Joe_McUbed/iStock Editorial via Getty Images

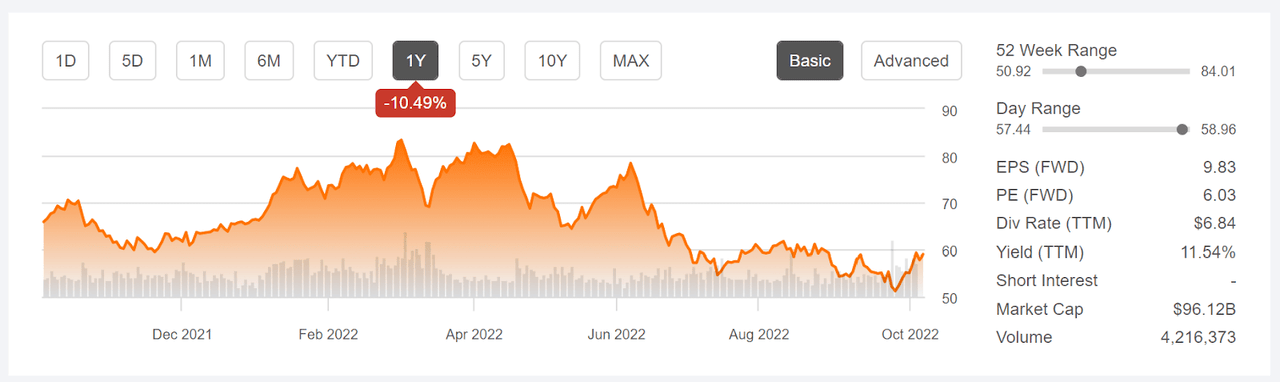

Rio Tinto (NYSE:RIO) is one of the largest metals mining companies in the world and the majority of the company’s revenues have come from sales to China. With the downturn in China’s real estate construction and growth in domestic steel production, along with falling global steel prices (partly due to declining demand from China), RIO’s earnings are expected to decline for years. Rising interest rates and the flattening of the yield curve have also made investors more wary about slowing global growth and the potential for a worldwide recession. In light of these headwinds, it is perhaps surprising that the shares have not declined more than 10.5% over the past year. Combined with the substantial dividend, RIO’s total 12-month return is about zero, as compared to -10.5% for the S&P 500 (SPY) and -1.1% for the iShares MSCI Global Metals & Mining Producers ETF (PICK). RIO has rallied in the past week and a half, rising 14.7% since October 26th.

12-Month price history and basic statistics for RIO (Source: Seeking Alpha)

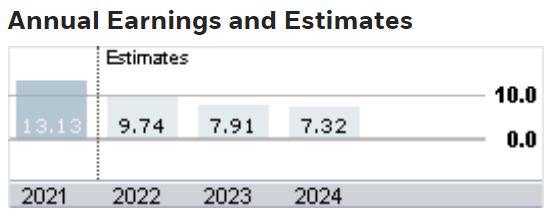

The consensus outlook for the next 3 to 5 years indicates annualized growth in EPS of -11.7% per year. Coming off of years of low interest rates that spurred investment in real estate, it is essentially a given that rising rates will continue to slow the demand for construction materials. The estimated EPS for RIO for 2022 is $9.74 per share, 26% below the 2021 level.

Annual earnings per share for RIO for 2021 and estimated EPS for 2022-2023 (Source: ETrade)

One of RIO’s notable features is the 11.5% dividend yield. Most income investors would be perfectly happy if they can convince themselves that the current dividend is sustainable but the current payout ratio is high, compared to both the sector median and the RIO’s average payout ratio over the past 5 years. With one substantial dividend cut so far in 2022, further dividend cuts are not improbable as earnings decline.

I last wrote about RIO on May 3, 2022, 5 months ago, at which time I downgraded the stock from a buy to a hold. At that time, RIO was trading at $71.12 vs. $59.08 today. The price decline of 17% since my post is partly offset by RIO’s substantial dividend distribution. RIO’s total return since market close on May 3rd is -13.2% vs. -8.3% for the S&P 500 over the same period. In analyzing a stock, I consider the fundamentals as well as two forms of consensus outlooks. The first is the well-known Wall Street analyst consensus outlook. The second is the market-implied outlook which represents the consensus view among buyers and sellers of options on a stock. One challenge with looking at RIO is that the analyst coverage is very thin. At the start of May, ETrade identified only 4 ranked analysts who had published a rating over the past 3 months, and only one of these had assigned a price target. This analyst had a 12-month price target that was 29% above the share price at that time. Investing.com aggregated the views of 5 analysts to calculate a consensus buy rating and a consensus 12-month price target that was 27.7% above the share price at that time. The market-implied outlook for RIO was bearish to mid-January of 2023, with expected annualized volatility of 37%. With the emerging catalysts for slowing steel demand (and lower prices), along with the Wall Street view that the shares were oversold and the bearish market-implied outlook into the start of 2023, I downgraded RIO from a buy to a hold.

For readers who are unfamiliar with the market-implied outlook, a brief explanation is needed. The price of an option on a stock is largely determined by the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires. By analyzing the prices of call and put options at a range of strike prices, all with the same expiration date, it is possible to calculate a probabilistic price forecast that reconciles the options prices. This is the market-implied outlook. For a deeper explanation and background, I recommend this monograph published by the CFA Institute.

With 5 months since I last wrote about RIO, a period during which interest rates have continued to rise and the ongoing weakening of real estate construction in China and elsewhere, I have calculated an updated market-implied outlook for RIO and I have compared this with available analyst outlooks in revisiting my rating.

Wall Street Consensus Outlook for RIO

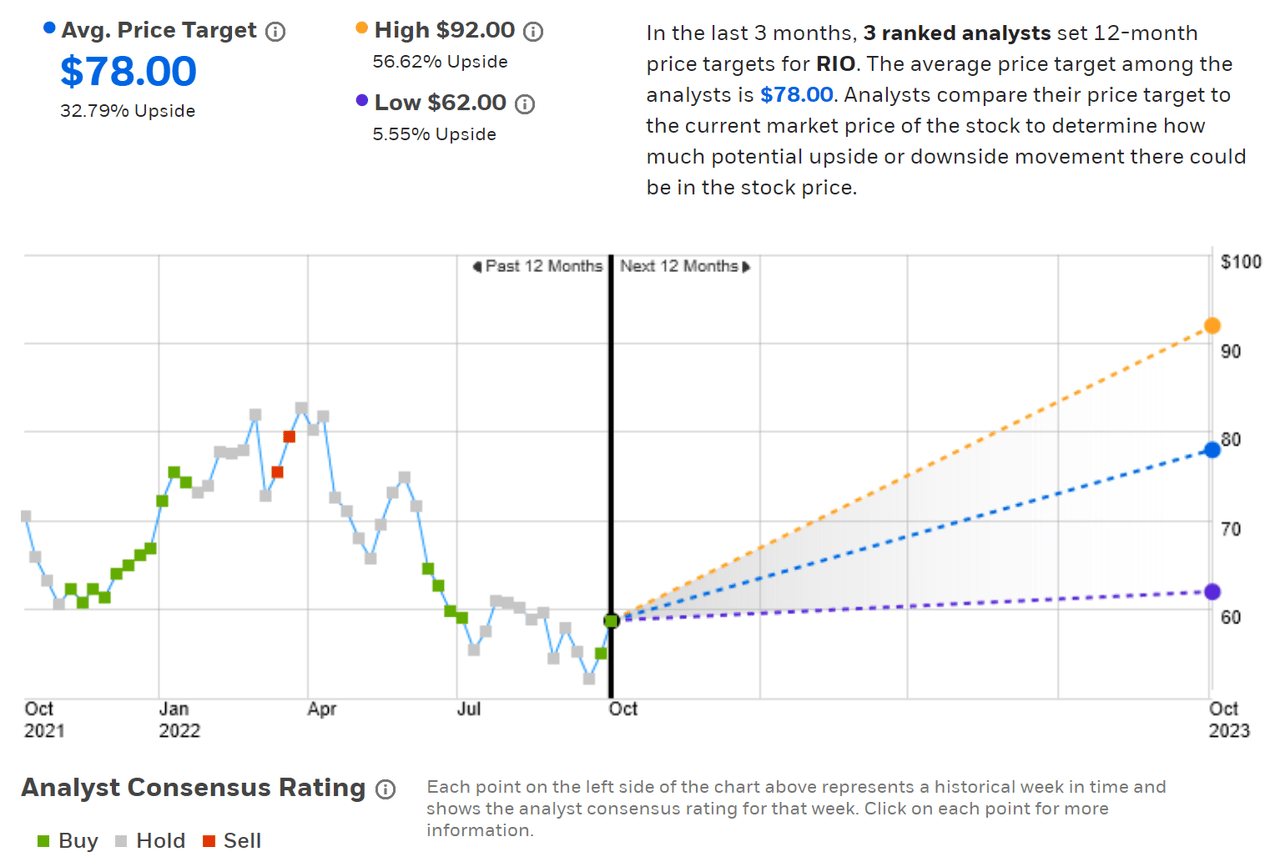

ETrade calculates the Wall Street consensus outlook for RIO by aggregating the views of the 3 ranked analysts who have published price targets and ratings for RIO over the past 3 months. The analyst coverage of RIO is the lowest that I have seen for an ADR on a company this large (market cap of about $100 Billion). All 3 of the analysts have 12-month price targets that are above the current share price, with the average implying a price gain of 32.8%. The consensus rating is a buy but the scant analyst coverages make it hard to assign much weight to the consensus.

Wall Street analyst consensus rating and 12-month price target for RIO (Source: ETrade)

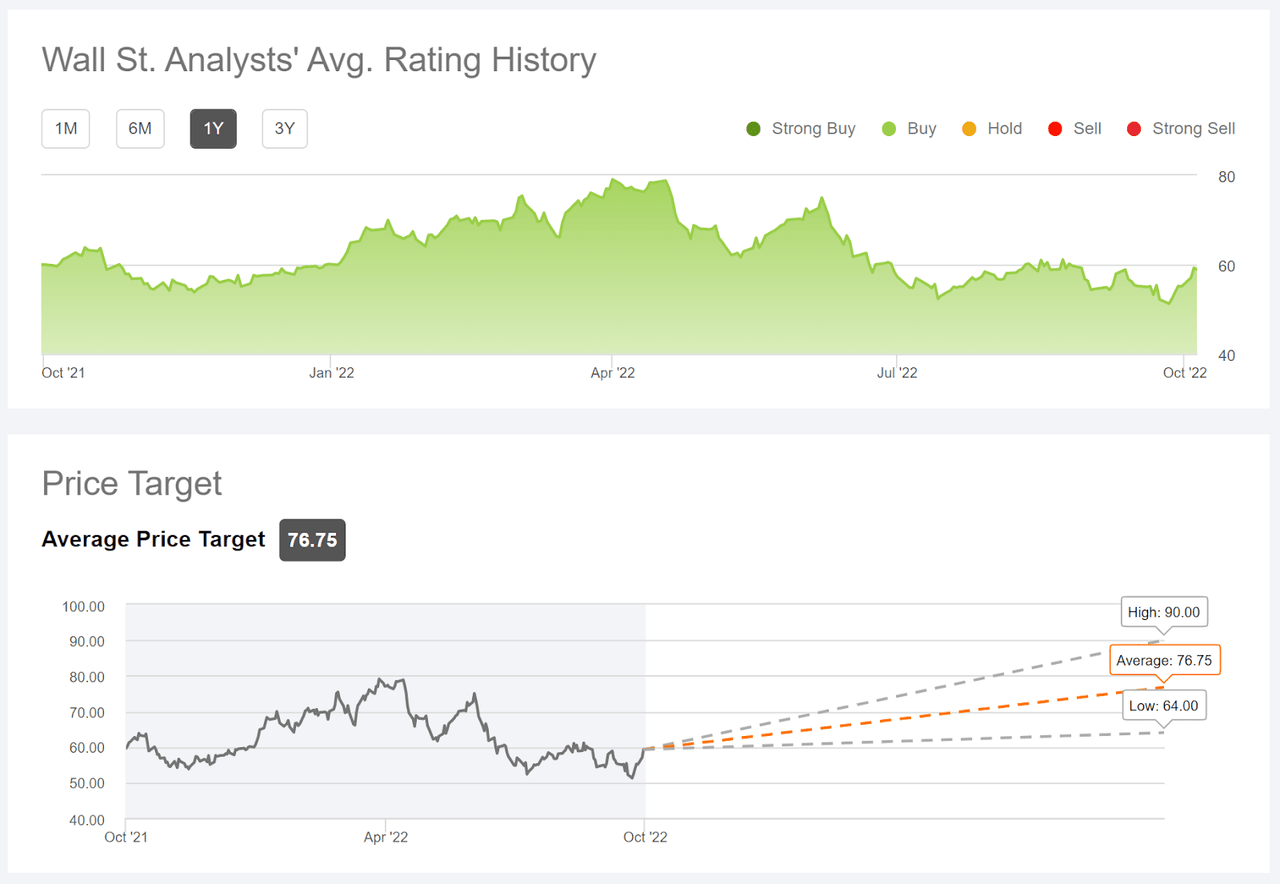

Seeking Alpha’s version of the Wall Street consensus outlook is calculated by combining the views of 5 analysts who have published price targets and ratings over the past 90 days. The consensus rating is a buy and the consensus 12-month price target is 30.7% above the current share price.

Wall Street analyst consensus rating and 12-month price target for RIO (Source: Seeking Alpha)

On the positive side, the consensus outlook for RIO is favorable, suggesting that the shares are undervalued. On the negative side, the analyst coverage is so thin that the consensus is lacking the ‘wisdom of crowds’ effect that tends to make the consensus a useful predictive indicator.

Market-Implied Outlook for RIO

I have calculated the market-implied outlook for RIO for the 3.5-month period from now until January 20, 2023 and for the 6.5-month period from now until April 21, 2023, using the prices of call and put options that expire on these dates. I would have preferred for the longer outlook to use options that expire closer to the middle of 2023, but the next later date on which options trade is January of 2024.

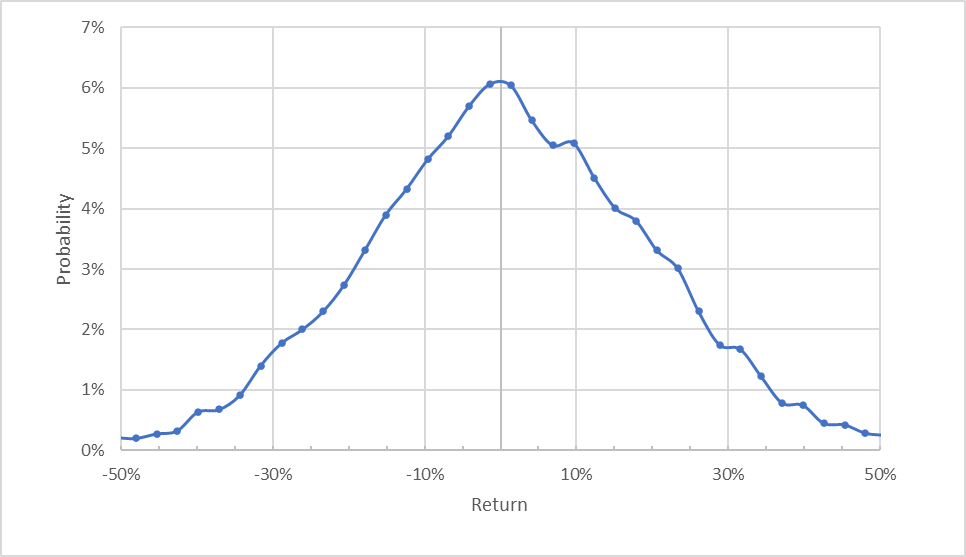

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Market-implied price return probabilities for RIO for the 3.5-month period from now until January 20, 2023 (Source: Author’s calculations using options quotes from ETrade)

The market-implied outlook for RIO for the next 3.5 months is generally symmetric about a return of zero, with comparable probabilities of positive and negative returns of the same size. The expected volatility calculated from this distribution is 42.7% (annualized), which is slightly higher than the expected volatility calculated at the start of May (37%).

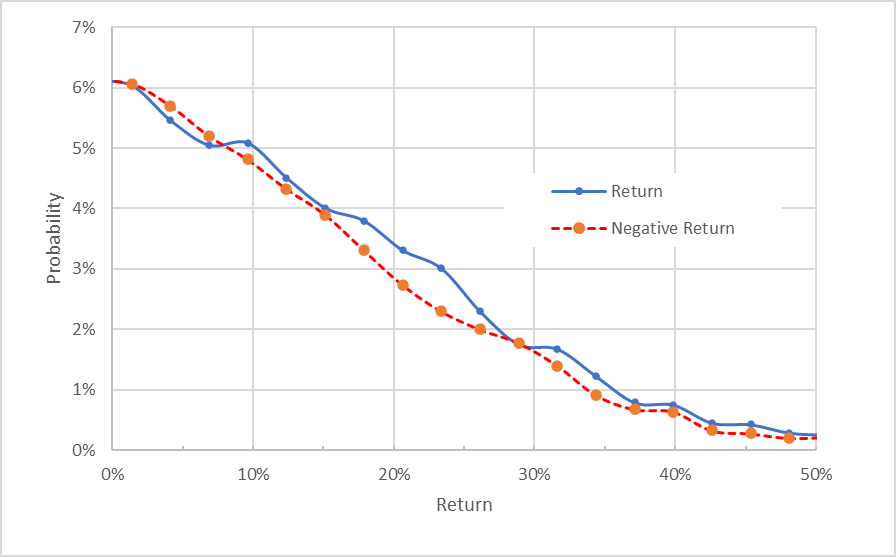

To make it easier to compare the relative probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

Market-implied price return probabilities for RIO for the 3.5-month period from now until January 20, 2023. The negative return side of the distribution has been rotated about the vertical axis (Source: Author’s calculations using options quotes from ETrade)

This view shows that the probabilities of positive returns tend to be slightly higher than the probabilities of negative returns of the same size (the blue line is on or above the dashed red line over most of the chart above). This positive tilt indicates a slightly bullish view from the options market.

Theory indicates that the market-implied outlook is expected to have a negative bias because investors, in aggregate, are risk averse and thus tend to pay more than fair value for downside protection. There is no way to measure the magnitude of this bias, or whether it is even present, however. The expectation of a negative bias in the outlook reinforces the bullish interpretation.

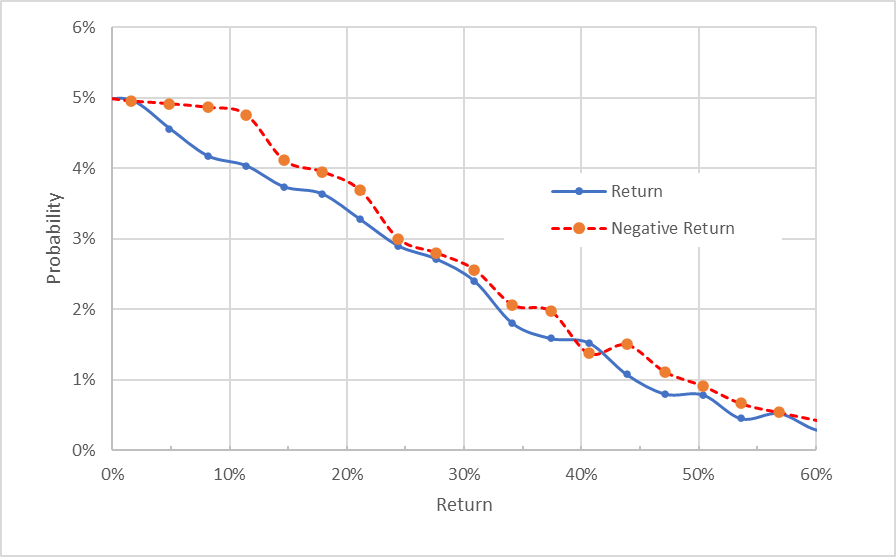

The market-implied outlook for the next 6.5 months, calculated using options that expire on April 21, 2023, has an apparent bearish tilt, with slightly higher probabilities of negative returns as compared to same-sized positive returns (the dashed red line is above the solid blue line over most of the chart below). Because of the expectation that the market-implied outlook will have a negative bias, this outlook is best interpreted as neutral. The expected volatility calculated from this outlook is 42.5%.

Market-implied price return probabilities for RIO for the 6.5-month period from now until April 21, 2023. The negative return side of the distribution has been rotated about the vertical axis (Source: Author’s calculations using options quotes from ETrade)

The market-implied outlooks suggest the potential for some price gains through the end of the year, with an overall neutral view by around the end of Q1. This is consistent with the recent positive momentum for RIO, with the shares gaining 13% over the past week, and a lack of direction over the longer term. The expected volatility, at 42%-43%, is quite high but this is also expected given RIO’s exposure to a global economic slowdown.

Summary

RIO is facing substantial risks from sales to China as construction falters and steel prices decline. The shares sold off earlier in 2022, falling 38.5% from a 12-month high close of $83.33 on March 3rd to a 12-month low close of $51.22 on September 26th. The shares have subsequently regained some of that loss. While analyst coverage on RIO is thin, the consensus view is that the shares have the potential to gain about 31% over the next year, even though earnings are expected to fall over this period. The situation suggests that the shares are oversold. The market-implied outlook suggests that there is decent potential for continued share price recovery into early 2023, but the longer view is neutral. Given the lack of analyst coverage, I put little weight on the Wall Street consensus. The substantial dividend cut earlier this year means that one should have little confidence in future distributions. I am maintaining a hold rating on the shares.

Be the first to comment