Ekaterina Belova

Article Overview

I am slowly beginning to initiate positions in emerging market equities and have sometimes found that closed-end funds are superior options. However, I am taking a wait-and-see approach with this fund for the following reasons:

- The discount to NAV is minimal on a historical basis

- I am concerned about the performance of emerging market corporate/sovereign debt

- I think there are greater opportunities in high dividend-yielding emerging market stocks

- The historical performance of this fund has been very poor

This high-yielding closed-end fund could be attractive later this year or early next year if the discount to NAV widens and the dividend remains at or above 10%.

Fund Overview

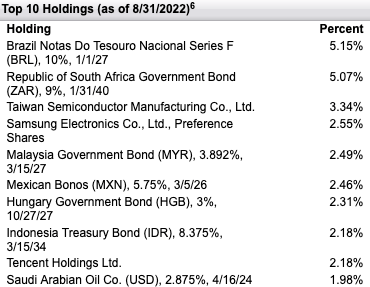

The First Trust Aberdeen Emerging Opportunity Fund (FEO) invests around 61% of its assets in fixed income investments (sovereign/corporate) and invests the rest in emerging market equities. Moreover, there is unhedged currency risk associated with this investment, as the fund only has around 36.1% USD currency exposure. The fund invests largely in sovereign and corporate debt, and also invests in common emerging market equities seen in other larger emerging market ETFs such as Vanguard’s emerging market ETF. Some of these companies include Taiwan Semiconductor Manufacturing (TSM), Samsung Electronics (OTCPK:SSNLF), and Tencent Holdings (OTCPK:TCEHY).

Aberdeen

The main unique feature of this fund is its fixed income investments, not its equity investments, as these equity investments are commonly found in other emerging market funds. Furthermore, investors may prefer this fund because it is a closed-end, high-yielding fund, and investors may have the opportunity to take advantage of any discounts on NAV. Based on the fund’s latest data, the quarterly dividend is $0.25/share, which is around a 10+% yield if nothing changes. I plan to monitor the fund’s yield during the upcoming quarters before potentially initiating a position in 2023.

Aberdeen

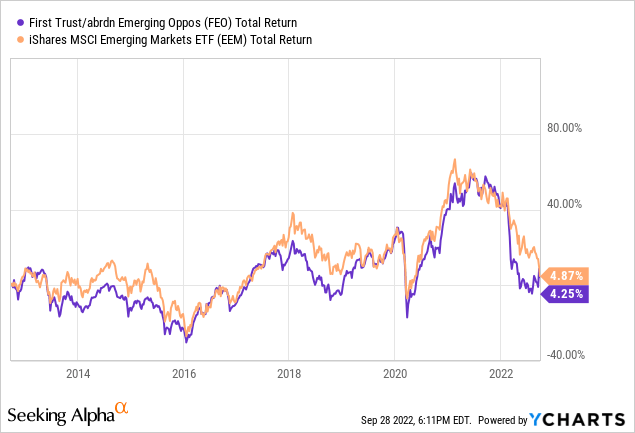

The historical performance of this fund has not been very favorable, and the fund has declined sharply YTD, in line with other major stock market indexes. The fund’s performance has more or less tracked the performance of the MSCI Emerging Markets ETF (EEM).

YCharts

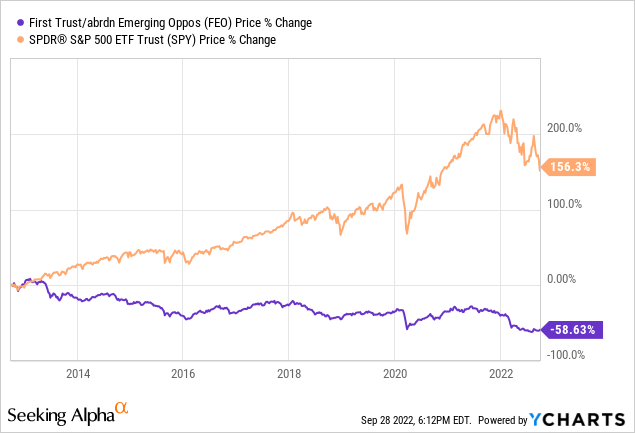

Meanwhile, the fund has also drastically underperformed the S&P 500 during the past decade. This could also be a contrarian indicator for emerging markets, as they have been underperforming for so long.

YCharts

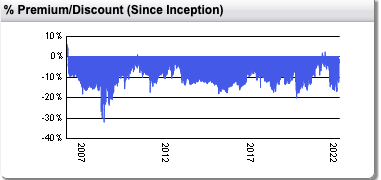

Historical Discount has been Stronger

This fund could be a good vehicle to take advantage of the discount on NAV, especially during declining market conditions. However, now is definitely not a good time to do so, as the fund only trades at a 0.88% discount to NAV, despite there being significant market turmoil in the past few months. The fund has declined over 30% YTD. In my view, this fund would only be attractive at a 10-20% discount to NAV, as emerging markets have their fair share of struggles ahead of them. The declining quality of emerging market sovereign debt, and the increased default risk, is one key risk that has been on my radar when assessing risks in emerging markets. I also see greater value in cheaper markets such as Egypt or other South American markets, which trade at single-digit PE ratios and have attractive dividend yields. With no major catalysts ahead for emerging markets, I think it is better to wait for a pullback.

|

Country |

PE |

Dividend Yield |

|

Colombia |

5.54 |

6.46% |

|

Chile |

7.70 |

5.25% |

|

Peru |

9.29 |

5.37% |

|

Egypt |

5.44 |

4.66% |

|

Pakistan |

3.90 |

7.23% |

|

Romania |

6.29 |

7.38% |

|

Poland |

4.94 |

4.45% |

Source: MSCI latest data

I personally would prefer these high dividend-yielding frontier and emerging markets, although they are lower than a lot of corporate or even sovereign debt. However, equities also have strong potential to deliver respectable capital gains on top of this, especially since many are down over 50% on a long-term basis. There are ETF products available for all of these countries, with the exception of Romania. I don’t think that now is the best time to be focusing on yield, but rather to buy crashes in contrarian/hated areas of the stock market and wait.

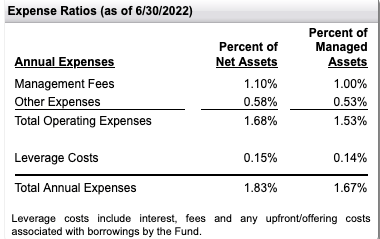

Management Fees are High

The management fees for this closed-end fund are extremely high, relative to both ETFs and other international closed-end funds. This is why I think there needs to be a much more significant discount to NAV for the fees to be justifiable. For example, the Korea Fund (KF) currently trades at a 15% discount to NAV, while other international closed-end funds can have a 10+% discount to NAV. The higher management fee can be justifiable based on the discount to NAV, as well as the fund/s choice to differentiate its top holdings.

Aberdeen

Other ETF and closed-end fund products have considerably cheaper management fees.

|

Investment Product |

Management Fee |

|

First Trust Aberdeen Emerging Markets |

1.1% ( not including an additional 73 bps of other costs/leveraging costs) |

|

Aberdeen India Fund (IFN) |

1.35% |

|

Korea Fund (KF) |

1.12% |

|

Vanguard FTSE Emerging Market ETF (VWO) |

0.08% |

|

iShares MSCI Emerging Market ETF(EEM) |

0.68% |

Source: Aberdeen/iShares/Vanguard

Downside Potential

It looks like a mixed bag for this fund. The current yield of $0.25/quarter means there will likely be limited selling pressure from investors who are in it for the long run and attracted to the extremely high dividend yield. However, broader emerging market turmoil has taken a negative toll on this fund, which still only trades at a minimum discount to NAV despite the poor performance this year. One really needs to consider the combined risks of increased corporate defaults, poor performance, and stronger discounts to NAV in the future. This fund is extremely hard to analyze, as the fund is diversified and the yield is based on emerging market equities, corporate debt, and sovereign debt in multiple countries.

Aberdeen

A 30% discount to NAV is not out of the question if emerging market stocks crash in 2023.

Country Narratives

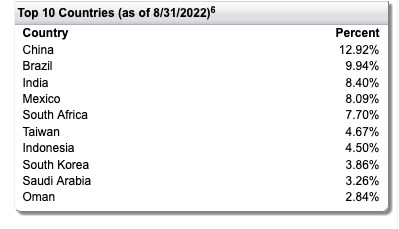

This fund is not too heavily concentrated in a particular country and has a lower weighting in China and Taiwan relative to MSCI (46.7% of the MSCI Emerging Markets Index is invested in China and Taiwan).

Aberdeen

All of the countries listed above experienced an increase in public debt after 2019, and only a few countries appear to be on a downtrend moving forward. Countries like Oman that have benefited from rising oil prices have been on a solid track, as Oman expects public debt as a % of GDP to fall to 48% of GDP by the end of this year. According to Vanguard, around 20% of the emerging debt market consists of wealthy oil exporters that have lower funding needs due to oil revenues. While targeting these countries makes sense, broad emerging market sovereign debt investing is risky. So far, only Russia and Sri Lanka have experienced sovereign debt defaults, but 19 countries currently have a distressed rating. This fund is very geographically diversified and has relatively strong exposure to China, making it difficult to make concentrated regional bets on countries with low public debt that benefit from the current commodity price movement. Corporate debt default rates have also been on the rise recently. Emerging Market corporate defaults are expected to exceed 10% this year for the first time since the financial crisis. This uptrend (from 8.5%) was largely due to default risks in China and Russia.

Final Thoughts

I have a neutral rating because of the following reasons: 1) I am waiting for a better entry point in the future, 2) I am worried about emerging markets (sovereign debt specifically) 3) I am more impressed with cheap equities in other emerging markets. In this type of environment, I think it is more important to accumulate emerging market equities during dips in 2022-2023 and focus on capital gains, not dividends, especially since the dividend yield for most equities/debt is below, at, or barely above inflation. I think there will be plenty of multi-bagger opportunities if you buy in 2023 and sell after 2025. Building a portfolio of companies like this, while waiting for large capital gains, is the best way to beat inflation. If you are able to enjoy a 5+% yield while waiting, then even better, but this shouldn’t be the core focus. Chasing high-yield debt securities in high inflation, low growth environment does not seem ideal. I am still interested in using this fund as a vehicle to trade emerging markets next year, especially if conditions become worse.

Be the first to comment