undefined undefined

Author’s note: This article was released to CEF/ETF Income Laboratory members as part of the CEF Weekly Roundup on October 4, 2022, with certain numbers updated. Please check latest data before investing.

NCZ postpones its distribution

Virtus Convertible & Income Fund II (NYSE:NCZ), a convertibles/high-yield bond fund, has postponed its monthly distribution (again). It had previously suspended its monthly distribution in July, but then announced the resumption of the distribution only one week later.

From the press release:

HARTFORD, Conn., Oct. 3, 2022 /PRNewswire/ — Virtus Convertible & Income Fund II, a closed-end fund, today announced that it has postponed payment of its monthly distribution of $0.0375 per common share that was scheduled to be paid on October 3, 2022 to shareholders of record as of September 12, 2022, and has postponed declaration of its monthly distribution of $0.0375 per common share that was scheduled to be declared on October 3, 2022 for payment on November 1, 2022. Recent market dislocations have caused the values of the Fund’s portfolio securities to decline and, as a result, the Fund’s asset coverage ratio for total leverage as of September 30, as calculated in accordance with the Investment Company Act of 1940, was below the 200% minimum asset coverage guideline. Compliance with the asset coverage ratio is required by the Fund’s governing documents for declaration or payment of the monthly distribution. As a result, the Fund is not authorized to declare or pay its monthly distribution until the coverage ratio is in compliance. The Fund intends to pay the October 3 common share distribution and resume declaration and payment of its monthly common share distributions once its coverage ratio is in compliance.

The reason for the suspension, both this time and the last, is due to NCV overstepping its leverage limits. This is because the fund’s liabilities are fixed, and as the net assets of the fund declines, the liability takes up a greater proportion of the total assets. When the CEF falls below the minimum 200% asset coverage requirement of the 1940 Act, it cannot declare new or pay distributions.

Income Lab

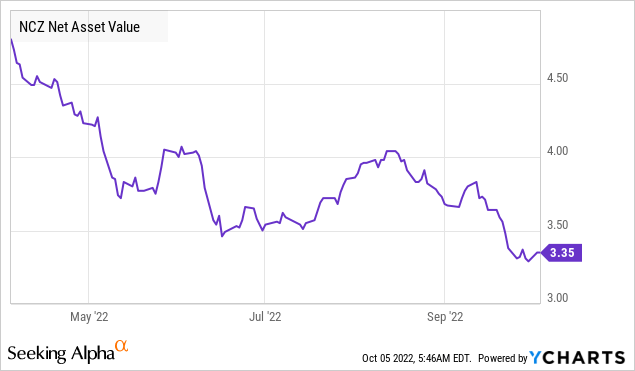

In July, the markets rebounded quickly enough so that NCZ rose above the 200% asset coverage level and could resume distributions again. However, the NAV is now even lower than in July, so the fund decided to take even more drastic action, by redeeming some of its auction rate preferred shares via tender offer. The sister fund Virtus Convertible & Income Fund II (NCV) did not have to postpone its distribution, but it is redeeming some of its preferred shares all the same as a precautionary measure.

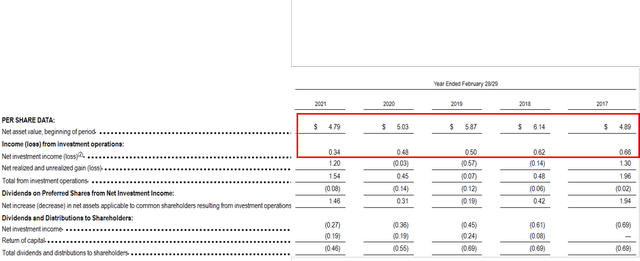

This deleveraging will likely lead to a further cut in the fund’s investment income, further eroding the distribution coverage which stood at 76% based on 2021 numbers. Hence, the fund’s distribution yield of 15.36% (NAV yield 13.43%) (as of October 7, 2022) should not be considered safe. This is why we always tell our members: don’t just look at the yield! A conservative distribution policy allows CEFs to maintain their distributions much easier. Unfortunately, NCZ’s consistent overdistribution policy has contributed to its NAV and income declining year-on-year over the past several years.

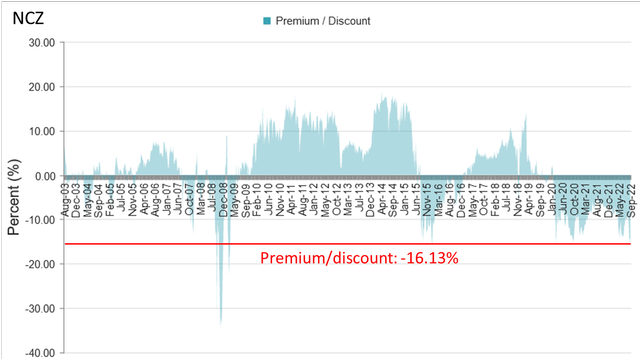

Going forward

As a result of the fund’s distribution difficulties together with generally negative market sentiment (remember that NCZ has a major allocation to convertibles which is tech-focused), NCZ’s discount (-16.13% as of October 7, 2022) has reached levels not seen since the GFC. On a valuation basis, there may be an opportunity to buy into NCZ and NCV in the future, but that would probably be if/when after a distribution cut is announced, leading to a further widening of the discount.

For more details on the fundamentals of NCZ, see Nick’s (a member of the Income Lab team) article here: NCZ: Higher Yield And Attractively Discounted, But Some Concerns

Be the first to comment