Alex Wong/Getty Images News

The Thesis

We previously called a bottom on Meta (NASDAQ:META) shares, with our article: “Meta: This Is The Bottom.” Following that article, the stock jumped from $160 to $183 per share, a nearly 15% bump. We decided to exit our position at $180 after learning more about the Android privacy changes coming down the pipe in 2024. We believe this is the main risk to Meta’s profits in the short term, and that we need to reset our valuation. We’re now projecting returns of 11% per annum, and maintain a “buy” rating on the shares.

The Bear In The Room

Through to 2020, cross-app tracking on your smart phone made Facebook and Instagram’s ads uncannily accurate. For example, if you were searching for some Bluetooth earbuds on your internet browser or Amazon (AMZN) app, Facebook and Instagram were able to gain access to that data and send you targeted advertisements for the same earbuds you looked at earlier that day. This gave advertisers a degree of certainty and high return on ad dollars spent. Therefore, advertisers were willing to pay more.

Apple’s iOS Update (Vox)

When Apple (AAPL) introduced prompts to block cross-app tracking, Meta said it would be about a $10 billion hit to its revenue. Now, here’s the part that scares us: Android has an 86% share of the global market, versus Apple’s 14% market share. According to CNBC, Android will be following in Apple’s footsteps come 2024:

“Google on Wednesday announced it’s adopting new privacy restrictions that will cut tracking across apps on its Android devices, following a similar move made by Apple last year that upended several firms’ advertising practices.”

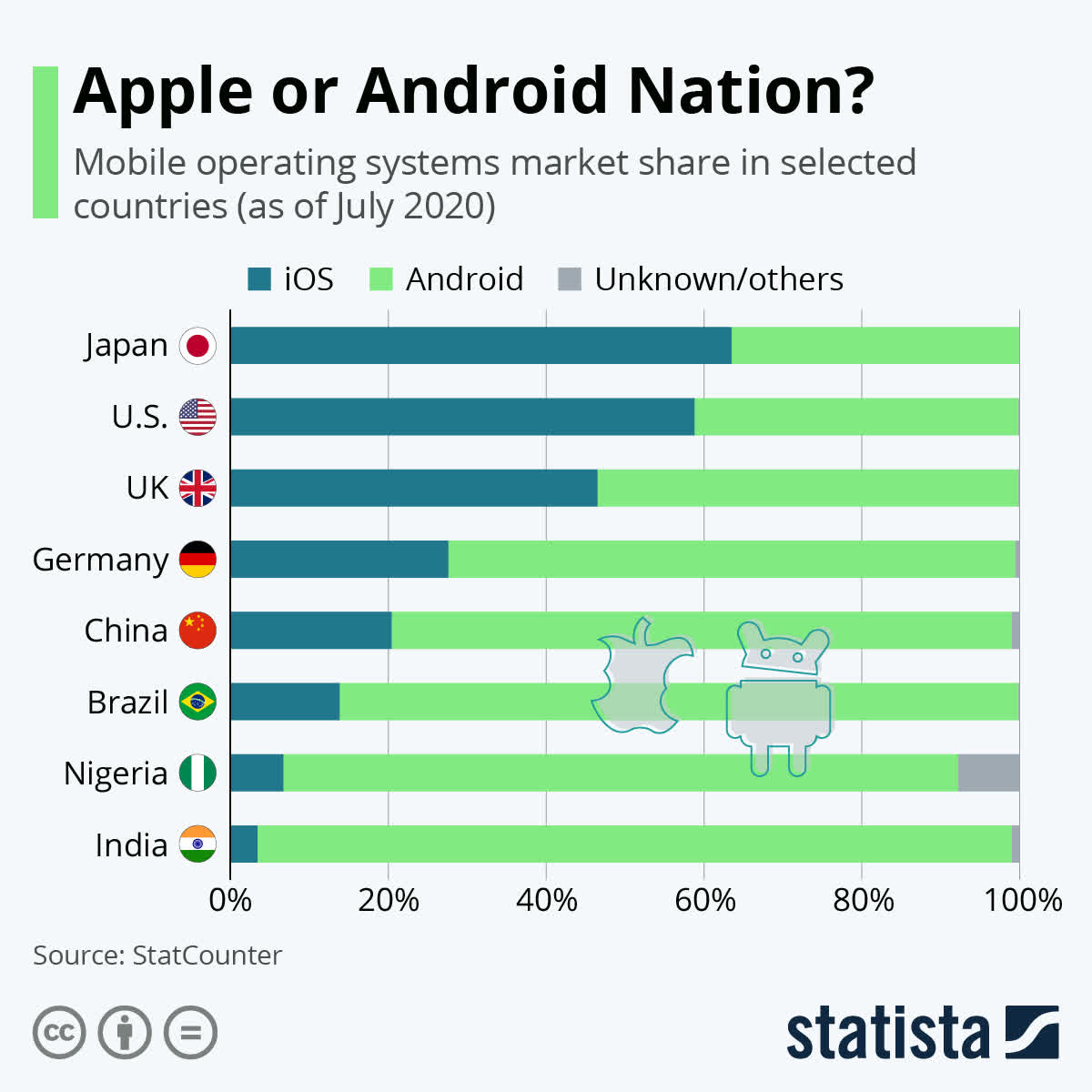

The not so bad news is that Meta has two years to prepare for these privacy changes from Android. Also, Android is concentrated in emerging markets, while Apple enjoys a large share in developed markets, such as the U.S.:

Market Share By Country (Statista)

Meanwhile, Europe is also cracking down on data privacy, causing Facebook and Instagram to threaten to pull their platforms from the continent:

Article Headline (The Drum)

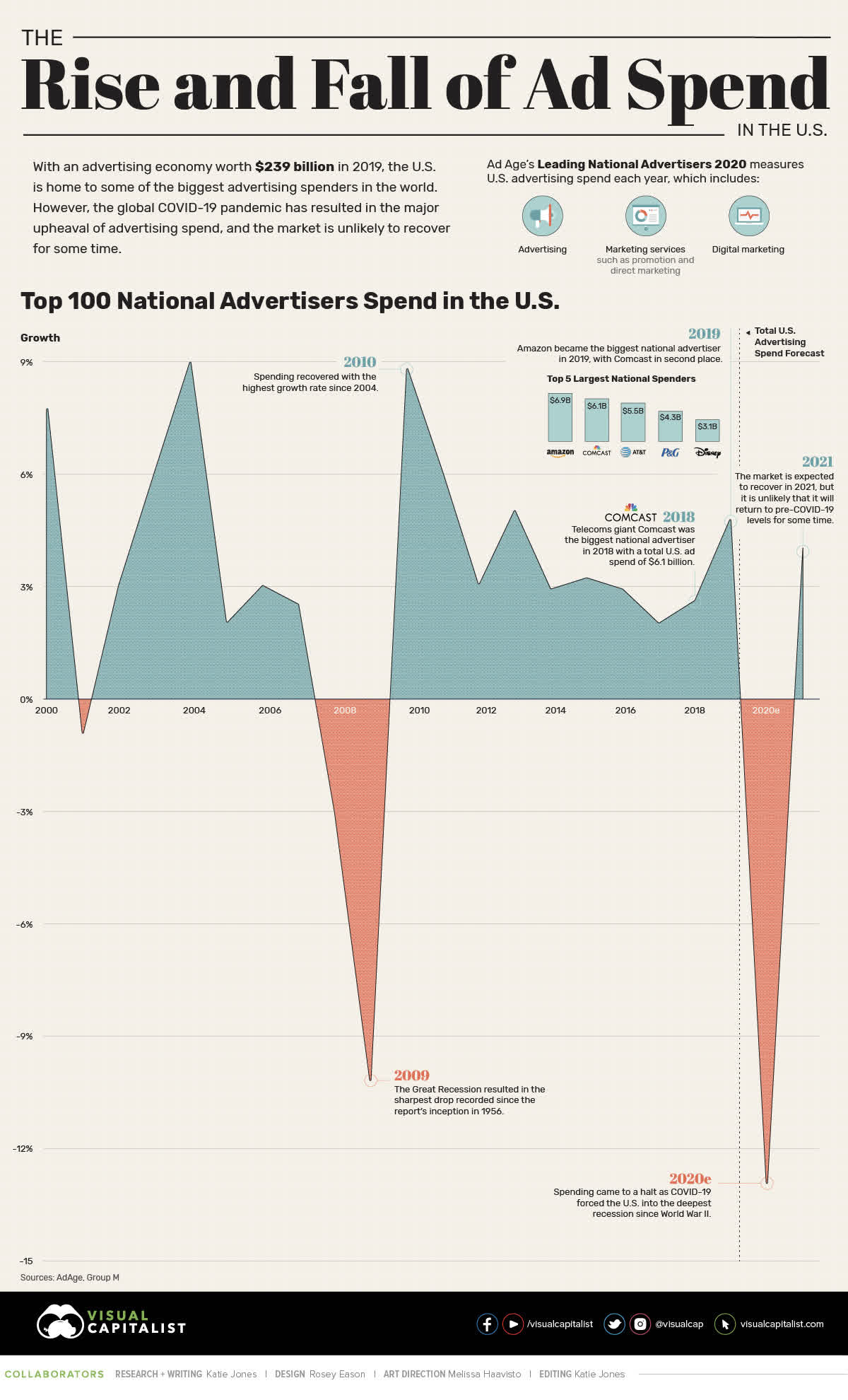

Peaks And Valleys Of The Ad Business

As stocks like Alphabet (GOOG) (GOOGL) and Meta correct, investors are beginning to shift their focus from the perpetual growth of the ad business, to the cyclicality of the ad business. While the shift to online ads continues, it may slow as data privacy takes a toll on the value proposition. Meanwhile, history has shown that advertising spend rises and falls with the economic cycle. Ad spend dropped off in 2001, 2008, and 2020:

The Rise And Fall Of Ad Spend (Visual Capitalist)

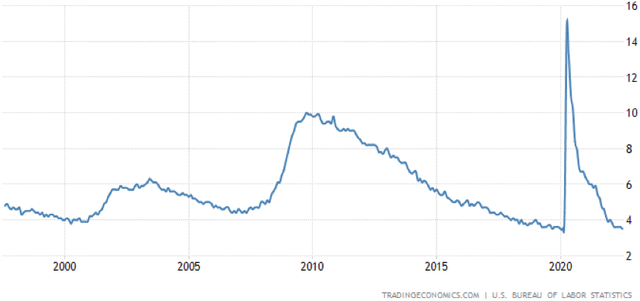

Advertising spiked in an enormous way in 2021. There’s reason to believe that, come 2023, it’ll drop off again. The unemployment rate shows us that the economy is still overheated in the United States. In recent history, every time unemployment reached 4%, it was followed by a recession. We’re currently at 3.5%:

U.S. Unemployment Rate (Trading Economics)

All things considered, we expect weakness in Meta’s earnings through to the end of 2024. Data privacy and cyclicality should take their toll. But, the stock’s already fallen 55% from its highs, so let’s take a look at long-term returns.

Long-term Returns

Looking out past 2024, Meta has a lot of promising growth drivers. The development of WhatsApp, the Metaverse, Instagram Reels, and Facebook Marketplace are all positives for the company.

Our 2032 price target from Meta is $464 per share, implying returns of 11% per annum.

- Over the next few years, we think consensus estimates have understated the effects ongoing data privacy will have on Meta’s family of apps. Meta’s revenue is likely to stagnant over the next few years, with margins falling slightly. Share buybacks, however, should cause Meta’s earnings of $12.00 per share to remain unchanged through to the end of 2024. After this reset, the innovative leadership of Mark Zuckerberg and the company’s industry tailwinds should propel it to grow EPS at 12% per annum, reaching $26.50 per share by 2032. We’ve applied a terminal multiple of 17.5x earnings.

Conclusion

Meta certainly has issues in the short term. We think data privacy changes and the economic cycle will cause the company’s revenue to stagnate over the next few years. Android’s proposed changes to cross-app tracking compelled us to temper expectations. Looking out long-term, we still believe in the monetization of WhatsApp, Instagram Reels, the Metaverse, and Facebook Marketplace. These fundamental pillars will benefit from industry growth and increasing ad spend over time. This should cause Meta’s growth to accelerate from 2025 to 2032. In the decade ahead, we expect Meta to deliver returns of 11% per annum and have a “buy” rating on the shares.

Be the first to comment