Gilnature/iStock via Getty Images

Investment Summary

Perhaps one of our biggest losses ever was incurred with our long position of Emergent BioSolutions Inc. (NYSE:EBS) back in 2021. You can check out our last publication here. For those unfamiliar, EBS had shot to stardom across the 10 years to 2020/2021 as a contract manufacturer for the U.S government, in addition to its NARCAN and anthrax vaccine portfolio. However, across the entirety of 2021, EBS was embroiled in controversy, starting with its Baltimore plant, ending with the U.S Federal Government cancelling its contract with EBS to manufacture Covid-19 vaccines.

Since then, the EBS share price has been on a one-way ticket down south, continuing the value erosion to rest at its lowest mark in more than a decade. We’ve kept EBS on our radar since exiting at a loss in late 2021, and we’re back here today to revisit the investment thesis. Alas, and unfortunately, following the company’s Q3 FY22 numbers and FY22 full year guidance, we see no change to our position. Hence, we continue to rate EBS a hold until more compelling evidence is available to suggest otherwise.

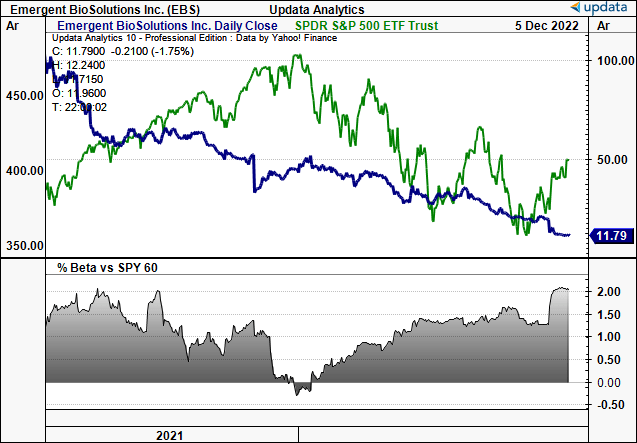

Exhibit 1. EBS 2-year price evolution, continued value erosion versus the S&P 500.

Data: Updata

EBS Q3 financial results not enough to move the needle

Turning to EBS’ Q3 numbers, we’d advise that its financials were fragmented throughout the P&L. Note, the company released its Q3 FY22 10-Q on November 8th.

On the positive side, the company’s products segment continued to deliver solid contributions, generating revenues of $186mm. However, products revenues were still down 27% compared to the prior year. Total revenue of $240mm decreased 510bps YoY, resulting in a decrease in adjusted gross margin of $101mm, or 54%. The decrease was driven by reduced sales volume and product mix, compounded by lower NARCAN and ACAM sales. This led to a decline in key profitability measures, with adjusted EBITDA of negative $15mm and adjusted net loss of $63mm. The underutilization of CDMO capacity and the costs associated with addressing the Camden warning letter from the FDA were cited as the primary reasons for the decline.

It’s also worth noting that in Q3, the company closed on the acquisition of TEMBEXA and began shipping doses to the US government. More details on the transaction and its particulars can be found here from EBS’ website.

Turning to OpEx, cost of product sales in Q3 was 22.7% or $86mm lower than the same quarter last year due to lower sales volume. Whereas the cost of its contract development and manufacturing organization (“CDMO”) was 50% lower, primarily due to reduced production across the CDMO network. R&D expenses were $39mm/25% behind, reflecting the company’s decision to cease development of COVID-related therapeutics and redirect those resources to other infectious disease programs. SG&A spend came in at $80mm, consistent with the prior year.

In terms of product revenues, the anthrax vaccine franchise performed well, with sales of $24mm above last year. The ACAM2000 smallpox vaccine also generated sales of $49mm, driven by demand in non-US markets. Meanwhile we saw the company’s nasal naloxone franchise recognized sales of $88mm. Finally, combined CDMO service and lease revenues were $36mm, slightly lower than the prior year.

We should also note that in the services segment, revenues were $36 mm, a YoY decline of 9.1%. This decline was primarily due to the re-baselining of the CDMO services business and reduced production at the Camden facility previously mentioned. The segment reported an adjusted gross margin of $7 mm, or 19%, a decrease of 12.5% compared to the prior year.

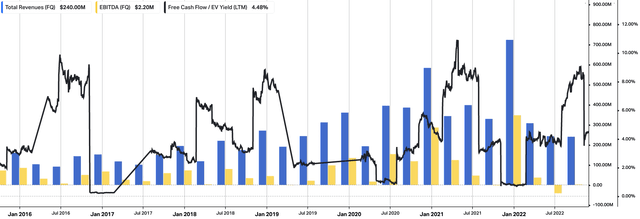

Looking ahead, the company has adjusted its FY22 expectations for its ACAM2000 smallpox vaccine. While discussions with the US government are ongoing, the timing of the option exercise under EBS’ 10-year procurement contract is uncertain. As a result, the company has removed the revenues associated with the option exercise from its forecast. We’d note this as a key downside risk to the EBS investment debate. A full review of EBS operating walkthrough from FY16–date is seen in Exhibit 2. You can see the impact of the last 2-years, with revenues plunging back to pre-FY19 levels.

Exhibit 2. EBS quarterly operating breakdown, FY16-date. Note the impact from the last 2 years on revenue and core EBITDA.

Data: HBI, Refinitiv Eikon, Koyfin

Guidance justifies further downsides ahead

Management adjusted its guidance for the full year of 2022 on the earnings call, to reflect lower revenues from ACAM, offset by the inclusion of TEMBEXA and an increased forecast for nasal naloxone.

It expects total revenues to be within the range of $1.05Bn–$1.1Bn, calling for a 38.6% YoY decline from FY21′. The breakdown of this assumes anthrax vaccine sales of $260mm–$275mm, ACAM2000 sales of $63mm, and a TEMBEXA sales forecast of $110mm to $115mm.

We’d also point out that EBS projects nasal naloxone product sales within a range of $350mm–$365mm, with other product sales plus C&G revenues of $167mm–$172mm and CDMO revenues of $110mm at the upper bound.

Despite the projected upsides, the company anticipates an adjusted net loss of $100mm–$70mm on adjusted EBITDA of ~$30mm at the upper end of guidance. This is key information that keeps us on the sidelines for now.

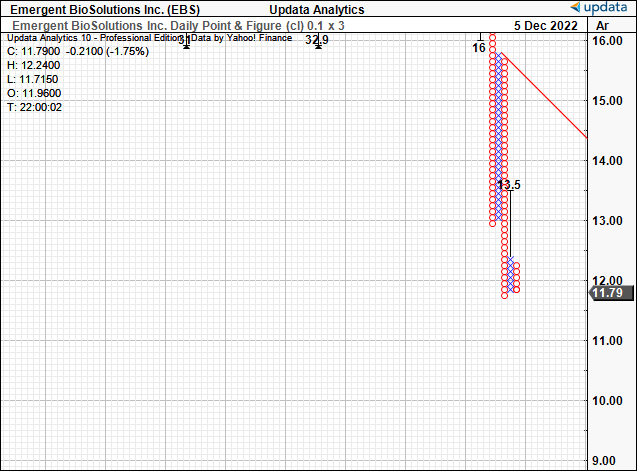

It’s therefore unsurprising to see downside targets on our point and figure studies [Exhibit 3] to the downside. Note, our last target of $13.5 has been taken out, and the stock trades beneath this level. We expect further downsides ahead, especially based on EBS’ financial progression this year to date and looking ahead.

Exhibit 3. No upside targets to latch onto, weak price action with lack of buying support.

Data: Updata

In short

After revisiting the company’s latest developments and financial results we’ve made no change to our position on EBS. We remain firmly at a hold, until there’s evidence to suggest otherwise. Being neutral, and without a directional view on the market, we haven’t provided a suggested price range on the stock. However, we’d caution investors that risks to top-line growth and EPS upside remain for EBS in this investment debate. Rate hold.

Be the first to comment