Trots1905/iStock via Getty Images

One of the most famous sayings regarding the stock market is that the market can stay irrational longer than you can stay solvent. While this is definitely the case when using leverage or other risky investments, sometimes patience will make all the difference. Though it can be painful, waiting for your investment to bear fruit is often the best choice, especially if you own stock in a high-quality company that is trading at a cheap price. Such is the case, I would argue, with Berry Global Group (NYSE:BERY). The sad truth is that the past few months have been rather trying for investors. Although the company has outperformed the broader market, shares are still down rather materially as investors fear what the economy will look like moving forward and as cash flows at the company contract. Short term, I don’t deny that there could be additional pain. But given how cheap shares of the company are and considering how fundamentally attractive it is, I do believe that this is still a prospect worthy of the ‘strong buy’ designation.

Ignore prices and focus on fundamentals

Back in November 2021, I wrote an article about Berry Global. In that article, I said that I was impressed by the company’s attractive growth in recent years. I called the company a cash cow and said that it likely offered nice upside potential moving forward. This was especially true when considering just how cheap shares were trading. All of this coalesced into what I believed was a great investment opportunity, leading me to rate the business a ‘strong buy’. Since then, saying that the company has underdelivered would be an understatement. While the S&P 500 is down by 18.6%, shares of Berry Global have generated a loss for investors of 15.9%.

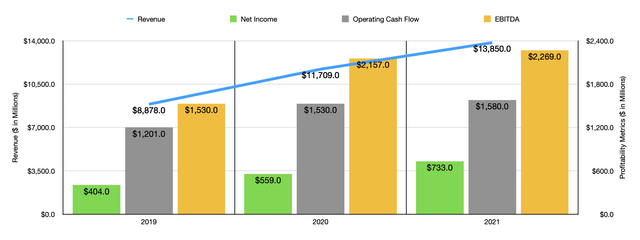

This decline is undoubtedly painful. Nobody likes to see their portfolio take a hit. But at the end of the day, we need to pay less attention to price fluctuations and pay more attention to fundamentals. Because while the market may be a voting machine in the short term, it is undeniably a weighing machine in the long run. What data we have so far is definitely encouraging. To see what I mean, we should first take a look at how the company finished its 2021 fiscal year. During that year, the business generated revenue of $13.85 billion. That represents an increase of 18.3% over the $11.71 billion the business generated in 2020. According to management, the vast majority of this improvement in sales came from an increase in the selling price that the company charges for its goods. This alone accounted for $1.43 billion, or 66.7%, of the increase in revenue the company saw from 2020 to 2021. However, the company also saw organic volume growth of 4%, indicating that demand for its products remains strong.

This increase in revenue brought with it a strong uptick in the company’s profitability. Net income rose from $559 million in 2020 to $733 million in 2021. That translates to a year-over-year increase of 31.1%. Other profitability metrics followed suit. Operating cash flow went from $1.53 billion to $1.58 billion. Although this increase was far weaker than the increase in that income, any improvement should be considered a positive. We also saw an improvement in EBITDA, with that metric climbing from $2.16 billion to $2.27 billion.

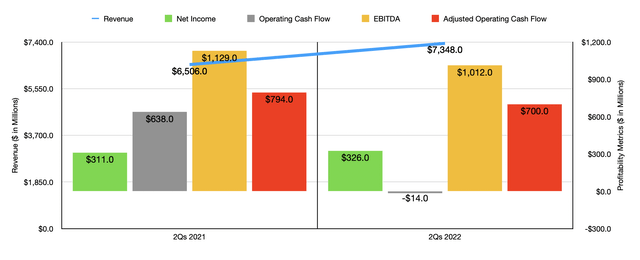

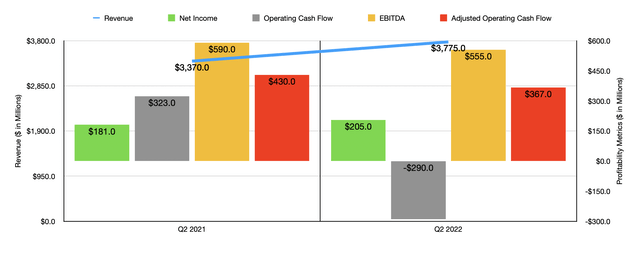

Now that we are into the 2022 fiscal year, we should definitely see what is transpiring. For the first half of the year, the company generated revenue of $7.35 billion. That is 12.9% above the $6.51 billion generated for the first half of the firm’s 2021 fiscal year. Once again, the company was able to pass on higher costs to its customers. In fact, this increase in selling prices added $1.3 billion to the company’s top line. Unfortunately, we did see some weakness in demand, with volume ultimately declining by 3%.

From a profitability perspective, the picture has been a bit more mixed. Now, income in the first half of 2022 totaled $326 million. That’s only 4.8% above the $311 million seen just one year earlier. Operating cash flow actually declined, dropping from $638 million to negative $14 million. But if we adjust for changes in working capital, the picture was not as bad. In that scenario, cash flow declined from $794 million to $700 million. Meanwhile, EBITDA for the company dropped from $1.13 billion to $1.01 billion.

Even though the company is experiencing some pain on its bottom line, management has a belief that the rest of the year will look pretty good. Earnings per share should be between $7.20 and $7.70. At the midpoint, that would translate to a net income of $970.7 million. The company also believes that this will not come at the expense of volume, with volume either remaining flat or climbing by about 1%, or somewhere in between. Unfortunately, no guidance was given when it came to other profitability metrics. But if we assume that they will increase at the same rate that net income should, we should anticipate operating cash flow of $2.09 billion and EBITDA of around $3.01 billion.

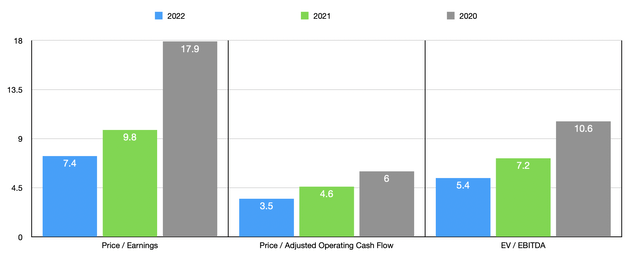

With this data, we can easily value the company. On a forward basis, the firm is trading at a price-to-earnings multiple of 7.4. Its price to operating cash flow multiple is even lower at 3.5, while its EV to EBITDA multiple should come in at 5.4. Even if the company sees its financial performance match what it did in 2021, shares are still cheap. The company would have a price-to-earnings multiple of 9.8. Its price to operating cash flow multiple would be 4.6, while its EV to EBITDA multiple would come in at 7.2. Even if financial performance were to revert back to 2020 levels, these multiples would not be outrageous, coming in at 17.9, 6, and 10.6, respectively. To put the pricing of the company into perspective, I decided to compare it to five other packaging firms. On a price-to-earnings basis, these companies ranged from a low of 10.8 to a high of 24.7. Using the price to operating cash flow approach, the range was from 9.6 to 17.4. And using the EV to EBITDA approach, the range was from 7.5 to 53.6. In all three cases, Berry Global was the cheapest of the group. And that is based on the 2021 results, not the more liberal 2022 estimates.

| Company | Price/Earnings | Price/Operating Cash Flow | EV/EBITDA |

| Berry Global Group | 9.8 | 4.6 | 7.2 |

| Greif, Inc. (GEF) | 10.8 | 9.6 | 7.5 |

| Crown Holdings (CCK) | 24.7 | 12.1 | 53.6 |

| Ranpak Holdings (PACK) | N/A | 17.4 | 13.2 |

| Silgan Holdings (SLGN) | 12.6 | 10.1 | 9.9 |

| Packaging Corporation of America (PKG) | 14.2 | 10.7 | 8.2 |

Takeaway

Although I think it’s perfectly reasonable to think that current market conditions will not persist indefinitely, I do not see a scenario where shares of Berry Global are realistically overpriced. Even in the worst scenario, I think the stock would be no worse than fairly valued. But when you consider its historical growth and how cheap the stock is right now, I do think that investors could be due for a great deal of additional upside. So because of this, I have decided to retain my ‘strong buy’ rating on the company for the foreseeable future.

Be the first to comment