Hispanolistic

CrowdStrike (NASDAQ:CRWD) has the potential to be one of the long-term winners in the secular growth trend of cybersecurity, due to its unique position in the industry and exposure to the faster growing segments of growth over the coming years.

Business Overview

CrowdStrike is a cybersecurity company, founded in 2011, that wanted to change how cybersecurity was offered to customers and provide a solution for the cloud era. Based on this business premise, CrowdStrike developed the Falcon platform, its main product, a solution tailored for the cloud era being the first multi-tenant, cloud native, intelligent security solution to detect threats and stop breaches. The company performed its IPO in 2019, currently has a market value of about $39 billion, and trades on the NASDAQ stock exchange.

According to the company, when CrowdStrike was launched cyber attackers had an edge over legacy cybersecurity products that could not keep pace with the rapid changes in technology, providing a business opportunity for a different company that could offer a better solution.

Historically, most of cybersecurity was designed to spot specific viruses and cyberattacks, but hackers are always making new ways to ambush people, corporations, and even governments, making legacy cybersecurity offerings outdated, making users exposed to new ways of attacks.

Based on this industry background, CrowdStrike went a step forward and provided a cybersecurity solution capable of using vast amounts of data through a single platform, being to some extent an intelligent machine that is constantly evolving through its Artificial Intelligence (AI) capabilities.

Business Model (CrowdStrike)

Its AI platform learns from events and potential threats to its customers every day, which automatically update its software to protect all users against every attack. If one customer is the target of hackers, its platform will learn from that event and updates Falcon to make all of its users protected against that specific hack.

This is revolutionary in the cybersecurity industry, which means that CrowdStrike is a disruptor and has the potential to become a long-term winner of the secular growth trend of rising cybersecurity spending, being therefore an interesting investment for a long-term investor.

As I’ve discussed several times in previous articles, I invest mainly in secular growth companies in a few investing themes, namely semiconductors, electric vehicles, digital payments, 5G and big data. I was not invested in cybersecurity because the industry is quite fragmented and I wasn’t sure which company would be a long-term winner, but more recently decided to add this theme to my portfolio through a position in CrowdStrike. This increased my portfolio diversification across several growth themes, while also adding a new position in an industry that has very good growth prospects over the next few years.

Industry Growth Prospects

Cybersecurity has very good long-term growth prospects, supported by the increasing number of cyberattacks due to the emergence of e-commerce platforms, the increasing number of cloud solutions, the rising number of smart devices, plus the migration of corporate data to the cloud instead of local servers. All these factors are driving the cybersecurity industry’s growth, which should lead to higher spending on cybersecurity solutions from several types of costumers over the next few years.

The risk of cyberattacks is increasing and public acknowledgement of this risk is rising due to some well-known hacks, such as the Colonial Pipeline ransomware attack, thus this is leading governments and corporations to increase their spending budget for cybersecurity solutions. The risk of significant losses for corporations coming from data breaches or hacking of its operating systems is considerable, plus it also leads to reputation damage and therefore there is rising demand worldwide for these types of solutions.

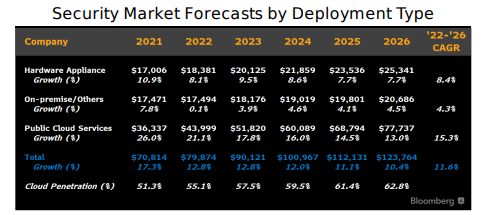

According to Bloomberg data, the U.S. cybersecurity market amounted to close to $71 billion in 2021, and it’s projected to grow by CAGR 11.6% during 2022-2026. However, as can be seen in the next table, the market segment with higher growth prospects is public cloud services, which is projected to have a CAGR above 15% during the same period, and is also expected to increase its market share within the cybersecurity market from 51% last year, to close to 63% by 2026.

U.S. market (Bloomberg)

This bodes well for cybersecurity companies that are focused on cloud solutions, such as CrowdStrike, which should enjoy higher growth during the coming years than legacy competitors.

Outside of the U.S., the cybersecurity market is also quite large, considering that according to Grand View Research data, the global cybersecurity market in 2021 amounted to $200 billion, which means some $129 billion was generated outside of the U.S. The global market is expected to reach some $500 billion in revenue by 2030, representing a CAGR of 12% from 2022-2030, which clearly shows that cybersecurity is an industry with good secular growth prospects during the rest of this decade.

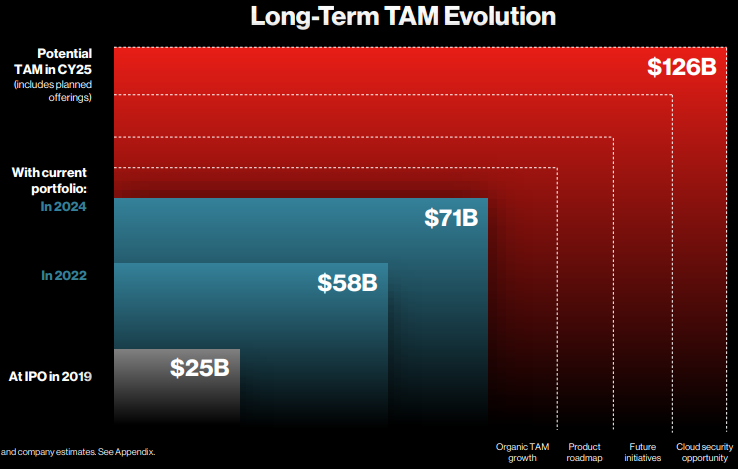

However, CrowdStrike does not target the entire industry, and according to the company, its total addressable market is about $58 billion this year, and is expected to increase at a CAGR of 10% during the next two years to more than $71 billion by 2024. As the company expands its product offering, its total addressable market is expected to increase meaningfully, which means that CrowdStrike still has a lot of opportunities to grow its business over the near future, considering that its market share is still rather low in the industry.

TAM (CrowdStrike)

Growth Strategy

While CrowdStrike’s growth prospects are strongly supported by overall industry growth, the company also has other opportunities to grow its business in the coming years. While initially CrowdStrike focused on relatively large and sophisticated enterprises, it has enlarged its offering to include customers of all market segments, and also has expanded its headcount in international markets, to grow its business across the globe, which in recent years were responsible for less than 30% of the company’s annual revenue and have good growth prospects over the coming years.

Beyond that, CrowdStrike also has good growth prospects through organic initiatives, which should lead to higher customer engagement and increasing revenue per customer.

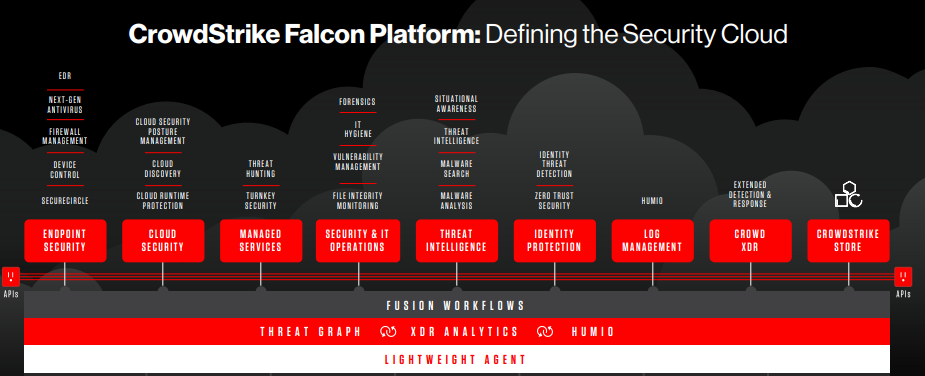

Indeed, through consolidation of siloed products the company can increase customer engagement, by offering several solutions integrated in its platform instead of customers using several suppliers of security solutions. For instance, CrowdStrike offers in its platform, in addition to cloud workload security, next-generation antiviruses, identity protection, endpoint detection and response, beyond other solutions.

Product offering (CrowdStrike)

This means that CrowdStrike can gain market share over legacy security providers, such as Broadcom’s (AVGO) Symantec or McAfee, due to its leading position in AI solutions and an extended product suite, being an important growth driver for the company over the medium to long term.

Additionally, CrowdStrike can also grow its revenue by further penetrating its existing customer base, considering that some costumers deploy Falcon across the organization, while others only deploy in some parts and later opt to subscribe to additional products. Given that customers can easily add cloud modules beyond what they currently have, as the company offers in-application trial usage, increasing customer engagement can be another significant growth source for CrowdStrike.

Financial Overview & Valuation

Regarding its financial performance, CrowdStrike has a very good history, given that its business has reported very high growth rates in recent years. Indeed, its revenues increased from just $481 million in fiscal year (FY) 2020, which ends in January, to $1.5 billion in FY 2022, representing an impressive annual growth rate of about 77% over the past couple of years. Not surprisingly, as a high-growth company, CrowdStrike has reported net losses over the past three fiscal years, as it continues to invest in business growth and improving its technological capabilities, a profile that is not expected to reverse soon.

During the first two quarters of FY 2023, CrowdStrike maintained a good operating and growth momentum, with revenue amounting to more than $1 billion in the first semester for the first time, up by 60% YoY. Investors should note that 94% of the company’s revenue comes from subscriptions, which are usually stable and recurring over the long term, boding well for its financial figures over the economic cycle.

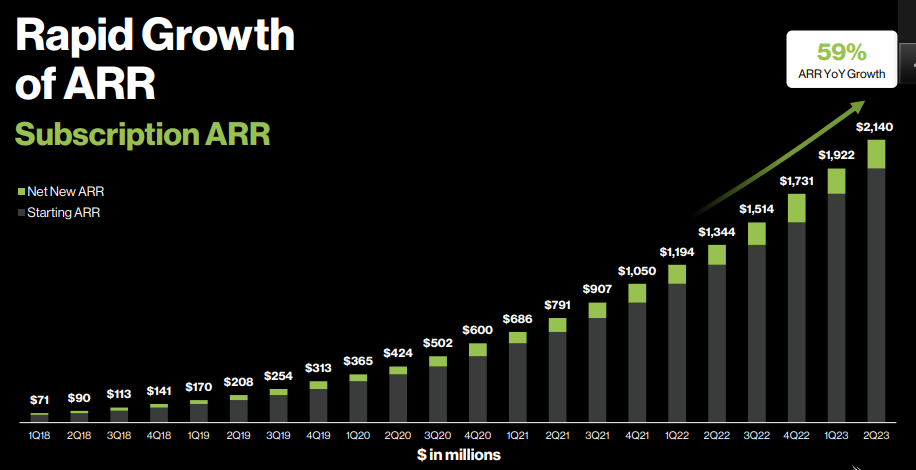

Indeed, its annual recurring revenue (ARR) coming from subscriptions amounted to more than $2.1 billion at the end of last quarter, a new record high, and also up by 59% YoY, showing that CrowdStrike remains on a solid growth path, despite the rising macroeconomic headwinds experienced in the U.S. and abroad over the past few months.

Subscription revenue (CrowdStrike)

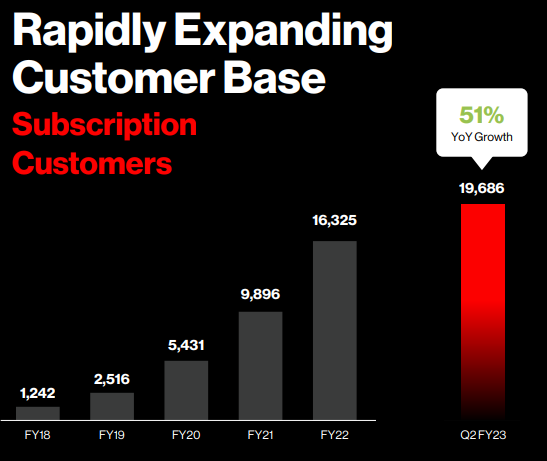

This strong growth has been supported by a rising number of customers, which amounted to close to 20,000 at the end of July 2022, representing annual growth of 51%, plus a higher engagement with the company’s customer base, considering that some 60% of its subscription customers have five or more modules subscribed.

Customers (CrowdStrike)

Beyond strong growth, CrowdStrike also enjoys high margins, considering that its gross margin was 77% in the first semester of FY 2023, which is usual within the SaaS industry. As the company’s size and revenue base becomes larger, CrowdStrike is enjoying positive operating leverage and has improved its operating margin to 17% during the past six months, setting a new record high and being a positive trend for the company to, eventually, reach breakeven in the next few years.

While the company continues to report losses on a GAAP basis, which amounted to $80 million in H1 FY 2023, these figures include close to $232 million in stock-based compensation (SBC). As SBC is a non-cash expense, CrowdStrike’s cash flow generation is quite good, considering that its free cash flow was $293 million in the first semester or 28% of its revenue. Regarding its balance sheet, it had some $2.32 billion in cash at the end of July, which means that it has a sound financial position and there isn’t much need to raise cash in the short to medium term.

As the business continues to exhibit good momentum, the company increased its guidance for the full FY 2023, and now expects annual revenue to be slightly above $2.2 billion, representing annual growth of 47% compared to the previous year.

Going forward, CrowdStrike is expected to remain on a strong growth path given that, according to analysts’ estimates, its revenue is estimated to grow by about 37% per year, over the next four years, and reach some $5.7 billion by FY 2026. Moreover, on a GAAP basis, the company is expected to reach a small profit by FY 2025, as operating leverage continues to improve and its business matures.

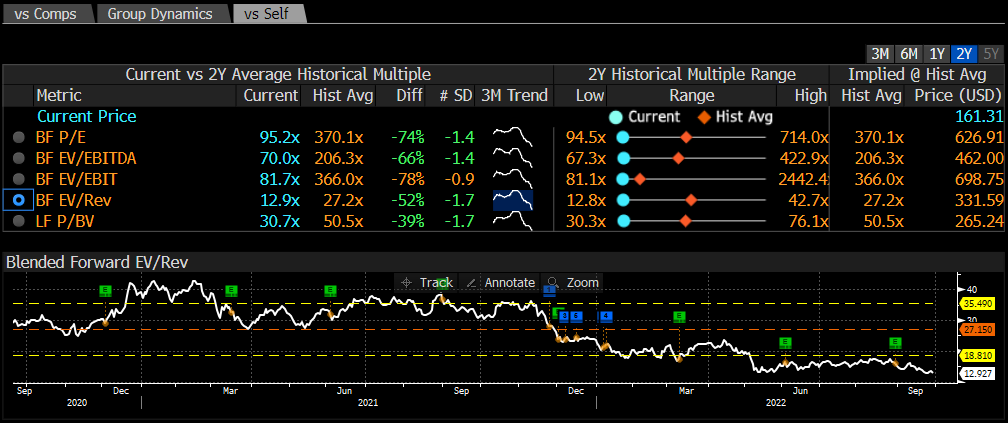

Regarding its valuation, as a non-profitable high-growth company, the best metric to analyze is EV/revenue. Like many other growth stocks, CrowdStrike’s valuation has considerably de-rated over the past few months, and is now trading at some 13x forward revenue, while its historical average over the past couple of years is above 27x.

Valuation (Bloomberg)

As the company’s fundamentals have remained quite strong during this period and growth remains quite high, this lower multiple does not seem warranted and CrowdStrike seems to be undervalued considering the company’s strong growth prospects over the medium term.

Conclusion

CrowdStrike has solid fundamentals, great growth prospects, and a positive financial profile, being therefore a great play for long-term investors who want to be exposed to the secular growth trend of cybersecurity. This means that its share price weakness in recent months is mainly justified by external factors and represents an opportunity for investors who are willing to hold its shares for a few years.

Be the first to comment