franckreporter

Many asset classes declined over the last few quarters: Gold (GLD) was losing value (compared to the USD), stocks were not a good investment, the real estate market seems to tumble and even the often annoying “To The Moon” boys and girls are rather silent which is a refreshing change of pace. But great investment opportunities are not made during euphoria and when everybody is screaming “To the moon” – great investment opportunities are made when these voices are going silent or are advising against investing.

So, let’s look at the market and try to find out if we are already looking at bargains and if the time has come to invest in stocks.

Where Are We?

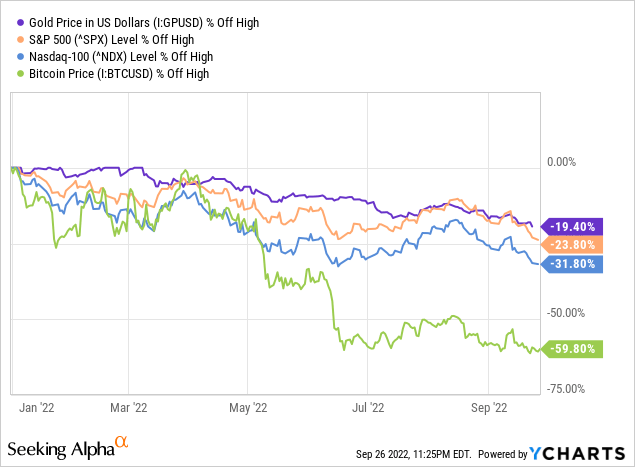

Your perspective on the market might depend a bit on the asset class you are looking at and in case of the stock market it might also depend a bit on your investing style and sector. Investors (or speculators) in cryptocurrencies and high-risk technology companies have been slaughtered in the last few quarters. However, investors of mature healthcare companies probably have not felt the same pain in 2022.

And when looking at the chart above we can see that the S&P 500 (SPY) fell about 24% from its previous high and the Nasdaq-100 (QQQ) declined even 32%. And depending on what voices you are listening to, this could either be the beginning of a long-lasting bear market or already the bottom of the bear market (and a great buying opportunity).

U.S. Stock Market is Overvalued

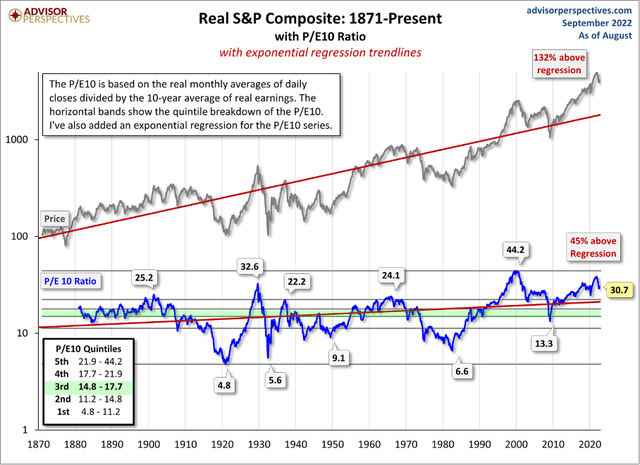

First, the overall market is far away from being a buying opportunity as several stocks are still trading for unreasonably high valuation multiples. The S&P 500 losing about 25% of its value could be in-line with mild recessions in the past, but the stock market is (still) extremely overvalued and it is dangerous to assume we are close to a market bottom. At a CAPE ratio of 30 the U.S. market was never close to a bottom during the last 150 years – a CAPE ratio of 30 is even higher than most peaks in the past.

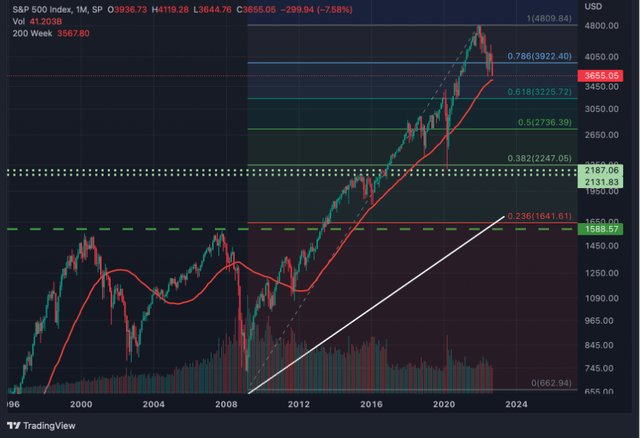

When looking at the chart of the S&P 500 we can identify some support levels where this bear market might find its bottom. Right now, the S&P 500 is certainly at a strong support level – the 200-week moving average – and another bounce off that support level is certainly a possibility. But a bullish upward wave will only be temporary. Over the coming quarters I assume that the S&P 500 will decline further, and we can identify two strong support levels.

The first strong support level for the S&P 500 is between 2,130 and 2,250. Here we find the 38% Fibonacci retracement of the last upward wave (the bullish wave that started in 2009). We can also find the highs of 2015 at that level as well as the COVID-19 lows from March 2020. All in all, this would be a strong support level and reflecting a 55% decline from the previous all-time highs (which would be in-line with previous severe bear markets).

However, there is a second price level that could be a likely target for a S&P 500 bottom. Around 1,600 points, we can not only identify the 23% Fibonacci retracement but also the two major stock market highs before the Great Financial Crisis and the Dotcom crash. And finally, we also have a long-term trendline (white line) connecting the lows of 1929, 1974, 1982 and 2009 which is currently around 1,600 points. This is not only a very strong support level – a pullback to the breakout level seems likely and a 66% decline from previous all-time highs is still reasonable considering the high CAPE ratio the U.S stock market is still trading for.

Individual Stocks? Some Opportunities!

While I considered the “overall market” still extremely overvalued (a huge part of individual companies is still overvalued), there is an argument to be made that it is easier to find buying opportunities. We can identify several high-quality businesses that declined 50% or more in the last few quarters.

But we still must be cautious about these stocks – even if we are convinced, they are trading below intrinsic value. And we must be cautious for two different reasons:

- Sentiments are not fundamentals: Even a stock trading below its intrinsic value might face further downside risk. In a bear market – and especially if I am right and we will be faced with the worst bear market in the last 90 years – many stocks are drawn down with the overall market and can decline to unjustified lows. This happens during every bear market. And of course, these stocks recover rather quick following the crisis, but it not only takes a strong stomach to withstand these brutal selloffs, it would also be best to buy at the lows because this is how great buying opportunities and high rewarding investments are made.

- Anchoring Bias: We are faced with the risk of being too optimistic. After a 13-year bull market, it seems likely that our expectations are unrealistically high. We can try to lower expectations and assume declining fundamentals during a recession, but we are faced with the risk of still being too optimistic for some companies and some industries. This is what is known as the anchoring effect. We are used to a certain number (for example a high annual growth rate a business reported over a long time) and estimates, or predictions will be rather close to that number although it does not make any sense (for example too optimistic growth rates). We can try to overcome this cognitive bias, but it is not easy. We sometimes just can’t imagine how hard businesses might get hit.

Investing just blindly in stocks is not a good idea (at the moment). The difficult question to answer is what companies we can invest in and what companies to avoid. In the following article I will look at several sectors and mostly at companies with great business models (and in most cases a wide economic moat), which are not an investment at the moment.

Banks and Insurance Companies

When writing about banks in the last few months, I have mentioned several times (see here, here, and here) that banking stocks might appear cheap, but I would not invest yet as I see more downside risk for banks – and these businesses have typically been hit hard by a recession and the stocks also declined steep. The same is true for insurance businesses and asset managers.

|

Company |

% off high right now* |

P/E ratio |

COVID decline |

GFC decline |

1998/2000 decline |

1990 decline |

|---|---|---|---|---|---|---|

|

U.S. Bancorp (USB) |

35.08% |

9.44 |

52.32% |

76.78% |

63.61% |

44.86% |

|

JPMorgan Chase (JPM) |

37.83% |

8.57 |

43.99% |

70.11% |

76.47% |

75.38% |

|

Toronto-Dominion (TD) |

27.25% |

9.96 |

43.06% |

65.95% |

52.33% |

N/A |

|

Royal Bank of Canada (RY) |

24.07% |

10.43 |

39.95% |

65.15% |

40.87% |

N/A |

*These stocks might already have declined steeper in the last few months (also for the following charts)

When looking at the data for these four banks (keep in mind, this is only a small selection of banks – those banks that I consider among the best performing), we see the stocks trading for a rather low P/E ratio of around 9-10. And when just looking at the P/E ratio these banks seem extremely cheap. But when looking at the performance during past recessions, banks usually fall steep during a recession. The average drawdown for all four banks (when using the available data) was 58%. The Toronto-Dominion Bank (average 54% drawdown) and the Royal Bank of Canada (average drawdown of 49%) declined not so steep, while U.S Bancorp (average drawdown of 59%) and JPMorgan Chase (average drawdown of 66%) had to report steeper drawdowns.

Another company belonging in that category is the German insurance company Allianz (OTCPK:ALIZF), which is also trading for a low P/E ratio right now (10.4 at the time of writing) and has lost already 30% from its previous high (not the all-time high!). And while Allianz might be a good investment with a tempting dividend yield of 6.5%, I think it might be good to stay patient and wait.

To make a good and informed decision about banks is rather difficult in my opinion as the already low P/E ratio might limit the downside risk. But banks will see declining earnings per share during recessions and therefore the current P/E ratios might be misleading. All in all, banks and insurance companies should not be bought at the beginning of a bear market and the eve of a recession.

Financial Service Companies

Aside from banks and financial institutions, we can also look at financial service companies, which I have also covered frequently in the past few quarters – most recently I have written again about the two rating agencies Morningstar Inc. (MORN) and Moody’s Corporation (MCO). But I have also written about companies like MSCI Inc. (MSCI) or FactSet Research Systems Inc. (FDS). And the conclusion for all these companies was more or less the same in the recent past: the stocks are all overvalued and while all are great businesses, the financial service companies are not a good investment right now.

|

Company |

% off high |

P/E ratio |

1990 decline |

2000 decline |

GFC decline |

COVID-19 decline |

|---|---|---|---|---|---|---|

|

MSCI |

37.68% |

43.28 |

N/A |

N/A |

69.06% |

32.36% |

|

FactSet |

20.54% |

37.95 |

52.48% |

59.02% |

54.88% |

33.73% |

|

Morningstar |

39.07% |

50.42 |

N/A |

N/A |

67.92% |

35.42% |

|

Moody’s Corp |

38.45% |

27.03 |

N/A |

38.74% |

79.12% |

42.14% |

|

S&P Global (SPGI) |

34.14% |

23.51 |

N/A |

31.33% |

75.83% |

38.28% |

While most of the stocks declined about 35% to 40% already, which is a solid correction, the average drawdown for these stocks in the past was 51% and I would assume there is still downside risk. Especially as price-earnings ratios of 38 (for FactSet), 43 (for MSCI) and 50 (for Morningstar) are not reasonable valuation multiples and especially not the numbers we see when stocks and indices reach the bottom.

In my recent articles about Morningstar and Moody’s Corporation I called both stocks more or less fairly valued, but still saw downside risk for both. And similar to banks and insurance companies I would continue to wait before I pull the trigger on these financial service companies.

Restaurants

Another sector from which I analyzed several businesses is the restaurant sector – including companies like McDonald’s Corporation (MCD), Starbucks Corporation (SBUX) or Darden Restaurants (DRI). I would also include Sysco Corporation (SYY) here although it is not a restaurant.

A first impulse would be to see restaurants not as great investment during recessions as people won’t be eating out so much. However, cheap restaurants might actually profit from a recession and a declining economy. On the one hand people have less disposable income and must save money, but on the other hand they still want to eat in a restaurant. The solution for this “dilemma” is often to pick cheaper restaurants.

|

Company |

% off high |

P/E ratio |

1990 decline |

1998/2000 decline |

GFC decline |

COVID-19 decline |

|---|---|---|---|---|---|---|

|

McDonald’s |

9.61% |

30.01 |

33.77% |

74.41% |

22.88% |

38.01% |

|

Starbucks |

32.72% |

23.89 |

N/A |

49.73% |

81.91% |

43.16% |

|

Darden Restaurants |

24.18% |

16.78 |

N/A |

46.97% |

71.24% |

73.22% |

|

Sysco |

17.96% |

27.87 |

25.57% |

32.61% |

47.85% |

63.59% |

Aside from Starbucks, the other three stocks are holding up quite well and declined not as steep as the S&P 500 (or the Nasdaq-100). And when looking at past recessions and bear markets, we also see several occasions of rather mild corrections. But the average decline for these three restaurants and Sysco was 50% during recessions in the last three decades. And when comparing it to the current declines, there seems still to be downside risk. And especially a P/E ratio of 28 for Sysco and a P/E ratio of 30 for McDonald’s seems to be too high.

While I would not buy restaurant stocks for the above-mentioned reasons just yet, I published an article in March 2022 to buy the dip in Starbucks and purchased shares for $81 and $74 in 2022. I am aware, that Starbucks is also facing downside risk – similar to the other companies – but in my opinion I purchased an undervalued asset (and so far, the market is agreeing with me). And if Starbucks should decline to $60 or $50 (a possibility), I have the chance to purchase additional shares.

Technology

Another sector we can look at is the technology sector. And similar to banks and insurance companies, technology stocks are also at a high risk to decline extremely steep during bear markets and recessions. The technology sector seems to be quite mixed with stocks trading rather close to the previous highs and other stocks that have declined extremely steep. In the following chart I look at five major U.S. technology companies – including Alphabet Inc. (GOOG) (GOOGL), Apple Inc. (AAPL), Microsoft Corporation (MSFT), NVIDIA Corporation (NVDA) and Adobe Inc. (ADBE).

|

Company |

% off high |

P/E ratio |

1990 decline |

1998/2000 decline |

GFC decline |

COVID-19 decline |

|---|---|---|---|---|---|---|

|

Alphabet |

34.44% |

18.39 |

N/A |

N/A |

65.29% |

30.87% |

|

Microsoft |

30.79% |

24.62 |

34.70% |

65.16% |

59.12% |

28.24% |

|

Apple |

17.16% |

24.88 |

49.62% |

81.59% |

60.87% |

31.43% |

|

NVIDIA |

63.36% |

40.10 |

N/A |

90.11% |

85.08% |

37.59% |

|

Adobe |

59.77% |

27.31 |

64.85% |

79.94% |

66.71% |

25.64% |

When looking at the numbers for NVIDIA and Adobe we see a 60% decline and it seems logical that we should call those two a bargain. When looking at the past performance of these two companies during recessions the current decline might be in line with the past (NVIDIA declined 70% on average) but when looking at declines in 2000 and the Great Financial Crisis it seems not unlikely for both to decline even more. And a P/E ratio of 40 still seems extremely high (for NVIDIA) and P/E ratio between 25 and 30 should also not be called cheap.

The average decline for these five stocks was 56% and it seems like there is a huge downside risk – especially for Apple, which is trading only 17% below its all-time high and for a P/E ratio of 25. Apple also declined 56% on average in the last four recessions and I know Apple is a different company than it was back then, but I don’t know if that will protect the business from a steep decline.

Industrials

Another category of stocks would be industrials – in this case exemplified by three companies: Nordson Corporation (NDSN), Graco Inc. (GGG) and 3M Company (MMM). This is another sector in which I would be rather cautious about buying although declines have often been rather moderate during past recessions.

|

Company |

% off high |

P/E ratio |

1990 decline |

1998/2000 decline |

GFC decline |

COVID-19 decline |

|---|---|---|---|---|---|---|

|

3M Company |

56.31% |

15.78 |

18.96% |

30.69% |

56.36% |

46.30% |

|

Graco |

24.40% |

24.00 |

36.81% |

44.73% |

70.42% |

30.60% |

|

Nordson |

21.44% |

25.74 |

41.53% |

44.11% |

74.05% |

44.36% |

And aside from 3M Company, which has been declining steep for other reasons (and has been declining long before this current bear market started), the other two stocks declined only between 20% and 25%. But when considering that these three companies declined 45% on average in previous bear markets/recessions, there is still downside risk. And although we are talking about great businesses, a P/E ratio of 25 still seems rather high and not the P/E ratio a stock would bottom at during a recession.

3M Company however might seem like a stock that can be bought, and all the negativities might be reflected by the stock price (but 3M Company is involved in different lawsuits and therefore might need more discussion than just two sentences in this article).

Conclusion

When trying to sum up, we can highlight the following five points:

- It might seem tempting to buy the dip after a 25% correction and it seems also likely that we will see a short-term bullish bounce. But over the next few quarters, we will most likely see lower lows and a continuation of the bear market.

- Several stocks already declined between 30% and 40%, but when looking at past recessions there seems to be more downside risk. And I assume the next recession to be a rather extreme one making the downside risk even greater.

- The stock market never bottomed at a CAPE ratio between 25 and 30 and in theory we have a long way to go down as the stock market usually bottomed at a CAPE ratio around 10.

- We see a lot of stocks still trading for 25 to 30 times earnings (or even higher), which is too high for a recession and bear market. Some high-quality growth business might justify such numbers, but during a recession it is extremely unlikely that stocks will stay at these valuation multiples.

- Some individual stocks can be bought, but it is still difficult to identify the companies that are undervalued and won’t be dragged down with the overall market in the coming quarters. We are not at a point (yet) where you can buy almost every high-quality business and make money.

Be the first to comment