Sibani Das

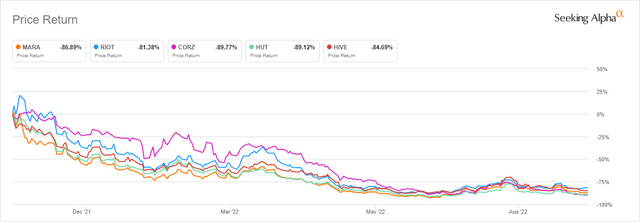

It has been an abysmal 11 months for Bitcoin (BTC-USD) miners. While the publicly traded companies have varying methods for scaling operations and treasury management, each of them have performed roughly in line with each other over the last year. Most of them are down anywhere from 80-90% since the early-November highs.

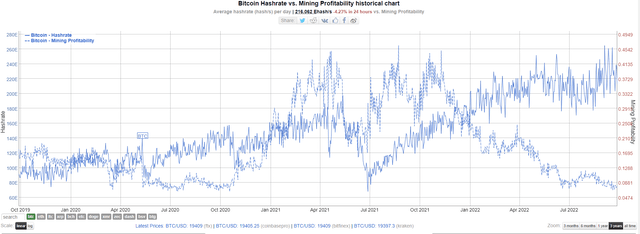

This is largely a testament to the vicious decline in profit margins that the companies have experienced since Bitcoin’s decline from a little under $70k down to $19k. Given the increase to hash rate over the same time period, the result has been a miner profitability figure now challenging 24 month lows.

Even if Bitcoin’s price can recover, the publicly traded miners have a tough road ahead given the supply dynamics of mining in the future. Still, if one wants to speculate on Bitcoin’s rise, the miners provide an incredible way to leverage that bet. While they’ve all performed about the same in crypto winter, I personally believe it’s prudent to be selective when picking a miner for the next cycle.

Marathon Digital Treasury and Production

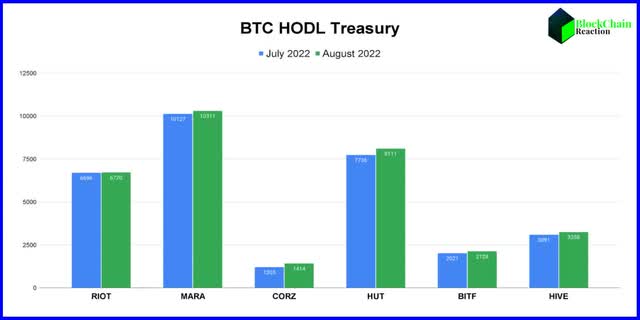

Marathon Digital (NASDAQ:MARA) is the largest publicly traded Bitcoin miner. It’s one of just two with a market capitalization over $1 billion. It has the largest Bitcoin holding of the public miners with 10,311 BTC in treasury as of the end of August.

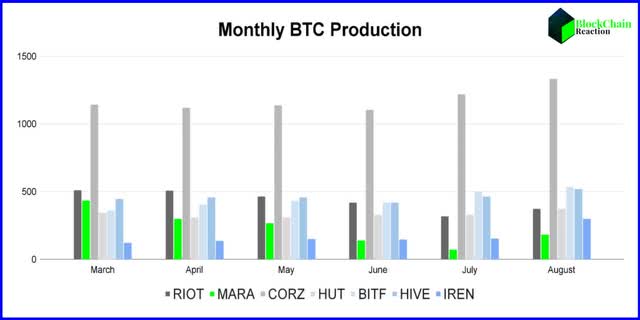

This is the good news, assuming the price of Bitcoin moves considerably higher, MARA will theoretically do well because of the BTC on the balance sheet increasing in value. The bad news is Marathon is no longer a leading Bitcoin miner from a monthly production standpoint.

It lags most of the other large mining companies. A large part of this decline is because of a June storm in Montana that knocked out power to Marathon’s machines. This outage impacted roughly 75% of Marathon’s mining footprint. The situation expedited plans to relocate from the Montana facility.

Marathon’s Model

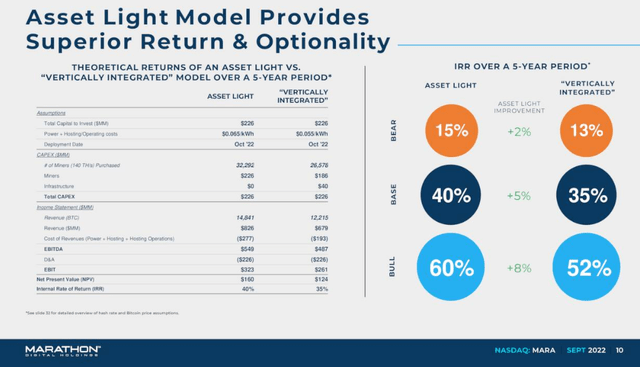

As mentioned above, while the BTC miners are all trying to produce the same digital coin, the way they’ve chosen to scale has been different. In the case of Marathon Digital, the company expects to get to 23 EH/s by mid-2023 through a hosting model. Rather than building their own datacenters, Marathon enters into agreements with other entities that provide mining hosting as a service. One such company is Applied Blockchain. The two organizations are working together to help MARA scale production. Marathon has stated this is a better approach than a vertically integrated one because it allows a better return according to the company’s estimates:

The issue with relying on hosting is it adds an additional layer of risk to operations. And there are already numerous risks associated with Bitcoin mining as a business model. Those risks include energy prices, Bitcoin’s price, and regulatory concerns. While some of these concerns can theoretically be alleviated by savvy hosting partner curation, one of MARA’s biggest hosting partners is Compute North. Analyst estimates have 45% of MARA’s 23 EH/S projection coming from Compute North. Compute North just filed for Chapter 11 bankruptcy. While Marathon has stated publicly that this shouldn’t immediately impact production, it perfectly exemplifies the added risk of working with third party vendors for hosting.

Valuation and Market Sentiment

Obviously, it is highly concerning that Compute North is in trouble. Now the Marathon Digital holders have to bank on higher Bitcoin prices and a vendor partner that just declared bankruptcy. This is not an advantageous position to be in compared to other mining outfits that self-host and that have better balance sheets.

| Company | Debt to Equity | Cash | Market Cap | P/B |

|---|---|---|---|---|

| Marathon Digital | 116.25% | $86.46 | $1,120 | 1.70 |

| Riot Blockchain (RIOT) | 1.67% | $272.51 | $1,040 | 0.78 |

| Core Scientific (CORZ) | 275.77% | $128.54 | $496.64 | 1.19 |

| Hut 8 Mining (HUT) | 9.78% | $46.71 | $329.89 | 0.84 |

| HIVE Blockchain (HIVE) | 15.35% | $11.93 | $295.92 | 1.17 |

Source: Seeking Alpha, Cash and Market Cap in millions

Marathon Digital now has one of the highest debt to equity positions in the mining space. It also has the highest price to book ratio of any publicly traded miner with more than a $100 million market cap and the company doesn’t have a whole lot of cash either compared to similarly sized peers. All that said, MARA has the largest Bitcoin treasury of any of the publicly traded miners with over 10k Bitcoin on the balance sheet. At a $19.5k BTC price as of submission, Marathon’s Bitcoin holdings are worth approximately $200 million. This means about 16% of MARA’s market cap is backed by its BTC position – this trails only Hut 8 Mining for the top HODL/MC ratio.

| Company | Short Position | Market Cap |

|---|---|---|

| Marathon Digital | 25.61% | $1,120 |

| Riot Blockchain | 16.17% | $1,040 |

| CleanSpark (CLSK) | 14.57% | $147.41 |

| HIVE Blockchain | 9.98% | $295.92 |

| Hut 8 Mining | 7.81% | $329.89 |

| Bitfarms (BITF) | 7.22% | $216.4 |

| Bit Digital (BTBT) | 6.52% | $96.47 |

| Core Scientific | 5.92% | $496.64 |

| Iris Energy (IREN) | 1.07% | $192.44 |

Source: Seeking Alpha

Given the high price to book ratio and the large debt to equity position, it might be a surprise to see Marathon Digital has far and away the largest short position of the top public miners. This would indicate the market is seeing the obstacles that Marathon Digital is facing and betting against the company. It isn’t just a declining Bitcoin price, it’s a hosting model that is presenting problems, a debt level that will be an issue if BTC doesn’t turn it around, and a monthly production trend that is heading the wrong direction.

Risks

As I mentioned above, the Bitcoin mining industry has a plethora of on-going risks. The largest of which may be a push to regulate them out of business. The success of Ethereum merging from a proof-of-work consensus mechanism to a proof-of-stake consensus mechanism is likely going to put pressure on Bitcoin’s developers to do the same in the name of saving the environment. These companies are already seeing margins get squeezed and there is a halving coming in the not too distant future. There are quite a bit of headwinds.

Summary

The public Bitcoin miners are phenomenal trading vehicles. I can’t say they’re good long term investments. While I have nothing against buying miners, I personally own two of them, I don’t think Marathon is one that is going to outperform the sector. I think the valuation, hosting model, and debt position are all going to keep a lid on MARA compared to peers. I don’t see how Marathon is going to be able to deliver on 23 EH/s by mid-2023. If I were long, I’d sell the next bear rally.

Be the first to comment