall robust housing market. However, the back half of the year- as well as 2023- present uncertainty and may offset some of the recently experienced upside. Despite the impressive fortitude of the company’s balance sheet and obvious ability to generate free cash flow, these notable risks coupled with a recent run up in price signal that the stock is fairly valued at current levels.

My method of analysis rests in looking at the past two earnings calls of companies and seeing what changed vs. what stayed the same. I’ll then talk about what those similarities and differences mean for the stock going forward as well as how it plays into my valuation of the company through a DCF/3-Statement Model.

What Stayed the Same from Q1 to Q2

Continued Pursuit of Acquisitions

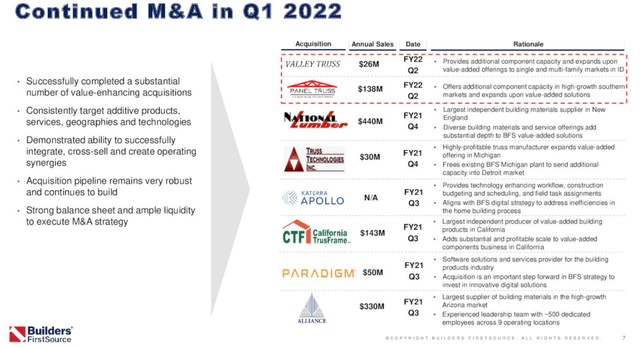

Builders FirstSource has taken on the role of a serial acquirer over the last several years. The company operates in a highly fragmented market and firmly believes that acquiring the right firms will help achieve maximum profitability through scale and aid in entering new homebuilding markets. This strategy was evident as ever in the last two earnings calls. In the Q1 call, management confirmed 2 acquisitions so far this year: Panel Truss and Valley Truss. Panel Truss had 2021 sales of $138 million and gives Builders component capacity in a high-growth Southern market. Valley Truss had $26 million in sales for 2021 and gives the company additional component capacity along with increasing value-added offerings in Idaho markets. The below slide details these acquisitions and others made in late 2021.

Q1 Earnings Call

The company spoke about another acquisition in the Q2 call: Homco. This lumber and hardware distributor serves the Flagstaff, AZ market and is set to contribute a diverse product mix and low customer concentration, with ’21 revenue coming in at $44 million. The company also stated they expect to spend over $500 million on acquisitions throughout 2022. Although this doesn’t quite match up to the $1.2 billion spent on M&A in 2021, investors must realize that these sorts of acquisitions will be a key component of the company’s capital allocation strategy in future years.

The company has an impressive ability to generate free cash flow and doesn’t pay a dividend, leaving ample room for this type of investment while maintaining a healthy balance sheet. Another thing to note is the company stating that in the event of a market downturn- where valuations would decrease- the firm wouldn’t stray away from making opportunistic purchases. As we get closer to 2023 where the overall housing market is more uncertain, there could be an uptick in acquisition activity.

What Changed from Q1 to Q2

2022 Guidance

The first thing to know about the guidance Builders FirstSource provides is that it’s built on a base business case. This includes a $400/mbf lumber pricing for all periods both past and present. This can lead to a confusing reconciliation process when trying to break out growth rates. For example, the company logged ~$19.9 billion in revenue in 2021. In the Q1 call, the company said its updated revenue guidance is 10-14% YoY growth on the base case. Well, the “base case” revenue in 2021 was $15.7 billion, so what they’re guiding revenue to be at for FY 2022 is $17.6 billion.

The problem arises that this $400/mbf commodity price is not what the company has seen in 2021 or 2022 up until very recently. Average prices were much higher last year as well as this year, so actual results will differ materially from what they are forecasting. If their forecast held true, revenue would have dropped nearly 12% from ’21 to ’22. Especially with where lumber prices began the year, it seems silly to include an uber-conservative guidance while actual business results are estimated to be vastly superior. This isn’t a claim of misleading investors and analysts because they do try to explain their reasonings and reiterate it’s a “base” business case. At the very least though, its seems an unnecessary practice that tends to add – and has already added – confusion to conversations around the shaping of the stock’s FY 2022 financial performance.

Getting back to the point at hand. Even though I don’t think the guidance is beneficial, there is some value in analyzing why their forecast changed from the Q1 call to the Q2 call. In Q1, management stated revenue would grow 10-14% on the base case with adjusted EBITDA growth of 18-22%. The Q2 projections came in the same for EBITDA growth but the top line projections were revised down to 8-12%. This lowered outlook was a result of the negative effect inflation, mortgage rates, and high cancellation percentages have on single family start projections. This has been a theme in many other calls I’ve analyzed and one investor’s shouldn’t take lightly. Despite these clouds looming on the horizon, first half outperformance for Builders FirstSource still paints a rosy full-year earnings picture for the stock. As lumber prices stabilize and the housing picture develops further, stay tuned for their Q3 earnings call where there is hopefully going to be more actionable 2022 guidance for investors to parse through.

Increased Discussion on Downturn Playbook

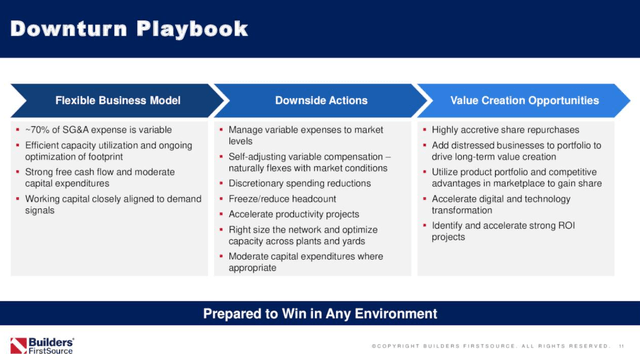

In the Q1 call, management called out that there was growing uncertainty across the industry. However, they said they affirm the industry remains strong and that the housing industry will continue to grow throughout 2022 on the back of homes being underbuilt and discussions with customers and homesites- also citing an 8% cancellation rate being indicative of durable customer demand. In the Q&A session, it was also brought up how Builders FirstSource would navigate a market downturn. A few common levers were touched upon such as managing variable expenses and the company having better economies of scale than years past, with the conversation being wrapped up with the company saying they still had continued confidence in the market as it stood and the momentum the firm currently had was strong.

As we step into the Q2 call, the relatively little amount of time and effort spent on answering the “downturn playbook” question in the first call turned into a major talking point. The company added two slides to their earnings presentation to address this topic, as can be seen below.

Q2 Earnings Presentation

Q2 Earnings Presentation

Recent industry dynamics certainly put managing a lower-volume environment at the forefront. Specifically, the call pointed out pockets of slowing demand stemming from higher mortgage rates and affordability concerns coupled with cancellation rates spiking up- both would affect end-market demands for the company’s products. I won’t rinse and repeat what is already displayed on the above slides, but it is clear that the firm is taking this downside scenario more seriously than in the Q1 call.

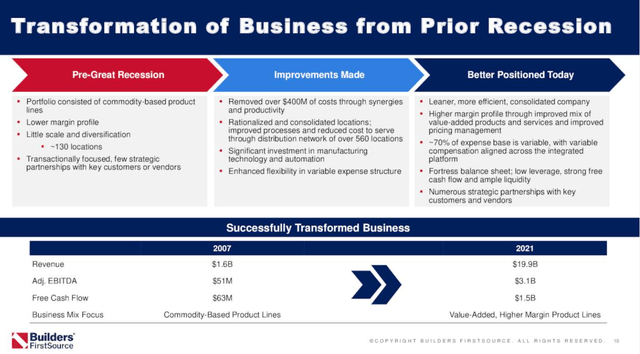

Despite this potentially making some investors skittish, I believe it’s better to message potential moves early in the game. Having the tougher conversations early in a downcycle paints a clear picture of what actions could be taken if the housing industry started taking a larger downturn. And as the company points out, Builders FirstSource is a changed company since the financial crisis. To be clear, I’m not entirely saying “it’s different this time”. It would be hard to argue that a significant housing downturn wouldn’t make the stock feel its negative effects. However, I believe the company has progressed and put itself in the right position to weather the storm to the best of their ability- especially in comparison to its peers.

What This All Means for BLDR’s Valuation

As mentioned in the intro of my article, I derive my share price targets from a discounted cash flow model that is driven by a full three-statement model for each company I analyze. At a high level, here are some assumptions for 2022 and beyond I gained from each earnings call that is input into my models.

1. Given that BLDR’s guidance is built around base business case, their revenue and margin guidance isn’t really helpful. They give a sensitivity table on what profits would look like given certain commodity price levels, but to avoid the math and guesswork, I’ll just be using average consensus estimates on the Seeking Alpha website. For ’22, ’23, and ’24, EPS estimates are $15.43, $8.22, and $9.38, respectively. Revenue for these years is $22.1 billion, $18.26 billion, and $19.32 billion. Both of these numbers reflect 2023 getting hit pretty hard due to the housing market, so I feel my model accurately reflects any downside risk.

2. The Q2 call gave updated CapEx guidance of $300 million for 2022, Interest Expense guidance of $180 million, and income tax expense of 23-25%. These are all implemented into my DCF to make for the most accurate cash flow picture.

3. The 10-year yield most recently traded at 3.883% and is the number being utilized in my model. Ultimately, an increase in this number will lead to future cash flows being discounted at a higher rate and make the stock less valuable. Over the last several months, this yield has been pretty volatile, thus impacting the valuation frequently with its large moves up and down. Sometimes seen as a weakness of the DCF model for those reasons, the best I can do is just have the most recent data plugged in- although some would argue to use a larger number due to the path the Fed seems to be going down.

4. Builders FirstSource has raised ~$700 million in cash this year due to issuing debt, this is reflected as a near-term cash flow which boosts the valuation of the stock. There also is a benefit to the stock price because the proportion of debt to equity increases. Since the debt is cheaper than equity, the higher debt levels actually decreases the WACC, thus what future cash flows are discounted by- boosting their present value.

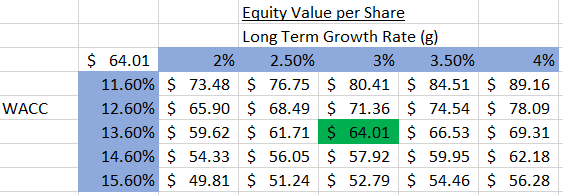

For those familiar with these types of models, there are obviously a lot more assumptions that go into it. In future articles, I plan on digging into my assumptions and what went wrong versus what went right. But to oversimplify everything and provide some numbers, here is a snippet of a valuation sensitivity table with a range of WACC (Weighted Average Cost of Capital) and Long-term growth rate assumptions (both very important for the terminal value of a DCF).

Personal Financial Model

A few notes about the inner-workings of my model and DCFs in general. A DCF sums the present value of all future years’ cash flows. There are two periods we project unlevered free cash flow for. The first stage is your forecast period, which for this model is 5 years. The stage one cash flows are ultimately determined by various assumptions such as revenue growth rate and profit margins, among other things. These 5 years of free cash flows are then discounted by some factor to get the present value of each and then summed together. For Builders FirstSource, the sum of its present valued cash flows for the next 5 years is $6.45 billion.

This completes the first half of the enterprise value calculation. The remaining step is to find a way to quantify the present value of all future cash flows after the initial 5-year forecast period. There are a few methods of doing this, but I use the Perpetuity Growth Model. At a high level, this model assumes an infinite long-term growth rate of free cash flows and utilizes this growth rate and Weighted Average Cost of Capital to arrive at the terminal value. This terminal value is then discounted to find the present value, and for Builders FirstSource this number is $7.93 billion. Adding this $7.93 billion terminal value of cash flows to the $6.45 billion of stage 1 cash flows brings us to the Enterprise Value of $14.37 billion.

We then need to get to Equity Value, which is first obtained by subtracting cash & equivalents from long-term debt to get Net Debt. For BLDR, Net Debt is equal to $3.38 billion. This number is subtracted from Enterprise Value and leaves us with an Equity Value of $10.99 billion. To get our final share price estimate, take this equity value and divide it by our diluted common shares outstanding (171.7 million) to get an average share price of $64.01.

As mentioned earlier, I will be reviewing particular assumptions and their accuracy (or lack thereof) in future articles when more company actuals are available.

Comps

For reference sake, here are some comparable companies and how Builders FirstSource stacks up in regards to some key ratios. Apples to apple comps are impossible to find in any industry, but both Boise Cascade (BCC) and Louisiana-Pacific (LPX) are sufficient. The main thing that stands out here is how much Builders FirstSource has outperformed the other two stocks over the course of the last month. All three stocks had a rough September as did the rest of the market, but BLDR shot back up much higher than the rest. My hunch is that this phenomena is due to the other two stocks being a little more commodity-dependent, especially with OSB- which has been pummeled lately. Despite the elevated appreciation for good reason, I don’t see anything worrisome in these comps.

| BLDR | LPX | BCC | |

| P/E Ratio | 15.43 | 12.49 | 20.01 |

| EPS | 4.10 | 4.32 | 3.09 |

| EV/EBITDA | 3.30 | 2.07 | 1.74 |

| EV/Sales | 0.61 | .82 | .24 |

| 1 Month Performance | +9.62% | +1.18% | +0.90% |

Source: Seeking Alpha Financials

The Bottom Line

There are certainly shortcomings to primarily analyzing earnings calls, but I believe it can be a very useful tool in a holistic analysis of a stock – especially as wording from executives across these calls can be so strategic and have a deeper meaning than face-value. Financial models also rely on forecasts and inputted assumptions, but just like earnings calls, if they are utilized correctly, they can provide valuable insights into the valuation and financial health of a company.

My Discounted Cash Flow valuation model suggests the intrinsic value of Builders FirstSource’s stock is $64.01, representing a ~1% upside from the most recent closing price of $63.24.

I really do like this stock. With its tuck-in acquisition strategy, rapidly scaling digital platform, and aggressive share repurchase program, it makes for an interesting follow. However, there is looming uncertainty on the strength of the housing industry for the near term. Seeing this, the company lowered its guidance- citing primarily affordability concerns amid rising mortgage rates and overall housing prices. I do value the effort leadership undertook to lay out all the levers at its disposal in the event of a downturn, but I still think downside risks outweigh the upside. If we couple this thought with the knowledge that the stock has just seen a rapid run up over the last few weeks, my conclusion is the stock is fairly valued at current levels- kudos to anyone who was able to pick up shares a mere 2 weeks ago and see their investment grow upwards of 20%.

If we do see the downturn many expect, keep a close eye on how the company carries out certain items listed in their downturn playbook. Some are easy to put to paper, but when the actual decisions need to be made, they can be harder to enact. All in all though, this is a really impressive company. The timing may just not be right for potential investors.

Be the first to comment