Just_Super/iStock via Getty Images

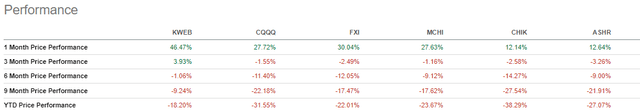

Growing hopes that China will reopen its economy have ignited a spectacular rebound in Chinese technology stocks, which have been among the biggest losers since the government’s sweeping tech crackdown and Covid-19 crisis hit in 2020. The KraneShares CSI China Internet ETF (KWEB), in particular, outperformed all other major China ETFs year-to-date after having registered a whopping 46.47% single-month gain.

However, we believe that hopes for a reopening are premature and that the recent rally appears to be largely speculative in nature rather than driven by improving economic fundamentals. As such, we see imminent risks of a failure in the market rebound, potentially resulting in sharp losses for investors caught in this speculative fervour.

Not only are we sceptical that the recent rally in Chinese equities can be sustained, but we also maintain our view that the potential returns for investing in China simply do not justify the risks associated with the political environment long term. It is simply not possible to perform an objective analysis of the Chinese economy or the future prospect of any Chinese company without first taking into account the political motivations of the Communist Party of China (CPC).

No Reopening Without Effective Vaccination

Crucially, we do not see any scope for a meaningful reopening of China’s economy unless there is an effective vaccination program in place. Without effective vaccination, there are few options available to prevent a surge in severe Covid cases from overwhelming China’s healthcare system. Either China expands its healthcare system to accommodate much larger numbers of severe Covid-19 infections so that it can pursue natural herd immunity, or it will have to stick to its “Zero Covid” strategy of rapidly containing new outbreaks through more lockdowns. Both options are extremely costly and difficult to execute given the sheer size of the country’s approximately 1.4 billion population.

Of course, there is the other more sensible and effective strategy of approving Moderna and Pfizer vaccines manufactured by U.S. companies and implementing a vaccination program, which many countries have indeed adopted and have mostly reopened. Then again, China’s seemingly irrational choices are intimately linked to the CPC’s political motivations.

Not only would using U.S.-manufactured vaccines be an admission of defeat for China’s domestically produced vaccines, but it would also turn President Xi Jinping’s “Zero Covid” strategy into a failure that would go down in history to be ridiculed for generations.

Easing Tech Crackdown Just A Sideshow

If investors look hard enough, they will find positive reasons to be bullish on Chinese technology stocks. Signs that Beijing is easing back on its crackdown on technology companies have buoyed sentiment on companies such as Alibaba (BABA) and Tencent (OTCPK:TCEHY), which make up around 18% the of KWEB. However, if we look beyond the superficial explanations offered by the media for justifying the tech crackdown, one would realize that the real underlying motivations for the crackdown are once again, driven by political interests.

The sudden decision by Chinese financial regulators to block the US$34 billion initial public offering of Ant Group in 2020 is difficult to justify in economic terms. Other crackdowns on the tutoring industry as well as mobile games serve as further examples of the unpredictable and uneconomic nature of policy decision-making within the CPC. Thus, even if the tech crackdown eases going forward, there is no telling which industry will be next in line.

China Tech Valuations Are Expensive Given The Risks

Some investors may point out that even after the sharp rebound in recent weeks, Chinese tech companies still seem attractive given how much they have fallen from the peak. However, we argue that the massive sell-off in Chinese tech stocks over the past two years is appropriate given how economic conditions have deteriorated and how uncertain the political landscape has evolved in China.

Based on the top 3 holdings of the KWEB ETF excluding companies with negative earnings, we note that trailing twelve-month P/E ratios average at a rich 20.7X while P/B ratios average 2.8X. We remain unconvinced that Chinese technology stocks should be priced at pre-2020 multiples given that we expect earnings to remain suppressed in 2023.

Not The End Of Tech Crackdowns

China’s technology giants naturally attract the attention of the CPC due to the enormous amount of user data collected by companies such as Ant Group, Tencent, Alibaba, and others that may potentially achieve the same scale in the future.

Technologies that enhance the freedoms of its users such as social media, cryptocurrencies, decentralised finance, and artificial intelligence, become a natural threat to the foundation of a tightly controlled economic and political system. Today the threat may be search engines, social media, mobile games, and innovative finance, tomorrow it could be cloud computing, artificial intelligence, decentralised finance, and encrypted information technologies.

Because the technology sector is politically more sensitive than other more traditional industries, it is more vulnerable to future intervention and could face more demanding regulations that risk undermining the competitiveness of Chinese tech companies over time. Although politically motivated interventions may not necessarily make Chinese tech stocks unprofitable investments, but such risks at the very least, justify a deep discount to be applied on valuations.

Accordingly, we view the spectacular rebound in the price of KWEB over the past few weeks as largely speculative in nature and that investors may be underpricing the risks associated with investing in Chinese tech companies.

In Conclusion

China’s economy is likely to struggle to reopen meaningfully from the Covid-19 pandemic while signs of an easing tech crackdown appear to be only temporary in our view.

In a nutshell, the downside risks of investing in Chinese tech companies far outweigh the prospects of a strong economic rebound in China.

Be the first to comment