thekopmylife

For over 6 months now, TG Therapeutics, Inc. (NASDAQ:TGTX) has been beset with problems, central to which is the all-around problem with P13K inhibitors. Recently, in April, the FDA organized a meeting to discuss this class of drugs. The executive summary of the briefing document outlines the problems associated with P13K inhibitors:

There are several central issues relating to the development of PI3K inhibitors in hematologic malignancies: concerning trends in overall survival (OS) in multiple randomized controlled trials (RCTs), toxicities of the PI3K inhibitor class, inadequate dose optimization, and trial design considerations regarding the limitations of single-arm trials. Alpelisib, a PI3K alpha-specific inhibitor approved in breast cancer and PIK3CA-related overgrowth spectrum, is not included in this discussion.

This directly affects TGTX’s umbralisib, which was approved for two hematologic malignancies, r/r FL and r/r MZL. After a series of safety warnings from the FDA, and findings of higher OS in the control arm, TGTX withdrew the drug from the market. There does not seem to be a future to this molecule. TGTX has shelved its advanced chronic lymphocytic leukemia and small lymphocytic lymphoma programs.

This series of events has greatly affected TGTX stock, which is down over 80% since the umbralisib debacle first started. TGTX hope now pins itself on ublituximab in Multiple Sclerosis, however, a 3-month delay to the PDUFA has moved the date from September 28 to December. This has also badly hurt the stock. Those who bought in at last year’s highs are in no position to sell out, because of the hope that the MS approval will help them recover their losses. But will it – that is the million-dollar question.

How umbralisib may hurt ublituximab is through the UNITY-CLL trial, which saw an overall death risk being higher in the drug arm. Called U2, this drug is a combo of umbralisib and ublituximab. While the FDA’s main concern has been P13K inhibitors, i.e., umbralisib – and ublituximab’s MS data has been excellent in both efficacy and safety – one wonders if the FDA will want to make sure it was umbralisib alone, and not ublituximab, which contributed to the poor OS data in UNITY-CLL. If the FDA is not sure, that may mean, at best, additional analysis, if such differentiated data is available somewhere. At worst, it may mean a safety trial.

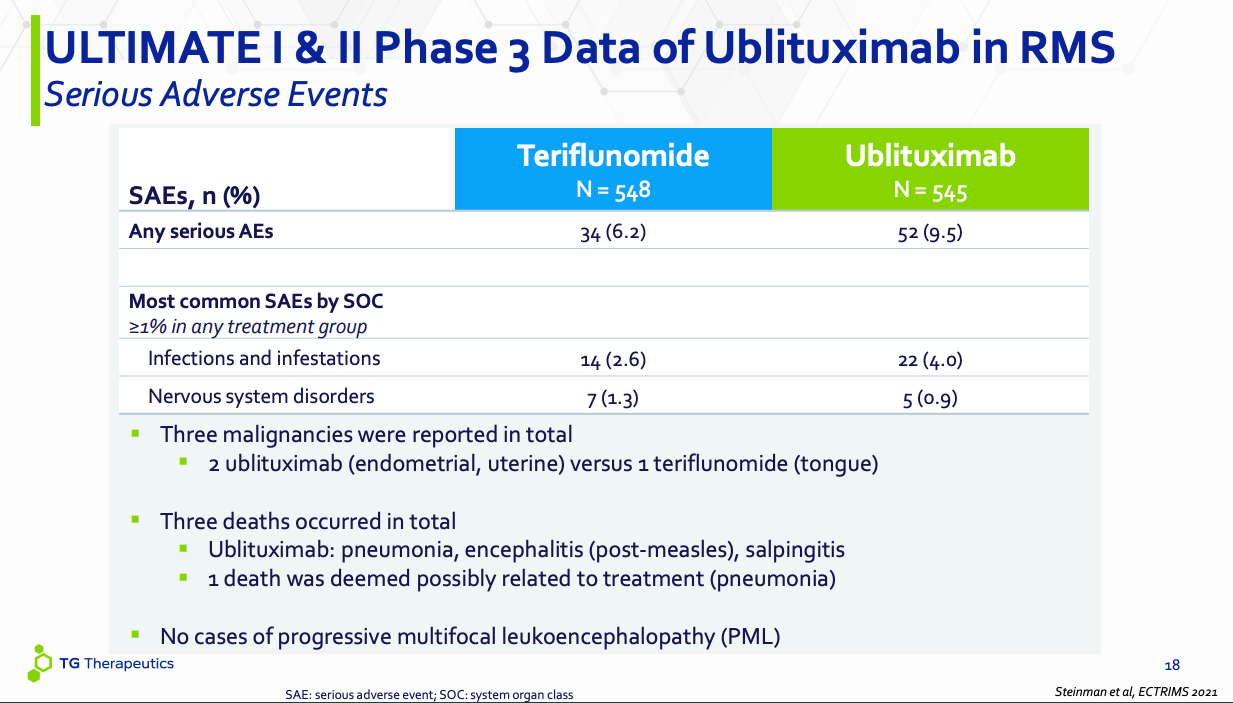

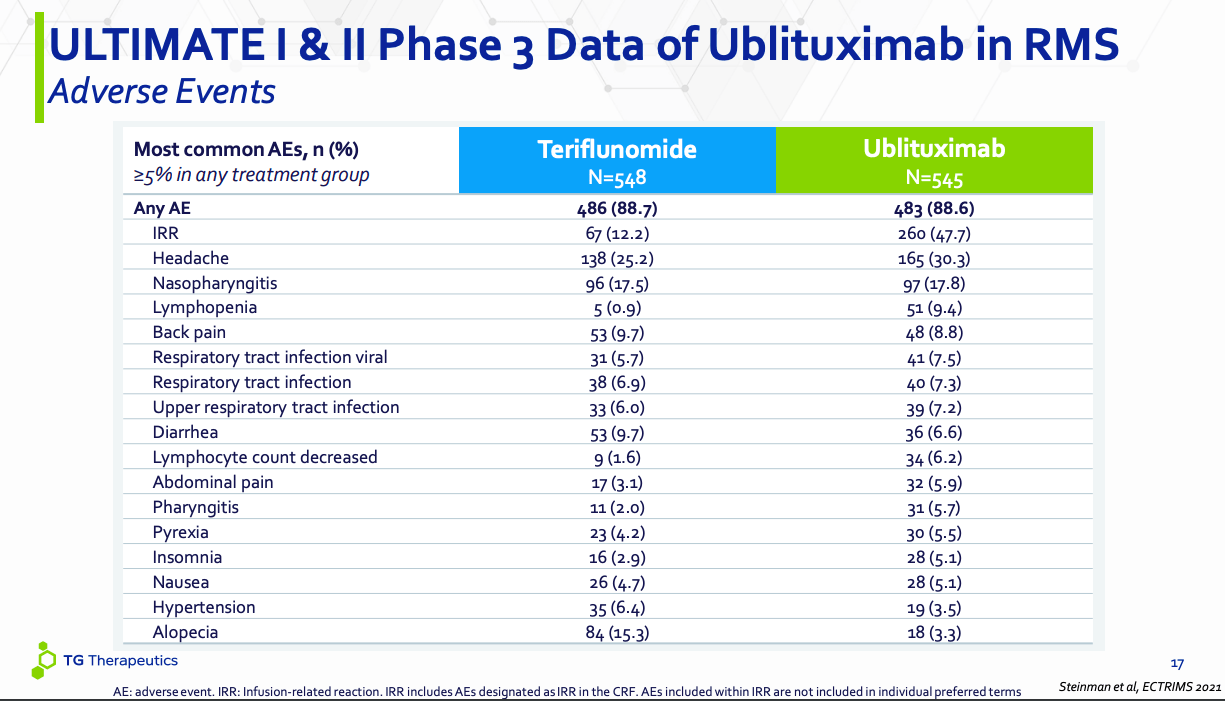

I covered ubli’s safety and efficacy data in a lot of detail earlier. The two comparison charts are reproduced below:

Ublituximab safety (TGTX website)

Ublituximab AE (TGTX website)

The first chart is for SAEs, or serious adverse events. Note that ubli is an immunomodulator that binds to CD20, a B-cell specific cell surface antigen. CD20 is exclusively expressed on the surface of B cells. Ubli’s function is basically to kill B cells through CD20-mediation. Now, B cells are involved in MS because although they do not normally cross the blood brain barrier, in MS, they do, and then they attack the myelin sheath protecting the nerves. So, reducing B cells in the body has a positive effect on MS. However, there is no specificity working here – ubli does not destroy only those B cells that attack the myelin sheath. It destroys all – or many – B cells. Now, B cells are our major defense against infections. So infection should be a recurrent adverse event in ublituximab.

This is what we see in both the charts. In the SAE chart, ubli has 22 SAEs of infection and infestation, while Aubagio has 14. Three deaths occurred in the ubli arm – all three were infection-related. Salpingitis is a bacterial infection, measles is, of course, a viral thing, while the pneumonia isn’t detailed. Bottom line is, all SAEs were infection-related. This means, ubli is doing its work of killing B cells well. Infection needs to be managed in another way.

The same pattern is seen in the all-AEs chart as well. There’s a huge number of injection-related infections in the ubli arm. Lymphopenia is huge – which means depleted B cells, or B lymphocytes. Almost every other AE where ubli has fared worse than aubagio is infection-related. Since ublituximab is given in a hospital setting, there is always a higher chance of infection. However, as I have discussed earlier, many of the MS drugs come with other severe diseases that are not seen with ubli. I think we can conclude that except the known effect on infection, ublituximab has a tolerable profile given the nature of the disease it targets, and its efficacy. We can also conclude that if the FDA has a safety-related question, it will probably be about infection, and there is no hidden surprise here after years of trials in hundreds of patients.

Recently, the company presented some additional ubli data – here – but nothing new and worrisome stands out. One interesting new positive is NEDA:

Proportion of participants achieving no evidence of disease activity (NEDA) (24-96 weeks re-baselined; P<0.0001 for all)

However, what we think and what the FDA – privy to a lot more information – things can be very different. Moreover, the 3-month extension is not reassuring. TGTX’s CEO Michael Weiss has tried to assure investors that such delays were seen for both Ocrevus and Kesimpta. He has also said that the delay will not impact launch – which I think is not exactly true. A delay will always impact launch because you cannot go all out with your commercialization plans unless you have an approval at hand, or you are big pharma.

Worse, the company hasn’t really provided a lot of reasons for the delay. All they have said is that the FDA wanted more analysis:

The FDA extended the PDUFA goal date to allow time to review a submission provided by the Company in response to an FDA information request, which the FDA deemed a major amendment. The submission comprised an integration and summary of certain clinical information that was previously provided to the FDA by the Company.

If this was so benign, maybe Weiss could have disclosed exactly what this clinical information was, whose integration and summary is a major amendment.

Talking about the CEO, social media is generally quite anti the CEO. Social media may or may not be a good indication of the facts, but they are often a good indication of the sentiment. And the sentiment currently is quite negative. I am confident, however, that if ubli gets approved, Weiss will rise considerably in the popularity contest.

Financials

TGTX has a market cap of $700mn and a cash reserve of $242mn. R&D expenses were $48mn and G&A were $20mn, which means that, at that rate, they have cash for some 3-4 quarters. Of course, R&D expenses should reduce a little, while G&A will go up before commercialization, however, if ubli gets approved, this cash should be adequate to launch it. If ubli fails, this company will be dead in the waters.

Bottom Line

TGTX is giving me much more scare than I bargained for. A company with an approved drug where analysts already saw a billion-dollar potential should have been nicely de-risked. Ubli should have been the icing on the cake. Right now, it is the final, increasingly erratic lifeline. I have a position which I averaged down earlier, however, I am not going to extend myself any further.

On the other hand, new investors will find the current price tantalizing. That’s not rational analysis – that’s sentiment – but new investors may find sentiment heavily inclined towards the positive at these prices. I will, however, simply sit on the sidelines and wait this out with whatever position I already have.

Be the first to comment